shadrin_andrey

Merry Christmas and happy holidays to all my readers!

I know Christmas is still a bit aways, but that “bit” is getting smaller and smaller. How does that song go?

“We’ve been waiting and waiting. It seems like a year!”

Well, that year has almost come and gone, as evidenced by all the Christmas lights everywhere. We can see them decorating people’s yards and houses (and living rooms too when curtains are pulled back).

Depending on where you are, the exact amount of decorations on display might be staggering. How soon they went up too.

One well-connected person said there are two types of people: Those who believe in letting Christmas festivities begin after Thanksgiving has passed… and those who don’t understand how it should be.

Yet this year, he said he had everything up nice and early. He knows so many others who did the same despite their typical traditionalist snobbery on the subject.

People want beautiful things to focus on. It’s as simple as that.

Fortunately for us, beauty can be found in a whole lot of places and in a whole lot of ways. Even if we’re not close enough to twinkling Christmas lights to enjoy the view.

At the risk of getting sentimental – though, really, ‘”tis the season,” isn’t it? – there are loved ones’ faces, a drive through the country, a memory popped up, a hope for the future…

It all depends on how you look at life.

My Way of Spending Christmas Cheer

There’s always a touch of guilt when I write an intro like that and then move on to stock market topics. Because I’m not trying to put a monetary value on any of the beauty mentioned above.

Then again, money is still important even if it’s not the most important thing in the world. And it’s especially important now when everything is as expensive as it is thanks to inflation.

So, ultimately, I set my guilt aside and bring up my favorite financial topic of all time: Real estate investment trusts (REITs). You could say this is my way of spreading Christmas cheer.

Which, as evidenced by statements above – and by discouraging realities all around us – the more Christmas cheer we get this year, the better.

Do I have to go down the list of reasons why that’s true? Probably not. We all know that political tensions haven’t calmed down since the elections passed… that the economy isn’t healthy… that the global situation is downright frightening no matter where you look…

And the stock market. Oh, the roller coaster ride that’s been the stock market.

Beginning with January’s stomach-churning drop, it’s been a long, long ride that most people would happily stop if they could.

Since we can’t though, let’s talk about what we can do with the ride as it is. Which, as I keep saying, isn’t as awful as you think.

These Christmas Gifts Should Prove to Be the Real Deals

So what investment beauty do I see around me?

How about stock price entry points that are very reasonable. And, in some cases very, very reasonable.

I’d call some of them entry prices of a lifetime, but let’s face it: We saw such stellar buys not even three years ago.

At the same time, the companies I’m recommending below are good ones. Strong ones. Ones that, by all fundamental indications will almost certainly stay that way well after the Christmas lights are back in their boxes and we have to find beauty elsewhere.

But what if prices go lower from here, you might be wondering? What about the incoming recession?

Well, first off, we don’t know a recession is coming. It probably is, mind you. As already mentioned, we’re not in the greatest economic environment of all time. And it’s probably going to take a while longer to get better, recession or no.

But we don’t know where the stock market is going to be. It’s proven far too predictable this year.

For that matter, it’s proven far too unpredictable over time. So much so that trying to predict its short-term movements – an attempt known as market timing – falls short an astronomical amount of the time.

It’s much more effective to simply look for strong companies trading at cheap prices.

As for my second reason to buy in now rather than later… Do you wait to buy your loved ones Christmas presents until after Christmas because they might be cheaper? (The presents, not the loved ones.)

If so, I’m going to guess you have a little less immediate beauty to indulge in. And as I already said or at least implied, we need to focus on the beauty that we can.

The more of it, the better.

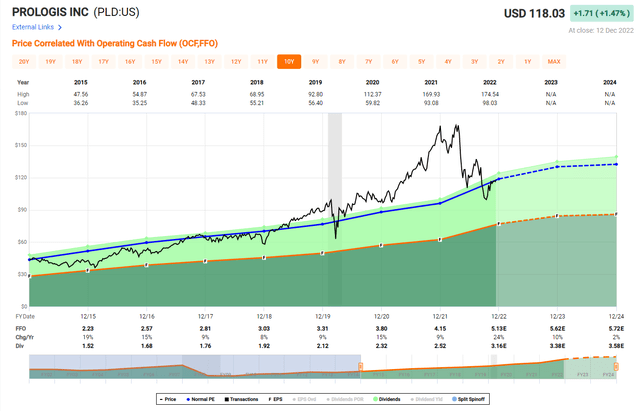

1. Prologis – (PLD)

With a market cap of over $100 billion, Prologis is not only the largest Industrial REIT, but the largest REIT period. Prologis is an A rated company with a fortress balance sheet and has one of the lowest Debt / Adj. EBITDA ratios in the entire REIT space of just 3.7x.

On top of that they have a fixed charge coverage ratio of 13.7x, which puts them in a strong position to service their debt obligations. Along with its stellar balance sheet, Prologis has established an international presence with almost 5,000 properties spread across 19 countries.

In all, they have 1.3 billion square feet of standing real estate and have $37 billion invested in land banks for future expansion. Prologis has an average 5-year FFO growth rate of 12.79% per annum and had an AFFO payout ratio of 75.45% in 2021.

Full year projections for 2022 put the AFFO payout at ~72%, which makes the dividend well covered. The current yield sits at 2.72% and on average they have increased the dividend by 8.46% annually over the last five years.

Prologis is not just one of the highest quality REITs you can own but is currently trading at a discount to its historic average.

Currently, Prologis is trading at 22.94 times FFO when its 5-year average FFO multiple is 25.37. Prologis is one of just 3 stocks that receive a perfect 100/100 iREIT IQ quality rating, between their credit quality, asset quality, and growth potential we rate Prologis as a “strong buy.”

FAST Graphs

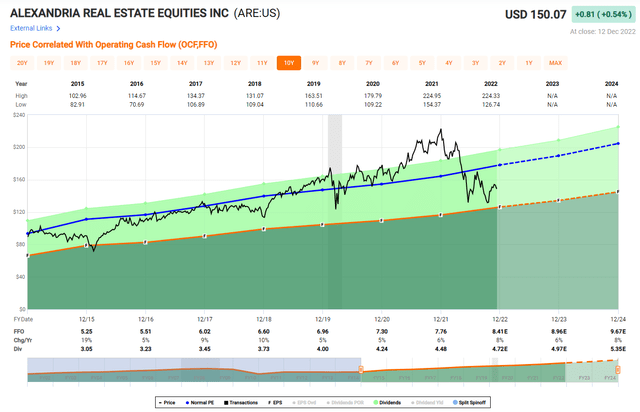

2. Alexandria Real Estate – (ARE)

The 2nd REIT on our list that receives a perfect 100/100 iREIT IQ quality rating is Alexandria Real Estate.

Alexandria is unique in that it’s in the office sector and has sold off YTD along with other REITs in the sector, but they are unlike any other office REIT.

Alexandria specializes in labs and life science facilities and tend to own real estate in clusters to create synergy. Their top three tenants are Bristol Myers Squibb, Moderna, and Eli Lilly which use Alexandria’s facilities for research and development.

The “work-from-home” phenomena that’s currently ongoing has created a cloud of uncertainty for the office sector as a whole, but medicine and scientific research cannot be done from home or over Zoom.

Excluding vacancies in recently acquired properties, Alexandria’s occupancy rate in North America was 98.4% as of Sept. 30, 2022.

Alexandria carries a credit rating of BBB+, has a Debt + Preferred / adj. EBITDA ratio of 5.4, and a fixed charge coverage ratio of 4.9x. Their average 5-year FFO growth rate is 6.93% and their average five-year dividend growth rate stands at 6.77%.

Their dividend is well covered with an AFFO payout of 79.43% in 2021 and a projected AFFO rate of ~72% for 2022.

Currently Alexandria trades at an FFO multiple of 17.82 which is well below the five-year average FFO multiple of 23.11.

I think there’s opportunity here for the FFO multiple to converge closer to its average once the market realizes that Alexandria is not impacted by the current environment like the rest of its office REIT peers. At iREIT, we rate Alexandria a buy.

