ArtMarie

A Quick Take On Alopexx

Alopexx (ALPX) has filed to raise $15 million in an IPO of its common stock, according to an S-1/A registration statement.

The firm is developing vaccines and monoclonal antibodies for various types of infections.

ALPX’s candidates have proven to be well tolerated as the company seeks to advance development into Phase 2 trials.

I’ll provide a final opinion when we learn more information about the IPO.

Alopexx Overview

Cambridge, Massachusetts-based Alopexx was founded to develop vaccines and antibodies for the prevention and treatment of fungal, parasitic and bacterial infections that express the target poly N-acetyl glucosamine (PNAG).

Management is headed by Co-founder, President and CEO, Daniel R. Vlock, MD, who has been with the firm since inception and previously held senior medical and research roles at GPC Biotech, Pharmacia and Ethicon Endo-Surgery, a subsidiary of Johnson & Johnson.

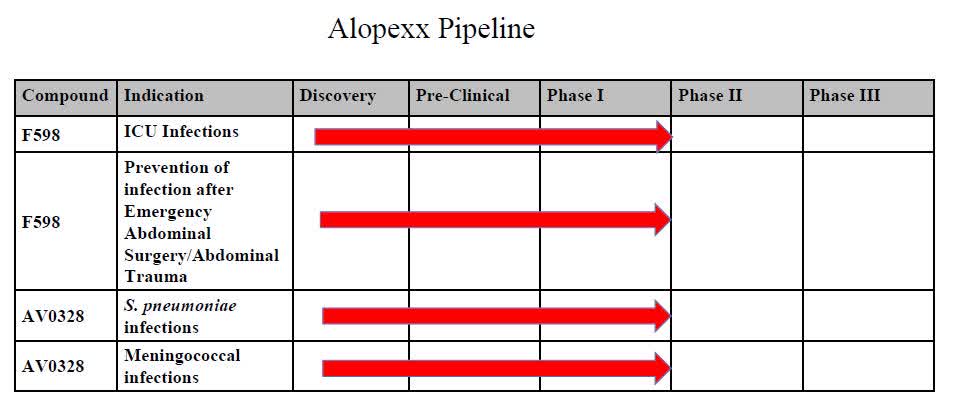

The firm’s lead candidates are vaccine AV0328 for the treatment of pneumonia and meningococcal infections and F598 monoclonal antibody for the treatment of ICU-acquired infections and prevention of post-operative abdominal infections.

Below is the current status of the company’s drug development pipeline:

Company Pipeline (SEC EDGAR)

Alopexx has booked fair market value investment of $4.95 million in convertible debt and equity as of June 30, 2022 from investors including Daniel Vlock and Peter Werth.

Alopexx’s Market & Competition

According to a 2022 market research report by Market Research Future, the global market for treating hospital-acquired infections was an estimated $23.7 billion in 2020 and is forecast to reach $32.5 billion in 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of 1.37% through 2030.

Key elements driving this expected growth are aging populations who are more susceptible to disease and the arrival of the COVID-19 pandemic driving increasing awareness of the importance of infection control.

Also, the Americas region is expected to continue to account for the greatest market demand by region, followed by Europe. The Asia Pacific region is expected to grow at the fastest rate of growth through 2030.

Major competitive vendors that provide or are developing related treatments include:

-

Pfizer

-

Merck

-

GlaxoSmithKline

-

Sanofi

-

SK Chemicals

-

Affinivax

-

Astellas

-

Several others

Alopexx’s Financial Status

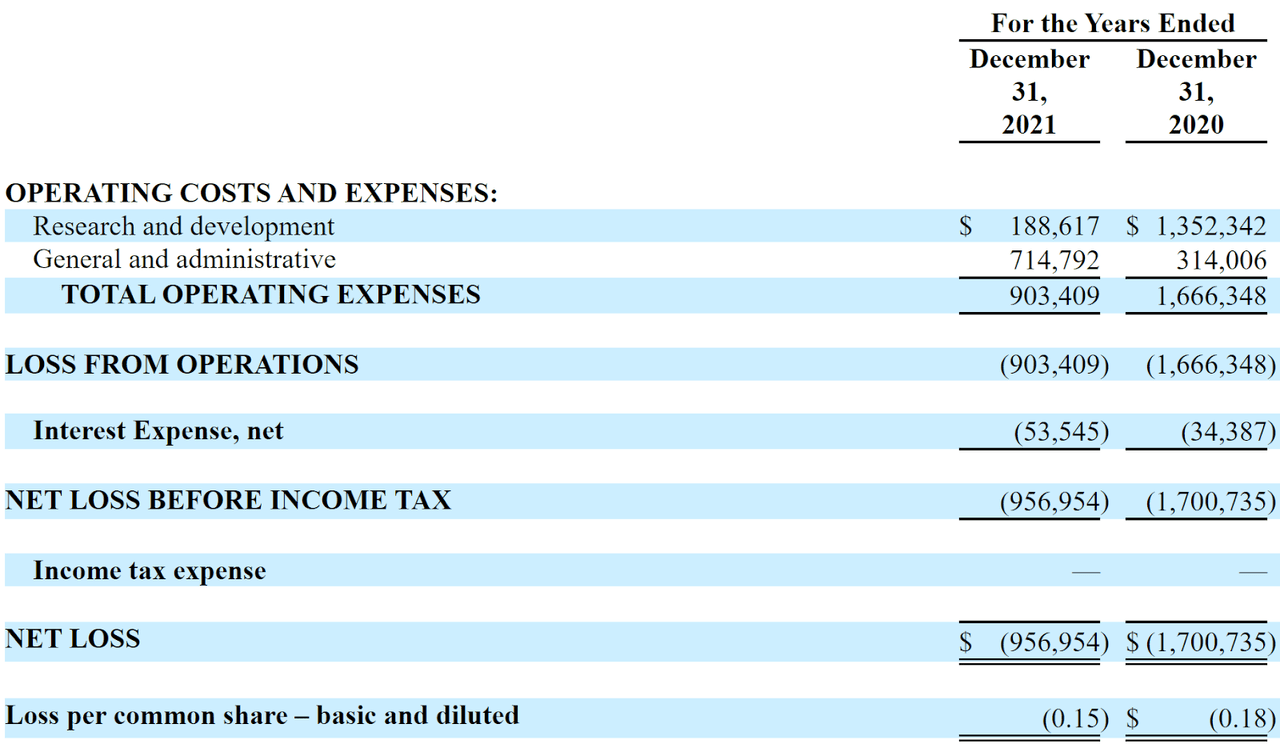

The firm’s recent financial results are typical of a development stage biopharma in that they feature no revenue and material R&D and G&A expenses associated with its drug development efforts.

Below are the company’s financial results for the past two calendar years:

Company Statement Of Operations (SEC EDGAR)

As of June 30, 2022, the company had $421,842 in cash and $2.5 million in total liabilities.

Alopexx’s IPO Details

Alopexx intends to raise $15 million in gross proceeds from an IPO of its common stock, although the final amount may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO as follows:

approximately $5.5 million to initiate a proof-of-concept trial of vaccine AV0328, including manufacturing and correlative laboratory studies;

approximately $4.5 million to initiate a proof-of-concept trial of our monoclonal antibody in ICU patients; and

the remainder for general corporate purposes, including working capital, operating expenses and capital expenditures, as well as a potential expansion of our research pipeline.

(Source – SEC)

Management’s presentation of the company roadshow is available here until the IPO is completed.

Regarding outstanding legal proceedings, management disclosed that ‘On June 8, 2022, the Company was sued in the Commercial Court of Nantes, France by Xenothera. The litigation is seeking, among other things, to compel the Company to enter into a license agreement with Xenothera, or provide 120,000,000 euros in damages. No liability has been recorded related to this matter.’

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary About Alopexx’s IPO

ALPX is seeking U.S. public capital market funding to advance its pipeline of vaccine and antibody drug candidates.

The firm’s lead candidates are vaccine AV0328 for the treatment of pneumonia and meningococcal infections and F598 monoclonal antibody for the treatment of ICU-acquired infections and prevention of post-operative abdominal infections.

Both candidates have proven to be well tolerated in Phase 1 safety trials.

The market opportunity for treating hospital-acquired infections is large but expected to grow at a slow rate of growth in the coming years.

Management hasn’t disclosed any major pharma firm collaboration relationships.

The company’s investor syndicate does not include any well-known life science-focused institutional venture capital firms or strategic investors.

ThinkEquity is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (52.5%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

For AV0328, the company may receive entry into the US FDA’s Accelerated Approval Program, which may reduce the time to potential approval.

When we learn management’s assumptions about IPO pricing and valuation, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Be the first to comment