Mario Tama

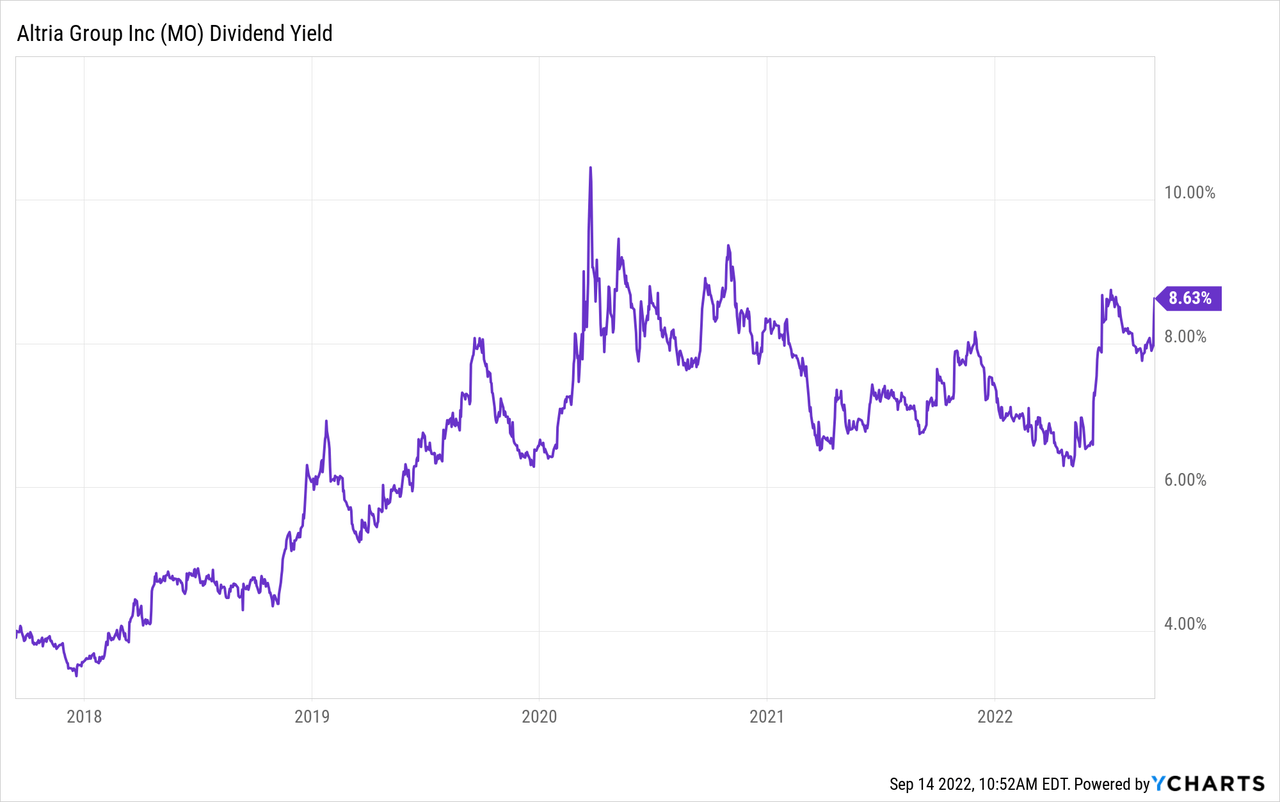

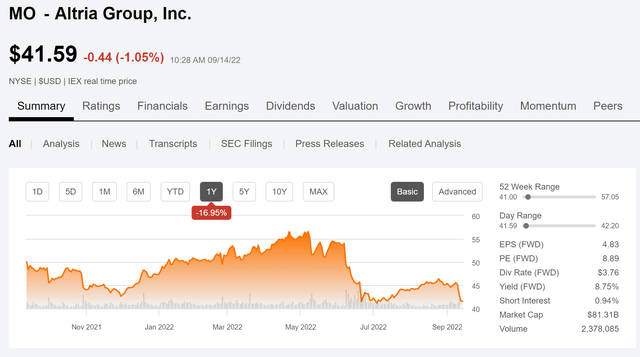

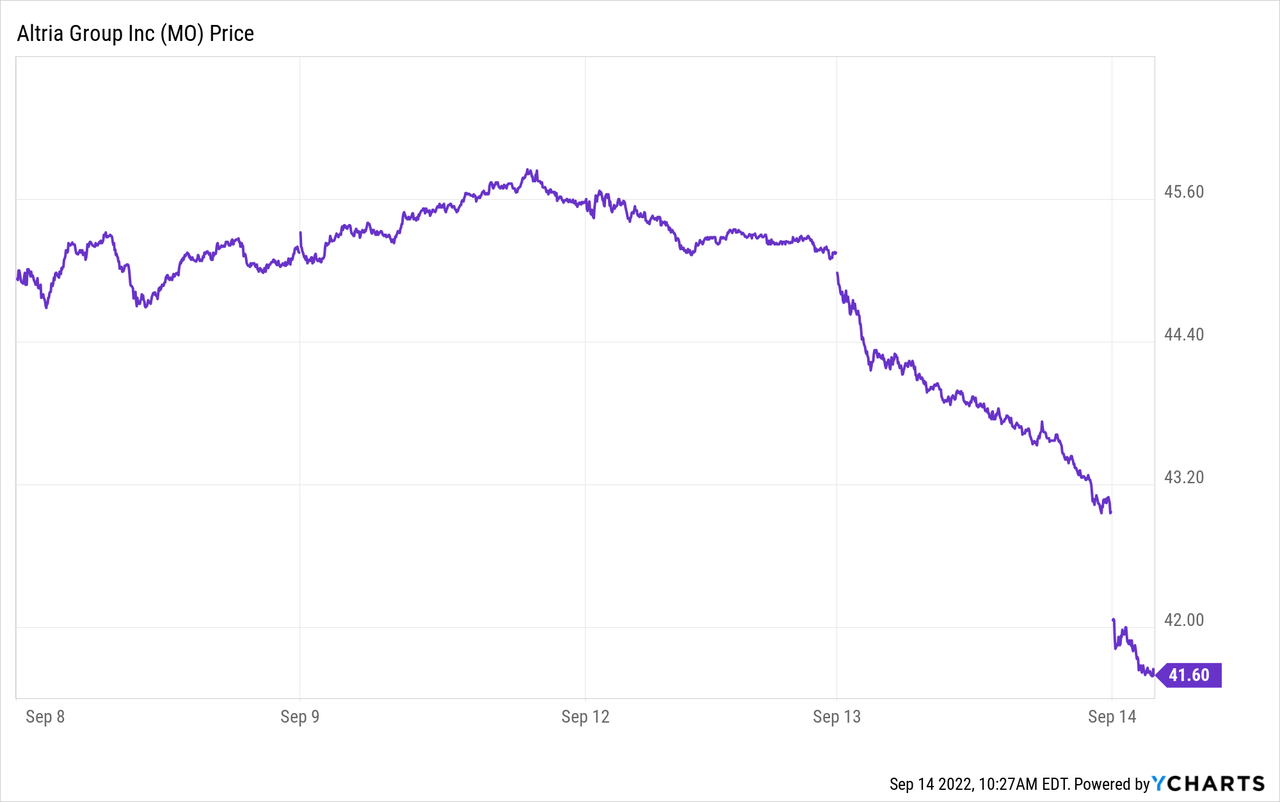

For income investors, tobacco company Altria (NYSE:NYSE:MO) is back at an attractive valuation. As the stock has recently fallen from $45 to $42, shares now approach a 9% dividend yield. Here’s what you need to know.

Over the past week, Altria stock has fallen sharply. Volatile market conditions are a major factor, to be sure. But some of the decline is also linked to the timing of the dividend. While Altria will pay out its quarterly dividend on Oct. 11, it went ex-dividend on Wednesday, Sept. 14. Historically, there’s been a tendency for Altria shares to fall immediately after the stock goes ex-dividend, perhaps related to dividend capture strategies.

How are things looking this time around? Altria’s dividend is now 94 cents per quarter, raised from 90 cents with the most recent announcement.

Given Tuesday’s close at $42.97, shares could logically be expected to trade at $42.03 on Wednesday to account for the reduction in the amount of the upcoming 94-cent dividend. Instead, shares have kept tumbling and are now into the $41s:

As the above graphic shows, the stock is down another 44 cents on Wednesday morning, in addition to the 94 cents that it would have fallen simply due to the dividend coming out of the stock price. Many financial sites automatically adjust the close price on ex-dividend date to account for the payment.

Let’s put that into graphical form:

Altria slumped from $45 to $43 thanks to the recent market tumble related to higher inflation. Wednesday morning, it would have been expected to fall to around $42 to account for the dividend payment. And now it has continued to drop even past that level, perhaps related to short-term traders cashing out now that the stock has gone ex-dividend.

In any case, shares are now nearly 10% cheaper than they were as recently as Sept. 9. Here’s why that should be intriguing for dividend investors.

Altria’s Dividend Hike Streak Continues

In August, Altria bumped its dividend from 90 cents to 94 cents per quarter. This dividend increase marks 53 years in a row of such annual dividend hikes for the company. It’s quite the track record for a firm in an industry that has supposedly been obsolete since the 1990s.

You can find plenty of other commentary about Altria on Seeking Alpha and elsewhere. I find the product they sell somewhat distasteful and prefer not to linger on the subject too much. So, we’ll stick purely to financials.

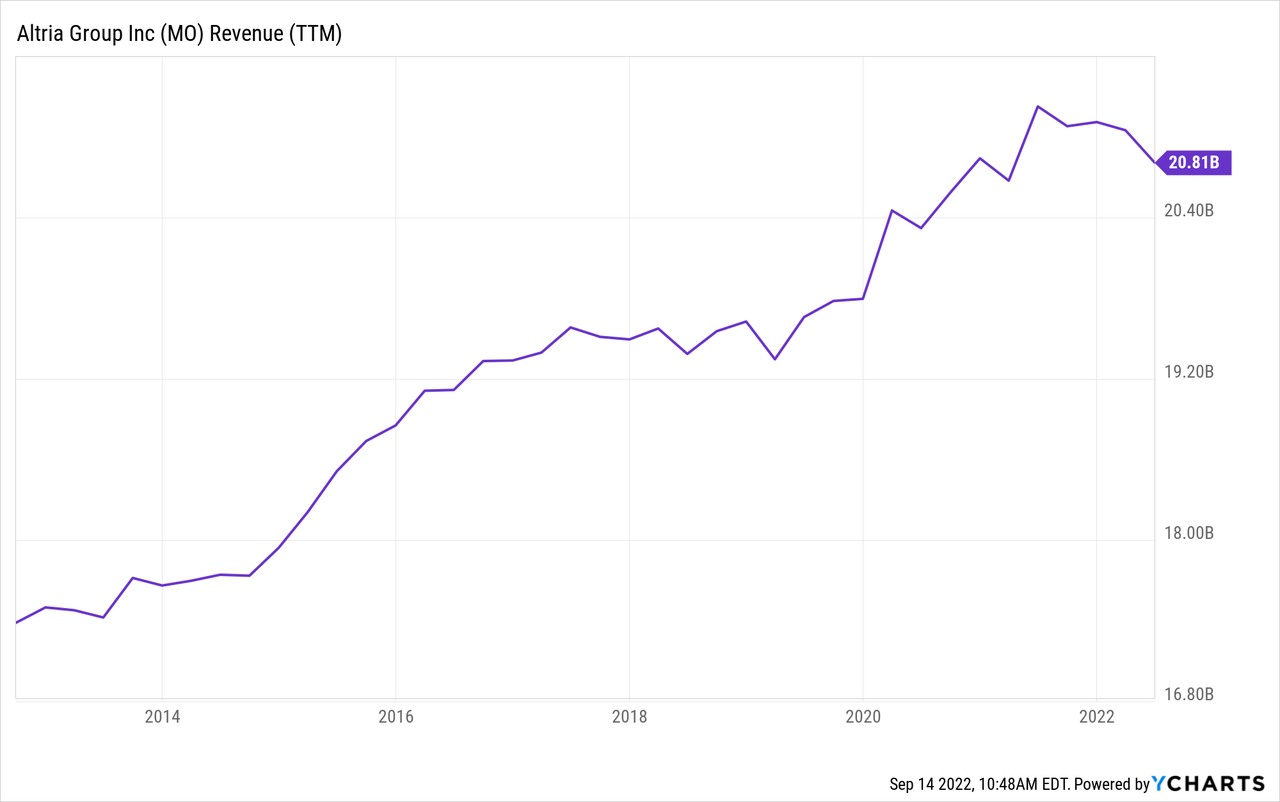

Altria’s core smokable business continues to see unit sales declines. No surprise there. However, contrary to the negative narrative you see at times, Altria actually remains a growth enterprise thanks to price hikes and sales from non-cigarette sources:

Say what you will about the tobacco industry, but this graph is not indicative of a dying business.

Balance Sheet Is Fine

What about the company’s excessive debt load, though? With $24 billion or so of debt, isn’t Altria drowning in liabilities? You certainly hear a lot of folks talking about the debt as a big problem, particularly when combined with the long-term drop in rates of tobacco usage.

But, when you look at the debt in the broader context of the income statement, it isn’t a showstopping issue.

While the company has a lot of debt, sure, it generates $12 billion annually in operating income. Against that, it pays just $1.2 billion of interest expense, or just 10% of operating income. Interest rates could double from here and Altria’s interest expense would go up to just $2.4 billion against said $12 billion of annual operating income. The interest expense is not excessive in proportion to the business’ size.

Furthermore, I’d note that operating income is up from $9 billion to $12 billion annually over just the past few years. The company’s net income has grown by more than twice its total annual interest expense in a short period of time. The debt is a non-factor in analyzing Altria’s stock or its ability to pay and keep increasing its dividend.

What else makes the dividend safe? With revenues and net income going up, Altria has room to keep increasing the dividend for a long time to come. But there’s more to the company’s financial strength than just price hikes on its main product line.

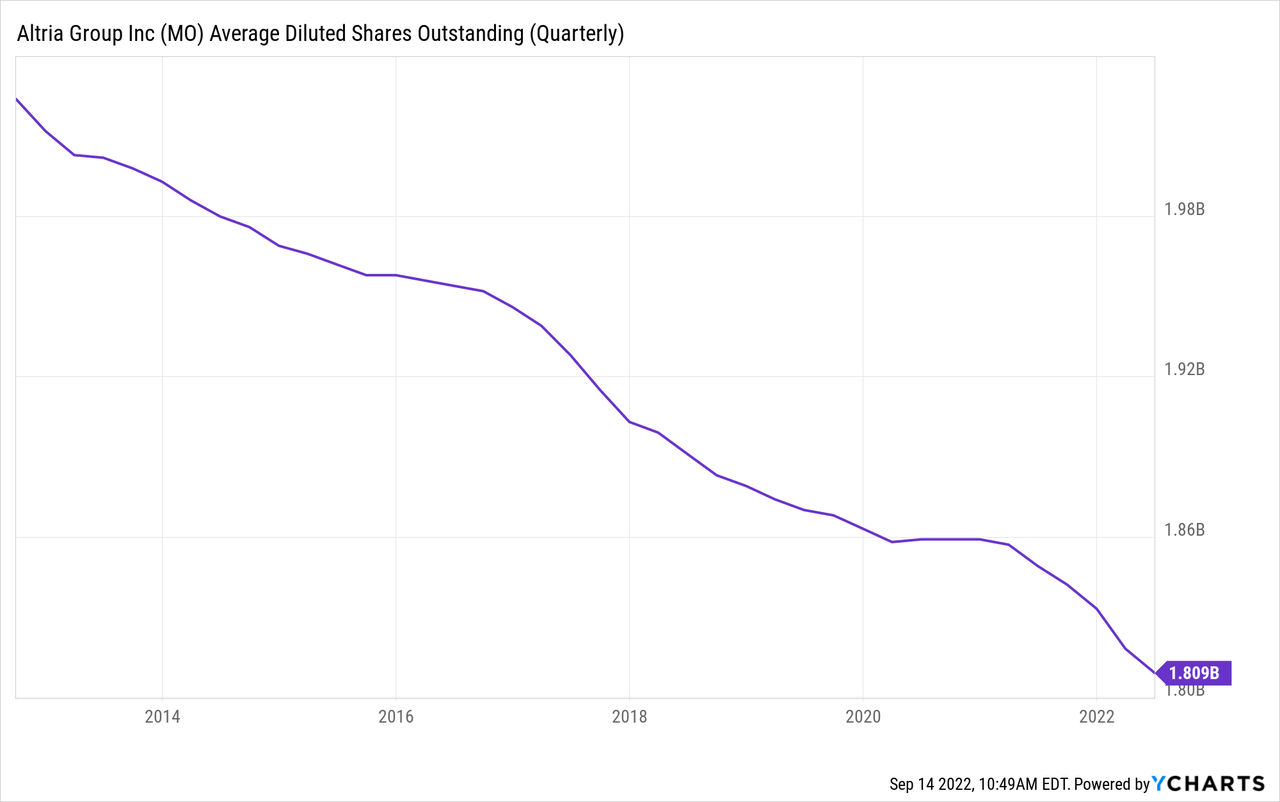

That other big element is the share buyback. Over the past decade, Altria has bought back a cool 200 million shares of its company, reducing the share count from 2.0 billion to 1.8 billion. I’d also note that the buyback has accelerated over the past year to take advantage of the currently depressed share price:

With the dividend now at $3.76 per share annually, the company is saving $752 million annually in dividends that it doesn’t have to pay on those retired 200 million shares.

This is another thing the “debt is bad” crowd is missing with Altria. It pays 8% on its dividend out to shareholders. Meanwhile, it is paying, on average, around 2.5% on its interest to banks and bondholders. It’s obviously far more cash flow positive to repurchase shares than to pay down debt. Especially in an inflationary environment, just keep letting that debt shrink and shrink in real terms as inflation makes the principal erode.

There’s plenty of bad things to say about Altria’s corporate decisions, particularly around its investments in Juul and the cannabis industry. And the primary product it sells isn’t one that has particularly promising long-term prospects.

But the actual financial results continue to be surprisingly strong, especially for a firm that trades at less than 10 times earnings. Of all the stocks that yield 8%+ out there, MO is surely one of the safest and lowest risk bets around as a pure high-income play.

I doubt the share price will appreciate much in the intermediate term. This is not a stock that should be purchased with much expectation of capital gains. It’s a bond for all intents and purposes. But if a greater than 8% coupon with a small annual increase fits your needs as a fixed income alternative, MO stock is a strong choice.

Be the first to comment