Diego Cerro Jimenez/iStock via Getty Images

Investment Thesis

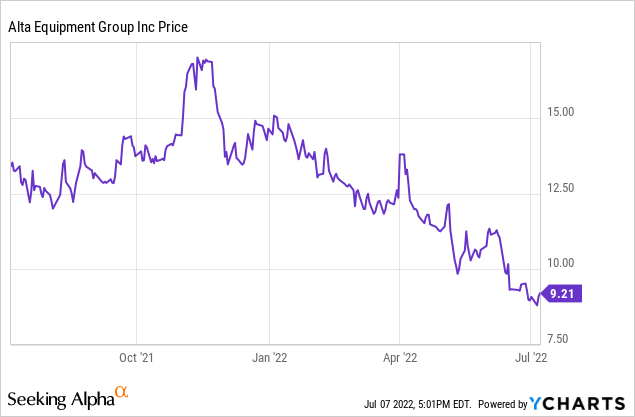

Alta Equipment Group (NYSE:ALTG) has fallen ~47% from its highs in November 2021 and represents an interesting opportunity to invest in a business where the CEO owns 23% of the stock and B. Riley (RILY) owns ~19% (and continues to accumulate shares in the open market). In addition, based on B. Riley’s recent actions and historical track record, I believe B. Riley sees an opportunity to achieve synergies by putting ALTG and Lazydays Holdings (LAZY) onto a single platform; in other words, there exists a nontrivial chance that B. Riley eventually acquires the rest of ALTG.

Background

Alta Equipment Group owns and operates an equipment platform in the US and has been in the business for over 37 years. The company sells, rents, and provides parts and service support for several categories of specialized equipment, including lift trucks, heavy and compact earthmoving equipment and other material handling and construction equipment.

It operates in 64 locations in Michigan, Illinois, Indiana, Ohio, Massachusetts, Maine, Connecticut, New Hampshire, Vermont, New York, Virginia and Florida. Within its territories, ALTG is the exclusive distributor of new equipment and replacement parts on behalf of Original Equipment Manufacturer (or OEM) partners.

ALTG engages in 5 main business activities:

-

New Equipment Sales: sells new material handling and construction equipment

-

Used Equipment Sales: sells used equipment, primarily from trade-ins from customers

-

Parts Sales: exclusive distributor of OEM parts in the majority of their territories

-

Repair and Maintenance Services: provide maintenance and repair services for customers’ equipment and maintains their own rental fleet

-

Equipment Rentals: rents material and construction equipment to customers

Since 2008, the company has completed over 25 acquisitions and expects acquisition activity to continue as OEM partners continue to support them as a consolidator by granting them new exclusive territories or consenting to acquisitions of existing dealers.

ALTG came public on February 14, 2020 by merging with B. Riley’s SPAC, B. Riley Principal Merger Corp.

Valuation

With 32,454,025 shares outstanding and a current price of $9.20, the market cap is ~$299M. With ~$310M in long-term debt and $470M in current liabilities, we’ll use a total EV of ~$1,079M (~$1.1B).

