Olemedia

Article

I first wrote about Allkem Limited (OTCPK:OROCF) back in May. In addition to discussing its Q3 numbers, the article was an introductory piece explaining why I liked the company and outlining its operations in very broad strokes. And while in this article I’ll be discussing Q4 and full-year results (the company uses a July-June fiscal year), I’ll also be delving deeper into some changes being planned at Olaroz Stage 1 and the progress being made on the Stage 2 addition.

FY22 Results

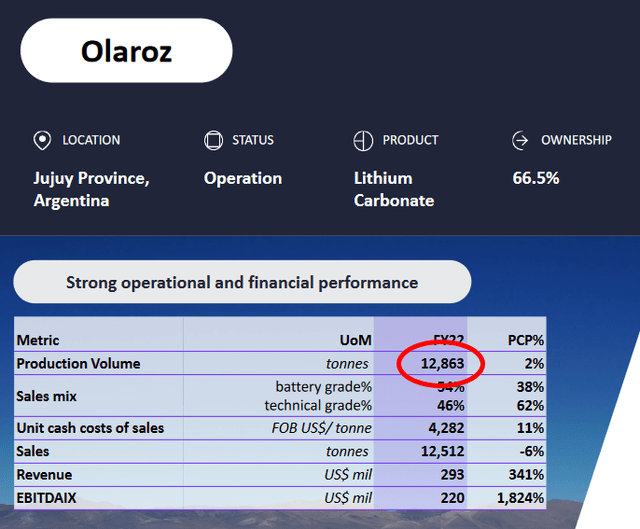

Given how strong lithium prices have been over recent months, it was unsurprising that Allkem posted solid FY22 results. EBITDA came in at $494.2 million on revenue of $769.8 million, while operating cash flow for the fiscal year hit $475.6 million. The numbers are hundreds and even thousands of percentage points higher than the consolidated results of Galaxy Resources and Orocobre, the two companies that merged to form Allkem a year ago. For that reason, I won’t get into year-over-year comparisons.

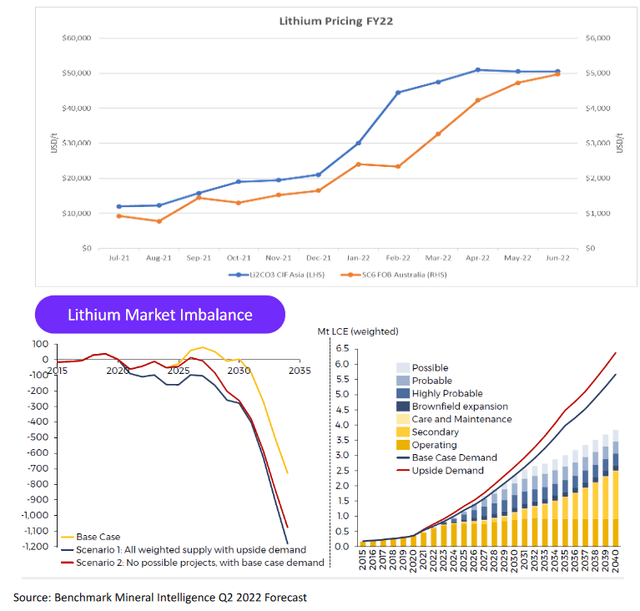

The main reasons for the strong numbers are higher realized prices for both spodumene concentrate (“SC6”) and lithium carbonate. In FY22, the company’s weighted average realized price for carbonate was $23,398/t compared to $4,983/t in FY21; a greater than four-fold increase. For SC6, Allkem was able to get $2,221/dmt in FY22, which is more than 5x the FY21 average price of $415/dmt. Again, while the results are commendable, they are rather unsurprising given the run up in prices and were long-ago baked into the company’s current 12.8x EV/EBITDA valuation.

What’s more interesting, however, are the carbonate and SC6 prices that Allkem can realize in the market today. And for that, the company’s CEO, Martin Perez de Solay, indicated during the company’s Q4 earnings call that he anticipates getting carbonate prices, “in the $47,000 per ton range for the first half of financial year ’23.” He also stated that, “spodumene concentrate pricing in the September quarter is expected to be above $5,000 per ton CIF.” He cited changes in some customer contracts and the continuing imbalance in lithium markets as reasons why Allkem will be able to get the higher realized prices.

If we assume that lithium prices continue to hold up, something that seems entirely likely, then Allkem should see an even greater inflow of cash than it did last year; this would see it add to its current cash balance of $663.5 million. These inflows should provide the company with all the cash it needs to successfully pursue its ambitious growth plans.

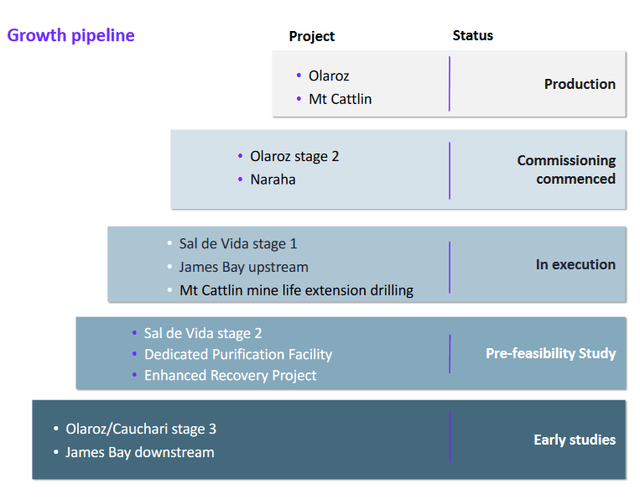

Olaroz Stage 1 & 2

Seeing as how I have previous covered them, I won’t discuss all of the company’s projects currently on the drawing board. Instead, I’ll focus on the project that is furthest along: Olaroz Stage 2. It is over 90% built and is scheduled to start production this December. It will see carbonate capacity at Allkem’s Argentinian site expanded by 25ktpa. That’s significant given that Olaroz’s current nameplate capacity is 17.5ktpa, and the addition will bring that number to 42.5ktpa.

However, it should be noted that currently the site, comprising Olaroz Stage 1, only manages to produce about 13ktpa, which is obviously 4.5ktpa short of the full nameplate. The reason for the production shortfall lies in the product mix now being output at the location. Production is currently split almost evenly between battery and technical grade carbonate.

Allkem plans to add a purification facility to Olaroz Stage 1 that will allow it to migrate all of Stage 1’s carbonate production over to technical grade and permit it to attain the full 17.5ktpa production capacity. Granted, an additional 4,500 tonnes is not huge, but given the previously discussed high price for carbonate, the production increase should give earnings a positive push. However, this project is still in the planning stage, so the added bump in production won’t occur for at least a few quarters.

But regardless of when the purification facility is added at Stage 1, Olaroz’s current product mix will soon change after the completion of Stage 2. That’s because Stage 2 will add 25ktpa of only technical grade lithium to the mix.

At this point, some readers may be asking why Allkem is adding technical grade capacity when everyone knows that the big money in the market is chasing battery grade lithium. And the answer to that question lies in Naraha, Japan.

That’s where Allkem has been building a battery grade lithium hydroxide conversion facility, which should see first production in December. The plant is a joint venture with Toyota Tsusho Corporation (“TTC”) that is 75%-owned by Allkem but that’ll be operated by TTC. TTC is providing the know-how and Allkem will provide the feedstock. That feedstock will be technical grade lithium carbonate coming from the newly opened Stage 2 project at all Olaroz.

Takeaway

Hydroxide capacity at Naraha will be 10ktpa, but I suspect that this is only a first step. Allkem wants to get in on the booming hydroxide market, but they have no experience in this particular area. So, the Naraha facility will allow them to deepen their knowledge while simultaneously building a relationship with TTC.

This will eventually create many potential future opportunities as Allkem looks to beef up its midstream capacity. Within the next couple of years, I wouldn’t be surprised if Allkem announced the construction of additional refining capacity to soak up more of the technical grade lithium coming out of Olaroz.

Risks

The main threats to this thesis come from execution risk and the macro environment. As with all large industrial projects, a certain amount of construction delays and missed deadlines are likely, and a lot depends on how serious those turn out to be. Also, sizeable changes in the rate of inflation, interest rates, and the price of lithium can have a negative impact on the company’s future plans.

Be the first to comment