Melena-Nsk/iStock via Getty Images

Published on the Value Lab 23/6/22

We are not Interfor (OTCPK:IFSPF) investors, but we’ve been following the company for some months now and find the commodity interesting as it connects to housing dynamics. While end markets are exposed to rate hikes, there are mitigating factors that can protect Interfor and keep it above breakeven. Moreover, tightness in logistics markets could become resolved as rates rise and allow Interfor more volumes and turnover, which has been one of the reasons for the slowdown prior to rising rates. While there is housing exposure, we think that it isn’t such a danger area, and there are mitigating factors that could soften a landing for lumber, including effects from the Ukraine invasion. Overall, it’s an interesting speculative idea.

Quick Reminder of Interfor Markets

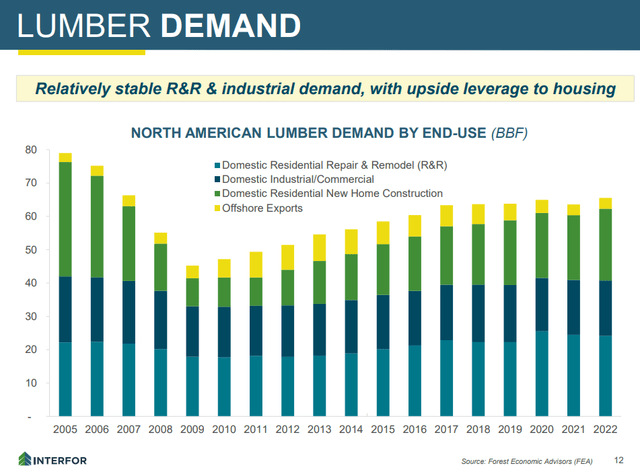

Interfor produces mainly everyday softwood lumber for use in DIY and also housing and construction. DIY is the primary market, where something like OSB would be more levered to housing starts.

The housing channel has been stable these last couple of years, including over the COVID-19 period where rising real estate prices continued but supply chain issues and lumber shortages meant that pent-up demand couldn’t be worked through at that moment. The DIY channel saw its spike in 2020 when everyone was in lockdown, and it’s retreating almost back to normalised levels.

Some Positives

It’s useful to understand on an incremental basis what contributes to the Interfor investment case:

- Exports are a pretty small contributor in terms of volumes, but the invasion of Ukraine and the consequent reticence or inability to acquire substantial timber and lumber supply from Ukraine and Russia means that Europe will have to resort to the US for imports. While this is unlikely to cause monumental shifts in the export share, it is a nice little factor that should contribute to overall lumber volume growth.

- DIY projects usually claim share of household budgets, albeit contracted ones, during a recession. This makes Interfor less levered to a housing slowdown compared to peers like West Fraser Timber (WFG) which have meaningful OSB exposure as well.

- Housing shortage is a secular force in the US, and while lumber shortages are in the past, the building cycle is still being slowed down by the shortages in later-stage fixtures and finishings. This means that the cycle has yet to reset onto early-stage materials like lumber. As rates rise and housing suffers, we should see a recommencement of lumber order activity once the new cohort of projects, granted a smaller cohort, begins to require lumber.

- If pressure comes off of goods and frees up some flatbeds, Interfor is reasonably well positioned to resume turnover to pent-up markets where lumber has had to stay put at sawmills due to lacking logistics coverage.

The Negatives

The negatives are really obvious. The macroeconomic environment is going to hurt housing starts in general. While the increment seems alright for Interfor as the building cycle is stalling before new lumber demand, housing could become a sore part of the economy, and with all the leverage that goes into the housing market from all participants, including developers, that segment could fall. While DIY accounts for quite a bit more than housing, and pent-up demand dynamics are evident, falling demand could take their toll on the lumber prices to which Interfor is highly leveraged.

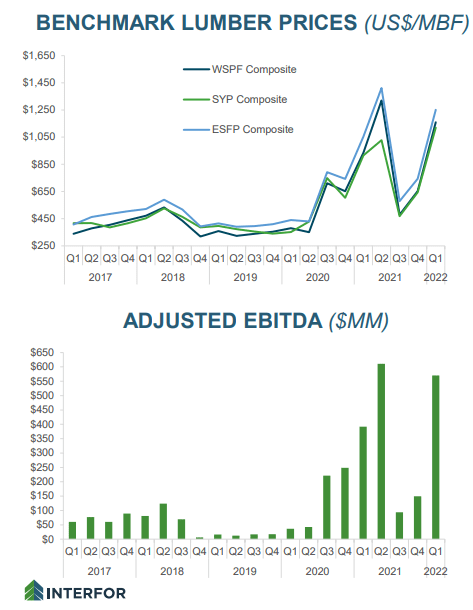

Operating Leverage (Q1 2022 Pres)

Current prices are 2.5x above breakeven, and would have to decline 60% before Interfor starts to see losses again. While commodities respond to changes in demand and supply on the margins, 60% is a long while to fall, and an LTM PE of 1.68x essentially assumes that prices will collapse tomorrow. On mid-cycle EBITDA forecasts, the multiple is similarly at only 1.7x. It is pricing falls way below 2018 levels, and probably something closer to 2019 lumber conditions, and given current prices, the run-rate for the next 3 months of production is likely to cover about 15-20% of EV before falling off to mid-cycle levels. This is a speculative investment, but any period for which lumber prices avoid collapse is a massive revaluation opportunity. By the time the mitigants time out and lumber sinks, your investment will already be partially recouped in company cash balances, and then it’s just paying the waiting game for a couple of years at most before we see a recovery. Overall, Interfor remains interesting.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment