Mario Tama/Getty Images News

Altria Group, Inc. (NYSE:MO) has dropped almost 16% over the past month as broader market weakness has combined with rising interest rates, hurting the appeal of the company’s dividend amidst general broader weakness in the markets. At the same time, the company has been punished by a purported FDA ban on Juul, it’s long ill-fated investment.

Despite the news, we still see the company as a unique investment opportunity.

Altria vs. USA

Altria vs. the USA is a tough lawsuit. We’re not lawyers, so we won’t dive deep.

However, the U.S. is arguing that Juul e-cigarettes contain multiple harmful chemicals (redacted from the filing) that are released during the smoking process. Altria is arguing that its 100+ thousand page report to the FDA proved those chemicals aren’t in fact harmful, and that Juul’s prevalence among teen users has put pressure on the government to unfairly regulate it.

Other observers in the e-cigarette industry say that Juul’s argument is reasonable, and so far, through rapidly filed lawsuits, the ban has been stayed. In our view, the market has already written off what was a very overpriced acquisition of Juul, at more than $13 billion. However, it’ll continue to be in the news for a while.

It’s also worth noting that, even if the product is removed, we expect it to be a max 1-2 year delay, as the company can redesign around those chemicals the government doesn’t approve of. It’s also worth noting Altria still has a substantial business in the low-risk space that could outperform from this ban and recapture lost revenue.

Altria Financial Performance

Overall Altria has continued to perform well financially. To start, the $75 billion company has a $10 billion state in Anheuser-Busch InBev (NYSE: BUD).

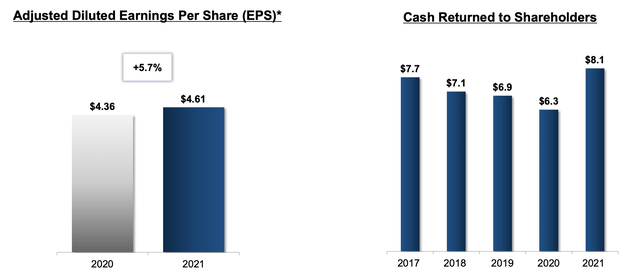

Altria Financial Performance – Altria Investor Presentation

The company saw ~6% earnings growth from 2020-2021 and expects similar growth going into 2022 giving the company a single-digit P/E ratio at its current valuation. The company returned $8 billion in cash to shareholders in 2021, and we expect stronger returns in 2022, driven by the company’s almost 9% dividend yield.

In 1Q 2022, the company returned $2.2 billion through $1.6 billion in dividends and $0.6 billion in repurchases. At current lower prices, this means the ability to repurchase almost 4% of the company on top of an almost 9% dividend yield. This is a low-double-digit shareholder yield that shows the company’s financial strength.

The company also has $25 billion in long-term debt that we’d like to see it continue to reduce.

Altria Alternative Products

The company has impressive alternative products businesses.

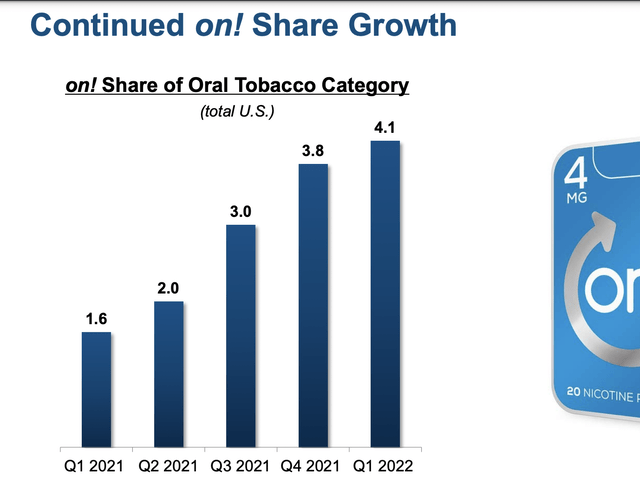

Altria Oral Tobacco – Altria Investor Presentation

The company’s share in the oral tobacco markets is growing. The company also has impressive e-vapor products. These two products form the basis of the company’s profits as people transition away from smoking but stick with nicotine. Since nicotine is the truly addictive chemical, this is very profitable for the company.

Secondly, the company also has its Cronos Group investment. Marijuana is on the path to legalization, and as another “sin” product, we expect that Altria is posed to dominate the product and its complex regulatory environment once it’s legalized. That could open a massive new business for the company worth billions.

These alternative businesses will help the company diversify from cigarettes.

Altria Shareholder Return Potential

Altria has a proven history of strong shareholder rewards that make the company a valuable investment.

First is the dividend. At an almost 9% yield, it’s worth investing for that dividend alone, even if the company never touches it again. The company does have a history of increasing it, one of the largest histories in the market. Those who invest know could see a double-digit dividend yield on investment in the next few years as EPS continues growing.

Second is the company’s share buybacks. This is another few % a year that enables continued dividend increases and drives overall shareholder rewards. Outside of this, the company has a manageable debt load although financials could improve as it saves on interest from paying down this debt load. We don’t expect debt to increase over the next several years.

Lastly, the company has a diversified business in the “sin” market, and with the potential of federal marijuana legalization, we actually see the potential for growth in the company’s shareholder returns. For these reasons, we recommend taking advantage of the company’s current share price to invest.

Thesis Risk

The largest risk to the company is a continued decline in the company’s businesses. Cigarettes have been in decline for decades, and as seen with Juul, the regulatory environment around the company has been growing significantly. Continued pressure here could hurt the company’s ability to continue driving earnings.

Conclusion

Altria’s dividend yield is now almost 9% on the back of the company’s recent share price weakness. Recent news around Juul has done no favors for the company’s business. The company’s annualized dividend of $6.4 billion is incredibly affordable and the company has continued to increase it as its EPS has grown by mid-single digits.

Be the first to comment