LeoPatrizi

Intro and Thesis

The last few months have been tough for all holders of Chinese equities – the iShares MSCI China ETF (MCHI), one of the closest analogs to (SPX), is down 27.57% year-to-date. The China Internet ETF (KWEB) and China Technology ETF (CQQQ) have fallen in line – down 25.55% and 35.11%, respectively. There are many reasons for this underperformance, but primarily these are the ongoing lockdowns and zero covid policies in the region, as well as growing geopolitical and country risks (the situation around Taiwan, rising authoritarianism, friendship with Xi and Putin, etc.).

I have been covering Alibaba’s stock (NYSE:BABA) since late September 2021. Since then, my bearish stance has changed to a neutral view – like the bulls, I see the company’s stock as undervalued (like many other companies in the region), but I cannot bring myself to recommend anyone to buy stocks in the Chinese market, including BABA, no matter how cheap it seems.

In my last article on the company, I talked about the growing risks of a devaluation of the yuan – this could eventually lead to a decline in dollar-adjusted earnings and disappoint Western investors who still believe they own a part of the company.

While the price is falling, BABA is not losing its bullish audience – since the beginning of November alone, there have already been 11 bullish articles and only 3 bearish articles published here on Seeking Alpha. It’s getting harder and harder to provide readers with something new – something no one else has written about. But I think I’ll succeed today.

I will look at the company through the prism of its 7 business segments and try to understand why Alibaba stock fell so hard year-to-date. I conclude that the reopening of China will become an important tailwind for BABA and will help improve the situation in key business areas. But it will not change my stance on the company that I consider uninvestable – not only because of Taiwan, delisting or authoritarianism. The problem is much deeper and lies primarily in the assets BABA owns and operates. Let’s dive in.

Segment #1: China Commerce

Taobao, Tmall, Taobao Deals, Taocaicai, Freshippo, Tmall Supermarket, Sun Art, Tmall Global, and Alibaba Health, as well as a wholesale business (1688.com), are the main parts of this business segment, according to the latest quarterly report.

The company generates 65.4% of its consolidated revenue domestically in China thanks to the above segments, with “China commerce” and “Local consumer services” reaching a total of 1 billion consumers by March 2022.

For obvious reasons, it is getting harder to grow its customer base for Alibaba every quarter – the market seems to be pretty saturated. From March 2021 to December 2021, annual active consumers [AAC] in China grew by almost 10%, and from December 2021 to March 2022 – by only 2%, i.e., month-on-month, the consumer base growth rate slowed from 1.1% to 0.85%, which is quite remarkable. GMV grew by only 2% in the first 3 months of 2022 – in line with the AAC over the same period. This indicates that the company stopped increasing ARPU in Q1 2022, which is quite alarming in my opinion and points to a decline in real consumption in China.

Alibaba’s core business segment faced additional headwinds in the form of a continuation of the zero-covid policy – as a result, Taobao and Tmall (the core business’s key sales products) started to decline even more rapidly:

Customer management revenue decreased by 7% year-over-year, primarily due to the low single-digit decline of online physical goods GMV generated on Taobao and Tmall, excluding unpaid orders year-over-year, mainly as a result of softer consumption demand, COVID-19 resurgence and restrictions, as well as ongoing competition. However, the decline narrowed compared to the prior June quarter as key categories such as apparel and accessories and consumer electronics saw less year-over-year decline. Healthcare products and interests-based consumption categories such as outdoor and active gear and pet care continued to exhibit resilient demand.

Source: From the company’s latest quarterly report

“Direct sales and others” revenue under China commerce retail business grew by 6% year-on-year, but due to its small impact within the “China commerce” segment, the main part of the company’s business recorded a slight growth of 1% YoY.

Optimization of user acquisition spending (in Taobao Deals) and pricing strategy (in Taocaicai) did not help the core segment to maintain its EBITA margin, which decreased from 33% to 32% year-on-year.

