Florent Molinier

Introduction

In April 2022, I wrote a bearish article on SA about Dutch electric vehicle (EV) charging company Allego (NYSE:ALLG) in which I said that its stock seemed to have attracted high retail investor interest and that the share price could fall below $10 once it fades.

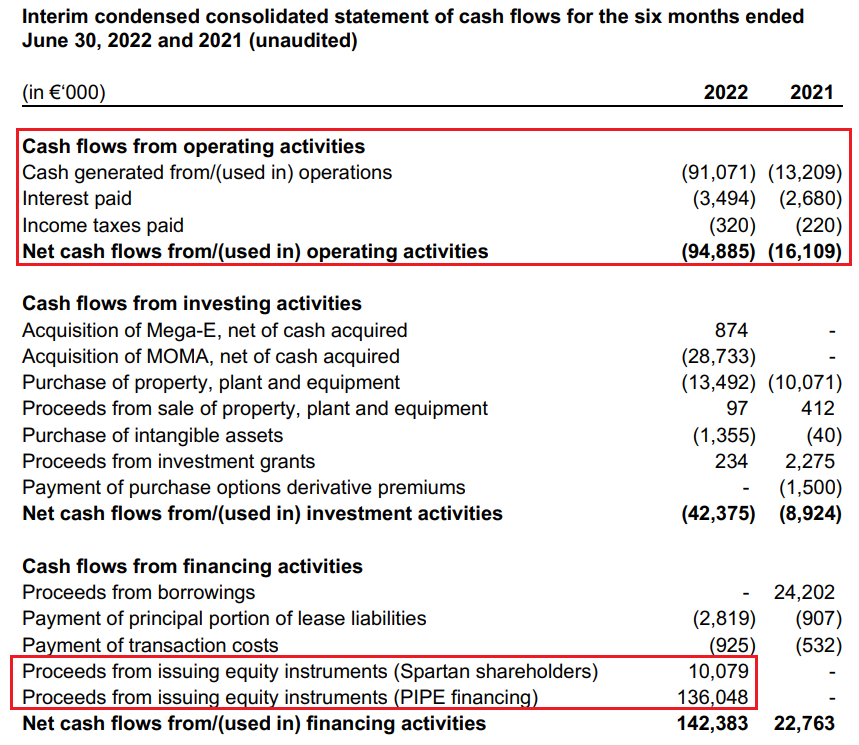

Well, the company’s market valuation has fallen by about two thirds in just 6 months, but analysts seem convinced that the share price could double thanks to rapidly growing electric vehicle adoption, supportive policies, and incentives. I don’t share their optimism as net cash used in operating activities was 94.9 million euros ($94 million) in H1 2022 and cash reserves stood at just 29.8 million euros ($29.5 million) at the end of June. In my view, it’s possible that the market valuation doubles in the near future, but this is likely to be achieved through a significant capital increase to fund operations. Let’s review.

Overview of the H1 2022 financial results

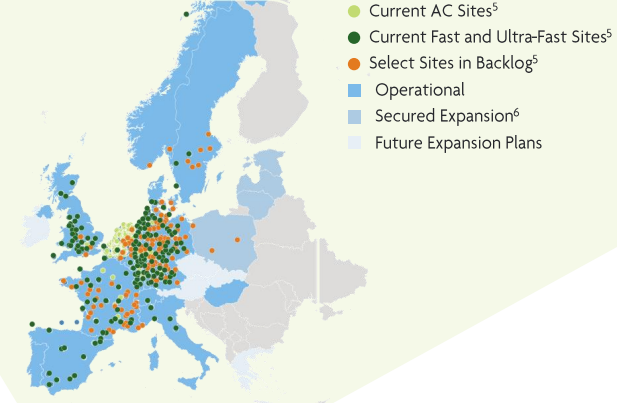

In case you haven’t read my previous article about Allego, here’s a short description of its business. The company was founded in 2013 and it currently has one of the largest EV charging networks in Europe with around 34,000 public and non-public charging ports as well as 18,200 public and non-public charging sites across 15 countries. However, Allego has a strong presence in only a few markets, namely Benelux, Germany, and London. In addition, many of the facilities in Benelux are AC charging points.

