Mario Tama/Getty Images News

By Brian Nelson, CFA

Altria Group, Inc. (NYSE:MO) has long battled the slow and steady decline of cigarette volumes with pricing expansion, and we view this as one of the most attractive attributes of its business. The firm also has an attractive stake in AB Inbev (BUD) that it can liquidate to support future growth initiatives or its dividend, more generally, but risks are mounting.

In trying to adapt to changing consumer preferences, Altria made a huge misstep with respect to JUUL Labs and had to take a massive write-down due to growing regulatory concerns, representing perhaps one of the greatest misallocations of capital that we can remember. Here’s a quick excerpt from its most recent 10-K on the JUUL debacle:

As part of the preparation of our financial statements for the quarters ended September 30, 2019, December 31, 2019 and September 30, 2020, (Altria) performed valuations of (its) investment in JUUL as a result of the existence of impairment indicators. As a result, we determined that our investment in JUUL was impaired and recorded total non-cash pre-tax impairment charges of $11.2 billion. While we believe the December 31, 2021, valuation of $1.7 billion is the appropriate current estimated fair value of our investment.

Altria paid ~$12.8 billion for the 35% stake in JUUL in December 2018, and just a few short years later, it has now written off almost the entire investment (it took another $100 million write-down in the first quarter of 2022, putting the value of its stake in JUUL now at $1.6 billion). Now that said, investing is all about future expectations and forward-looking analysis, but it’s hard for us to overlook this tremendous misstep that has cost investors dearly. On a price-only basis, according to data from Seeking Alpha, Altria’s shares have fallen more than 40% during the past five years, and what once was a stable cigarette maker with pricing power holding a very nice attractive stake in AB-Inbev has now become one of the riskiest dividend-paying stocks on the market.

Share price performance has been abysmal. Altria’s stock has collapsed through our $47 per share fair value estimate to now trade in the low-$40s, and we can’t help but think its lofty ~8.7% dividend yield is unsustainable given declining cigarette volumes, a hefty net debt position, and an ominous regulatory overhang. Usually when dividend yields start to approach the 9%-10% range with respect to corporates, as opposed to master limited partnerships or REITs, the market is factoring in a decent probability of a payout cut. With its share price under attack, management may have little incentive to preserve such a high dividend yield, as it can still cut the payout and offer investors an attractive yield, one that is significantly above that of the average S&P 500 company. Investors, especially income investors, that are counting on its lofty dividend yield for years to come should heed caution.

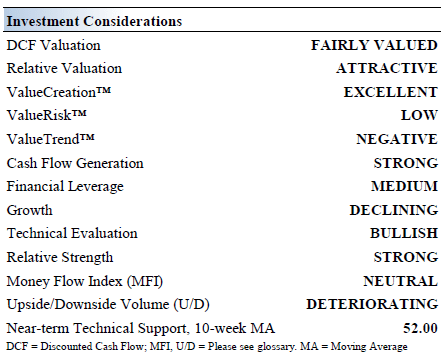

Altria Group‘s Investment Considerations

Image source: Valuentum. The key investment considerations we evaluate for Altria. (Image source: Valuentum)

Altria makes and sells cigarettes and smokeless products in the U.S. It owns the Marlboro cigarette brand (specifically for U.S. sales), the Copenhagen, Skoal, on!, Red Seal, and Husky oral tobacco product brands, and the Black & Mild cigar brand. The company was founded in 1919 and is headquartered in Richmond, Virginia. It is working aggressively towards its Vision by 2030 to transition away from combustible cigarettes to a smoke-free future.

Altria had a ~10% equity interest in AB InBev, a large equity stake in Cronos Group, and a ~35% equity stake in JUUL at the end of 2021. As noted above, its investment in JUUL has turned into a nightmare, and the FDA has ordered JUUL e-cigarettes off the U.S. market. With these investments in mind, Altria’s balance sheet remains bloated due to its large net debt load. Management is also aggressively buying back stock when it should look to potentially pare down its debt load. During the first quarter of 2022, it spent $576 million on share buybacks and still had $1.2 billion on its share repurchase program. The executive team might better serve investors by halting buybacks, altogether.

