NooMUboN/iStock via Getty Images

The relentless bear market we’ve seen this year has taken its toll on a huge number of stocks. After all, that’s how bear markets work. However, not all stocks have suffered, and one that has performed extremely well is energy drink manufacturer Celsius Holdings (NASDAQ:CELH). The company is not as well-known as some of its competitors in what is a very crowded space, but its stock has been a tremendous performer in what has been a terrible year for stocks.

The growth story is outstanding and while this one carries a lot of execution risk (and high short interest), it looks like there’s plenty to be optimistic about given its recent pullback.

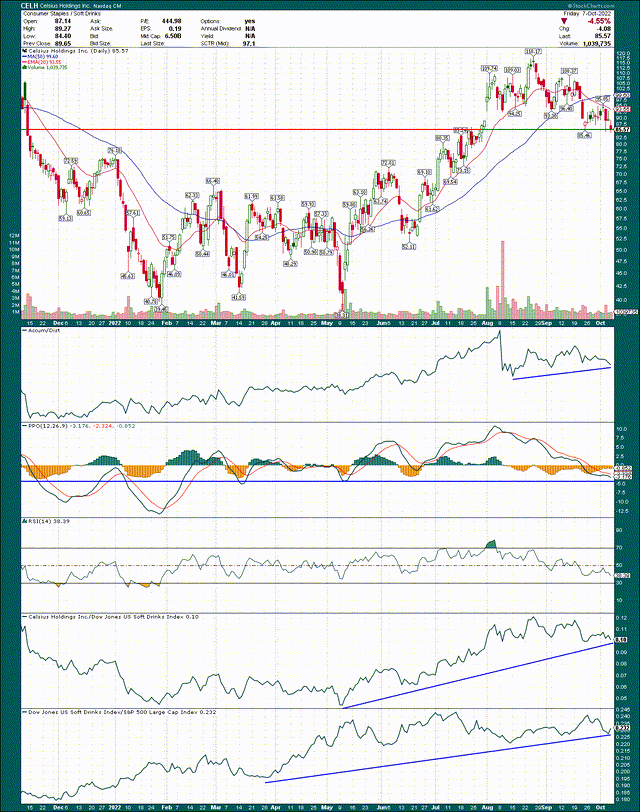

Will support hold?

The daily chart is a bit messy in the past couple of months after a meteoric rise during the spring and summer months.

I’ve noted price support at the prior relative low at $85, and the stock traded just above that at the close on Friday. To me, this price support level is absolutely critical because if it fails, the heavy short interest of 20%+ could see this one get heavily punished. That’s one risk of owning a stock with high short interest, but given the way the rest of the chart looks, I’m not so sure that will happen.

The accumulation/distribution line continues to elevate, which means big money is buying dips rather than selling rips. The PPO is closing in on the level where prior selloffs have stopped from a momentum perspective, which increases the odds we’ll see a bounce. Ditto for the 14-day RSI.

From a relative strength perspective, this one really couldn’t be any better. The drinks category has been terrific this year as it is defensive in nature, but Celsius, which is a very long way from being defensive, has massively outperformed one of the best sectors in the market this year. That’s a perfect setup for a long, and particularly as we trade at what should be price support.

On the whole, this one looks like a good risk/reward on the long side due to this combination of factors.

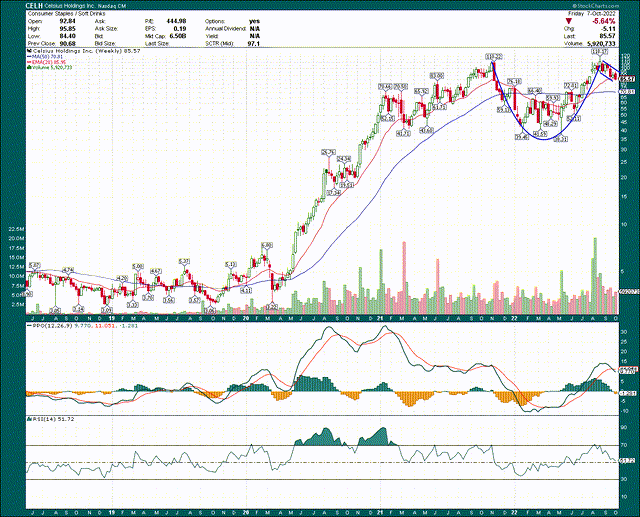

On the weekly chart, I see a potential long-term cup-and-handle forming, and if that’s the case, Celsius could be off to the races sooner than later.

The formation is quite easy to see above, and it’s important to note that this is occurring with the PPO well into bullish territory, and with the 14-week RSI trading down to centerline support. The formation looks complete at the moment, so if this is to hold, we should see the bounce soon. That correlates to the price support level noted on the daily chart, so from a technical perspective, I think the odds are firmly in the favor of the bulls at the moment.

Plenty of growth, but will it last?

Celsius is an energy drink brand, but it tries to differentiate with the idea that it’s “healthier” than alternatives. We can all debate the idea of a “healthy” energy drink, but the fact is people buy energy drinks in the billions of servings globally ever year. This category matters, and Celsius is making a big splash with its formula.

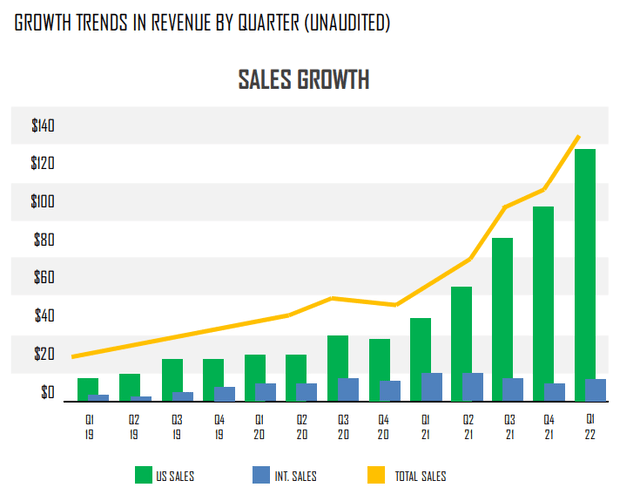

That formula includes more natural ingredients, as well as vitamins and more natural sources of caffeine. The message is clearly resonating with consumers, because the company’s growth trajectory is nothing short of staggering.

Total sales have ballooned higher as the company has ramped its distribution points, and as its packaging/messaging around its “healthier” alternative to other drinks has continued to resonate with customers. International sales are a small fraction of the total, and growth internationally just hasn’t worked out so far. That could change in the future, but for now, this is a US story.

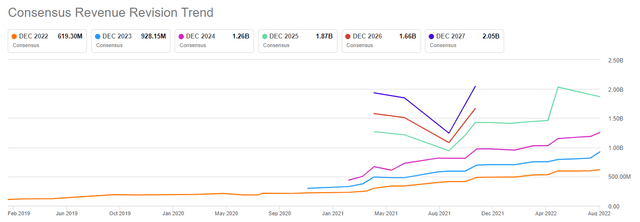

As impressive as that chart is, this one is better.

Analysts have continued to ramp their expectations for Celsius’ revenue in not only this year, but the out years as well. And why not? The company continues to execute on building its brands, but also demonstrating to distributors that its product sells. All retailers want is something on their shelves they know will move, and Celsius moves right now. In a year where cuts to estimates have been the norm for countless companies, Celsius is bucking the trend, and this could not be more bullish.

But it isn’t just a revenue story, as Celsius is already profitable, and that profitability is getting better steadily.

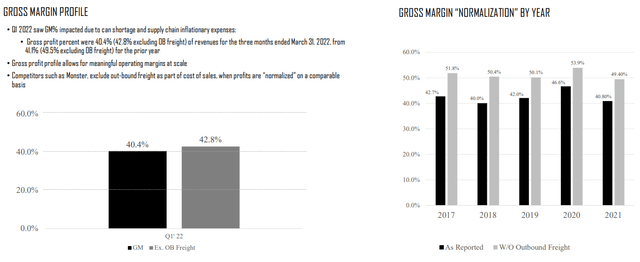

We can see some notes on gross margins here from the company’s presentation, and note that freight has been a sizable factor. We know this to be the case with any company that makes a physical product given trucking and other forms of freight are very expensive on a historical basis, and that’s something Celsius is trying to manage. However, freight costs are largely outside of its control, so it’s focusing on things it can control. One of those things is the operating leverage the company sees with its gross margins in the low-40s, so let’s have a look.

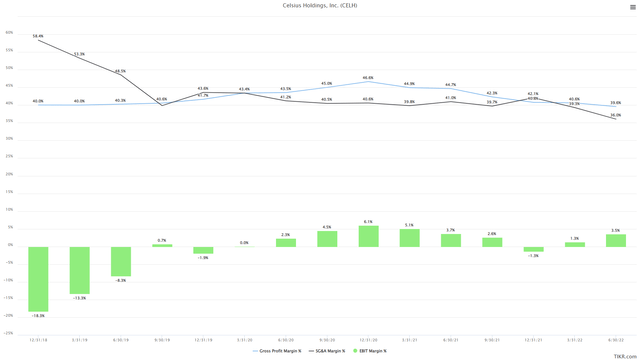

Below we have trailing-twelve-months gross margins, SG&A costs, and operating margins to see how operating leverage is working for Celsius.

SG&A costs have come way down in the past few years, as you’d expect given revenue has ramped higher. That’s great, and so long as revenue is growing, that number should continue to come down as operating costs rise less quickly than revenue.

Gross margins are coming down in recent quarters given some of the factors discussed above, but even still, operating margins are on the mend. Celsius’ most recent four quarters have seen operating margins of 3.5%, and barring a massive shift higher in freight, we should continue to see that number move higher in the quarters to come. Revenue growth is the key here, and Celsius has plenty of that.

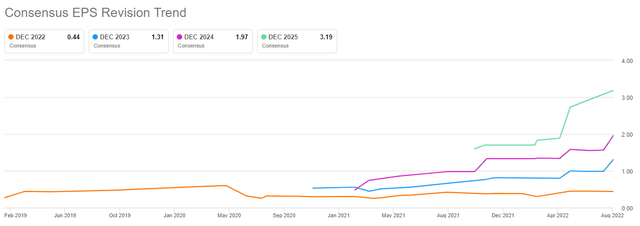

If we take all of this and combine it into EPS revisions, we can see another very bullish outlook.

Analysts are seeing not only much higher profitability coming – as evidenced by lines moving up and to the right – but also in the gaps between the years. That implies huge year-over-year growth, which is the product of revenue increases and operating leverage. This playbook is tried and true, so Celsius needs only to continue doing what it is already doing to make these estimates become reality.

Risks to the bull case

I mentioned some competitive risks above, and that is likely the biggest risk for Celsius going forward. From Monster to Red Bull to the countless other energy drink brands, competition is quite stiff. The good news is that the market for energy drinks is enormous, and Celsius’ focus on being a healthier alternative is a differentiator. Will it stick? Only time will tell, but early signs are good.

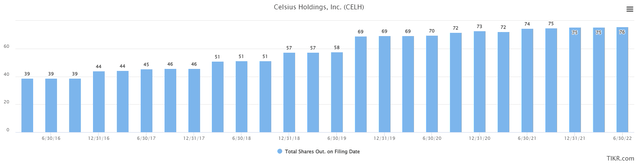

Second, the company has, in the past, used common shares as a sort of piggy bank, and it has massively diluted shareholders over time.

The good news is that the worst of the dilution seems to be behind it, given the share count has been roughly flat since the end of 2020. That’s a two-year period without significant dilution, so it is possible the company is more serious about not diluting shareholders into oblivion. In addition, given Celsius is profitable now, it shouldn’t need to fund its capital requirements with shares any longer, as the business is reaching the point where it can be self-funding. But anytime a company has a history of dilution like this, I want potential buyers to be aware.

Finally, short interest is very high, with over a fifth of the float being shorted today. That can make for explosive rallies to the upside when we get a breakout, but it also exaggerates moves to the downside. If Celsius breaks price support, high short interest means the move down is likely to be swift and brutal. Trading any stock with elevated short interest carries additional risk, and this is something you must be okay with before moving into Celsius.

A decent valuation

When valuing Celsius, we cannot use price-to-earnings simply because it has only recently become consistently profitable, and only just. However, we can use price-to-sales, which we see below on a forward basis for the past three years.

Shares traded as high as 31X sales, and obviously, that’s unsustainable. However, at 8X forward sales today, the valuation is much more tenable for a hot brand with mushrooming sales. It was slightly cheaper earlier this year but the rally we’ve seen in the stock boosted the valuation. Still, 8X forward sales looks decent, but not cheap, so on the valuation front, I think we’re in an okay position. Could be better, could be worse, but with the growth story, it’s good enough.

Final thoughts

On the whole, I see the pullback that recently occurred as an attractive buying chance for Celsius. The stock is potentially completing a long-term cup-and-handle, right as the daily chart is showing the potential for a bounce. We’ll see if that occurs, but the fundamental case is quite enticing here as well. There’s a lot of growth on the horizon, and those looking to capture that growth have a nice opportunity to buy Celsius right above price support today. I’m putting CELH stock into a buy rating, with the caveat that stop-loss orders are critical with volatile stocks such as this one.

Be the first to comment