Allego

Allego’s Alamo software platform aims to identify premium charging sites and forecast demand based on external traffic statistics and the company claims its internal rate of return [IRR] at the site level is about 30%, excluding subsidies. In addition, Allego usually signs long-term power purchase agreements which means that it should be relatively well insulated from the current energy crisis in Europe. In H1 2022, its results were impacted by 7.1 million euros ($7 million) higher energy costs, but this was partially offset by higher income from the sale of carbon credit certificates.

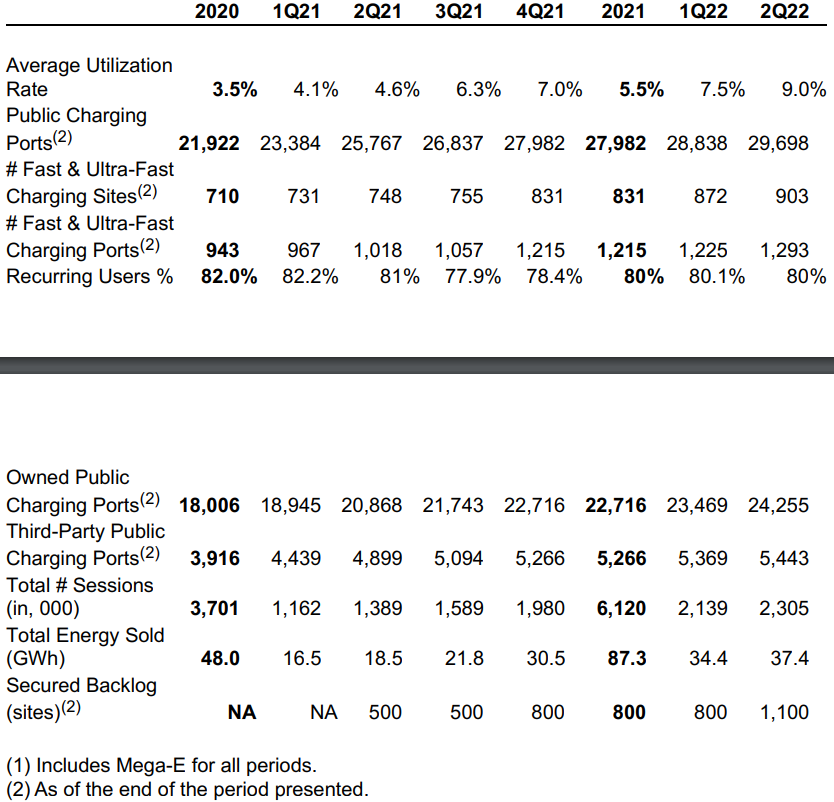

The company’s average utilization rates have been increasing steadily over the past few years as EVs gain traction in Europe and recurring users have been hovering around 80%. In Q2 2022, the backlog increased to 1,100 sites, which is 120% higher compared to a year earlier.

Allego

As you can see from the table above, the charging network has been growing rapidly and in March 2022, Allego merged with a special-purpose acquisition company (SPAC) to finance part of its CAPEX, which was expected to stand at 188 million euros ($186.3 million) this year alone. The deal was supposed to create a company with $490 million in cash, but redemptions reached 98%. As a result, Allego received only 146.1 million euros ($144.8 million) from the SPAC deal. This puts the company in a tight spot from a liquidity point of view as cash flow from operating activities is currently deep in the red. Cash and cash equivalents were already below $30 million at the end of June, which means Allego will likely need to carry out a capital increase before the end of 2022, even if we exclude CAPEX or acquisitions.