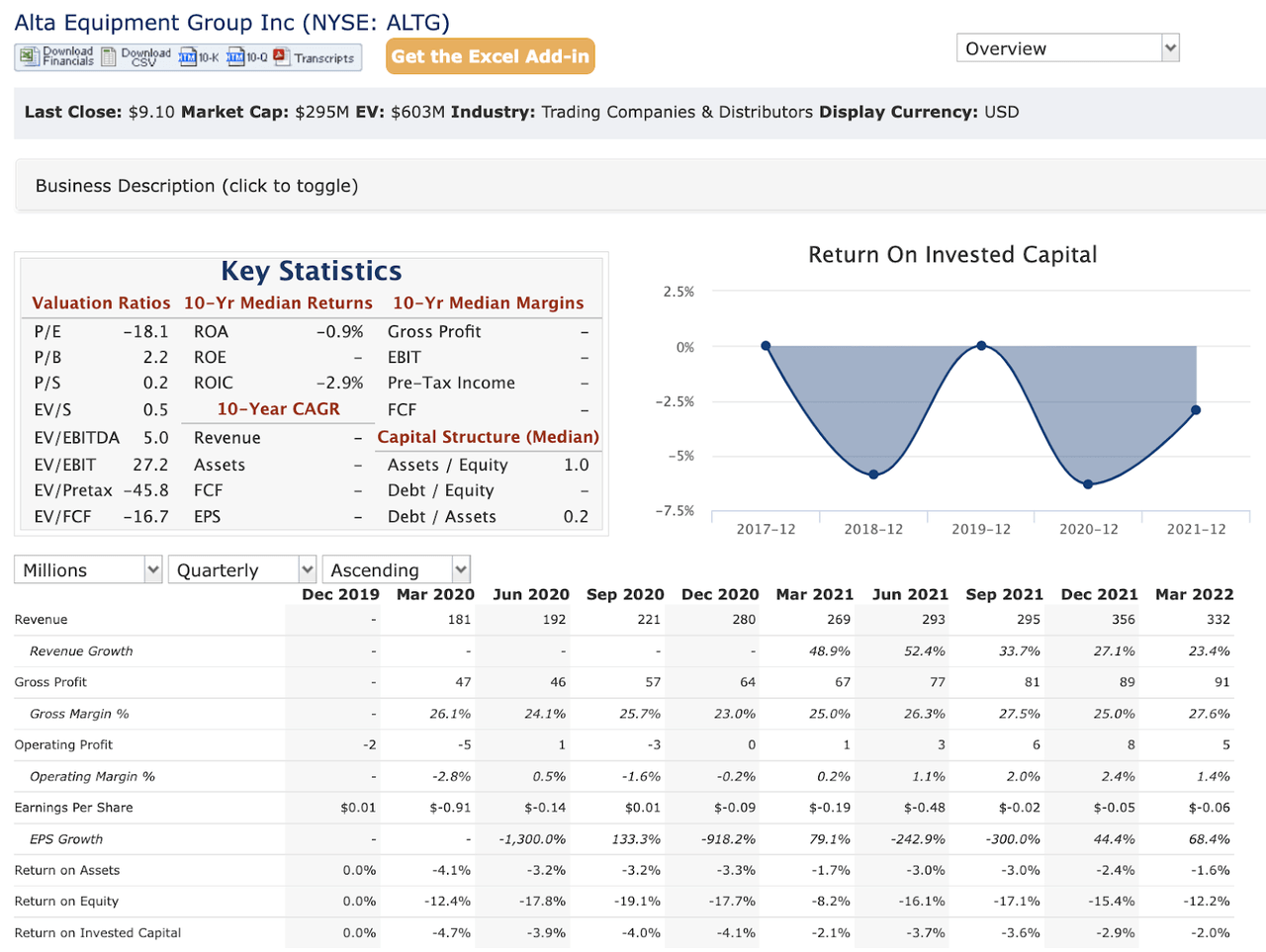

QuickFS (ALTG)

On the surface, the valuation of ALTG frankly looks terrible:

-

EV/S: $1.1B / $1.3B = 0.85x

-

P/B: 2.2x

-

P/FCF and P/E: N/A since ALTG isn’t profitable

In its Q1 2022 presentation, ALTG is guiding between $137M to $142M of adjusted EBITDA, which means ALTG is trading ~8x EV/EBITDA. That seems like a reasonable/cheap valuation an informed investor would make to acquire the company… which brings us to the crux of the thesis.

Insider Ownership + Buying

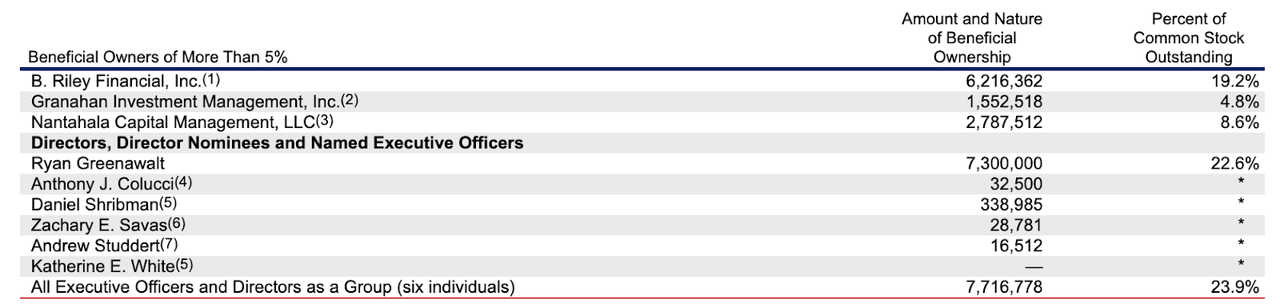

DEF 14A (ALTG)

The chairman and CEO, Ryan Greenawalt, owns ~23% of the shares (which demonstrates good alignment).

