Alena Kravchenko/iStock Editorial via Getty Images

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) is spending big bucks on its buyback program. If the company maintains the current buyback scale, it can invest close to a trillion dollars on its buybacks in this decade. This is a massive buyback program that can be compared to Apple (AAPL). Over the last few years, Apple has invested close to half a trillion dollars in its buyback program and expunged over 35% of its outstanding stock. Google has an added incentive to ramp up its buyback program as new growth drivers are becoming profitable and do not require massive investments by the company.

Different investors have held positive and negative views about massive buybacks. Warren Buffett had previously mentioned that he was against buybacks but has recently ramped up buybacks in Berkshire Hathaway (BRK.A) and has a big investment in Apple which is known for its huge buybacks. If Google Cloud operations continue to show improvement in margins, we could see a jump in Google’s operating income which will further increase the need to ramp up buybacks. Investors should gauge future EPS trajectory by adding the impact of buybacks on the outstanding stock of Google.

Google competes with Apple

Apple is known for its massive buyback program as the management tries to reach cash neutral position. Over the last few years, Apple has invested close to half a trillion dollars in its buybacks which has helped the company expunge close to 35% of its outstanding stock. The buybacks alone have been responsible for a cumulative jump of 50% in the EPS. It is likely that Google’s management would be inclined to follow the footsteps of Apple to improve its own EPS growth trend.

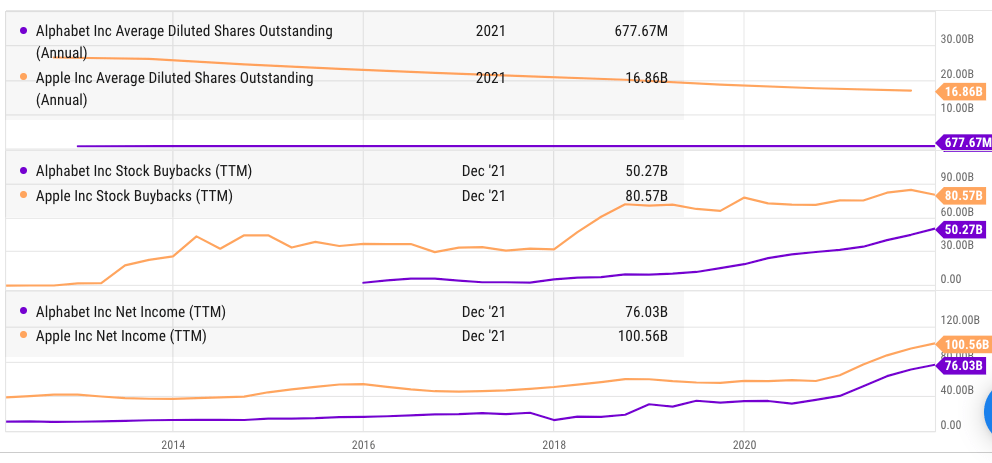

YCharts

Figure 1: Comparison of outstanding stock, buybacks, and net income of Google and Apple.

Apple’s outstanding stock stood at 26 billion in 2012 and has now declined to less than 17 billion, a decline of 35%. Google’s net income has increased significantly in recent quarters which has allowed the management to spend more on buybacks. We can see from the above chart that Google’s buybacks pace is getting closer to Apple’s.

No need to hoard cash

The jury is still out over the long-term benefits of buybacks in improving stock price growth. It does help in increasing EPS but Wall Street has shown a greater attraction for companies that can deliver better top line growth. Amazon (AMZN) is an example where rapid stock growth was delivered due to good revenue growth. However, Amazon has also jumped on the buyback bandwagon recently.

Google faces a dilemma because it does not have many new services which require a massive investment. Google’s YouTube relies on user-generated content and does not need to spend a huge amount like other streaming players. Google Cloud had an annualized revenue rate of $22 billion in the recent quarter and is on the path to profitability. If the margin gap between Google Cloud and Amazon’s AWS reduces, we should see a further increase in the operating income of Google.

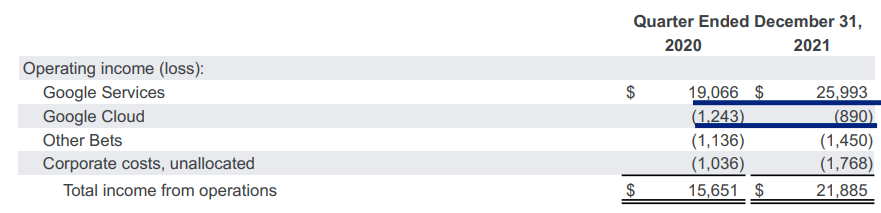

Company Filings

Figure 2: Improvement in operating income of core service and Google Cloud.

At the current growth rate, Google Cloud could hit $100 billion revenue rate by 2025. AWS has an operating margin of 30%. If Google Cloud can show a modest 20% margin, it would add another $20 billion to the operating income for the company by 2025. Other segments like hardware and subscription also do not require huge investments of the scale that Amazon does.

