courtneyk/E+ via Getty Images

Investment thesis

I believe investors should stay neutral on Alight (NYSE:ALIT) until a better opportunity arises.

While I am neutral on the stock, I am positive on the business. Alight is a company that offers human capital solutions and offers a cloud-based solution that is more efficient and effective than traditional approaches. The HR industry is evolving, with an increasing focus on temporary workers and employee wellbeing, as well as the need to navigate complex regulatory landscapes. ALIT is well-positioned to capitalize on these trends.

Business overview

Alight, Inc. offers human capital solutions. The firm specializes in guiding clients through the complexities of health, wealth, and human resources. Alight has a global customer base.

Secular trends happening in the HR industry

In my opinion, the employee-employer dynamic is evolving, and the future prosperity of a company could be affected by a wide range of factors. Traditional approaches are built on service-centric, highly individualized models that are cumbersome, time-consuming, and costly for both employers and employees to use. Unfortunately, these solutions have not evolved to meet the changing demands of the market and therefore cannot provide the necessary personalization, data, or analytics within a robust compliance framework. In addition, businesses waste millions of dollars annually on employee benefits that are underutilized. I know firsthand how much money is allocated to these programs but ultimately goes to waste.

First of all, the world is evolving, and with it, the conventional employment model of a single, permanent position with a single employer. Part-timers and talent on demand now make up about a third of the workforce in the United States, as employers around the world respond to the growing demand for temporary workers to fill specific skill gaps. I think that the extra work and complexity that managing gig work has caused for employers and employees has opened up a big market opportunity to help employers and employees manage these arrangements more efficiently and effectively.

Second, “employee wellbeing” is gaining traction as a business priority. My impression is that in this particularly difficult global period, workers are trying to strike a balance between health and financial wellness. The average student loan balance for a Millennial or recent graduate is still well over $30,000, and many working adults worry that they won’t be able to retire when they want to. As a result of this shift, I see a pressing need for integrated health and wealth solutions.

Finally, employers still face challenges from the regulatory landscape. There is a slew of new regulations and agency guidance that employers must be familiar with because of recent legislative changes. Over 70 changes have been made to the ACA since it was first passed in 2010, as documented by ALIT S-1. In my opinion, keeping up with compliance requirements has quickly risen to the top of the list of priorities for most businesses, and there is a widespread desire to find ways to make this process easier.

ALIT is a leading player in this field with global reach

ALIT is different from the conventional, outdated system that many companies are still using. They offer a cutting-edge, cloud-based solution that can cut service costs and boost revenue recognition times. Its platforms are being developed to offer a consistent user interface regardless of the user’s context or the method by which they access the company’s services (web, desktop, or mobile). These data and AI-driven platforms will stand out from the crowd in a number of important ways.

In my opinion, ALIT is the preeminent global payroll service provider and a leading administrator of defined benefit and defined contribution plans for employee financial wellbeing and well-being. For instance, ALIT’s Employer Solutions, provide comprehensive services to help their employees make sense of and make the most of the health, retirement, and other benefits their employers offer.

In my opinion, ALIT’s global presence and sizeable presence are two of its most important characteristics. Currently, ALIT has clients in over a hundred different nations. It is my opinion that ALIT’s efforts to increase its presence on a global scale have made it possible for the company to secure contracts with some of the most recognizable companies in the world.

Well experienced and strong marketing strategy

By fusing in-depth domain knowledge with a focus on people-first technology, ALIT is able to assist clients in navigating transformations. I think that ALIT’s ability to get and keep customers is helped by the fact that it divides its sales force by industry, with the idea that each sales representative will have the domain knowledge and technical expertise to communicate with customers.

In addition, ALIT has made it possible to refocus on the C-suite by facilitating a move toward value-based selling and guaranteed ROI for customers, two strategies that generate the highest value for customers by leveraging integration and data-driven insights. Because of the wealth of information at their disposal, ALIT is in a prime position to ascertain the wants and needs of upper-level management as the company expands. Since ALIT has been around for over 20 years, they have accumulated a wealth of information and experience that should make it much simpler for them to figure out what their customers want.

