Liudmila Chernetska/iStock via Getty Images

Introduction

Despite the turbulent ride in markets thus far into 2022, the share price of Altria Group, Inc. (NYSE:MO) was actually seeing a relatively solid start to the year after climbing 10% by early June. Well, that was until the news that the FDA was proposing to ban JUUL E-cigarettes in the United States sent the share price plunging. This came on the back of earlier news that the Biden administration is still pushing to reduce nicotine in cigarettes to non-addictive levels. Thus, disappointingly, I feel it is now time to start thinking about the end of their dividends, despite being a long-time supporter.

Background

Ever since the major tobacco lawsuits two decades ago, the tobacco industry has not been a stranger to controversy and government regulatory risk, but the last five years have still felt like a rollercoaster ride. There have been frequent negative headlines starting back in the middle of 2017, when the FDA first proposed to reduce nicotine levels in cigarettes. The subsequently proposed menthol cigarette ban later in 2018 continued to levy more downwards pressure upon share prices, despite these regulatory actions still not being enacted and thus only lurking in the dark, metaphorically speaking.

Fast-forward to 2021 and, once again, their flagship reduced-risk product, IQOS, was banned in the United States in what was sadly a precursor to JUUL facing a similar fate recently. Despite these setbacks weighing down Altria’s share price, thankfully their dividends have not disappointed nor has their cash flow performance that continues to generate immense free cash flow.

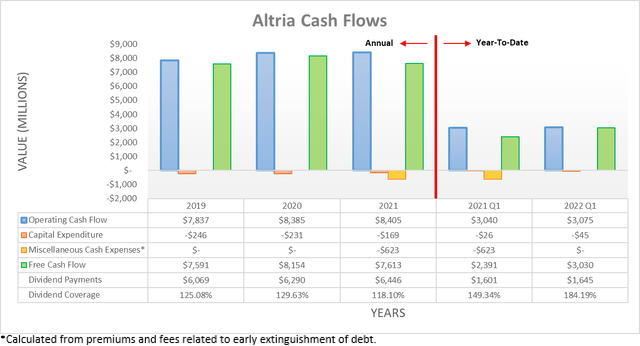

Thanks to the economically resilient and inelastic demand of the tobacco industry, the secular decline of tobacco demand is yet to wreak havoc upon their dividends with their current quarterly rate of $0.90 per share almost 50% higher than their previous level of $0.61 per share five years ago. This very strong improvement was underpinned by their operating cash flow and very minimal capital expenditure, which leaves immense free cash flow that consistently provides strong dividend coverage of 125%+. Whilst this dipped to only an adequate 118.10% during 2021, this was simply due to an abnormal $623m early debt extinguishment fee. When looking into 2022, their steady performance continued with operating cash flow of $3.075b during the first quarter, effectively flat year-on-year versus their previous result of $3.04b during the first quarter of 2021.

Since their historical cash flow performance is hardly breaking news, the big question is how they will fare going forwards in this increasingly difficult regulatory environment that is likely to see further setbacks as the federal government intensifies its anti-tobacco policies. Following this latest setback with JUUL, which is being described as a “serious” issue for their reduced-risk efforts and previous missteps with IQOS that are increasingly leaving them reliant upon their core cigarette business segment, it seems prudent for investors to start thinking about the end of their dividends.

Whether JUUL overcomes the proposed ban remains to be seen, but it should be remembered that even before this latest setback, their investment was already disappointing, with frequent large multi-billion dollar impairments. Whilst their strong dividend coverage provides safety in the short to medium term, eventually, their declining cigarette volumes will weigh down their financial performance, especially if the FDA finally proceeds with their proposed nicotine regulations, as wished by the Biden administration.

When looking elsewhere, after their now largely failed JUUL investment, sadly their balance sheet is weighed down with debt, thereby seeing their net debt currently standing at $22.569b. Thankfully, this only sees a net debt-to-operating cash flow of 2.69, which remains within the moderate territory of between 2.01 and 3.50. This seems safe, but nevertheless, it still reduces their ability to make further investments to diversify into other areas without potentially jeopardizing the safety of their dividends.

It should be remembered that shareholders are not the only stakeholders within their capital structure, and thus if their future earnings eventually diminish sufficiently to warrant a dividend reduction, their leverage metrics would also deteriorate significantly. This would create a requirement to deleverage because debt markets would be far less willing to routinely refinance debt as they are currently and by extension, this means that once their dividends start to wobble, they are likely to fall off a cliff very quickly down to zero as they have to retain relatively more of their free cash flow.

