Oselote/iStock via Getty Images

Introduction

The past two years have been tough for Integra Resources (NYSE:ITRG) (TSXV:ITR:CA) investors as sentiment in the precious metals mining space has been bearish and the results of the pre-feasibility study (PFS) released in February 2022 were underwhelming. However, I think the company looks undervalued at the moment. It has a lot of cash and I like its plan to re-focus on heap leaching as this will slash CAPEX and speed up permitting. In addition, an 11,000-meter drill program focused on low-grade stockpiles should extend the short mine life. Let’s review.

Overview of the business and financials

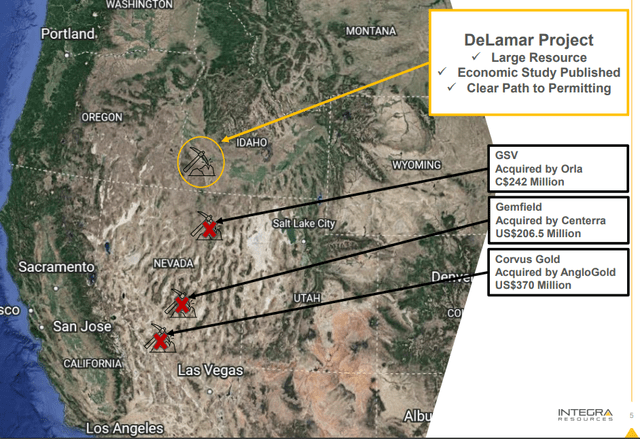

The main asset of Integra Resources is the DeLamar gold-silver project in southwestern Idaho which includes the historic mine of the same name of Kinross Gold (NYSE:KGC) that was closed in 1998 due to low metal prices (gold was below $300 per ounce back then). It was a somewhat large mine that produced about 1.6 million ounces of gold and 100 million ounces of silver over two decades so there’s a large low-grade stockpile left behind. As you can see from the picture below, DeLamar is located relatively close to several projects that were recently acquired for over $200 million each. While this project is not located in Nevada, Idaho is still considered to be among the top best mining jurisdictions in the world.

Integra Resources

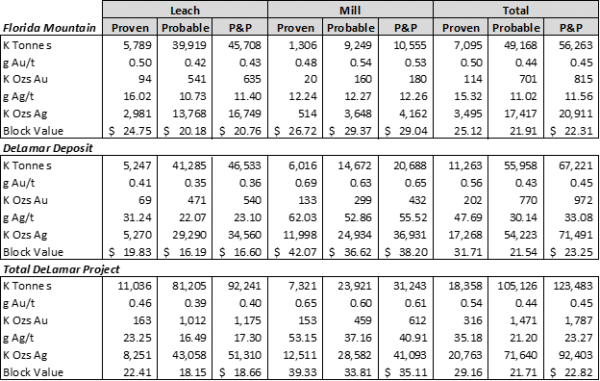

In 2017, Integra bought this project for about C$12.2 million ($9.5 million) in cash and shares with the hopes of finding more gold and silver and restarting production. At that time, DeLamar had an inferred resource of 1.59 million ounces of gold and 91.9 million ounces of silver, which is equal to around 2.67 million ounces of gold equivalent averaging 0.7 g/t gold equivalent. Integra immediately embarked on a 20,000-meter drill program and today DeLamar has proven and probable mineral reserves of 1.79 million ounces of gold and 92.4 million ounces of silver.

Integra Resources

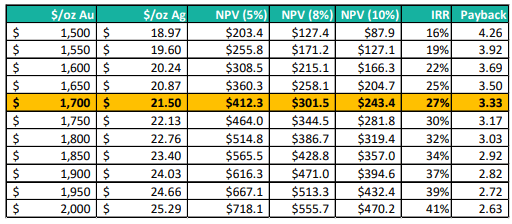

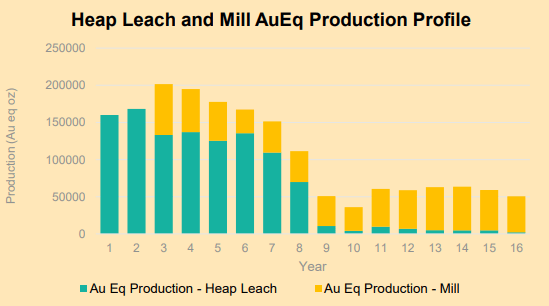

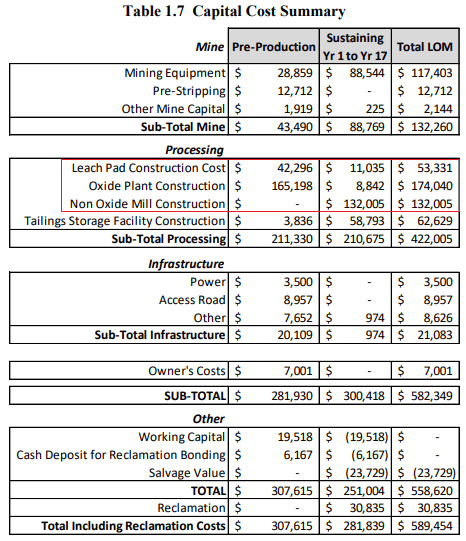

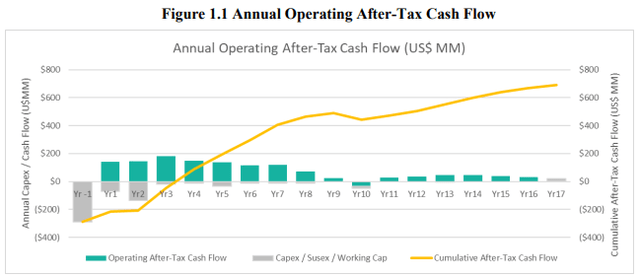

Looking at the key financial figures for DeLamar, Integra released the results of a PFS in February 2022 that showed a net present value (NPV) of $412 million and an internal rate of return (IRR) at $1,700 per ounce of gold and $21.50 per ounce of silver. The company focused on a two-stage mine involving heap leaching and milling of ore that would produce 1.15 million ounces of gold and 49.9 million ounces of silver over a life of mine (LOM) of 16 years.

Integra Resources

The numbers look compelling at first glance, but the issue is that many investors had high expectations considering Integra had said that annual production would be increased by over 50% compared to the preliminary economic assessment (PEA) released in 2019. However, annual production was cut to 110,000 ounces of gold equivalent as the production during the second part of the LOM is very low.

Integra Resources

In addition, sustaining CAPEX soared by 63% to $281.9 million as the capacity of the mill was boosted from 2,000 tpd to 6,000 tpd. Initial CAPEX, in turn, rose to $307.6 million from $161 million as the heap leach capacity was increased to 35,000 tpd from 27,000 tpd.

Integra Resources

In my view, Integra went in the wrong direction here as it makes little sense to build a larger mill when production drops to about 50,000 ounces of gold equivalent per year after the mine runs out of oxide and mixed ore material. It’s just not worth it and this was reflected in the NPV which fell sharply from $604.9 million in the PEA. Sure, processing that non-oxide ore would still be profitable but just barely. Overall, the NPV is lower, and the project is much harder to fund now due to the much higher CAPEX.

Integra Resources

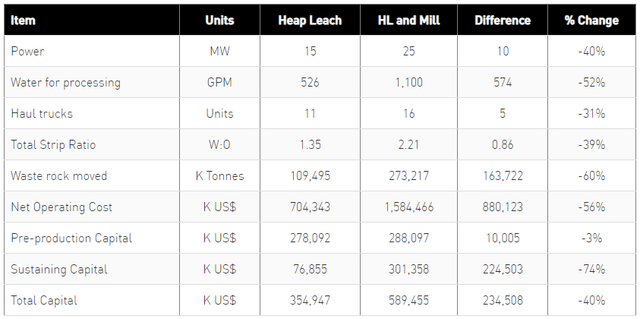

Well, the good news is that Integra is pivoting as it announced in April that it wants to go with the heap leach stage as a stand-alone mine project. As the mill is eliminated, CAPEX is down by about $235 million over the life of mine and this should fast-track permitting, with a mine plan of operations expected to be filed in late 2023. The issue here is that initial CAPEX is still pretty high, and the life of mine is cut to just 8 years as the non-oxide material is left out.

Integra Resources

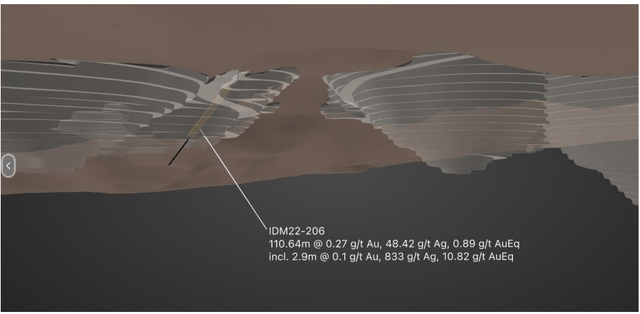

Under the new plan, the IRR has increased to 33% but the NPV is down to just $314 million. In order to boost the life of mine and the NPV, Integra has launched an 11,000-meter exploration drill program focused on the low-grade gold-silver stockpiles left behind from mining the old deposits and I think this is a good idea. You see, Integra estimates that there are about 60 million tonnes of oxide run-of-mine (ROM) material at surface and the grades seem relatively high – the first drill hole at Sullivan Gulch on the eastern portion of DeLamar intersected 0.27 g/t gold and 48.42 g/t silver or 0.89 g/t of gold equivalent over 110.64 meters.

Integra Resources

In my view, these low-grade gold-silver stockpiles could eventually extend the life of mine by at least 2 years.

Overall, I think that DeLamar is a compelling low-cost project with somewhat high initial CAPEX requirements whose key financials are likely to improve over the coming year. Considering development-stage gold mining companies usually trade at about 0.3x NAV, Integra should be valued at above $100 million. I also like that the company has a strong balance sheet, which means that stock dilution risk should be low in the short term. As of September, Integra has $20.5 million in cash and cash equivalents.

Looking at the risks for the bull case, I think that the major one is lower gold prices over the coming months. The sentiment in the sector is still bearish at the moment as major central banks around the world are raising interest rates at a rapid pace.

goldprice.org

Investor takeaway

In my view, Integra lost a lot of momentum due to the results of its PFS study but the future is looking bright as the company is focusing on its most profitable ounces now, which significantly reduces CAPEX and speeds up permitting. In my view, the first drill results at the low-grade stockpiles look promising and they could extend the life of mine by at least 2 years. This should provide a nice boost to the NPV and give the company some much-needed momentum. Overall, I rate Integra as a speculative buy. In my view, risk-averse investors should avoid this stock.

Be the first to comment