Kevin Frayer/Getty Images News

It’s been a little more than a year since I started covering Alibaba (NYSE:BABA)(OTCPK:BABAF) here on Seeking Alpha. So far, I was right when at the beginning I said that even though it appeared that a crackdown against Alibaba by the Chinese regulators was coming to an end, the grip of the Chinese Communist Party over the private sector would not ease over the coming years. Since the beginning of this year, Beijing has aggressively entered the cloud and online payment businesses and has imposed new travel restrictions in various big cities of China, all of which have negatively affected Alibaba’s financials and its ability to continue to generate aggressive returns for investors.

Even though we saw that Beijing has recently agreed to give the green light to open up the books of Chinese-based firms to the U.S. inspectors in order for the Chinese-based companies to avoid delisting from the American exchanges, there’s a risk that it won’t help Alibaba’s stock to significantly recover anytime soon. The latest speech of Xi Jinping during the opening of the 20th National Congress of the CCP in Beijing along with his reelection for an unprecedented third term as the general secretary of the party signals that the Chinese state would continue to interfere directly and indirectly in the affairs of the private sector.

As a result, it’s hard to justify a long position in Alibaba even at the current price, as it seems that the policies that were implemented in recent years and hurt the company’s financials would remain in place, making it challenging for Alibaba to meet investors’ expectations going forward.

More Bad News For Alibaba

The ongoing 20th National Congress of the CCP is hosted at a moment when China faces unprecedented economic headwinds. Currently, 1 in 5 of China’s urban youth is unemployed due to the pandemic and Beijing’s interference in the affairs of the private sector, which I’ve covered in the past, while at the same time the country is already facing a demographic crisis that’s only going to deepen in the following years. In 2022, the negative effects of the One Child policy would kick in, as China’s population is expected to shrink this year for the first time in decades, as fertility has decreased from 2.6 in the late 1960s to 1.15 last year.

At the same time, earlier this year Chinese officials set a target of a 5.5% GDP growth rate this year, the lowest in decades, but after a GDP growth of only 0.4% in Q2, that target was dropped, while the World Bank estimates that China’s economy would grow only at 2.8% this year. What’s worse is that at the beginning of this week China’s National Bureau of Statistics delayed the publication of China’s Q3 GDP numbers along with home price data without citing any reasons or a new date, which could be interpreted as a signal that the growth has been relatively weak in recent months.

While the Chinese government along with the People’s Bank of China have been trying to stimulate growth with new financial aid packages and lower rates, it seems that their approach is failing so far, as the latest data indicates that consumer spending is decreasing. During China’s Golden Week holiday, which took place earlier this month, the country’s tourism revenues were down 26% from a year ago, as the number of trips that passengers took was down 36% Y/Y although the plane ticket prices decreased by 12% Y/Y. In addition, even the sale of cinema tickets this year was worse than even in 2020 when the situation with the spread of Covid-19 was worse than it’s today.

On top of all of that, the effects from the fall of one of the biggest Chinese developers Evergrande are still experienced in China today. In addition to the mortgage strikes that took place in July and August, earlier this month Shanghai-based developer CIFI defaulted on its 2025 bonds despite receiving state funds earlier this year to mitigate risks from the Evergrande fallout, which indicates that the housing crisis in China is far from over.

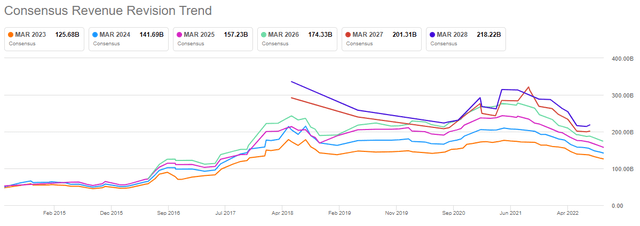

As the biggest eCommerce firm on the mainland, all of these developments have already negatively affected Alibaba’s business, and since China’s economy is not growing as quickly as predicted while the macro risks are mounting, there are reasons to believe that the company could continue to disappoint its investors in the foreseeable future. In recent months, there have already been several downside revisions of the revenue forecast by the advisory firms, as it seems that Alibaba is still unable to tackle all of the challenges that continue to negatively affect its financials and growth prospects to this day.