Altria posted large losses on its equity investment in Cronos Group (~$1.8 billion deal in 2019), a leading cannabinoid company based in Toronto, and its equity stake in the embattled US e-cigarette market JUUL Labs (~$12.8 billion deal in 2018). Those deals added a lot of debt to its balance sheet and significantly grew its annual interest expenses. Management noted during its first-quarter 2022 results that it is “off to a strong start to the year,” but it did caution that most of its expected earnings generation will be “weighted toward the second half of the year.” With consumers battling inflationary pressures, a back-end-loaded year doesn’t offer investors much confidence that Altria will deliver on its 2022 full-year adjusted diluted EPS range of $4.79-$4.93 per share, at least in our view. We’re skeptical.

Altria relies heavily on its brand strength and the related pricing power to offset secular declines in the consumption of cigarettes in the U.S. The firm is attempting to pivot towards next generation smoking products to revive its revenue growth trajectory, though there are limits to this strategy. We think Altria may be among the riskiest of tobacco stocks given its misstep with JUUL, and again we’re concerned by its hefty net debt positions, which weighs heavily on our estimate of its intrinsic value and its Dividend Cushion ratio. At the end of the first quarter of 2022, Altria held total debt of $27.92 billion, versus a meager cash balance of just $5.35 billion. Annual cash dividends paid for the past three fiscal years have averaged about $6.3 billion yearly, a huge obligation to continue to fulfill.

Recent initiatives from the FDA in cracking down on nicotine levels and menthol in tobacco products should be monitored, and the FDA is also working to regulate and reduce teen use of e-cigarettes. These actions have had a material impact on Altria’s recent investments. Many industry observers believe that Altria’s major debacle with JUUL may play right into the hands of Philip Morris (PM) and British American Tobacco (BTI). Furthermore, Philip Morris’ deal to acquire Swedish Match only adds greater competitive pressure on Altria to right the ship sooner than later.

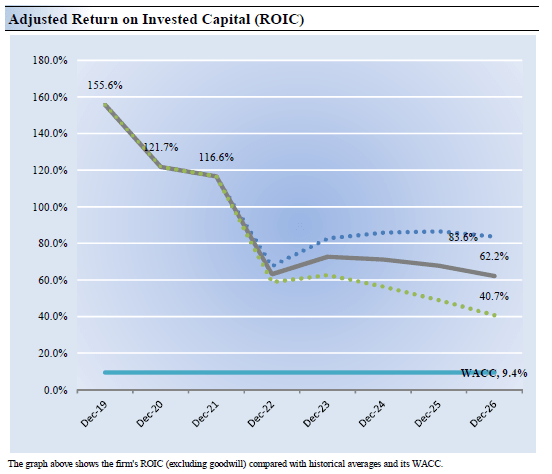

Altria’s Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Altria Group’s 3-year historical return on invested capital (without goodwill) has been comfortably above the estimate of its cost of capital of 9.4%.

As such, we assign the firm a ValueCreation™ rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Though Altria may remain an economic profit generator in coming years, pressures on this measure are apparent.

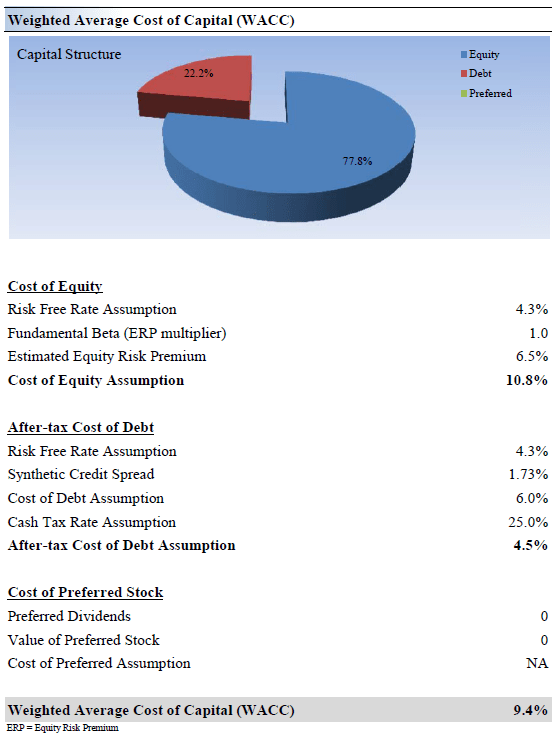

Image source: Valuentum. Altria’s economic profit stream will face considerable pressure in coming years, in our view. (Image source: Valuentum) Image source: Valuentum. How we calculate the weighted average cost of capital for Altria. (Image source: Valuentum)