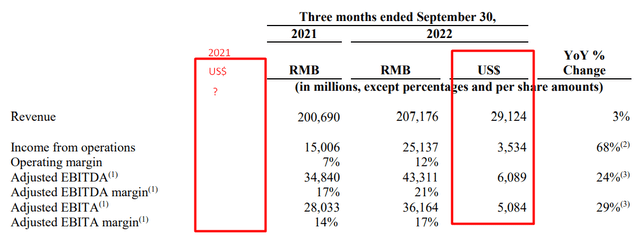

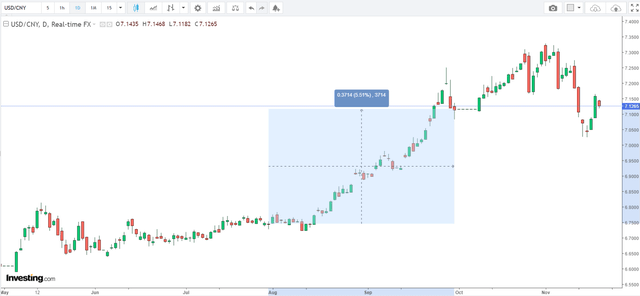

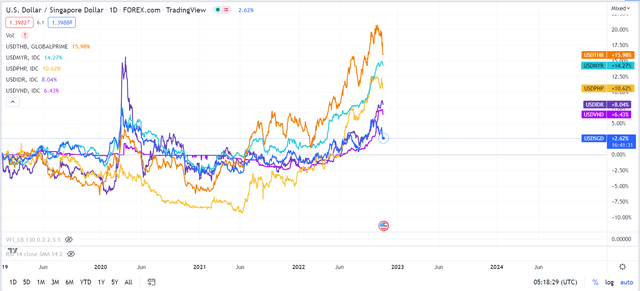

During Q3, we saw the USDCNY shoot up more than 5.5%, and this currency pair still remains quite high despite the recent weakness in the (DXY) index, threatening BABA and the entire Chinese economy going forward:

What does this mean for the core segment of Alibaba? That means the company is physically losing 5.5% more than you see in its financial reports, where it reports to investors in yuan. Yes, we see the column with USD as a separate line, but only for the last period – we cannot compare it with the first period without additional calculations.

BABA’s latest quarterly statements, author’s notes

With inflation still quite low compared to developed Western countries, China continues to monetarily stimulate the economy while allowing draconian lockdowns. Logistics chains are not being restored, orders are either getting smaller in volume or their average bill is dropping. Business activity in the country declines (a key growth driver for Alibaba’s business), and the CCP ends up with no choice but to lift the lockdown in the short term. However, the debt that has accumulated over the past few years will have to be reduced in some way – the surest way is the devaluation of the national currency. This is what I expect to happen in the medium term, and for Alibaba, this will mean 2 things: First, its core business segment will finally recover, which may bring quotes back to some level; second, against the backdrop of the devaluation of its national currency, the company will have to grow at twice the pace to keep investors happy, and while inflation is still low and the market is already quite saturated, this will be very difficult to do.

Based on the above, my tactical outlook changes from “bearish-neutral” to “bullish-neutral” for the core business segment of BABA, but from a strategic perspective, I do not believe that the company will be able to achieve multiple growth rates in its home market in the next 2-5 years.

Segment #2: International commerce

This particular segment comprises Lazada, AliExpress, Trendyol, Daraz, and Alibaba.com. Let’s look at the most important ones in order.

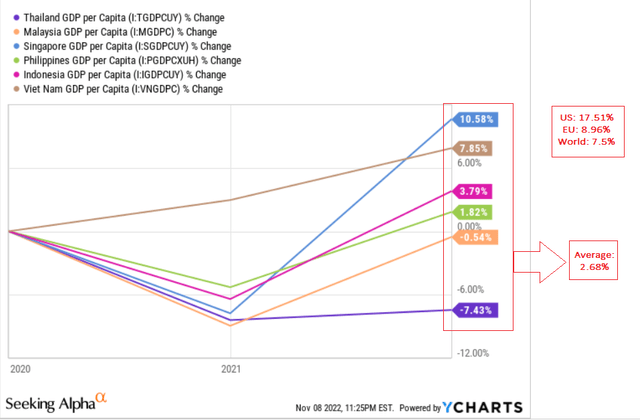

Lazada is one of the largest e-commerce operators in Southeast Asia serving areas such as Singapore, Malaysia, Indonesia, Thailand, Vietnam, and the Philippines. These are all developing countries whose digital economies are set to reach a gross merchandise value of more than $276 billion by 2025, on par with major markets such as South Korea and Japan, according to Srii Srinivasan from Chargeback Gurus.

However, the coronavirus has greatly delayed these ambitions – compared to the developed countries, the (non-digital) economies of these countries have become many times weaker (concerning GDP per capita dynamics), as they are strongly linked to the situation in China, which affects the entire region.

Moreover, this growth is strongly negative in dollar terms – and that is the case even before deducting inflation rates.

We have to pay tribute to Lazada – this is a fairly fast-growing sub-segment, perhaps the only one that drives the entire “International commerce” segment.

In Southeast Asia, Lazada orders also declined year-over-year during the quarter, mainly due to shopping activities normalizing back to offline channels with the lifting of COVID-19 restrictions in the region. Lazada has continued to improve monetization rate by offering more value-added services as well as enhancing operating efficiency. During the quarter, losses per order for Lazada narrowed by over 25% compared to the same period last year.

Source: From the company’s latest quarterly report

From the reopening of China, Lazada will also feel a pretty strong influx of orders. In the long term, I also agree with J.P. Morgan – the analysts see a positive effect on the region due to the developing deglobalization processes in the world:

De-globalization is a forecast, not a current reality. Globalization has not ended, but it is being slowly restructured as supply chains continue to shift to Southeast Asia and Mexico.

Source: J.P. Morgan [October 18]

However, the risks of a loss of purchasing power in the region now seem more relevant (especially for Singapore and Thailand), unless domestic prices actually fall or wages rise to compensate, says Michelle Jamrisko [Bloomberg’s reporter].

The next fairly important sub-segment is AliExpress, which listed Russia, the United States, Spain, France, and Brazil as the leading markets. Since 2013, Russia has been its largest market. As a result, in 2019 it established a new joint venture called “AliExpress Russia” with three Russian investors.

However, due to the war unleashed by Russia in Ukraine, this market has become problematic. Alibaba decided in March this year to stop investing in this joint project for its part, according to Russian sources. In August 2022, the loss of “AliExpress Russia” for 11 billion rubles (about $180.4 million to date) was announced, i.e., Alibaba’s share in this project (47.85%) saw a net loss of more than $86 million for 1H 2022. It seems like a drop in the bucket, but in the same period (1H 2022) Alibaba generated a net profit of $1.851 billion (including minority interests), which means that “AliExpress Russia” negatively impacted the consolidated net profit of the company by about 4.45%.

We now know that Alibaba is no longer investing new money on its side, and therefore “AliExpress Russia” has cut 50% of its staff, although the website continues to function. Since Alibaba has not sold its stake (at least it was not mentioned in the last report), another negative impact on the overall net profit of the company may be coming – due to the reduced labor expenses, this effect will be smaller, but it still will.

I think that “AliExpress Russia” will be completely shot down shortly due to the termination of financing by its main shareholders and rather strong competition in the Russian e-commerce market represented by sanctioned Wildberries (the largest online retailer in the country with a turnover of $17.7 billion in 9M 2022 alone, that according to some sources, has close ties to Putin’s Rosneft). Wildberries was founded in 2004 and managed to become the 4th largest retailer in Europe in the “blue ocean” of the Russian e-commerce market, which has not yet settled down, and to enter the top 10 retailers worldwide, even overtaking JD.com (JD) from China in terms of monthly website visits [source].

The Russian e-commerce market, while not important to Alibaba in terms of share of total revenue, has been a key geographic point for the company’s international expansion, writes Motley Fool’s Leo Sun. Back in 2020 “AliExpress Russia” planned to reach $10 billion in gross sales and serve 50 million customers by 2022 or 2023. It is now obvious that a significant portion of this market will end up in the pockets of Wildberries and its smaller peers. At the same time, however, Chinese goods in Russia will not disappear – Wildberries sellers mostly order their goods on 1688.com or Taobao, replenishing the “China Commerce” business I described above. For Alibaba, the development of AliExpress in Russia was an opportunity to increase the company’s overall margins in the long run – selling directly without middlemen is much more profitable than developing a B2B marketplace. Now that prospect looks rather vague for Alibaba.