FAST Graphs

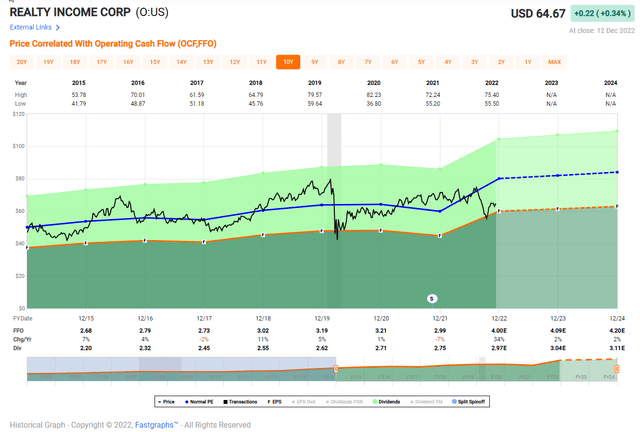

3. Realty Income – (O)

The third and final REIT on our list to receive a perfect 100/100 iREIT quality rating is Realty Income.

One of the more well-known and respected REITs, Realty Income concentrates on single tenant triple net leases in the Retail space and has more than 11,000 properties in all 50 states and has recently established an international presence with properties in the UK and Spain.

Since going public in 1994, Realty Income has delivered a 14.6% compound annual shareholder return as well as a 4.4% compound annual dividend growth rate.

Realty Income prides itself on its dividend track record and is one of the few REITs that qualifies as an S&P 500 Dividend Aristocrat with 27 consecutive years of increasing the dividend.

The dividend is paid monthly and is typically increased each quarter and currently pays a yield of 4.62%. The dividend is well covered with an estimated 2022 AFFO payout ratio of ~76%.

Realty Income has an A- credit rating and a strong balance sheet with a Net Debt to Adj. EBITDAre ratio of 5.2 and a fixed charge coverage ratio of 5.5x.

Currently Realty Income trades at an FFO multiple of 16.36 which is well under their five-year average FFO multiple of 20.93.

Realty income is one of the most reliable, battle-tested REITs in the market today. They have survived and thrived through multiple recessions, the disruption to retail by e-commerce, and most recently the pandemic.

Through each crisis they have not only continued the dividend without interruption but increased it as well. At iREIT, we rate Realty Income as a BUY.

FAST Graphs

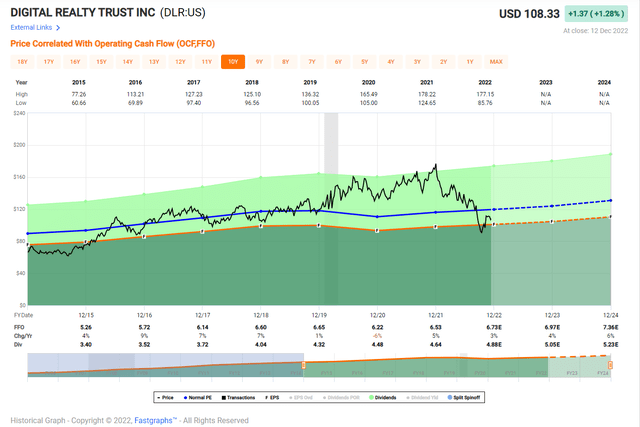

4. Digital Realty Trust – (DLR)

Digital Realty owns over 300 Data Centers across the globe and serves over 4,000 customers.

Data Centers are very specialized facilities that house servers and are a critical piece to the digital infrastructure of the world.

Data centers belong in the REIT “e-commerce trifecta” (cell towers, logistics, data centers) as they are a key component in the e-commerce chain. This should allow Digital Realty to continue to ride the e-commerce wave well into the future.

The company has a BBB investment grade credit rating and has manageable debt levels with a Net Debt / Adjusted EBITDA of 6.4 and a fixed charge coverage ratio of 5.7x.

Over the last 10 years Digital Realty has averaged an FFO growth rate of 4.20% and a dividend growth rate of 5.50%. They also have an enviable dividend record with 17 years of consecutive increases.

