maybefalse/iStock Unreleased via Getty Images

Alibaba (NYSE:BABA) will be posting its FY2Q23 quarter results in about two weeks’ time. While the stock has been trending down since the last quarter, the expectations are reaching extremely low levels and with a low bar to beat, Alibaba is like a coiled spring, ready to bounce up on any good news. As a matter of fact, I think that there are some factors that will drive a re-rating in the stock and shift sentiment more positively. It is only a matter of time before this happens and, in my opinion, it is not a matter of if, but when. I aim to help investors see that we may be near the bottom, rather than realising it only in hindsight that the bottom is already in.

Investment thesis

Alibaba is a stock that I have been writing about for some time and the earlier articles can be found here. Since the last article, I think that we have seen investor sentiment around Alibaba worsen given the delisting risk and concerns on macro. However, as highlighted in this article, the delisting risk is overblown, in my view, and any clearing of obstacles in this front will serve as a huge share price catalyst. On the other hand, the macro concerns around Alibaba are real given that e-commerce will slow down if consumer sentiment weakens. That said, as elaborated below, the online retail sales numbers actually improved in the quarter which should surprise investors positively in the coming FY2Q23 results. I like the risk/reward opportunity for Alibaba, and it remains an attractive contrarian investment for the following reasons:

- China commerce: Management is focused on driving quality growth in the China commerce segment as Alibaba has more than one billion users across its platforms that each spend about $1,300 each year. This brings further monetization opportunity as well as a chance to increase wallet share per user.

- International commerce: Lazada remains one of the fastest growing and most promising segments for Alibaba given that there are structural tailwinds driving the international markets, like the low e-commerce penetration in Southeast Asia. As such, Lazada will be a key growth driver in the long-term as management utilizes the expertise from China e-commerce to expand internationally.

- Cloud: While Alibaba has been hit with the crackdown on big tech firms in China, it continues to maintain its market leadership position in the Asia-Pacific region and gain share in the Chinese cloud market. Ali Cloud will look to expand overseas as it has multiple levers to pull to move towards its next phase of growth.

- Investing for future growth: Alibaba continues to invest for the future, especially in key strategy and technological areas that will help it gain capabilities needed for long-term, sustainable and quality growth.

The elephant in the room

There are concerns about the PCAOB accounting audits that are to be conducted on Alibaba. In my view, investors have been too negative on the PCAOB accounting audits. Firstly, PCAOB’s ongoing audits pertain to a group of US-listed Chinese firms. Secondly, it is worth noting that Alibaba’s CFO has reiterated that Alibaba’s financial statements are prepared in accordance with the US GAAP standards and rules, audited by PwC Hong Kong, and its financial statements have received and qualified opinion from PWC every year.

As such, other than a potential further weakness in macro, the other biggest overhang on Alibaba right now is the ongoing audits by PCAOB, as there are concerns that PCAOB might find issues with Alibaba’s financial statements.

In fact, after the signing of the agreement between American and Chinese authorities in August, this has significantly reduced ADR delisting risks which has not yet been fully priced in, in my view.

Also, the US audit inspectors were also said to have finished their on-site China work ahead of schedule, which signals some kind of progress in the process as well as an increased likelihood of no issues being found.

Lastly, Alibaba’s Hong Kong listing could be approved for Southbound Stock Connect, potentially in early CY2023. This is definitely another positive as more mainland investors can drive demand and liquidity for the Hong Kong listed shares.

Improving trends for online retail sales growth

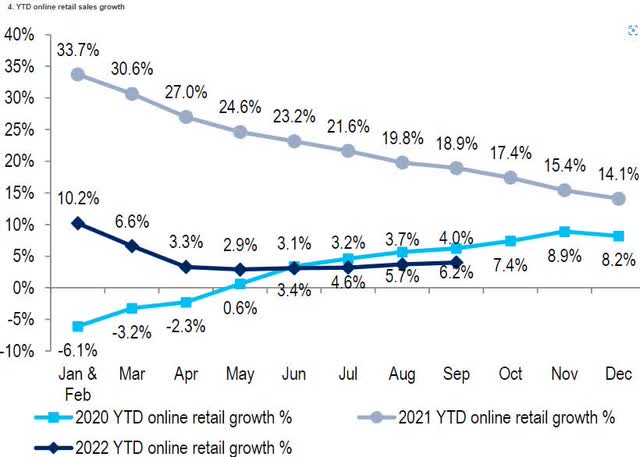

Based on the YTD 2022 online retail sales growth numbers below, we can see that since July, there has been a pickup in the YTD online retail sales growth from 2.9% in May to 4.0% in September. In fact, the most recent September NBS figures were slightly higher-than-expected as online retail sales of 6.2% year on year and 8.3% year on year online physical sales in September suggests online consumption continues to increase as the pandemic continues.