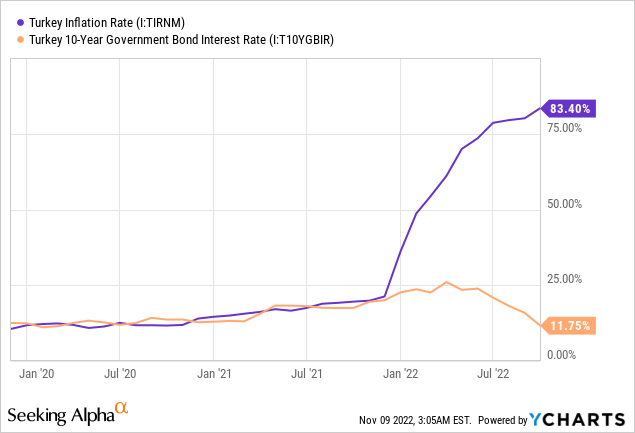

Now a few words about Trendyol – the Turkish equivalent of Alibaba.com and Turkey’s first decacorn with a capitalization of over $10 billion (as of August 2021). The year-over-year EBITA loss of the whole “International commerce” was primarily due to an increase in loss of Trendyol resulting from its investments in new businesses, such as international business and local consumer services in Türkiye, according to the latest Alibaba’s report. As of June 30, 2022, Trendyol served more than 225 thousand merchants on its marketplace platform, and the number of overall orders grew 65% YoY in Q2 FY2023.

I believe that Trendyol’s problem is much deeper than the “growth problem” that BABA management would have us believe. Again, the issue is the macro-economy of the region, which is racing full speed into the ditch under the yoke of Erdogan. You ask – how can the central bank’s interest rate be lowered against a backdrop of inflation more than doubling over the past year? I will answer you: Welcome to Turkey and Erdoganomics:

To conduct international business in such a currency is not only unsafe but literally harmful because when the reports are consolidated there may be heavy losses that are difficult to cover up with words about an early stage of development. With such inflation as in Turkey, each stall would have to double its revenue, but its owner is unlikely to reach for it.

A few words about Daraz – a Pakistani e-commerce project bought by Alibaba in 2018. Back on December 1, 2021, Daraz’s CEO told Bloomberg that the company’s numbers will be actually doubling in the coming years. – Given the growth prospects of the Pakistani market, its startup industry has attracted more than $300 million in funding in 2021 (most of it going to potential e-commerce rivals).

However, since 2020, the USD/Pakistani rupee has increased by 43% and GDP per capita by only 3.79% – the average Pakistani has become much poorer than before the pandemic, especially with inflation at 9.5% in the country today. How fast should order volumes and ARPU grow to compensate for these factors?

The interim conclusion on “International commerce” is that the end of Alibaba’s operating losses here is not yet in sight. The company has stakes in fast-growing projects that received the last rounds of funding at their peak (typically 2020-21), so their value has now plummeted (Klarna immediately comes to mind as a side example, whose non-public valuation has dropped like 90% after re-valuation). Perhaps this partly explains what many “BABA bulls” do not understand – “why the stock has become so cheap?”

In the near future, I expect inflationary pressures and currency depreciation in the above countries (especially Turkey) to continue to have a negative impact on net income and EBITA consolidation. Interestingly, the only currency that has not suffered much in nominal terms (the ruble) will no longer offset the negative impact, as the excess revenues of Wildberries (and of Russia in general) will now be deposited in yuan within “China Commerce”, and thus for the revenues of this segment of Alibaba, the new inflow will be negligible. The company is truly experiencing the perfect storm of emerging geopolitical and macroeconomic risks.

Segment #3: Local consumer services

This segment mainly includes location-based services, such as Ele.me, Taoxianda, Amap (previously reported under the Innovation initiatives and others segment), and Fliggy.

This entire segment represents only 6.3% of total revenue but has the largest negative impact on adjusted EBITA, which would have been 16.1% higher in Q2 FY2023 excluding this operating loss.

In the most recent reporting quarter, sales in this segment grew 21% year-over-year, primarily due to the more efficient use of subsidies and strong revenue growth of Amap, the CEO said during the Q2 FY2023 earnings conference call.

Ele.me is an online platform for food delivery services that was acquired by Alibaba in 2018. This app continues to grow strongly – Alibaba’s CEO even reported positive momentum in the unit economics metrics. However, it is clear that this component of the company has lost value since early 2022 due to its business model in the image and likeness of its Western peers:

| Ele.me’s public peers performance, YTD | |

| Uber Technologies (UBER) | -34.29% |

| DoorDash (DASH) | -59.61% |

| Delivery Hero (DHERO) | -55.2% |

| Deliveroo PLC (OTCPK:DROOF) | -56.41% |

| Blue Apron Holdings (APRN) | -83.85% |

| Average return | -57.87% |

| Median return | -56.41% |

Source: Author’s selection

Taoxianda is an online-offline integration service solution for FMCG brands and third-party grocery retail partners. It facilitates the digitalization of retailers’ operations, helps them open online stores, and provides customized marketing recommendations, according to Alibaba’s website.

It was born in 2017 as a result of Ali’s “new retail” strategy to divert traffic to offline fresh supermarkets and increase online sales, Min.news writes. In my view, the e-commerce business model that formerly drew customers in high-margin industries (including consumer electronics, apparel, and cosmetics) turned out to be no longer practical in the fresh food industry. It is challenging for the platform to negotiate pricing with suppliers when customers have not formed the habit of purchasing fresh food online. As a result, this project is still putting a lot of pressure on EBITA and is only generating losses after the company put its main focus on its development and made it its main investment project.

Not touching Alibaba’s Amap (an analog to Google Maps, about which I could not find much information), I turn to Fliggy – a Chinese travel booking platform backed by Alibaba Group. I could not figure out how much this particular sub-segment generates for Alibaba in terms of revenue/EBITA, but by definition, this project is costly and should grow very quickly if the zero-covid policy is lifted. However, it is also important to keep in mind that the closest analog in the West – Airbnb (ABNB) – has fallen 42.49% since the beginning of the year, which means that this sub-segment should theoretically lose even more value, taking into account Chinese peculiarities and the lack of a similar scale to ABNB.

All of these sub-segments cannot be written off – after the planned opening of China, we will most likely see their resurgence, but the question here is – at what price? How long will it take and how much new CAPEX required to revive Alibaba’s portfolio of “Local consumer services” projects? This sounds like a question for posterity as no one can give a clear answer today.

Segment #4: Cainiao

It’s a Chinese logistics company, providing domestic and international one-stop-shop logistics services and supply chain management solutions; it accounts for 6.45% of consolidated Alibaba’s sales as of September 30, 2022.

Sales in the last quarter increased by 36% (YoY) and adjusted EBITA broke even (positive 125 RMB vs. negative 315 RMB last year). The company explains it as follows:

Cainiao’s various business saw a robust growth in this quarter and there were clear improvements in cost efficiency. Cainiao Post network grew by 20% year-on-year and now has more than 170,000 locations. It has comprehensive coverage in residential communities, school campuses and the rural villages across China. Cainiao Post has become an important touch point for serving consumers.

Source: Earnings Call (Q2 2023), CEO’s words

The difference between this segment’s operating profit excluding adjustments for share-based compensation and amortization of intangible assets and the adjusted EBITA I referred to above is about 5x – that is, Cainiao is still operating at a loss, but this situation has improved rapidly YoY.

Here we see the negative impact of the decrease in orders from AliExpress – the synergy effect is not always beneficial for e-commerce business models, as practice shows. Given the risks I have already mentioned for AliExpress, I expect continued pressure for Cainiao. Of course, the reopening of China should brighten the picture a bit, but that could take some time.

Segment #5: Cloud

It comprises Alibaba Cloud and DingTalk and is probably the most promising business segment for Alibaba, based on what I constantly see in bullish articles. It accounts for 10% of the overall company’s sales.

