AaronAmat/iStock via Getty Images

Introduction

Altria Group, Inc. (NYSE:MO) released Q2 2022 results on Thursday morning (July 28). MO stock finished the day flattish (down 0.2%).

We upgraded our rating on Altria to Buy in February 2020. Shares currently have a gain of 11% since our upgrade, with dividends more than offsetting a 7% decline in the share price, having fallen 23% from their April 2022 peak:

|

Librarian Capital Altria Rating vs. Share Price (Last 1 Year)  Source: Seeking Alpha (28-Jul-22). |

Q2 2022 results were largely in line with our investment case. Macro headwinds are pressuring Altria volumes, and both revenues and operating income fell year-on-year. However, part of the decline was due to one-off items, and management reaffirmed their guidance for a 4-7% Adjusted EPS growth in 2022. We expect continuing stability in the U.S. cigarette market, and recent FDA action on e-vapor makes this more likely. Altria shares now trade at a 9.3x P/E and an 8.2% Dividend Yield. Our forecasts indicate a total return of 74% (20.0% annualized) by 2025 year-end. Buy.

Altria Buy Case Recap

Our investment case on Altria is based on the continuing ability of its cigarette business to deliver on its traditional earnings algorithm, which includes:

- A low-to-mid single-digit annual decline in cigarette volumes

- A mid-to-high single-digit annual rise in average cigarette prices

- Together these give a low-single-digit annual growth in revenues

- Revenues After Excise tend to grow even faster as excise growth lags

- EBIT margin expands with higher unit price and operational savings

- Including buybacks, EPS tends to grow at mid-to-high single-digits

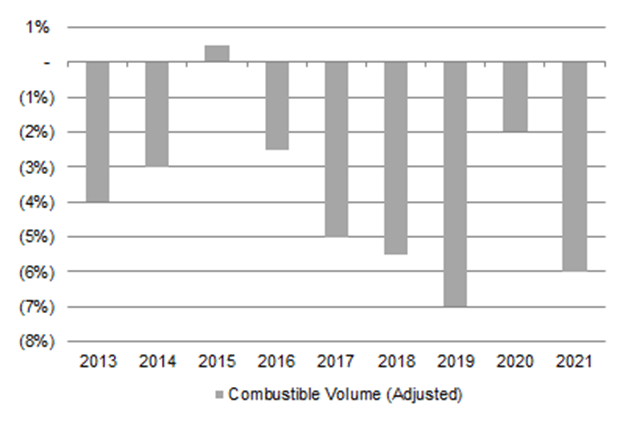

Altria’s cigarette volume decline accelerated during 2016-19, partly attributed to an explosive growth in U.S. e-vapor. However, Altria still guided to an EPS growth of 4-7% in both 2019 and 2020 (achieving 5.8% in 2019).

FDA actions against e-vapor in late 2019 pushed e-vapor volume downwards until Q1 2020, after which it resumed growing but at a modest pace.

COVID-19 boosted U.S. cigarette consumption, as pandemic restrictions meant more occasions to smoke and government stimulus programs added to smokers’ disposable incomes. Altria’s Smokeable volume decline was just 2% in 2020, and remained below 5% during H1 2021 (but rising in H2).

|

Altria Smokeable Volume Declines (Adjusted) (2013-21)  Source: Altria company filings. NB. Figures adjusted for inventory movements. |

We believe declines in U.S. cigarette volume will remain stable, with e-vapor growth staying modest, and nicotine pouches and Heat Not Burn both being too small to have a meaningful impact.

Q2 2022 was an atypically bad quarter for Altria, due to rises in gasoline prices and inflation.

Revenues and Profits Declined in Q2

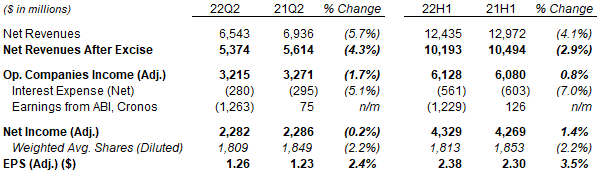

In Q2 2022, Altria’s Net Revenues After Excise fell 4.3% year-on-year, and Adjusted Operating Companies Income (“OCI”) fell 1.7%. Net Income fell 0.2%, but Adjusted EPS rose 2.4% largely because of a lower share count:

|

Altria Group P&L (Q1& H1 2022 vs. Prior Year)  Source: Altria results release (Q2 2022). |

Across H1, Net Revenues After Excise fell 2.9%, OCI rose 0.8%, Net Income rose 1.4% and Adjusted EPS rose 3.5%.

