riskms/iStock via Getty Images

Thesis Summary

Alibaba Group Holding Limited (NYSE:BABA) is stock investors love to hate. On a fundamental level, the company has always looked like a significant investment. However, fears of delisting and political tensions have prevented the stock from shining. More recently, the genuine threat of COVID lockdowns has damaged growth.

However, in the latest quarter, we saw glimmers of hope. Not only did BABA maintain its revenues in hard times, but it is also addressing one of investors’ main concerns with the company for years: profitability.

On the one hand, we have early signs that BABA’s worst moments may be behind it. And on the other, we have imminent signs that the PBOC is ready to start easing monetary policy again, just as the economy and inflation seem to be slowing down.

It is time to inflate the BABA bubble once more.

Early Signs of Recovery

In my last article on BABA, I talked about the risks surrounding de-listing and the threat of war. While these risks are still present, BABA has shown encouraging results.

Alibaba has had a tough year. The Chinese government has been harsher with COVID lockdowns, which has hurt BABA at a time when the stock market, especially tech stocks, was crashing fast.

However, the recent results published at the beginning of the month have shown encouraging results. BABA delivered a solid beat on both revenue and earnings.

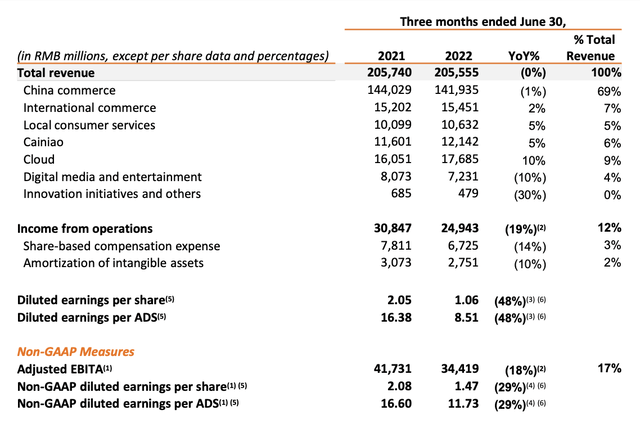

BABA revenues (Investor Presentation)

As we can see in the slide above, BABA achieved a slight growth in most of its main segments, but China commerce, responsible for 69% of revenues, fell YoY by 1%. With that said, operating income took a bigger hit, down nearly 20% YoY, and Earnings per ADS were down 29%.

Alibaba is Addressing Its Issues

Growth has been challenging in the last year, but the company has faced an unprecedented situation as the CCP enforced some of the harshest COVID restrictions worldwide.

That said, it is clear that Alibaba is set to keep growing and dominating Chinese commerce. The concern for investors isn’t growth but rather profitability. Luckily, this is precisely the area where Alibaba is trying its hardest to improve.

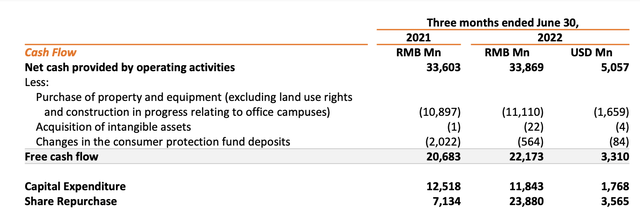

For starters, despite worse margins and a hard year, Alibaba has still managed to grow its free cash flow:

BABA cash flow (Investor Presentation)

On top of this, in June, Alibaba trimmed its employee count by 10% amid the recent sales slowdown. The CEO recently discussed profitability as one of BABA’s primary concerns. In the earnings call, he mentioned that the company was looking to narrow losses in various segments, including the delivery unit.

Now, clearly, Alibaba has to continue to grow, and the Commerce segment has tight margins. However, we have all seen just how much profitability Cloud has given Amazon Inc (AMZN), and despite the challenges, this segment grew by 10%. Moving forward, BABA can reign in costs in its other sectors and recover the previous growth in Cloud, it will become much more profitable.

It’s time to start blowing bubbles.

Alibaba is one of the largest companies in China. It addresses consumers’ needs, which is why its growth is tied to the economy’s strength and consumer spending.

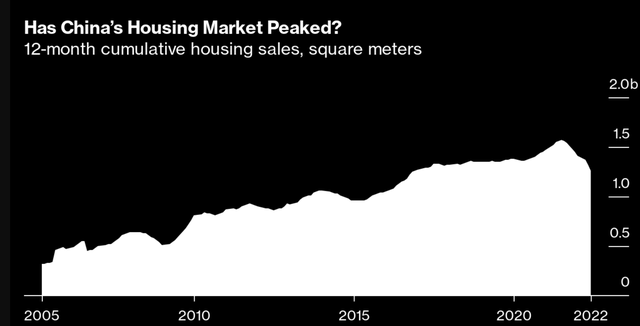

China has been leading the way in many areas in the last decade, and in the last few months, it has also led the way in this recession. Chinese home prices, for example, have been leading the worldwide decline:

As we can see above, Chinese house sales started to decline in 2021. Meanwhile, the US housing market is showing signs of weakness.

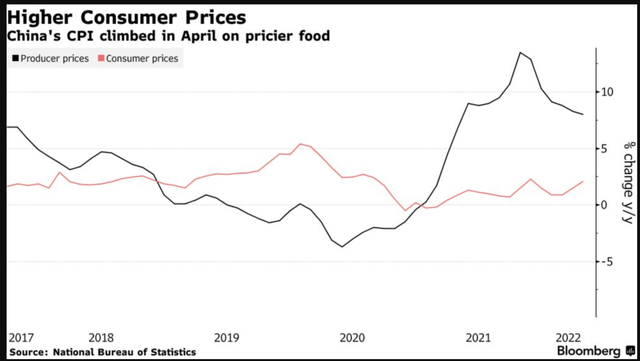

We also see signs that China’s inflation levels may have peaked too. Below we have the CPI and PPI for China.

CPI and PPI (National Bureau of Statistics)

As we can see, after Production Prices peaked in early 2021, we have seen a steady fall. Add to this falling commodity prices in the last month and lower projected worldwide demand, and it looks like China’s inflation may have stopped.

With inflation peaking, and recent economic data showing slowing economic growth, the People’s Bank of China has not hesitated to step in and lower medium-term rates by ten basis points. A return to loose monetary policy is no longer speculation but reality, at least in the world’s second-largest economy.

This opens the door to another liquidity-induced stock market rally. China’s Central Bank has cut its one-year rate to 2.75%. This still leaves much room for further cuts in months to come.

This would add liquidity to the stock market and directly increase the spending capabilities of Chinese consumers, which are BABA’s primary source of income. In 2020, the stock market rallied against all odds amid a worldwide pandemic. If history repeats itself, we could face another “counterintuitive” rally just as the world enters a global recession. If so, BABA could be one of the best stocks to ride the next wave up.

Valuation

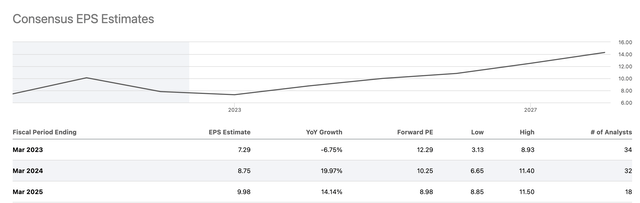

With the return of loose monetary policy, it’s only reasonable to assume that BABA could regain the kind of valuation multiples it held in the past. Using analyst estimates and historical P/E ratios, we can reach a target price for the company:

Analysts expect that by March 2025, BABA could attain EPS of just under $10. This would lead to a PE of 8.98. BABA’s average 5-year P/E has been close to 30. so even if we assume a conservative P/E of 20, this would imply shares could increase by over 100%.

A similar valuation using P/S multiples leads to an even more bullish outlook, with BABA share appreciating by over 300%.

Risks

The risks with BABA are well known, and these were the focus of my last piece on BABA. However, since I wrote this piece, Taiwan tensions have escalated, which poses another risk to BABA. Add to this regulatory pressure and delisting fears, and understandably, many investors will stay away from this.

However, I believe that with the help of the PBOC, BABA could stage a strong recovery. And as the price picks up, investors will begin to pile into this name again.

Takeaway

Alibaba is an excellent company in a delicate position. Nonetheless, war doesn’t benefit anyone, and China has shown it will do everything it can to support its economy, which means supporting BABA too.

Be the first to comment