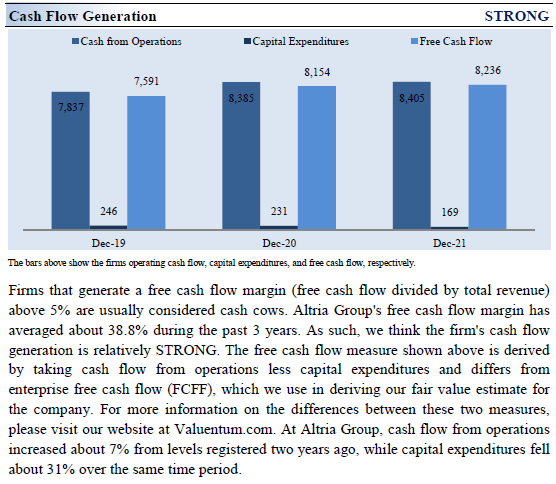

Altria’s Cash Flow and Valuation Analysis

Image source: Valuentum. Despite all of its troubles, Altria remains a very, very strong free cash flow generator. (Image source: Valuentum)

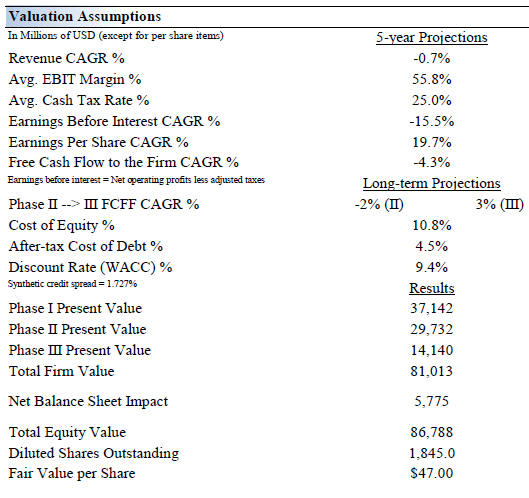

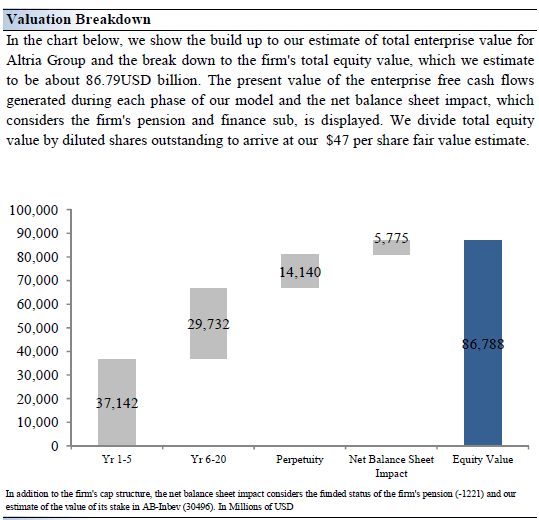

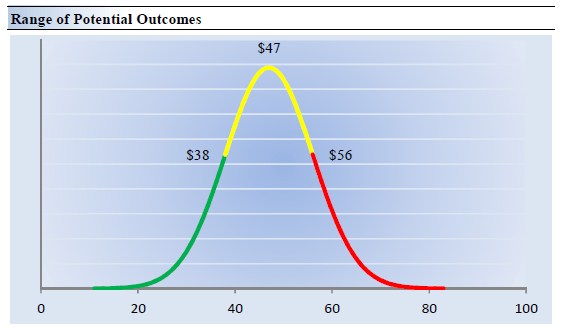

We think Altria Group is worth $47 per share with a fair value range of $38- $56 per share. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of -0.7% during the next five years, a pace that is lower than the firm’s 3- year historical compound annual growth rate of 2.5%.

Our valuation model reflects a 5-year projected average operating margin of 55.8%, which is above Altria Group’s trailing 3- year average. Beyond year 5, we assume free cash flow will grow at an annual rate of -2% (negative 2%) for the next 15 years and 3% in perpetuity. For Altria Group, we use a 9.4% weighted average cost of capital to discount future free cash flows.