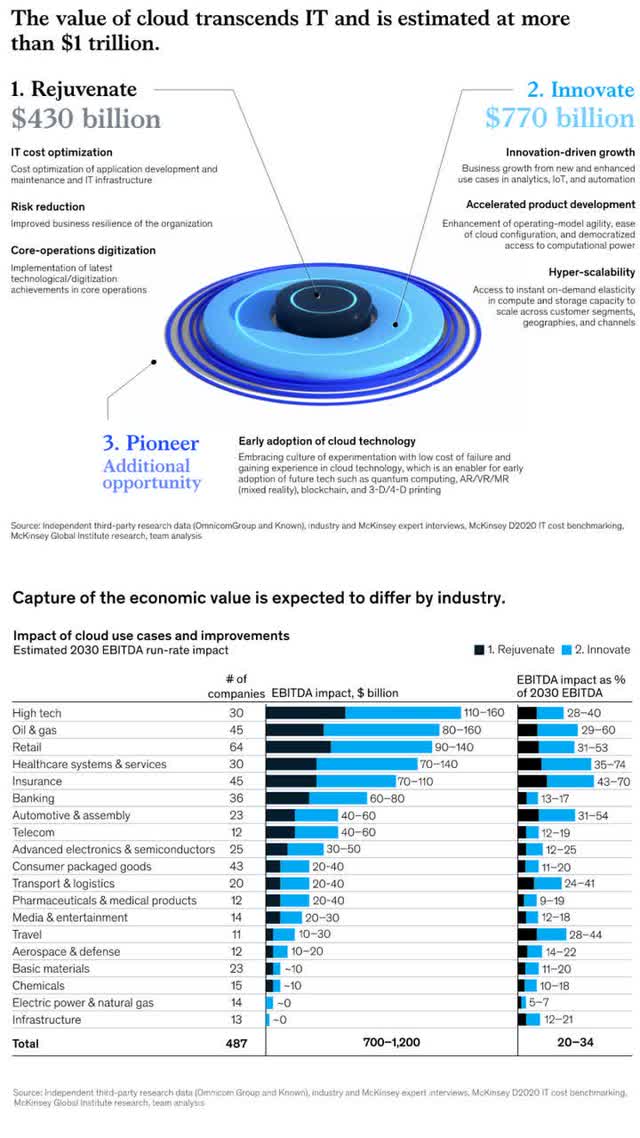

Indeed, the cloud market is expected to have the brightest $1 trillion future by 2030, according to a recent McKinsey study:

But such strong growth of the end market should also lead to the growth of Alibaba Cloud’s sales, right? Yes, if you are hoping for 4% growth – that’s how much this segment showed in Q2 2023 (YoY), with adjusted EBITA growing by only 9.6%.

However, management has tried to assure us that this segment is now “healthier and more sustainable” – even though it grew by 4%, even less than last quarter (10%):

In our Cloud segment, Alibaba Cloud revenue growth was 4% year-on-year this year. Through structural adjustments over the past few quarters, Alibaba Cloud’s revenue structure is now healthier and more sustainable. Public cloud revenue grew double digit year-on-year this quarter, while hybrid cloud declined. In the interest of pursuing high-quality growth, we proactively control the development of our business that only resale hosting infrastructure that has been commoditized in the market.

Source: Earnings Call (Q2 2023), CEO’s words

At the same time, AWS is up 27.5% in 2Q 2022, Azure is up 20% and Google Cloud is up 38%, according to CRN.com.

As I wrote about the company in one of my previous articles, Alibaba Cloud will exclusively target the Chinese market in the future, where the CCP is tightening the rules on data collection and storage by private companies every year. Alibaba’s growth is very important to the CCP (as a facade for a “healthy economy”), but Alibaba Cloud’s growth is completely unprofitable for them (“nothing can compete with the state in data collection”). Therefore, I see Alibaba Cloud’s growth in the future as quite limited compared to Western counterparts – this is simply a characteristic of the market that investors and the company itself will have to come to terms with.

Segment #6: Digital media and entertainment

This segment comprises Youku, Quark, Alibaba Pictures, and other content and distribution platforms, as well as our online games business; it accounts for 4.1% of consolidated sales.