China retail sales improving (NBS)

Efficiency gains could be a knight in shining armour

There is no doubt that concerns about macro is there. It is understandable given how uncertain the global macro backdrop is. However, I think one area that could be overlooked by investors is the profitability angle of Alibaba. The focus should be on efficiency gains, which in my view, could surprise positively given what management has been prioritizing in recent quarters.

I think that we could see better-than-expected EBITDA and profitability as a result of efficiency gains. This comes as Alibaba’s management continues to optimize investment spend in their strategic initiatives, as well as improve operating efficiencies further. I think we could see less losses in some businesses like Taobao Deals, Taocaicai and Freshippo.

Valuation

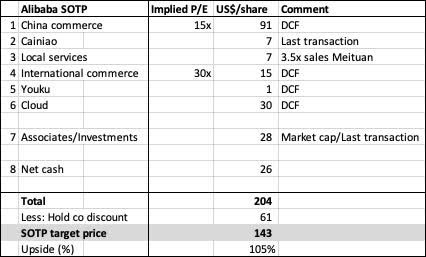

As a result of a large number of different types of businesses under Alibaba, I continue to attempt to value Alibaba using a sum of the parts valuation model.

- For China commerce, my financial forecasts for 2023F have been de-risked, in my view, as I have taken into account a potential slowdown in China commerce contributed by the weakening macroeconomic environment in China, that may affect near-term consumer sentiment and thus, e-commerce demand in the near-term.

- For Cainiao, Local Services and the other associates and investments held by Alibaba, these are valued as of the latest market capitalisations and transaction values of the respective companies, taking into account the recent changes in their respective share prices.

- For Cloud, International Commerce and Youku, I use a DCF method to determine the value of these businesses based on a forecast of future performances of each of these business segments. Embedded in my forecasts are the assumptions of the long-term growth potential of Lazada within the International Commerce segment, as well as opportunities for international expansion for the Cloud segment.

Applying a 30% holding discount, the target price for Alibaba is $143, implying 105% upside from current levels.

Alibaba Target Price – sum of the parts valuation model (Author generated model)

Risks

Competition

Alibaba remains in a vulnerable position given how large it is. It needs to continue to invest in the future as its leadership position could come under pressure if competitors continue to innovate. In the China e-commerce sector, local players like JD.com (JD) and Pinduoduo (PDD) remain fierce competitors as the e-commerce landscape in China matures. On top of these e-commerce players, there is also competition in the form of TikTok and other formats that compete with Alibaba. In its international e-commerce segment, Amazon (AMZN) and Sea Limited’s (SE) Shopee remain committed to their international expansion and adds further pressure to Lazada’s business segments.

Regulatory and political risks

As the technology sector crackdown and common prosperity measures earlier have illustrated, there remain risks that the crackdown on big tech in China is not yet over. While China’s 20th Party Congress is over, it remains to be seen how Xi Jinping’s new team could handle big tech in China. If there are signs that the big tech and antitrust crackdowns are over, this will be an upside risk to Alibaba as it has been hit the hardest by regulatory and political risks. If the crackdown on big tech China firms continues, this could cause further pain to Alibaba shareholders.

Cloud risks

While Alibaba has a strong position in the cloud market and it has continued to gain share at the expense of other players in China, the competition from players like Huawei, Tencent (OTCPK:TCEHY) and China Telecom could make operating in the segment harder as growth and margins are likely affected.

Conclusion

Alibaba is like a coiled spring ready to bounce back up. With the right news as catalysts, this is not a matter of if, but a matter of when. As there are increasing signs that the delisting risks are slowly improving, this should remove a huge overhang on the Alibaba stock as this has been one of the biggest concerns around the stock. Another concern is macro weakening, which will affect e-commerce companies negatively. On a positive note, online retail sales data for the quarter shows a better-than-expected growth in the numbers, which could surprise e-commerce growth in China for the quarter. Lastly, management continues to prioritize efficiency gains and improvements in the cost structure, and as a result, this might lead to a positive surprise on EBITDA and profitability in the upcoming quarterly results. Based on a sum of the parts valuation, the target price for Alibaba is $143, implying 105% upside from current levels.

**Author’s note: I am starting a marketplace service, Outperforming the Market, which will be launching on 10 Jan 2023. Outperforming the Market aims to help investors identify high conviction growth and value stocks to form a barbell portfolio that outperforms the market.

Mark your calendars, because early subscribers can reserve a spot as a Legacy Discount Member, which gives you generous introductory prices. Thank you for reading and following my work. See you there!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment