SouthWorks

Description

At the current price of $3.52, I think Allego N.V. (NYSE:ALLG) has more than a fivefold upside from where it is today. Allego is an important part of the world of electric vehicles because it offers high-value electric vehicle (“EV”) charging services to customers outside of the company and is one of the largest public EV charging networks in Europe.

Company overview

Allego provides high-value-added EV charging services to third-party clients and operates one of Europe’s largest public EV charging networks. As of December 31, 2021, Allego had over 672,000 distinct network users, and it owned or operated over 31,000 public charging ports, 16,000 public and private sites, and 14 different countries. All EV drivers of cars, trucks, and buses have easy access to Europe’s vast, vehicle-neutral public network. To become more vehicle agnostic, Allego has focused on EV charging options that can be accessed by the greatest number of vehicles, regardless of vehicle type or OEM. ALLG makes the majority of its money through the sale of charging equipment, installation services, and the use and maintenance of setting equipment.

Charging network is a key element in the world of electric vehicles

Allego’s primary business is the development, ownership, and management of fast and ultra-rapid EV charging stations. It is one of Europe’s most prominent public EV charging networks. ALLG employs proprietary Allamo software to locate premium charging locations and forecast demand based on outside traffic data. These sites are typically in densely populated urban or suburban areas, and Allamo has been instrumental in establishing a dependable pipeline. All EV drivers benefit from interoperability and a better user experience thanks to the proprietary software developed by Allego.

Allego charging stations can charge vehicles regardless of their OEM or user group. EV charging station owners can also use the Allego EVCloud to get software solutions for payment, analytics, and customer service.

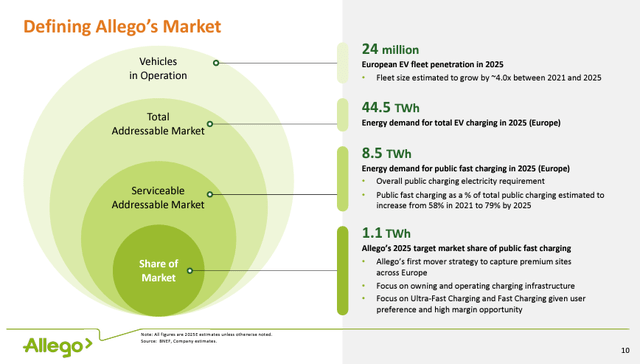

This is a very large market

In the major European markets of Benelux, Denmark, France, Germany, Hungary, Norway, Switzerland, Portugal, Sweden, and the United Kingdom, Allego estimates it holds a 12% share of the fast and ultra-fast charging locations market. To keep its position as the market leader in electric vehicle charging, the firm plans to expand its system of public charging stations. Additionally, management hopes to develop the services industry and public charging infrastructure. The objective is to grow the Allego user base and strengthen ties with B2B customers. ALLG also gives EV drivers who use the Allego network or its services access to more features of the Allego software platform.

The industry has high government regulatory hurdles

Differences in European, national, and regional regulations governing EV policy, as well as building and grid connection permits, can cause installation delays or cost differences between jurisdictions. In the regions where Allego is active, two primary licenses are essential. Separate permits are needed for both building the charging station and connecting it to the distribution grid operator’s network.

Since Allego is familiar with the rules and regulations in this field, it may be able to speed up the installation and commissioning process, making it more efficient and lower operational costs.

Attractive business model

The foundation of Allego’s business strategy is the provision of highly reliable charging outlets to all categories of EV users. The company has made a one-of-a-kind, proprietary software platform that any mobility service provider [MSP] can use to manage hardware chargers and charging sessions on Allego’s network.

Allego offers high-value-added third-party services as a strategic focus for technologies that aren’t central to the company’s operations. This industry is propelled by lucrative service contracts with third parties for tasks like web design and technical layout. Allego’s white-label software suite allows it to manage large and complex solutions and act as a one-stop-shop for its clients. From concept to completion, Allego develops the entire charging system for its clients, including all necessary components, setup, and ongoing support. The charging chain between lease car companies and EV drivers can be set up, or OEM dealerships can be outfitted with chargers and run by a third party.

By investing funds in its own charging stations, Allego hopes to attract and keep EV drivers as customers for the long haul. It is possible that the services market will see an uptick in foot traffic if fleet companies or last-mile providers start looking for solutions to provide charging on the go.

Allego doesn’t make its own hardware, but it has a wide variety of reliable suppliers from which it can obtain unique features. Furthermore, Allego is in a prime position to pick out optimal hardware because it is hardware agnostic. Allego also collaborates with OEMs on firmware and hardware. At the moment, Allego is putting all of its efforts into creating a system that can directly interact with EV drivers to manage charging sessions and payments.

Business model supported by a strong marketing and growth strategy

Allego has local teams and subsidiaries in each country where it operates to manage public charging networks. Site selection is handled by a centralized network team, while lease agreements are handled at the site level. The Allego team communicates well with retailers, real estate companies, cities, and other groups that need space or charging and may be able to get it from Allego.

The way Allego provides customer service is divided into two segments.

- Commercial customers: There are already plenty of businesses that either own or rent parking lots. To that end, Allego caters to businesses that want to convert their parking lots into fully electric facilities. This is typically done through a sale or service, though Allego may choose to invest in the network if site quality warrants it. The charging stations would join the Allego charging network if the company ever decides to construct one. Businesses can set their own prices for using the Allego software platform while still making it available to the public. The ability to invest in real estate has allowed Allego to secure prime locations and develop lasting partnerships with its commercial clientele. As a result, Allego has a compelling offering for many European commercial sites thanks to its ability to provide a dual-tracked approach based on customer needs.

- Fleet customers: Allego’s fleet customers include businesses operating in the industries of transportation, logistics, sales, service, motorpool, shared transit, and ridesharing. Fleet customers can take advantage of Allego’s full suite of charging options, from home chargers and installations to priority access to the company’s network and discounted rates, as well as charging infrastructure tailored to their needs. However, EV drivers can only get Allego’s home charging solutions through B2B contracts.

The Allego charging network is a high-margin business that requires significant investment. The services that Allego provides do not require a large initial investment, but they do allow the company to take advantage of synergies and generate a network effect that drives up traffic. In addition, Allego can save money on running costs by expanding its services while simultaneously developing its charging network.

Valuation

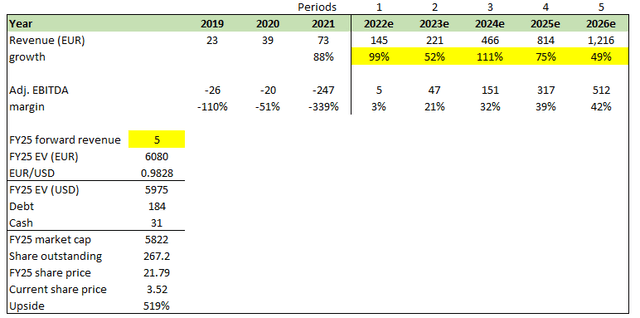

I believe ALLG is worth USD23.91 in FY25, representing a more than 5x upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue and EBITDA growth will follow management’s FY22 (2Q22 transcript) and long-term guidance (in SPAC deck), driven by organic share gains and fixed cost leverage.

- I valued ALLG using a forward growth multiple since it is easier to comp against its peers, who are not profitable at the moment. The 2 direct publicly available comps are EVgo (EVGO) and Fastned (OTCPK:FNEDF), and both are trading at a higher multiple than ALLG given the higher expected growth. ALLG could eventually trade at a similar multiple, but that is anyone’s guess. The conservative way is to value it at the same valuation today (5x revenue). Even at this valuation, there is still significant upside available.

KEY RISKS

Faces much competition

The EV charging market is still expanding, and the level of competition is rising. Europe is the largest EV market outside China and is more developed than the U.S. Allego faces numerous rivals in both its services and charging network industries. Allego competes with established utilities, oil and gas firms, EV charging players, and firms connected to automakers when building its own public EV charging network. Allego also has competition from various businesses in the services sector, including hardware producers, providers of software platforms, installers, and maintenance providers. Allego must constantly work to stay competitive in its markets despite its long history in Europe.

Electric vehicles may only become mainstream.

The premise that electric vehicles will be extensively embraced is necessary for ALLG products to see considerable acceptance. There is no assurance that it will be, even though trends point in that direction. If not, ALLG may be in existential danger.

Dependent on energy supply

The development and functioning of Allego’s charging stations depend on the electricity supply, which is outside of its control. The system’s capacity may be impacted or limited by Allego’s charging points’ access to electricity sources, such as planned or unplanned power outages. Any long-term power outage or limited grid capacity could hurt the customer experience, Allego’s business, and operational outcomes.

Summary

At the time of this writing, the share price of ALLG is undervalued. Allego has an average market share of 12% in the key European markets for fast and ultra-fast charging stations. By investing in its network of public charging stations, it is likely to keep growing its lead in EV charging and take over the market.

Be the first to comment