Most of the cash produced by Google is stored in securities with close to zero percent returns. This increases the incentive by the management to invest that amount in its own stock which hopefully can return a double-digit return over the long run.

Ideal long-term bet

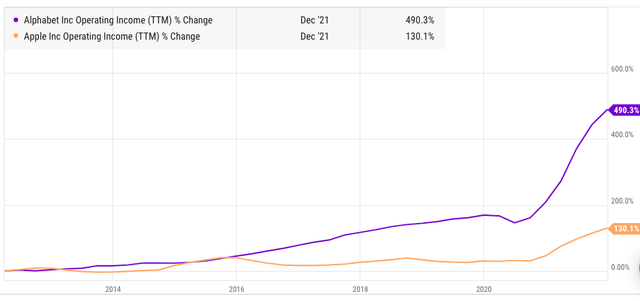

Google’s performance is significantly different from Apple which reported a stagnant operating income for a number of years prior to the 5G iPhone cycle. Despite a stagnant operating income, Apple was able to give good dividend growth and a steady increase in buybacks. It is likely that Google’s buyback trajectory would be much higher due to the ability of the company to show rapid operating income growth.

Figure 3: Comparison of operating income of Google and Apple.

Google is ramping up its hardware business and is already in the second position in the smart home devices segment. Better performance in Pixel devices would be another tailwind for future margins. Amazon, Apple and many other companies are spending over $10 billion a year on their streaming content business. This scale of spending can increase as the competition gets tougher in this space.

Google does not need to spend on a similar scale for its YouTube business because most of the content is user-generated. We might see some investment by Google in original programming within YouTube, but this would be nowhere near the scale of investment in streaming content by Apple, Amazon, and others. This trend should lead to further improvement in operating income of the company which the management could divert towards higher buybacks.

Impact on stock

Google’s buyback has already crossed $50 billion for the trailing twelve months. It is certainly possible that Google spends a staggering trillion dollars on buybacks in this decade. The only thing which can prevent it is some regulation. However, there is nothing on the horizon that points to some legislation to limit the buyback scale of companies in U.S.

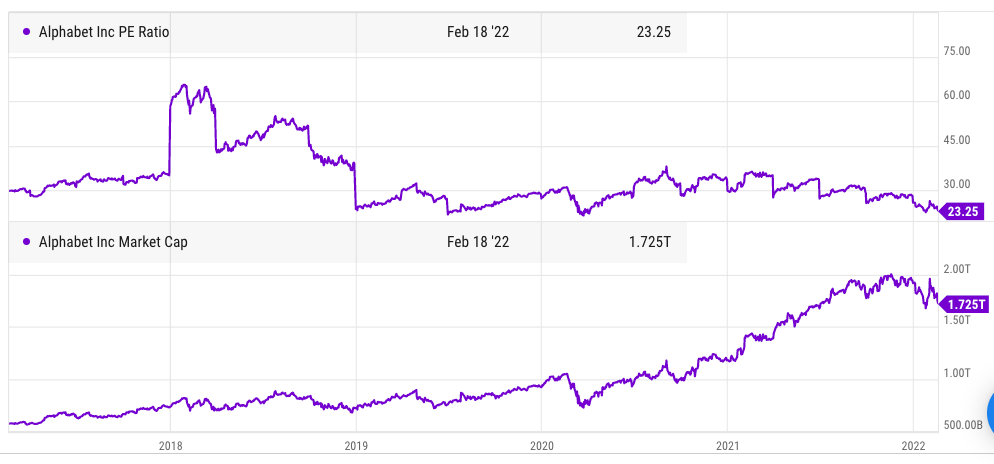

Ycharts

Figure 4: Trend of Google’s PE ratio and its market cap.

Alphabet stock has been trading in the range of 20 to 30 times its PE ratio for the past few years. If the company continues to invest in buybacks at the current scale, it will lead to an annual increase in EPS in the range of 3% to 4% due to buybacks, on a standalone basis. Google also has significant drivers of top line and bottom-line growth which will further improve the long-term EPS growth potential. A long-term bet in the stock needs to take the current and future buyback scale into account to gauge the stock trend. The buybacks will also provide a good floor to the stock price in case of a major recession or stock market correction.

Investor takeaway

Google is following Apple’s footsteps by ramping up the scale of buybacks. If the company continues to increase the buyback scale, it would be investing close to a trillion dollars in buybacks in the current decade. Google does not have a massive need to invest in loss-making segments like streaming content which many other tech companies are doing. Its cloud business will also turn profitable in the near term and could be a major contributor to operating income if the margin gap between Google Cloud and AWS reduces.

On a standalone basis, the buyback program can give a 3% to 4% tailwind to EPS growth if the stock continues to trade in a PE ratio range of 20 to 30. Other growth drivers should help the stock improve its earnings which can make Alphabet stock a good long-term bet.

Be the first to comment