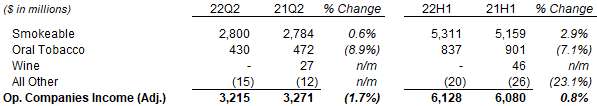

Macro headwinds on Altria cigarette volumes was certainly a factor in Q2, but there were also one-offs. The disposal of the Wine business, for example, contributed 0.8% to the year-on-year OCI decline in both Q2 and H1:

|

Altria OCI by Segment (Q1& H1 2022 vs. Prior Year)  Source: Altria results release (Q1 2022). |

The Smokeable segment contributed 87% of segment OCI in Q2, and rose 0.6% year-on-year. Oral Tobacco, the other segment, saw OCI fell 8.9% as it continued to struggle with structural issues.

Macro Headwinds Hitting Cigarettes Demand

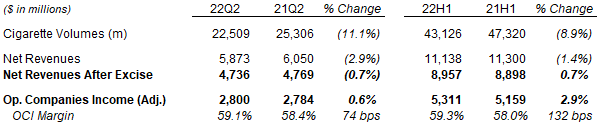

Cigarette volumes in the Smokeable segment fell 11.1% year-on-year. However, as is structural for tobacco, Net Revenues fell only 2.9% thanks to price increases, and Net Revenues After Excise fell only 0.7% as excise did not rise as much as price. Smokeable Adjusted OCI rose 0.6% even on lower revenues, driven by lower promotion spend:

|

Altria Smokeable Financials (Q1& H1 2022 vs. Prior Year)  Source: Altria results release (Q2 2022). |

The gap between volume decline (11.1%) and Net Revenue After Excise decline (0.7%) was achieved while the average retail pack price for Marlboro cigarettes rose by just 5.6% ($0.43) year-on-year, below inflation and lower than the ($0.45) increase in Q2 2021. Marlboro’s retail share actually rose 10 bps from Q1 (at 42.7%), and total discount segment market share of the industry was sequentially stable at 26.4%.

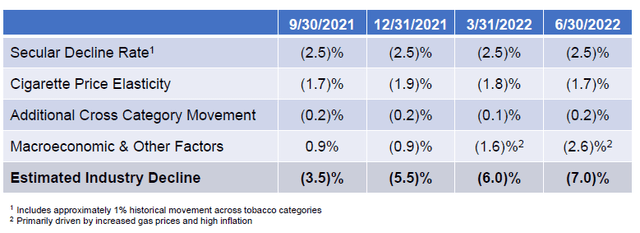

Management attributed the volume decline to macro headwinds, specifically higher gasoline prices and inflation. In Altria’s estimates, “Macroeconomic & Other Factors” as a headwind to industry volume stood at 2.6% on a last-twelve-month basis as of Q2 2022, continuing its deterioration from being a positive benefit in the 12 months to Q3 2021:

|

U.S. Cigarette Industry Volume Decline by Component (Rolling 12 Months)  Source: Altria quarterly metrics (Q2 2022). |

However, Altria’s year-on-year decline in Q2 was also made worse by one-off items. Trade inventory movements made its volume decline about 1 ppt worse; its cigarette volume decline was an estimated 10% on an adjusted basis. There was also a one-off step-up in MSA settlement costs as higher inflation assumptions have been used.

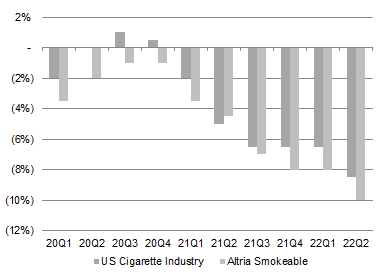

Management observed that consumers have prioritized tobacco purchases by reducing non-tobacco purchases, and that surveys indicate smokers remained brand-loyal. Volume declines may decelerate once consumers have adjusted to the new environment, and prior-year comparables will also get easier as we move into H2 2022:

|

1-Year Cigarette Volume Decline – Altria vs. Industry (Since 2020)  1-Year Cigarette Volume Decline – Altria vs. Industry (Since 2020) |

To sum up, the Smokeable segment generated positive OCI growth even with an 11% shipment volume decline, while the underlying decline was about 1 ppt less. We believe that there is a good chance that Q2 would mark the trough in year-on-year volume declines, and expect OCI growth to return to low-to-mid single-digits in future quarters.

FDA Actions Limiting E-Vapor Growth

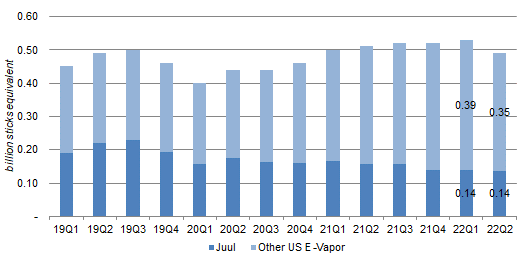

FDA actions have caused U.S. e-vapor volume to reverse in Q2, and may hinder it further in future.