Youku is a video hosting service based in Beijing, China, that was acquired by BABA in 2015. The management said Youku continued to narrow losses year-over-year but was offset by increased losses of other entertainment businesses due to the COVID impact. Let’s remember this moment.

Quark is what Alibaba launched in June 2020 as a provider of a one-stop information search, storage, and consumption platform for young people. Judging by the description of the platform, it is an analog to Google, with a faster engine and AI gadgets.

Alibaba Pictures – a Chinese analog to Disney (DIS) and Netflix (NFLX) that invests in making movies in China and markets them locally.

And all of these 3 high-growth projects (combined) grew 4% of revenue year-over-year, with improving operating loss and EBITA margin.

My guess is that the zero-covid policy hit Alibaba Pictures hard, which ultimately led to such a sharp decline in revenue and EBIT/EBITA. But why did I ask you to keep Youku in mind? Because its closest counterpart, Bilibili (BILI), is down 64% year-to-date, while its EBITDA margin [TTM] is down from 30% to 38% (rounded) year-to-date. If we assume that Youku has gone in the same direction, then this subsidiary in the structure of BABA has most likely also lost at least 1/3 of its value from the beginning of the year.

“Digital media and entertainment” is another “fast growth” business segment that dragged BABA lower than many value investors could have thought of.

Segment #7: Innovation initiatives and others

This tiny segment (0.2% of total BABA sales) includes businesses such as DAMO Academy, Tmall Genie, and some others.

According to the official website, “Alibaba’s DAMO Academy (Academy for Discovery, Adventure, Momentum, and Outlook) is dedicated to exploring the unknown through scientific and technological research and innovation. The driving force behind the Academy is the pursuit of the betterment of humanity.”

Tmall Genie is a smart speaker developed in 2017, using the intelligent personal assistant service AliGenie. It’s the second top-selling smart speaker (behind Baidu’s (BIDU) one) in China, where the addressable market amounted to 4 billion yuan in the 1st half of 2022, according to Statista.

Again, this all sounds very “modernistic,” but until we look at the financial results of this segment:

- Sales – down 45% YoY;

- Negative EBIT deepened by 9% YoY;

- Negative adjusted EBITA deepened 19% YoY;

- Amortization of intangible assets rose 15x YoY.

I can understand why EBIT/EBITA has fallen – costs are too high. But why are revenues falling? Management has not clarified the situation and promised to invest even more in innovation and growth going forward.

Bottom Line

I hope readers now understand why I named this article the way you saw it.

The structure of BABA’s portfolio reminds me of a typical Innovation ETF fund – lots of fast-growing companies, a focus on the future, forgoing profitability in favor of growing a customer base, and wasted money from investors who did not have time to take timely profits without feeling the signs of impending disaster.

The difference between the building blocks of BABA and those growth-oriented funds is that they have 1) a higher geopolitical risk and 2) a higher currency risk. Moreover, many of them have already forfeited the growth rates that main US-based fast-growing companies maintain to date – Tesla (TSLA), for example, has been growing at an average of 53% year-over-year since March 2020.

However, credit should be given to Alibaba – in the latest reporting quarter, many of its fast-growing segments showed better growth than in the 1st quarter of FY2023 (in terms of EBITA and margin momentum).

I really hope my long article did not tire you – I tried to analyze Alibaba’s business structure in detail to understand the real reasons for the 30% share price drop since the beginning of the year.

If we summarize the individual segments, we can say one thing with certainty: BABA’s stock did not fall just because Western investors decided to reduce their exposure to China overnight. It was caused by the bursting of the “fast-growing bubble” within the company itself, whose segments simply matched the values of their publicly-traded counterparts (and lost their growth rates down the road).

The loss of a potentially high-margin and growing Russian market, macroeconomic and idiosyncratic problems in Southeast Asia, Pakistan, and Turkey, and saturation of the e-commerce market within mainland China – all of these are the main reason for the fall of BABA, rather than the risk of delisting or attacking Taiwan (although this is also the case).

Yes, China’s reopening will smooth the picture, but that will take some time. Therefore, I do not recommend considering Alibaba as an investment in the medium to long term.

Thank you for reading!

Be the first to comment