Allego

Allego

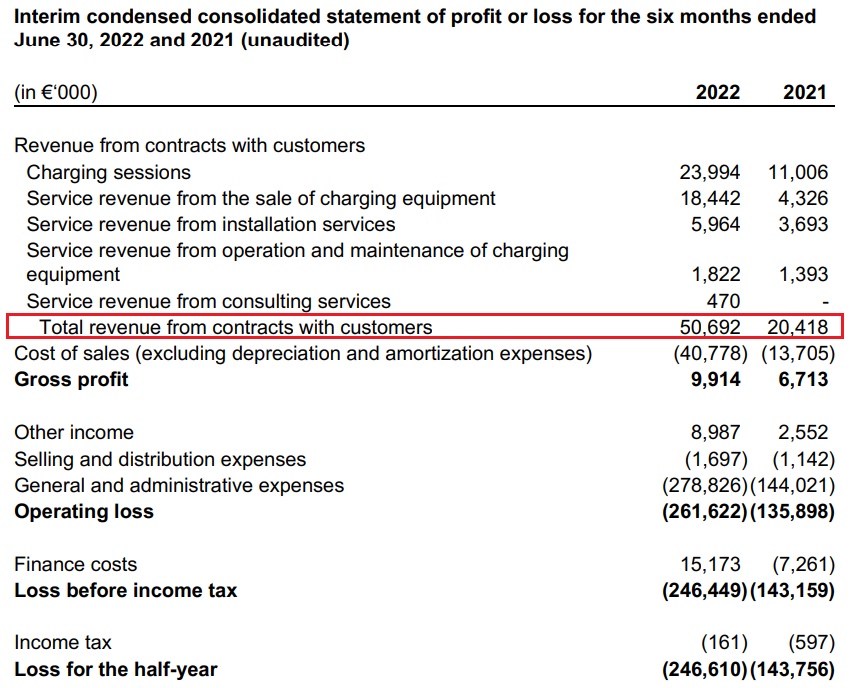

Looking at the H1 2022 financial results, I think they were disappointing as revenues came in at 50.7 million euros ($50.2 million) and total revenues for the full year are now expected to stand at between 135 million euros ($133.8 million) and 155 million euros ($153.6 million). These figures are below the forecasts in the SPAC deal presentation despite Allego enacting an average 10% price increase effective September 1 in most markets to mitigate the effects of higher energy prices. What’s even worse is that operational EBITDA was negative 1.5 million euros ($1.5 million) in H1 2022, which is such a large deviation from the forecasts that it casts significant doubts about the expectations for the coming years.

Allego

You might be wondering why net cash used operating activities isn’t much higher considering the net loss was 246.6 million euros ($244.3 million) in H1 2022. Well, this is because share-based payment expenses soared to 241.3 million euros ($239.1 million) during the period from 121.9 million euros ($120.8 million) a year earlier. Considering the market valuation of Allego stands at $1.22 billion as of the time of writing, there could be significant stock dilution here even without a capital increase unless the share price recovers very soon.

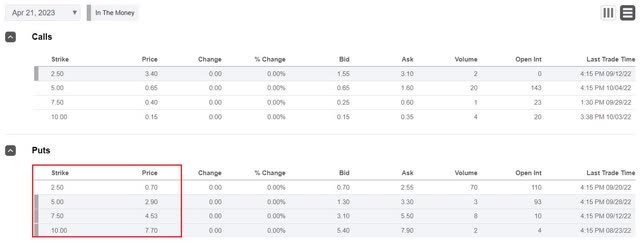

So, how do you play this one? Well, short selling seems dangerous as data from Fintel shows that the short borrow fee rate stands at 248.48% as of the time of writing. Also, put options at all strike prices are expensive the moment and it could be best for risk-averse investors to avoid Allego.

Seeking Alpha

Looking at the risks to the bear case, I think that there are two major ones. First, I could be underestimating Allego’s borrowing options. In my view, a new debt facility could buy it only a few months. In July, the company managed to upsize its 120 million euro ($118.9 million) senior debt facility through a 50 million euro ($49.5 million) accordion feature and is currently pursuing a new expanded financing package. Second, Allego has one of the largest EV charging networks and it could become a takeover target for one of its competitors or a company that wants to enter this market.

Investor takeaway

In March, Allego completed a lackluster listing on NYSE and the company is already behind on its 2022 revenue and EBITDA targets. Cash and cash equivalents were down to below $30 million at the end of June, and it seems that significant stock dilution in a month of two could be inevitable even if the company puts the brakes on all CAPEX plans despite its large backlog.

I’m still bearish on Allego but I think that it could be best for investors to stay away from this company as short borrow fee rates are over 200% and put options are expensive at the moment.

Be the first to comment