Alibaba’s Consensus Revenue Revision Trend (Seeking Alpha)

In addition to all of those economic problems, city-wide lockdowns are also to blame for those downward revisions. Due to the lockdown in Shanghai in April and May, Alibaba had one of the toughest quarters, as all of the growth during the period evaporated, while revenues were down 4.22% Y/Y in dollar terms. At the same time, the street expects Alibaba’s revenue to decline Y/Y in Q2 and Q3, which could lead to the first annual decline in years.

What’s worse is that it appears that the worst is not over yet for the company, as additional lockdowns are likely to follow in the foreseeable future. Back in June, there were already reports that quoted Chinese officials who were saying that lockdowns and travel restrictions could last for the next five years in order to decrease the spread of Covid-19 across the mainland. Then, in his speech at the National Congress, Xi Jinping doubled down on the zero-Covid policy, which means that we shouldn’t expect the easing of movement restrictions anytime soon.

Just recently, there were already reports of the biggest increase in Covid-19 cases in Shanghai since August, while at the same time there are currently 36 Chinese cities that are under various types of travel restrictions or controls. On top of that, just days ago, several areas of the city of Xi’an were put under lockdown, affecting as many as 13 million people, while iPhone maker Foxconn imposed some travel restrictions at its campus in Zhengzhou. Considering all of this, there are real reasons to believe that in case of a serious Covid-19 outbreak similar to the one that we witnessed in April, there’s a real possibility that more people would be put under travel restrictions, which would continue to negatively affect Alibaba’s ability to grow and create value.

What Should Investors Expect Next?

One of the major themes of Xi Jinping’s latest speech was the strive to achieve common prosperity, which is a policy first invented by Mao Zedong that aims at achieving an egalitarian society with a more equal distribution of income and opportunities. During his speech, Xi Jinping has been constantly referring to Marxism and the need to build a modern socialist country in all respects, and there are already talks of increasing income taxes to achieve better wealth distribution.

This U-turn from a more capitalistic approach of Deng Xiaoping, under whom China began to open up itself in the second part of the last century and attract international capital, to a more socialist approach of Xi Jinping has already negatively affected Alibaba, which a year ago lost its tax preferences and saw its tax expenses significantly increase. At the same time, during the tech crackdown that occurred last year, Alibaba was likely required to pledge $15.5 billion to the common prosperity fund in the following years. It’s unclear whether any money has been spent so far, but such a sum alone accounts for ~22% of Alibaba’s liquidity at the end of June, and it could’ve been spent on share buybacks for example, or on new acquisitions than on the state-sponsored programs.

Considering all of those developments, the main question that investors should ask themselves is how they should even value a company that operates in a country where talks about the redistribution of wealth and creation of a socialist state are becoming an official policy.

Back in September, I created a DCF model that showed Alibaba’s fair value to be $128.71 per share, which represents an upside of nearly 80% from the current price. However, the problem with that model is that it assumes that Alibaba would be able to operate without further disruptions and would be acting in the best interests of shareholders without fearing any state interference. Considering Xi Jinping’s reelection and the policy that he expects to pursue that’s unlikely to be the case in the foreseeable future.

Therefore, all the talks about the cheap levels at which Alibaba is trading are irrelevant at this stage, in my opinion, since for months the company was undervalued, but it didn’t stop its stock from depreciating by ~60% in the last 12 months, even though NASDAQ is down only ~30% in the same period.

On top of that, when a government decides not to release the most important metrics about the state of the economy likely in order to not to overshadow the National Congress with possible weak numbers, questions are being raised about whether it’s safe to invest in stocks such as Alibaba in the current environment in the first place. A large portion of the institutional investors have already closed their positions in the stock in the last year and very limited buying in recent months suggests that the risks of owning Alibaba are still too high at this stage.

The Bottom Line

The reelection of Xi Jinping for an unprecedented third term as the general secretary of the CCP ushers in a new era for China and its companies. With a mandate to rule the country for another five years, we’re likely going to see additional interference of the state in the private sector and a more confrontational stance of Beijing against the Western world, which could lead to the shareholder value destruction of Chinese-based businesses.

Considering the change in the environment in which Alibaba operates, it’s no longer enough to look at simple ratios such as P/E, P/S, etc., and conclude whether the Chinese-based company is undervalued or overvalued. While Alibaba operates a solid business model, the domestic and geopolitical risks and challenges that are materializing and are about to materialize outweigh all the growth opportunities in my opinion, as the company doesn’t have any control over it, making it impossible to justify a long position even at the current price.

Be the first to comment