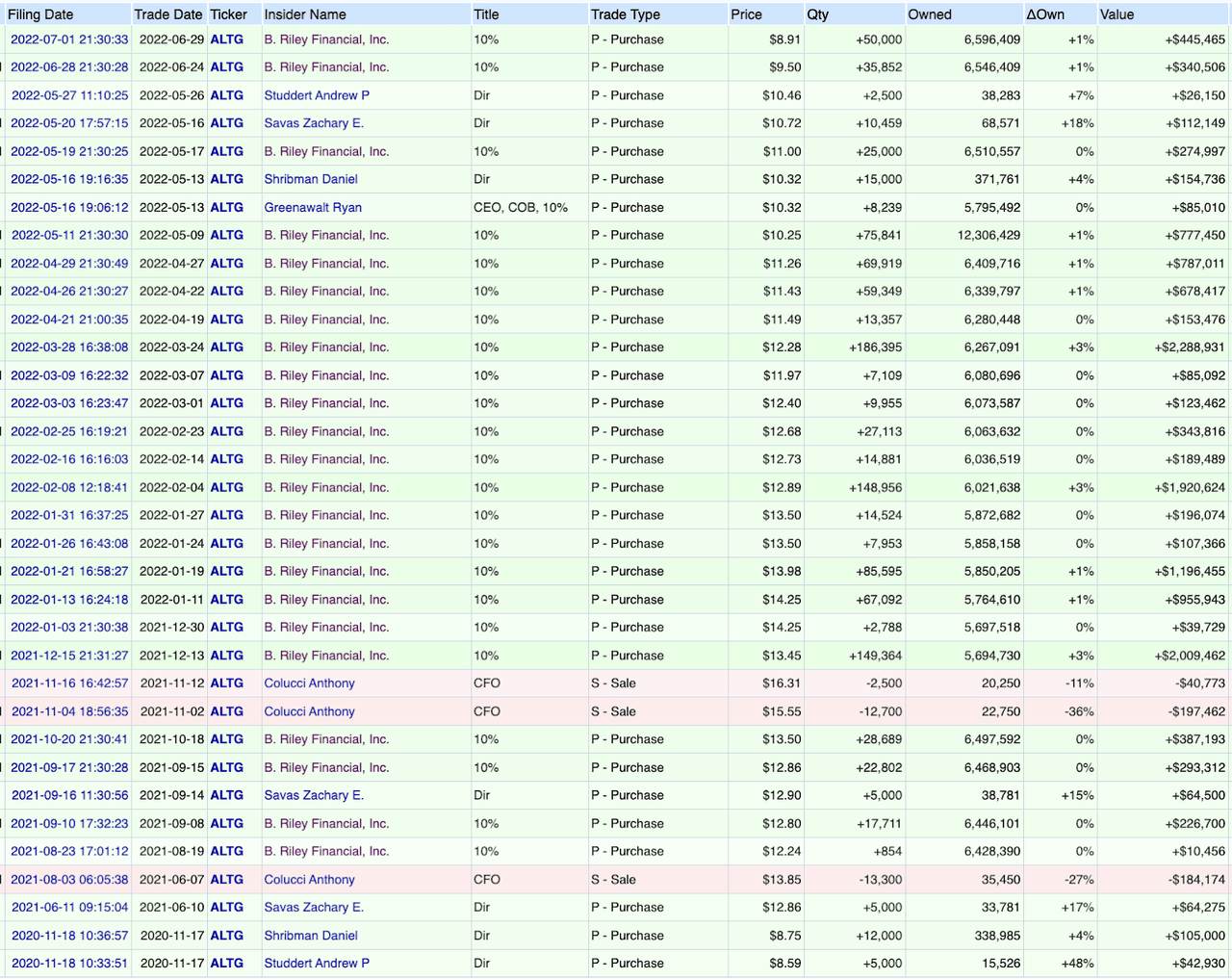

B. Riley Financial (NASDAQ: RILY), whose SPAC merged with Alta Equipment, owns ~19% and has been continually adding to its stake, paying anywhere between $9 and $14 per share.

OpenInsider (ALTG)

Those who have followed me know that I think pretty highly of B. Riley (see my two write-ups on RILY: Wonderful Company Trading At 4x EBITDA, Yields 6% And Insiders Are Still Buying); they are smart capital allocators who are opportunistic, shareholder friendly, and like to acquire assets cheaply. For example, in 2016, RILY acquired United Online (consumer facing dial-up Internet access business) for $71M in cash and stock; the company was (and still is) in terminal decline, but it produces ~$30M+ a year in EBITDA. In short, RILY acquired it for ~2x EBITDA and it still throws off cash for RILY today that is being used for funding new deals.

I also recently wrote up a piece (Lazydays Holdings: Trading 50% Below Rejected Takeout Offer), where the crux of the thesis is RILY offering $25/share for LAZY. After researching ALTG, I noticed that LAZY and ALTG are pretty similar…

ALTG business description (emphasis mine) (source: ALTG 10-K):

We own and operate one of the largest integrated equipment dealership platforms in the United States (“U.S.”). Through our branch network, we sell, rent, and provide parts and service support for several categories of specialized equipment, including lift trucks, heavy and compact earthmoving equipment and other material handling and construction equipment. We engage in five principal business activities in these equipment categories: new equipment sales, used equipment sales, parts sales, repair and maintenance services, and equipment rentals.

LAZY business description (emphasis mine) (source: LAZY 10-K):

The Company operates Recreational Vehicle (“RV”) dealerships and offers a comprehensive portfolio of products and services for RV owners and outdoor enthusiasts. The Company generates revenue by providing a full spectrum of RV products: New and pre-owned RV sales, RV-parts and service, financing and insurance products, third-party protection plans, after-market parts and accessories, and RV camping facilities.

In short, they are both dealerships, except one is for specialized equipment and the other is for recreational vehicles. If RILY were to bring them under one umbrella or onto a single platform, there are certainly synergies that can be obtained by combining the two companies.

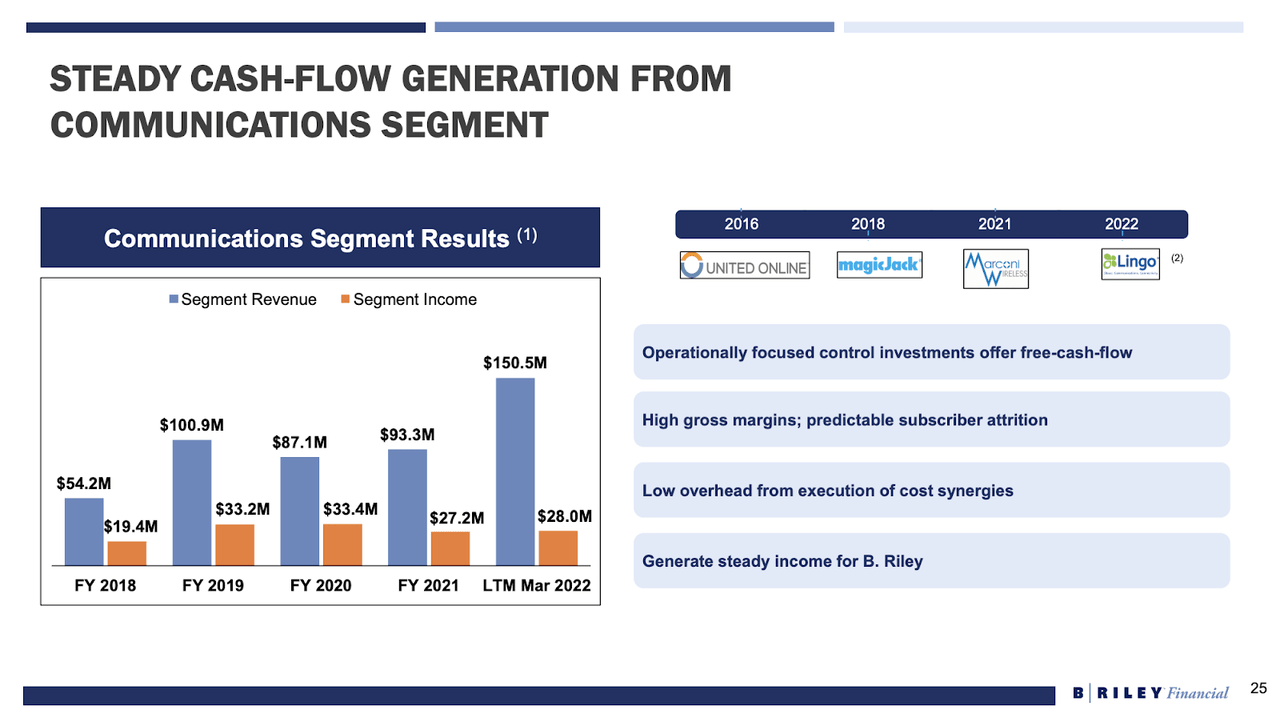

In fact, I believe this is a play that RILY has done before; for example, it brought United Online, magicJack, Lingo, and Marconi Wireless onto one platform (its “Communications” segment under Principal Investments). By bringing together various companies that operate in similar areas onto one platform, they can achieve certain cost synergies that would not be possible if they operated separately. As Kenneth Young, CEO of B. Riley Principal Investments, put it after the magicJack acquisition (source):

With magicJack, we look to replicate the success we’ve had with our United Online acquisition by again leveraging our operational expertise to generate significant cash flows. The synergistic potential, combined with magicJack’s subscriber base and brand name, makes this an attractive investment opportunity.

RILY Investor Presentation

If you look carefully, they also seem to be applying the same playbook to their Wealth Management and Capital Markets / Investment Banking segments, but that’s a discussion for another day.

Catalysts

-

Takeout Offer / Continued Accumulation: similar to LAZY, there exists a nontrivial chance that RILY offers to acquire the rest of ALTG; however, a steady accumulation of ALTG stock would also serve as a “soft” catalyst

-

Continued Acquisitions: ALTG has been steadily acquiring companies over the years and continued acquisitions would help the company grow and scale

Risks

-

Misallocation of Capital: one of the biggest risks any company faces, but this is mitigated by the CEO owning a large chunk of the company and a savvy shareholder owning 19%

-

Business Model: another common risk, but selling parts for specialized equipment (e.g. lift trucks, heavy and compact earthmoving equipment, etc.) will probably be in demand for decades to come

Takeaway

ALTG represents an interesting opportunity where the CEO owns 23% of the stock and a smart capital allocator, who owns ~19%, continues to accumulate shares in the open market. I’ve argued that RILY sees an opportunity to achieve cost synergies by putting both LAZY and ALTG onto one platform (a playbook they have successfully employed in its communications, wealth management, and capital markets/investment banking segments) and there is a nontrivial chance that RILY eventually acquires the rest of ALTG. In addition, at ~8x 2022 EBITDA valuation, investors are certainly not overpaying for the company.

Based on the analysis above, I recommend a long position in (and careful monitoring of) ALTG for the enterprising investor.

Be the first to comment