Discounted Cash Flow Valuations

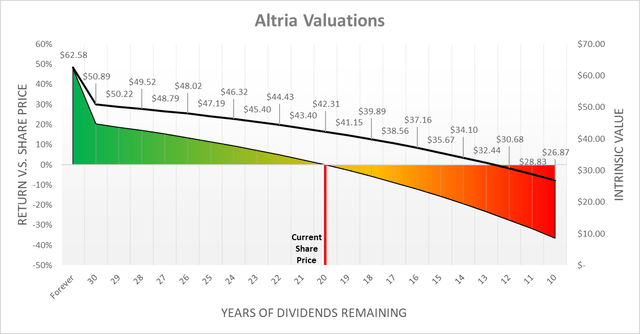

Since they are a very mature company whose core business segment faces a long-term secular decline as tobacco demand diminishes, their shares are almost exclusively sought by income investors. This means that their intrinsic value is heavily dependent upon the future income they can provide their shareholders, and thus can be estimated by utilizing discounted cash flow valuations that replace their free cash flow with their dividend payments. If interested, further details regarding the inputs utilized for these valuations can be found in the relevant subsequent section.

There are numerous ways to approach these valuations, but given their continuous setbacks trying to diversify away from tobacco, sadly, it now seems best to structure these around the idea of their dividends coming to an end. In my view, the most bearish scenario should still see another ten years of their current quarterly dividends of $0.90 per share thanks to their immense free cash flow, after which they are overwhelmed with minimal scope to reward their shareholders, as their debt becomes too burdensome as their earnings erode. Conversely, I see the most bullish scenario where their current dividends are sustained perpetually into the future, as they manage to diversify into new areas. Meanwhile, the remaining scenarios reside in between this range, whereby their dividends end at one-year intervals. Whilst they are likely to provide further dividend increases during the coming years, I expect these to be immaterial following these seemingly never-ending setbacks, with their exclusion providing a margin of safety.

When reviewing the results, the current share price of $42.31 aligns with the intrinsic value whereby their dividends last for another 20 years before they subsequently end and fall to zero. If phrased another way, this means that their share price appears to be pricing another 20 years of their current dividends, and thus if they last longer, investors stand to generate alpha and vice-a-versa. Under the most bullish scenario, this sees an intrinsic value of $62.58, which is a very impressive 48% higher than their current share price, which would see investors generate significant alpha. Meanwhile, under the most bearish scenario, their intrinsic value is merely $26.87 and thus 36% lower, thereby seeing investors nursing sizeable losses.

Since Altria was able to keep operating cash flow steady year-on-year during the first quarter of 2022 despite cigarette volumes declining 8.0% year-on-year, I personally expect their strong coverage will see their current dividends continuing as long as there are no further regulatory issues, such as lowering nicotine to non-addictive levels. Whilst this would indicate an intrinsic value towards the upper end of this range of circa $50, disappointingly, this nicotine regulation remains in the cards. This, in my eyes, leaves their intrinsic value lower around their current share price.

Since we are talking about government regulatory risks across future years, the most difficult issue arises from the fact that no investor can say with 100% certainty that they know what will happen. By providing a variety of results, readers can cross-reference their own views with these valuations, as they may vary from my own.

Valuation Inputs

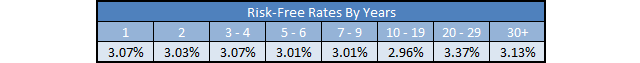

When conducting these discounted cash flow valuations, they utilized a cost of equity as determined by the Capital Asset Pricing Model. The inputs were a Beta of 0.60 (as per Barron’s), an expected market return of 7.50% and risk-free rates per year that track the United States Treasury yield curve on July 12th, 2022, as the table included below displays.

Author

Conclusion

Even though their dividends are safe in the short to medium-term, a sizeable portion of their intrinsic value is still tied to the next decade. Following Altria’s continuous setbacks in diversifying away from tobacco, the outlook is increasingly cloudy, especially with the prospects of lower nicotine levels on the horizon. If Altria manages to overcome these hurdles, investors stand to generate significant alpha with their share price well below their intrinsic value. On the other hand, if not, shareholders stand to nurse sizeable losses. Thus, after years of issuing a buy or strong buy ratings, I now believe that downgrading to a hold rating is appropriate, with any potential rally providing an opportunity to sell.

Notes: Unless specified otherwise, all figures in this article were taken from Altria’s SEC filings, all calculated figures were performed by the author.

Be the first to comment