Image source: Valuentum. The key assumptions within our discounted cash flow model to arrive at Altria’s fair value estimate. (Image source: Valuentum) Image source: Valuentum. Altria’s distribution of its fair value composition. (Image source: Valuentum)

Altria’s Margin of Safety Analysis

Image source: Valuentum. How we derive the fair value estimate range for Altria in light of its myriad risks. (Image source: Valuentum)

Our discounted cash flow process values each company on the basis of the present value of all future free cash flows. Although we estimate Altria’s fair value at about $47 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Altria Group. We think the firm is attractive below $38 per share (the green line), but quite expensive above $56 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. We believe Altria could visit the lower end of our fair value range sooner than later.

Altria’s Dividend May Not Be Safe in the Long Run

Though Altria has a track record that very few firms can match, its balance sheet is bloated even after considering its equity investments in AB InBev and Cronos Group. Its big ~$12.8 billion bet on JUUL Labs in 2018 did not pan out favorably and Altria was forced to write off most of its investment in the embattled e-cigarette company. The company’s total debt load swelled higher to fund its deals with JUUL Labs and Cronos Group, significantly increasing Altria’s annual interest expenses. Our opinion of Altria’s dividend has soured, and we expect its per share dividend growth will slow down in the coming years, and management may even cut it should they decide to pare down debt, which may be wise in the current inflationary economic environment.

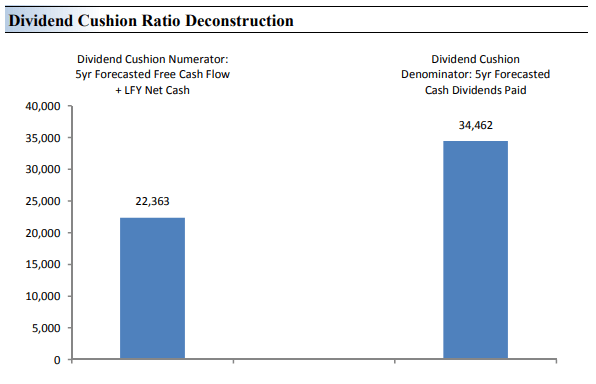

Image Source: Valuentum. The Dividend Cushion Ratio Deconstruction, shown in the image to the right, reveals the numerator and denominator of the Dividend Cushion ratio. (Image Source: Valuentum)

The Dividend Cushion Ratio Deconstruction, shown in the image above, reveals the numerator and denominator of the Dividend Cushion ratio. At the core, the larger the numerator, or the healthier a company’s balance sheet and future free cash flow generation, relative to the denominator, or a company’s cash dividend obligations, the more durable the dividend.

In the context of the Dividend Cushion ratio, Altria’s numerator is smaller than its denominator suggesting weak dividend coverage in the future. The Dividend Cushion Ratio Deconstruction image puts sources of free cash in the context of financial obligations next to expected cash dividend payments over the next 5 years on a side-by-side comparison.

Because the Dividend Cushion ratio and many of its components are forward-looking, our dividend evaluation may change upon subsequent updates as future forecasts are altered to reflect new information, but the takeaway is clear: Altria’s dividend is not as healthy as income investors might want it to be.

Concluding Thoughts

Altria is a Dividend Aristocrat that owns Philip Morris USA, which is behind the Marlboro cigarette brand in the U.S. The company is a tremendous cash flow generator with relatively modest capital expenditure requirements (to maintain a certain level of revenues). Excluding corporate events, such as spin-offs, the firm has raised its dividend 55+ times in the past 50+ years.

Altria has equity interests in AB InBev, Cronos Group, and JUUL Labs, and management is targeting a dividend payout ratio of ~80% of Altria’s adjusted earnings per share over the long haul. We like Altria’s pricing power, which provides a degree of protection from falling cigarette unit volumes, but there’s a lot more going on.

We can’t overlook the key risks to the payout stemming from a misallocation of capital, a hefty net debt load, growing competition, and a Dividend Cushion ratio that falls below parity (0.6). We think the executive suite may be wise to cut the payout, as they aren’t getting much credit in the share price to maintain it. Income investors should be cautious.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment