Sergei Chuyko

Investment Thesis

Alliance Resource Partners (NASDAQ:ARLP) reported Q3 results pre-market yesterday and the stock was extremely volatile, searching for direction, yet ultimately ending the day higher.

Anyone that follows the coal industry knows that countries around the world have suddenly received a rude awakening that the need for reliable low-cost energy can only really come from fossil fuels.

Or perhaps, better said, government policy, for now, appears to favor the use of fossil fuels over nuclear usage, but that’s a discussion for another day.

The thesis facing ARLP is straightforward. There’s a supply-demand imbalance. There’s not enough supply coming online relative to the global demand for coal.

For as long as there continues to be a misguided popular opinion, as well as, capital flows being directed toward renewable energy, rather than ensuring there’s sufficient baseload energy to meet rising power demand, there is going to be undersupply in the coal market.

In summary, ARLP is cheaply valued relative to the free cash flow it is likely to see over the next twelve months.

What’s Happening Right Now?

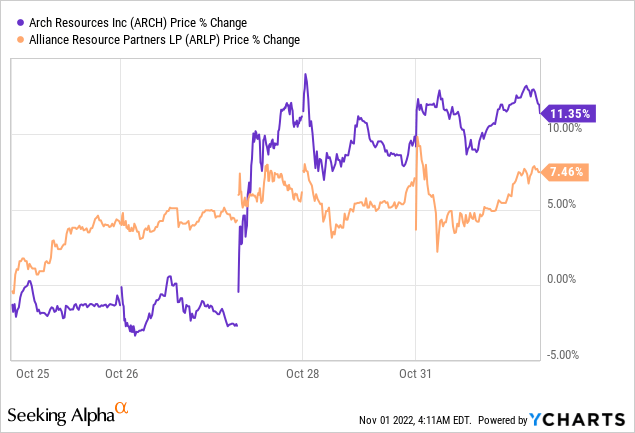

ARLP’s results came on the back of Arch Resources’ (ARCH) results.

Arch’s results come on the 27th of October, and the stock performed well the next trading day, as Arch did what Arch does, and announced a strong variable dividend.

Hence, it’s logical for investors to assume that ARLP would perhaps follow suit, with its own special dividend. However, that wasn’t the case. Hence, at first glance investors were not overly enthused.

But as tempers simmered down, and investors had more time to sieve through ARLP’s Q3 results, investors were overall pleased.

Meanwhile, before getting down into the quarter’s results, I’ll momentarily digress and discuss the macro environment.

Alliance Resource Partners’ Revenues Come In Strong

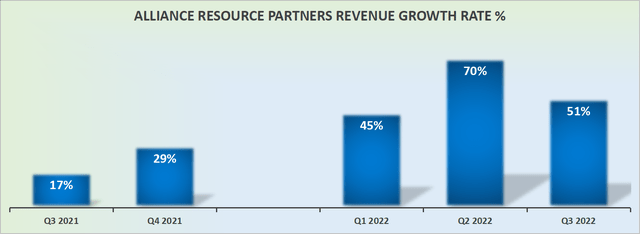

ARLP revenue growth rates

I recognize that ARLP missed topline estimates for Q3. That being said, keep in mind that despite the reasonably tough comps with the prior year, Q3 2022 still saw revenues up 51% y/y.

In my opinion that puts a lot of the mega-cap tech names to shame. No, I correct myself. That puts all the mega-cap tech names to shame.

Balance Sheet Continues to Improve

I’m a value investor investing in commodities. Consequently, any investment thesis has to start on the balance sheet.

This time last year, ARLP had approximately $335 million of net debt. While this time around its net debt fell to approximately $150 million. A dramatic change for a company with a market cap of approximately $3 billion.

With that in mind, plus what we’ll discuss in the next section, I believe that it’s possible that over the next 18 months, ARLP could end up with a slight net cash position.

ARLP’s $400 million senior notes mature in May 2025. Realistically, ARLP will want to get ahead of that maturity by at least a year. That means that at some point in late 2023, we should expect to see ARLP communicating with investors about its plans to deal with its senior notes.

Keep in mind that back in 2017, with rates extremely low, ARLP’s notes carried a 7.5% yield. With rates today around 4%, I suspect that refinancing those bonds would probably carry a 10% coupon. That’s not a thesis breaker, but it is something for investors to keep in mind.

EBITDA Margins Jump Higher

During Q3 2022, ARLP’s adjusted EBITDA was up 78% y/y to $225 million. From a cash perspective, ARLP’s free cash flow reached $245. Put another day, the amount of free cash flow that ARLP made this quarter is significantly more than its net debt position.

All this implies that given the current environment if ARLP desired, it would be able to pay back all its debt simply with its existing cash on its balance sheet, plus one quarter’s free cash flows.

ARLP Stock Valuation – 8.2% Yield, Next Year 13% Yield?

As noted throughout, ARLP is oozing free cash flows. At the start of 2022, ARLP’s cash distribution annualized at $1.00. Right now, after a few raises in the interim quarters, ARLP’s cash distribution now annualizes at $2.00, for an 8% yield.

Hence, given this backdrop, it doesn’t take much for an investor to start to ponder what will 2023 look like.

Is there a scenario where ARLP’s total cash distribution could reach $3.00 by this time next year? That would put ARLP at a forward yield of approximately 13%.

On yet the other hand, ARLP’s stock is now priced at approximately 5x this year’s free cash flow. This is not as cheap as it was at the start of the year, but, if investors were to believe that demand for coal continues to outstrip supply, that bodes well for 2023.

The Bottom Line

This is the one-line summary, Alliance Resource Partners continues to tick along and remain very attractively priced.

If one were to nitpick one negative consideration it would be that ongoing shipping delays continue to impact ARLP’s financials. Even though this should now start to improve, this has nevertheless been a persistent headwind for a while.

Accordingly, ARLP had to downwards revise its total sales volume for 2022, by approximately 2% for the year as a whole.

Again, this is clearly not a substantial negative consideration, but it may have led some investors to view this downwards revised guidance in a negative light.

Overall, it was yet another positive quarter for ARLP.

Be the first to comment