Cineberg/iStock Editorial via Getty Images

Author’s Note: This is the free version of a premium article posted on iREIT on Alpha back on 20th of June.

Dear subscribers,

You may recall my initial piece on Allianz (OTCPK:ALIZY) where I went through the world’s largest insurance business and one of the premier asset managers on the entire planet. Walking into what is essentially inflation, rate, and a potential recession, my recipe entails taking cover under quality, safety, and dividends.

Allianz is a primary part of that strategy – and I will show you why that continues to be the case here.

Given the recent share price weakness, it’s time to consider adding more to Allianz here.

Revisiting Allianz – A Long-Term Hold

So, Allianz is one of my core financial holdings. I’ve taken profits and reduced my holdings in financials, down to the very core, undervalued businesses. I sold most remainders of my Unum investment (UNM) for close to $36.50, reinvesting most of it into my core financial holdings.

What are these core holdings?

They currently include companies like Allianz, Munich Re (OTCPK:MURGY), Hannover Re (OTCPK:HVRRY), BlackRock (BLK), Manulife (MFC), and others. Allianz is one of the major ones. For more basic information, I refer you to my initial article on the company. This is an update.

Allianz published 1Q22 numbers back in May. This was before the serious, deep part of the crash really began. The core of the message is that revenues on a group-wide basis were up 6.2%, and segment-specific revenues saw increases across the board – in P&C, Life/Health, and the asset management arm.

The company saw strong amounts of internal growth, as well as delivered a strong profit of around €3.2B for the quarter, with growth in key segments. Now, the shareholders’ net income was down massively – this was due to a €1.9B provision the company recorded for AllianzGI U.S. Structured Alpha, and the company believes that with this provision, the matter is now put to bed in terms of exposures and payments. Aside from this one-time non-recurring provision, company results were strong, but starting to show impacts from the current market environment.

Underwriting results were down somewhat, but weighed up by strong asset management performance and good AUM, with favorable FX which increased operating profit by 11.2% for the segment.

The company also takes advantage of its current cheap price and has started the first tranche of its planned buybacks. The amount planned is €1B, with half of that representing 0.6% of the outstanding capital.

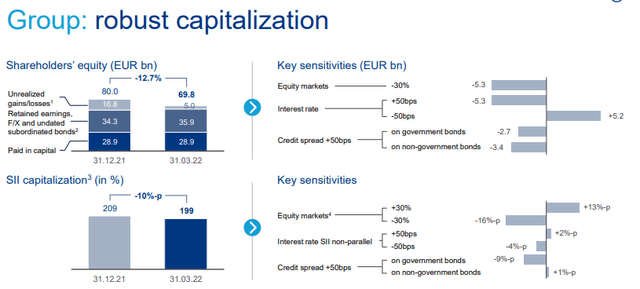

Allianz continues to enjoy extremely strong capitalization numbers, but the time has also come to look at the company’s sensitivities in terms of interest rates, markets, spreads, and other factors.

Allianz Presentation (Allianz IR)

The main sensitivities for the company remain interest rate/spread risks. In a combined stress scenario with a negative interest rate, equity, and spread impacts, the company expects additional impacts due to cross-impacts from the individual sensitivities. In layman terms – if things get worse, expect ALIZY to get somewhat worse as well.

However, Allianz remains at high group solvency of very close to 200%, which comfortably supports the company’s generous dividends. The company continues to expect a capital generation net of tax and a dividend of around 10% in 2022, supporting a strong upside for the business.

On an individual basis, results and trends are more encouraging. The P&C operations came in at very strong levels, seeing strong internal growth across almost the entire board of geographies where the company is active. Furthermore, the company managed to push rate changes in terms of renewals of up to 11-12% in some cases for Global lines, with averages of around 3.5-4%. It’s not as high as the increase in inflation, but it’s still a respectable achievement that, combined with new business and double-digit business growth in key geographies, will keep the company above most of its peers. Investment income was up 5% YoY, due to increased interest rates which drove higher incomes from debt, asset base increases, and inflation-linked bonds.

Life/Health saw very similar trends, seeing new business margin increases of up to 7.2% (3.5% on average) across its business lines and geographies. The investment margin in the segment continues to be good.

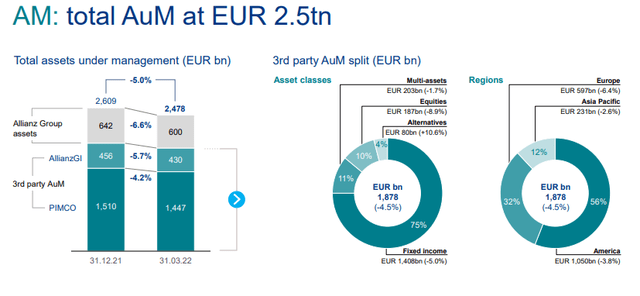

Asset management continues, at least as of the report, to be strong. Allianz manages €2.5T worth of assets across multiple classes and geographies.

Allianz Asset management (Allianz IR)

Equity markets are driving a continuing AUM decrease, with higher interest rates starting to impact as well, and the company is recording net outflows from the business. It has, however, still outperformed third-party benchmarks on a 3-year pre-fee basis – and Allianz considers the Asset Management segment to be 3rd-party resilient.

With net income impacts from litigation and the market environment currently in the shape, it’s no wonder that the company is experiencing downward pressure and why Allianz has traded down for the past few weeks as of writing this article. But does this mean that the company has somehow grown a materially worse or negative investment?

I would say no.

The DOJ/SEC settlement of the Structured Alpha case marks an end to some of these issues, but it doesn’t come without its hurt. The company’s plea means that Allianz will be disqualified (AGI US) from advising the U.S. registered mutual funds – but with the impairments already in place, this isn’t as heavy a hit as we might expect. The disqualification isn’t a horror show, but an impact. What’s important here is that the DOJ did not find any knowledge of or participation in misconduct at Allianz or any other Allianz entity.

The end outcome is that AGI is restricted in the US, but not Allianz SE as a group. The good news is, once again that any such amounts payable and the $5B of compensation have already been reflected in the provisions set up for 2021 and Q1 ’22. I expect no further negatives from this case for Allianz for the rest of the current year. I see the net effect of this as a positive due to clarity, even if it means I’m downgrading my FY22 numbers.

The profit warning in May came also as a result of this case – and when it came, it did come as a bit of a surprise. But with this now included, and with the case now confirmed finished, investors in Allianz can look forward. This is a massive positive, and the sentiment here should not be underestimated.

I downgrade my EPS forecasts for Allianz by the entire amount of the impairment, which on a per-share basis when accounting for buybacks comes to around a 10.7% lower EPS of around €19/share for the full year, versus over €20/year.

That’s the impact for Allianz.

The company remains an unquestioned market leader in insurance, with a 30% German exposure, but its global balance makes it a very appealing insurance play with the addition of asset management. Its PIMCO and AGI arms are highly profitable and remain very unique in the insurance universe.

This remains an argument for the company.

What I want to show you is valuation, because, at €183, this business is truly excellent.

Allianz – Updated Valuation & Upside

You may remember my original stance on the company here, and where it should trade. Well, that stance has grown stronger. Every single perspective, including insurance-specific embedded valuations, P/E multiples, NAV, Yield, book values, and EBITDA multiples – all point to one singular direction – this company needs to go “up”.

Peers are easy. Zurich Insurance (OTCQX:ZURVY), AXA (OTCQX:AXAHY), Generali, Aviva, and others – you know them. These companies trade at averages of between 7-11X P/E, while Allianz is around 8.5X. However, this completely fails to take into account the advantage of Allianz’s asset management arm, its size and AUM, and its lower reliance on home market premiums, most of which these peers have.

Because of that, I’m unwilling to give Allianz a premium lower than 15-20%, which implies peer-based price targets of €210-€225/share. But this isn’t even the best or highest implication for the company.

Looking at the embedded-based valuation of Allianz and considering a WACC of 8.9% and a risk-free rate of 3.5% to reflect the increased interest rate as well as a now-increased 4%+ cost of debt, we still get a share-based embedded value of €235/share. Again, no matter how you slice this one, this company is trading below where it should be trading.

For NAV, I use earnings multiples at below-market average P/E rates. Zurich trades closer to 10X – I use 8X for Allianz. This gives me a net asset value of around €98B for the company, which based on 404M shares outstanding net of treasury comes to an implied NAV/Share, again of €235/share.

Do other analysts agree with my assessments of the company, or do they think I am wrong?

On average, they think I’m being too conservative. The average price target for Allianz, based on a range of €190 low and €285 high and 17 analysts is €248/share, which is more than €10/share above my current PT for Allianz. Out of those 17 analysts, 14 are currently either at a “Buy” or an “outperform” rating.

I can understand investors wanting to take safety first here, and maybe wait to see what happens. Me, I do a combination of both. I deploy capital on a weekly, strategic basis depending on how the market moves, and I do so in undervalued businesses. I’m never “not” investing.

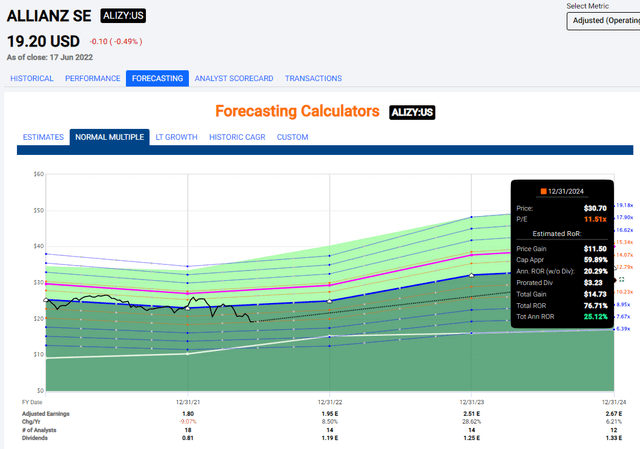

ALIZY is a strong ADR for those wanting a US-based investment option for Allianz. The core question, as with the native share, is whether the forecasts can be considered to be accurate in any way. I believe they can.

Allianz Upside (F.A.S.T Graphs)

The ADR trades at around 1-2X P/E higher than the native, which means that the P/E target should be higher as well. I’ve chosen to go conservative even here, targeting an equivalent of a 9.5X native P/E, which still give us a 25% annual upside to a 2024E. It is, of course, possible that growth will be slower now – and history gives some credence to the notion that analysts here might be a bit positive.

However, history also gives a clear indication that when this ADR trades at close to 10X P/E, that’s a sign to invest. The same is true for the native – when we’re looking at less than 9-10X P/E, you should be buying Allianz if you want to make money long-term.

Allianz is AA rated.

Allianz has a well-covered dividend of below 60% of even the 2022E EPS, with the impairment impact. It currently yields almost 6%.

Allianz is one of the absolute safest insurers and asset managers on the planet.

Thesis

Where do you get a 6% well-covered yield that’s secured by the world’s biggest insurance company and an AA graded credit rating? That’s Allianz – nowhere else.

Oh, others may have larger yields. You can have REITs that have impressive yields, even coupled with good or A-grade credit. But Allianz is AA – it’s better – and it’s higher even than some REITs like Realty Income (O). This does not make it “better” than any of these great businesses – that’s not what I am saying.

I’m saying that the combination of fundamentals, of yield, of valuation and of the upside seen in this company results in only one long-term stance that’s valid to me.

“Buy”.

It may be years until it recovers. If so, well and good. I’m pushing capital to work that will see, in that case, returns of well over 80% total once this happens, and that 6% yield that almost beats inflation keeps me very happy until that time.

No, dear subscribers – there aren’t many companies that do what Allianz does and do it quite as well as they do. This is worth something, and this is worth your consideration.

I truly believe that any portfolio without a significant Allianz position needs to have a good reason for this lack – and I back that stance up with skin in the game, having a 2.5%+ exposure, with a willingness to have up to 5% of my portfolio in Allianz.

I’m buying more. I recently covered the company in my general article on 10 buyable companies, and this is my stance and my targets.

Thank you for reading.

Be the first to comment