In my opinion, ALIT can keep their market dominance by attracting new customers in a wide range of industries and sizes with an improved go-to-market strategy. Management has indicated that they are investing in order to take advantage of what I believe to be a sizable opportunity to increase both their mid-market customer base and their international presence (as per S-1). For instance, ALIT has created a new sales team focused on standalone solution sales and trained their sales representatives in value-based selling and industry specialization.

In addition, ALIT has a successful track record of upselling to existing customers, thereby broadening and deepening their connections with those customers. To give just one example, among ALIT’s top 100 Employer Solutions customers, 59% have increased the number of solutions they purchase from ALIT since 2017 (as per S-1). For this reason, I believe ALIT has a good chance to continue to upsell and cross-sell their products to a deep pool of customers, especially with their integrated wealth solutions.

Strong customer relationship across various industries

When comparing ALIT to its competition, I believe that the company’s greatest strength is its more than two decades of experience connecting with various levels of leadership (division heads, CHROs, and CFOs) at some of the world’s largest and most successful companies. I think that the foundation of any successful business is the quality of its relationships with its customers, and I know that ALIT has built its success on the strength of its partnerships with its clients. The prospectus states that ALIT has over 4,000 clients, including 70% of the Fortune 100 and more than 50% of the Fortune 500, as well as companies in the middle market. In my view, ALIT’s largest competitive advantage is its extensive and diverse customer base.

M&A strategy could further improve growth runway

ALIT’s growth could be sped up in a number of ways other than through organic means alone, such as through opportunistic acquisitions in all of the markets they operate in or through the formation of new strategic partnerships. In my opinion, ALIT is in a good position to take advantage of the industry’s fragmentation and make value-accretive acquisitions, and I see mergers and acquisitions as a way to bolster the company’s capabilities and solution portfolio. Successful acquisitions in the past by ALIT lend credence to this theory. The ALIT prospectus claims that the company’s acquisitions have added over $20 billion in TAM and over 2 million customers.

Valuation

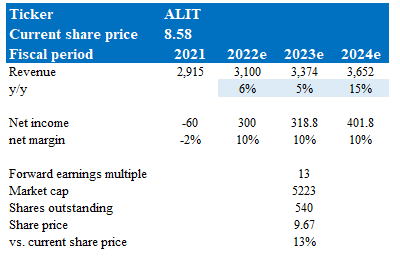

According to my model, ALIT is currently 13% undervalued. ALIT is valued on a forward earnings basis in my model because the company generates earnings that can be used to estimate future cash flow today. The model is based on management’s FY22 forecast (both revenue and earnings).

Overall, I expect ALIT growth to continue as they gain market share, but growth will slow in FY23 due to the recession outlook (high interest rates and inflation). So far, the business has performed well, and as a result, I believe it will be able to recover following this weak macro period.

ALIT is currently trading at 13x forward earnings, and I assumed it would trade in a similar range a year from now if no major events occurred. However, ALIT used to trade at a much higher multiple, so there is potential for a re-rating upward.

Based on these assumptions, I estimate ALIT’s stock to be worth $9.67 in fiscal year 23.

Own estimates

Risks

Recession

ALIT is affected by the health of the industries and markets their clients operate in. When local economies are bad, some customers may spend less on technology and other things they don’t have to, which can slow the growth of both new and existing businesses.

Change in regulation

As was previously stated, there are a growing number of regulations that businesses must follow. If ALIT doesn’t account for everything that could go wrong, the company could face unanticipated legal action that would be bad for business.

Conclusion

My advice is to wait for the stock’s price to drop before buying. As an industry frontrunner, Alight serves clients all over the world. It provides a cloud-based alternative to conventional methods that is more time- and cost-effective. The human resources field is changing, with more attention being paid to contingent workers and employee wellness, and more complicated regulatory landscapes to be navigated. ALIT is positioned favorably to benefit from these tendencies.

Be the first to comment