According to estimates quoted by Altria, U.S. e-vapor volume in Q2 was down 7% from Q1, its first sequential decline since Q1 2020, largely due to a reduction in vape store volumes:

|

U.S E-Vapor Category Volume by Quarter (Since 2019)  Source: Altria company filings. |

The FDA has been active in issuing Marketing Denial Orders (“MDOs”) on an increasing number of e-vapor products since late 2021, including Juul (which has obtained a temporary stay from the courts) and Imperial Brands (OTCQX:IMBBY) (which tried but failed). Enforcement actions may have been stepped up after a law giving the FDA explicit authority to regulate synthetic nicotine went into effect in April. In the first two weeks of July, warning letters were sent to 107 retailers.

On the Q2 earnings call, Altria management highlighted how the FDA has so far issued Marketing Granted Orders to only 23 e-vapor products representing just 1% of e-vapor industry volume, how the only decisions made on flavored e-vapor products have been rejections, and how a substantial number of e-vapor products contain synthetic nicotine and were thus required to obtain FDA authorisations by July 13. Altria expects further changes in the sector.

Continuing stability in the U.S. cigarettes market will be beneficial to Altria earnings, and ongoing FDA actions on e-vapor make this more likely.

On the other hand, other ongoing FDA efforts to change current regulations will be negative to Altria. These include proposed bans on menthol cigarettes and flavored cigars, which have been in a rulemaking process since April, and a potential reduction in the level of nicotine in cigarettes, which has not formally entered a rulemaking process. However, all these will involve long and legally-contested processes, possibly running into years, and bans on menthol cigarettes and flavored cigars will have a relatively limited impact on Altria in our view, as the vast majority of smokers will likely migrate to non-flavored varieties.

Altria Can Now Pursue Other E-vapor Options

Altria can also now pursue other e-vapor options, though there are few good options.

Since its $12.8bn investment in Juul in 2018, Altria has been bound by a non-compete clause in e-vapor. However, in Q2 2022, Altria wrote down the value of its Juul investment by a further $1.2bn to $450m, thereby bringing about one of the scenarios (the value of its Juul stake falling below $1.28bn) where it can opt to be released from the non-compete. Altria has not decided to be released “at this time”, as doing so would cost it board seats and other investment rights. However, it can choose to be released at any time.

There are few easy e-vapor options for Altria. Njoy, reported to be running a sale process (by the Wall Street Journal, subscription required), has only 3% of the U.S. e-vapor market, is mostly active in disposables and supposedly come with a $5b price tag. Philip Morris’ (PM) VEEV seems to be making good progress in many non-U.S. markets (see our Q2 review), but its plans to enter the U.S. market by acquiring Swedish Match (OTCPK:SWMAY) means it has little motive to cooperate.

Altria stated it has two product platforms, in Heat Not Burn and oral tobacco respectively, where designs will be finalized by 2022 year-end and efforts to obtain regulatory approvals will begin thereafter. However, these are likely to need multiple years. (PM took 2 years to get its IQOS PMTA approved; Swedish Match took 4 for ZYN.) It is possible that Altria may also decide to pursue its own organic product development in e-vapor eventually.

Altria Still Struggling in Oral Tobacco

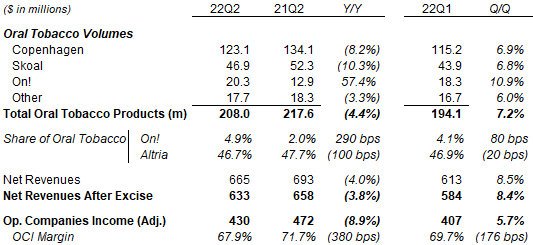

Altria is still struggling in Oral Tobacco, though the segment is only 13% of segment OCI.

Oral Tobacco revenues fell 4.4% year-on-year in Q2, as overall volume and market share continued to fall. OCI fell 8.9% year-on-year, more than revenues, in part due to promotional spend on Altria’s On! nicotine pouches. Altria’s overall share in oral tobacco fell 1 ppt year-on-year, from 47.7% to 46.7%:

|

Altria Oral Tobacco Financials (Q2 2022 vs. Prior Periods)  Altria Oral Tobacco Financials (Q2 2022 vs. Prior Periods) |

There was some improvement sequentially, with On!’s share of the oral tobacco category rising from 4.1% to 4.9%. Revenues and OCI also grew, but potentially due to seasonal patterns in volume.