Currently the dividend yield is 4.56% and the projected AFFO payout ratio for 2022 is ~77%. Digital Realty currently trades at an FFO multiple of 15.92 which compares favorably to its five-year average FFO multiple of 19.66.

Throughout this year there has been a short campaign against Digital Reality and Data Centers in general. The basic premise has been that the cloud hyper-scalers will start building out their own data centers and stop leasing from Data Center REITs.

While this has been a possibility for the last decade, nothing in the numbers suggests leasing activity has slowed, and as a matter of fact, in Q3-22 Digital Realty had record leasing as the company bookings were $176 million. At iREIT, we rate Digital Realty a strong buy.

FAST Graphs

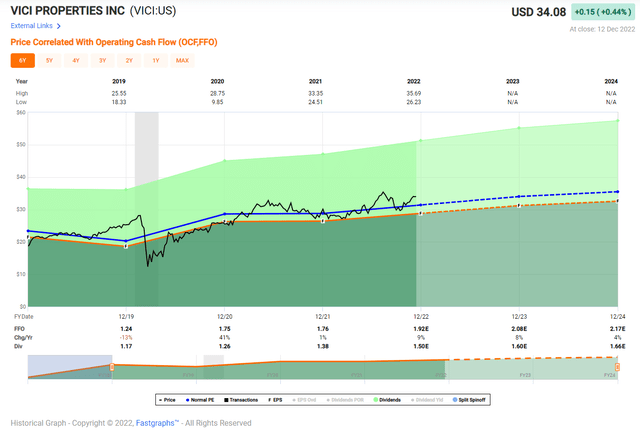

5. VICI Properties – (VICI)

VICI Properties is a triple net lease that went public in 2018 and owns experiential real estate that includes casinos, golf courses, hotel rooms, restaurants, bars, and nightclubs.

They have been a standout in 2022 with a YTD gain of +13.29% – while most REITs have been down double digits over the same time frame.

VICI has high tenant concentration with a total of 9 tenants. Its two largest tenants, Caesars and MGM Resorts, make up 43% and 33% of their annual cash rent respectively.

While normally this tenant concentration would be of concern, the properties Caesars and MGM operate are iconic and cannot be easily replaced.

Additionally, the weighted average lease term (‘WALT’) for Caesars is 32.9 years and the WALT for MGM is 53.4 years which should provide stability for years to come especially since most of VICI’s leases come with CPI linked escalators which should give them some protection against rising rates.

VICI has a -BBB credit rating with a Net Debt to EBITDA of 5.8 and 100% of their debt is fixed rate. Over the last 4 years VICI has had an FFO growth rate of 7.64% and an average dividend growth rate of 11.51%.

VICI currently yields 4.60% and has a projected AFFO payout ratio of ~78% in 2022. Currently VICI trades at an FFO multiple of 17.76, which is in line with its 5-year average FFO multiple of 17.43. At iREIT, we rate VICI Properties as a buy.

FAST Graphs

In Closing…

Of course, my frequent followers know that I can’t just provide you with a list of 5 REITs because as Sir John Templeton explained,

“The only investors who shouldn’t diversify are those who are right 100 percent of the time.”

So, within the next 12 days – when the big man comes down the chimney – I’ll provide my loyal fans with another five more durable dividend payers. As the title to my article suggests, I don’t want to provide you with just five “good” REITs, but instead 5 “great” ones.

What’s my definition of “great?”

“Greatness Isn’t Just Talent. It’s Talent Applied Consistently”.

That’s from one of the world’s great golfers, Gary Player, and while he was quoting from his motivational sports mindset, I’m of the opinion that it also applies to dividend growth stocks.

You see, I think the greatest stocks to own are the ones that have delivered a consistent and reliable model of dividend repeatability.

Through recessions, pandemics, inflation, rising rates, you name it – these are the stocks that you want to own – especially right now. So be in the lookout for my next in my series called “All I Want For Christmas Are A Few Great REITs.”

Happy SWAN Investing!

Be the first to comment