DieterMeyrl/E+ via Getty Images

Every time I take a fresh look at Altimmune (NASDAQ:ALT), it seems to have evolved into a new company. For a biopharma, its pipeline is the company; since Altimmune’s pipeline seems to keep evolving, it does look like a new company every year. Once they had NasoVAX, then during the Covid-19 period they went into treating SARS-CoV-2, and now that I look at it, they have evolved into a NASH company.

That’s funny because I remember decades ago in an Economics class our professor telling us that many companies do not have profit as a motive for existing; for many companies, he told us, without giving an example, the motive is simply to exist. I thought about that over the years, and when I look at a lot of biopharma companies running clinical trials for a decade or more, raising funds from the market, and doing everything else a company should do without actually making a single dollar in revenue let alone profit, I kind of get what my old professor was telling us. Many companies have no intention of ever making a profit, ever getting a drug approved. They exist because that keeps management in the job.

I am not saying – yet – that this is what the company we are discussing today is doing; this is just a broad observation which applies to many emerging biopharma who have no real intention to ever actually emerge.

Coming to Altimmune, I see from my December 2020 article that I was urging them to focus on NasoVAX. Altimmune, at that time, had produced some good early data from its NasoVAX studies. More importantly, like I said then, they seemed to have found the best of both worlds between intranasal and parenteral flu vaccines. The former is live attenuated, while the latter is inactivated but non-mucosal. Each has its own problem, and Altimmune seemed to have taken the best of both and developed NasoVAX. Given the vast market, I thought it prudent for the company to focus on NasoVAX. However, they went on a tangent to Covid-19, and the stock went up largely on hype. In late 2020, the FDA put the Covid trial on hold, and by mid-2021, the company had abandoned both their Covid programs.

One thing that went in favor of the company was that the Covid-19 spike helped them raise a good amount of cash. At that time, they were able to raise $200mn from the market, which added substantially to their dwindling coffers. I thought that they would use this cash to focus on NasoVAX; however, now I see that they have made pemvidutide, the NASH asset, their lead candidate, and NasoVAX isn’t even in the pipeline any more. Besides NASH, they have HeptCell, which we had seen before, for hepatitis B.

Pemvidutide produced some interesting early data from a phase 1 trial. There was a very good and competitive reduction in obesity, but the effect was ruined by ALT elevation in a single patient (source), which crashed the stock when they announced this data. The company noted:

One patient experienced elevated ALT levels that resolved rapidly after a pause in dosing.

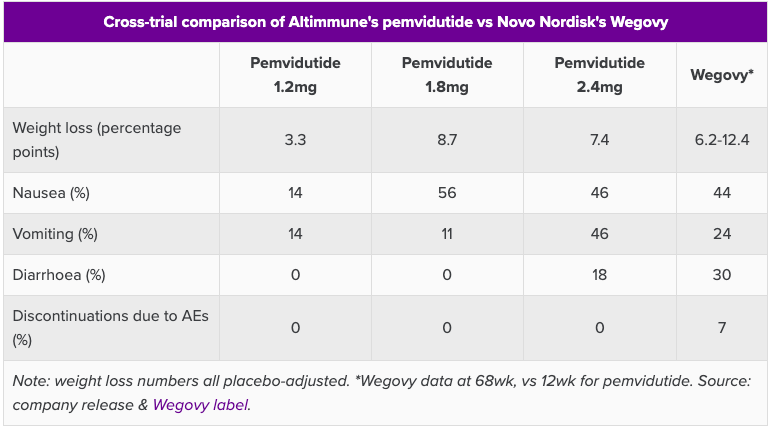

Here’s some comparison data:

ALT-801 Comparison data (Evaluate Vantage)

Wegovy is Novo Nordisk’s (NVO) anti-obesity drug semaglutide. It mimics the activity of glucagon-like peptide-1 (GLP-1), which makes the brain think that the stomach is full. Pemvidutide is a dual agonist of GLP-1/Glucagon receptor. From 12-week data announced in September, 10.3% mean weight loss was achieved in patients at the 1.8mg dose. This was the same dose which saw the ALT elevation; however, the data, otherwise, seems very competitive. Moreover, there was a greater than 90% reduction in liver fat by MRI-PDFF at 6 weeks.

The company initiated a phase 1b NAFLD study in October, which will read out in H1 2022. Based on the findings of the NAFLD study, the Company intends to initiate a 52-week biopsy driven Phase 2 NASH study in 2022. Another phase 2 trial in obesity started enrolling this year. The study is expected to enroll 320 non-diabetic patients in the US. Data is expected next year.

Financials

ALT now has a market cap of $251mn and a cash reserve of $191mn as of December. Research and development expenses were $20.2 million for the three months ended December 31, 2021, while General and administrative expenses were $3.8 million. As late-stage trials happen, these figures will definitely increase; however, the company seems comfortably positioned in terms of cash.

Bottom Line

So, what should a long-term follower/sometime investor in ALT think of all these developments? There’s a feeling of deja vu here; we have seen good data from ALT before, only to see things fizzle out. NASH/NAFLD/Obesity are highly competitive markets. For this small company to become a revenue generator in any of these fields looks like a very long shot. On the other hand, data seen so far from the Australian obesity trial is very interesting. I think the prudent thing to do here is to play it safe, wait and watch, and see how it goes. If you are a short-term or high-risk investor, you may have a different approach to Altimmune’s current avatar as a liver disease player.

Be the first to comment