ollaweila

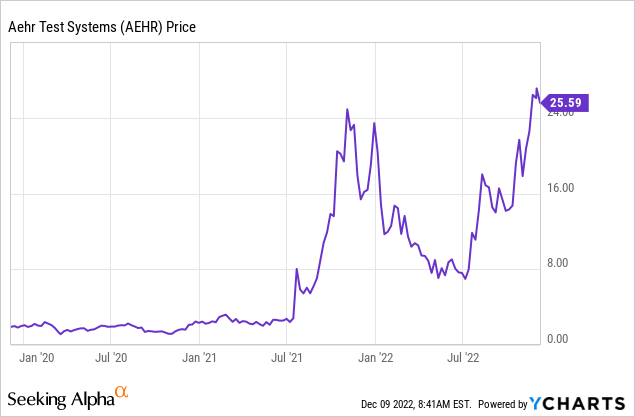

When you scan the internet for companies active in the billion-dollar SiC or silicon carbide market, you are not likely to find Aehr Test Systems (NASDAQ:AEHR), but the fact that this $665 million company grew revenues at 89% Y/Y in its latest reporting quarter points to strong demand for its FOX-XP/FOX-NP wafer test systems.

However, after having appreciated by nearly 180% since July, in sharp contrast with the broader market (S&P 500) which is down by 3.75%, the stock’s P/E multiple is at 44.8x, which begs the question as to whether it is not better to wait for a drop before investing.

Thus, the objective of this thesis is to provide an answer to the above question by assessing the rationale for getting exposure to SiC through AEHR. First, for those new to the technology, it has superior properties compared to conventional silicon-based components, as I will enumerate below.

Product Differentiation Resulting in Surging Sales

Made up of both silicon and carbon, SiC offers almost ten times greater breakdown strength as well as better thermal conductivity than standalone silicon, which makes it ideal for high-voltage applications in EVs (electric vehicles), power supplies, solar inverters, and wind turbines. Naturally, then, applications have made their way into automotive and power generation where there is a constant need to improve electrical conduction and operate at higher voltages and temperatures. In case all this sounds too theoretical, please note that Tesla (NASDAQ: TSLA) started to use SiC for its Model 3 back in 2019.

Despite all these advantages, SiC-related sensors still require to be tested before being fitted into cars in order to filter out defective ones. This is where AEHR comes into play, namely for designing test systems that can differentiate between the good and bad, in order to limit liability for the chip manufacturers who supply components to the EV industry. The company also provides wafer-level burn-in capabilities (for stress testing) in order to qualify components before going into production.

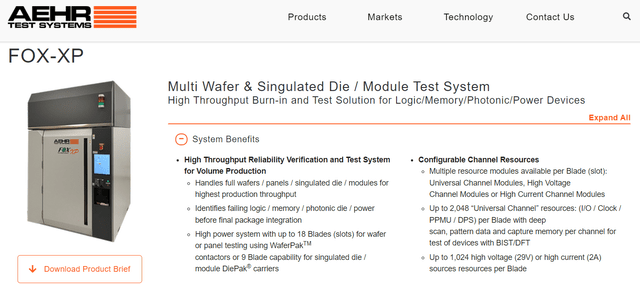

Going into more detail, AEHR sells FOX-XP systems (as shown below) and WaferPak modules, differentiating itself through turnkey solutions or the complete product lineup. By contrast, the gear from competing automated test equipment providers involves sourcing bits and pieces from different suppliers, thereby proving more expensive for customers, going up to $1 million. On the other hand, the equivalent AEHR system which packages probes, circuit boards, and power supplies together costs only about $200K, or around five times less.

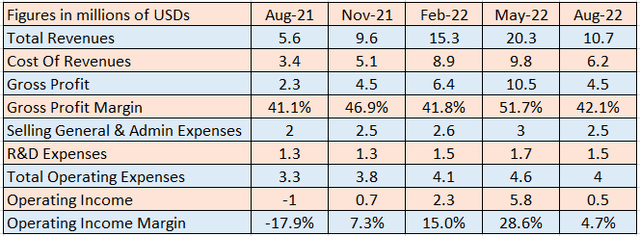

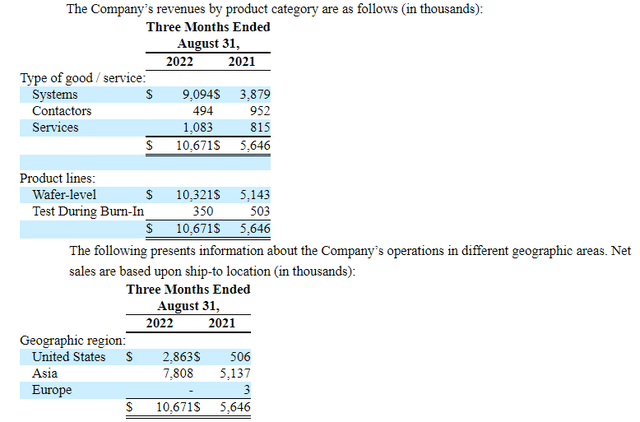

These more favorable cost dynamics have translated into AEHR’s sales surging by 89% in the first quarter of fiscal 2023 (Q1) which ended in August when compared to the same period last year (table below). It is also noticed that the company has been able to make up for Covid lows of 2020-2021 when clients delayed orders due to car factories being in hibernation mode. This also signifies that it is not immune to an economic slowdown.

Equally important, the operating income margin also appears to have emerged from negative territory in the latest quarter.

AEHR’s income statement (seekingalpha.com)

However, a deeper look at profitability is required given that both the gross and operating income margins are sequentially lower compared to Q4-2022 which ended in May, especially in the current economic context.

Assessing Risks, Backlog, and Profitability

According to data from the Federal Reserve itself, recession risks have accelerated recently due to the U.S. central bank having hiked interest rates by 75 basis points on the last four occasions and planning to continue raising, albeit at a more moderate pace. This gloomy outlook has been confirmed to a large extent by the CEOs of the largest U.S. banks who see high inflation as threatening consumer demand and eating into corporate earnings.

In contrast, for the auto sector, analysts saw continued improvement for 2022 given that there has been a deficit in production in the last two years due to supply chains being stretched. This deficit also extends to microchips where demand was seen as outstripping supply in August.

Now, normally such a demand-supply configuration results in additional bookings or backlogs for chip and test equipment suppliers, and this has indeed been the case for AEHR. Thus backlog, which records the customer orders which have yet to be fulfilled reached $19.5 million at the end of Q1, which represents about 38% of the fiscal year 2022 revenues. Therefore, in case of a drastic slowdown of economic conditions whereby car manufacturers have to delay orders, this backlog provides AEHR some cushion.

Still, looking across the industry, this backlog remains far from the 1.5x to 3x of annual revenues for Infineon (OTCQX:IFNNY) and NXP (NXPI) which manufacture chips for the auto industry as I had identified in a recent thesis.

Furthermore, the company is favored by an inflection point in the use of SiC compared to traditional semiconductors, namely for high voltage/temperature operations as I mentioned earlier. For this matter, its FOX-XP tests carried out at the wafer level are easier than those done at the module level for screening faulty power devices while being faster too as they can test 18 wafers at the same time.

Looking forward to the fiscal year, according to the management, the company should also benefit from an increase in profitability due to the product mix. For this matter, gross margins which fell by 9.6% on a sequential basis as shown in the above table were due to reduced sales of its WaferPak Contactors as a proportion of total sales (pictured below).

Now, since most of the company’s clients (who are from Asia as shown above) normally buy these components only after buying FOX-XP systems, the expectation is for related orders to be received during the rest of the fiscal year. Adding to this there should be some “absorption of manufacturing overhead” which usually comes with higher production volumes, which should result in gross margins improving in fiscal 2023.

Discussion and key Takeaways

Balancing out, operating margins should trend higher with AEHR having some degree of protection (cushion) against demand destruction in case economic conditions deteriorate, while its differentiated technology should enable it to drive more growth. However, in the same way, as intermediary companies which are located somewhere in the middle of the supply chain as they do not sell directly to end customers, AEHR has a visibility problem which partly explains why there is a big difference (of $10 million) between the upper and lower limit of its total annual revenues forecasts of $60 million to $70 million for fiscal 2023.

Now, when this visibility problem is viewed in the context of Tesla’s slowing production in Shanghai amid sluggish demand for electric vehicles, then there are some reasons to be concerned.

In this respect, with the Asian market accounting for 90% of AEHR’s sales in fiscal 2022, the company has expanded its Asian operations with a repair center in the Philippines in order to reduce supply chain issues. This is surely a positive together with the fact that the company bagged an initial order for around $1.2 million from a new customer in China. It is also diversified into silicon photonics used in data communications. Moreover, AEHR is financially strong with more than $36 million in cash and less than $1 million of debt on the balance sheet.

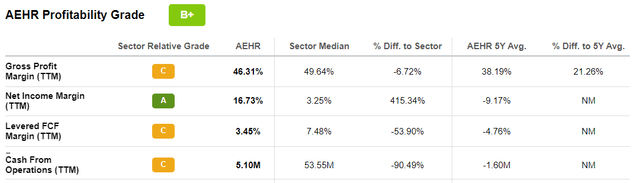

Pursuing further, the company also has a good profitability score of B+ as shown in the table below, but, in view of the uncertainty both in Asia and the U.S., it is better to wait for the expectations about consumables to materialize before investing in the stock. I am also prudent because of the lower cash margins, both FCF and money generated from operations.

AEHR profitability metrics (seekingalpha.com)

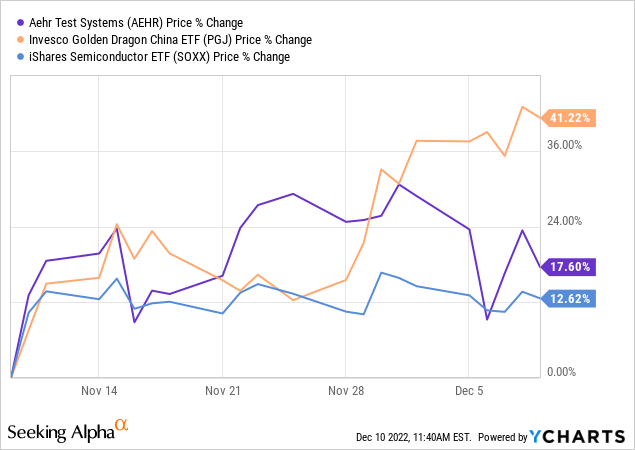

To further support my neutral position, there is the fact that, in addition to momentum induced by winning new contracts, AEHR stock’s price has been getting some support from the Invesco Golden Dragon China ETF (PGJ) which has in turn benefited from the China Covid reopening story. Thus, its gains of 17.6% have outpaced the iShares Semiconductor ETF (SOXX) by nearly 5% as shown below.

While many market participants are bullish on Chinese stocks, I am not, as according to Larry Summers, the economist who successfully predicted that inflation won’t be transitory, thinks that there are chances that China rapidly moving away from its Covid Zero policy may backfire. Part of the reason is that the country’s vaccines are not as efficient as their western counterparts.

Thus, there are chances for a pullback towards the $22-24 support level or even below, which could provide an opportunity to buy the stock as its valuations which are at least 48% higher than the IT sector, get lower. While this happens, the management would have executed its strategy to sell more consumables and boost margins.

Finally, AEHR has a moat as its SiC testing technology allows it to maintain its competitive advantage. It also has a certain amount of backlog, but, the company is not immune to a prolonged economic slowdown engulfing both the U.S. and Asia. Also, it does not constitute an opportunistic buy at present.

Be the first to comment