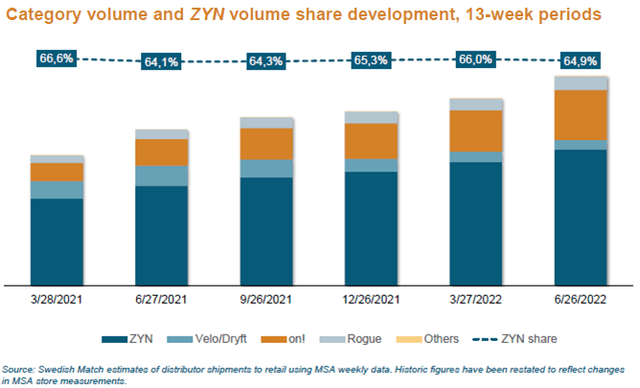

We know from Swedish Match’s Q2 results that its ZYN nicotine pouches continue to dominate the market, and that they have reduced promotions in Q2 (potentially explain Altria’s gain) but will be increasing them again in Q3.

|

U.S. Nicotine Pouches Volume & Market Share (Since Q1 2021)  Source: Swedish Match results presentation (Q2 2022). |

We do not expect any improvements in Altria’s competitive position in oral tobacco. Should Philip Morris’ acquisition of Swedish Match completed by year-end as planned, ZYN would become an even more formidable competitor. However, the segment’s relatively small contribution means this does not invalidate the overall investment case.

No Update on U.S. IQOS

Altria stated that they remain in discussions with Philip Morris on its exclusive U.S. license for IQOS. The two companies have been in dispute on whether Altria has fulfilled the contractual conditions required to renew the license beyond 2024.

Philip Morris stated on their Q2 2022 earnings call that they continue to expect IQOS to be available in the U.S. again in H1 2023.

Altria Dividend Yield and Valuation

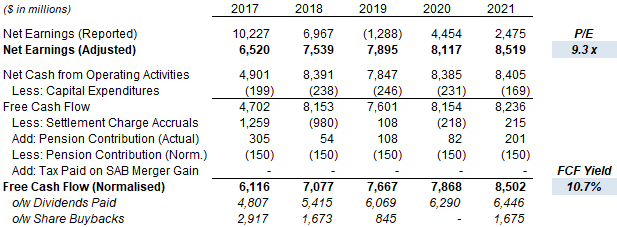

At $44.00, Altria shares are trading at a 9.3x P/E and a 10.7% Free Cash Flow (“FCF”) Yield (normalized):

|

Altria Valuation & Cashflows (2017-21)  Source: Altria company filings. |

Relative to the midpoint of the reaffirmed 2022 EPS guidance ($4.79-4.93), Altria’s P/E multiple is 9.1x.

The Dividend Yield is 8.2%, with Altria stock currently paying a dividend of $0.90 per quarter ($3.60 annualized). Altria targets an 80% Payout Ratio, and the dividend was raised 4.7% in August 2021.

Altria’s minority stakes in Anheuser-Busch InBev, Juul and Cronos are currently worth a combined $10.4bn, or 13% of its market capitalization. Management reiterated that BUD is a financial investment, and we expect this to be sold eventually to facilitate more buybacks and dividends.

Buybacks totalled $1.1bn in H1, including $507m in Q2 at an average price of $50.35. The current buyback program has $750bn remaining, equivalent to 0.9% of the current market capitalization, and will be executed by year-end.

Altria Stock Forecasts

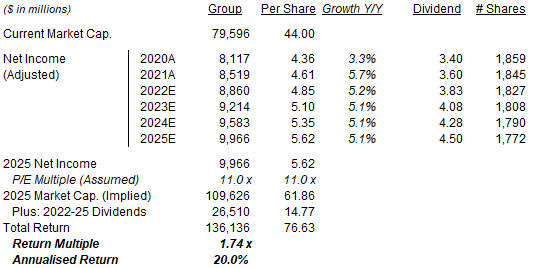

We keep the assumptions in our forecasts unchanged:

- Net Income growth of 4% annually

- Share count to fall by 1% annually

- Dividend Payout to be 79% in 2022, and 80% thereafter

- P/E at 12.0x at 2025 year-end, implying a 6.7% Dividend Yield

Our 2025 EPS forecast is unchanged at $5.62:

|

Illustrative Altria Return Forecasts  Source: Librarian Capital estimates. |

With shares at $44.00, we expect an exit price of $62 and a total return of 74% (20.0% annualized) by 2025 year-end.

Is Altria Stock A Buy? Conclusion

We reiterate our Buy rating on Altria Group, Inc.

Be the first to comment