Philiphotographer/iStock Unreleased via Getty Images

Alibaba (NYSE:BABA) has been hammered since its 2020 all-time high. The stock was down by as much as 77% from its ATH and is still off by approximately 70%. Alibaba got hit with a perfect storm of harmful elements ranging from government regulations to hedge fund blowups, an earnings decline, and more. However, the company’s period of declining EPS is ending, and Alibaba should begin to increase earnings in the coming quarters. Furthermore, Alibaba owns a significant stake in Ant Group, China’s biggest fintech company with more than a billion users. While the Chinese government halted Ant’s IPO, there are whispers of its revival. Alibaba is dirt cheap now, and the Ant IPO could unlock substantial shareholder value. Alibaba’s stock is still on sale, and shares will likely move significantly higher in the coming years.

The Ant Group IPO Revival

Alibaba’s stock surged recently on rumors of an Ant Group IPO revival. However, the rally was short lived as Chinese regulators said they had not assessed Ant’s IPO. Ant Group is Alibaba’s financial arm and was supposed to be the biggest IPO in history. The company looked to raise more than $34 billion, pushing its market upwards of $300 billion. Alibaba owns around one-third of Ant Group. So, Ant was all set to go public, which would have unlocked substantial value for Alibaba shareholders, but then Jack Ma said this:

“China does not have a systemic financial risk problem. Chinese finance does not carry risk; rather, the risk comes from lacking a system.” “China today needs policy experts, not paper pushers.” In his comments, Ma also dismissed Chinese banks as “pawnshops” giving loans to companies “that do not need money. As a result, many good companies have turned into bad companies.”

Soon after these comments were made, the Ant Group IPO was halted. The message here is that no matter who you are or how rich you are, you don’t go against the CCP. However, while the Ant IPO was halted, it’s not likely a permanent outcome. With more than 1.3 billion users, Ant Group is the most prominent fintech company in the world. The company owns China’s most popular online payment system Alipay, which processed roughly $17 trillion in payments in mainland China in one year.

So, if you want to talk about unlocking value, let’s talk about the Ant Group IPO. Yes, the deal is on hold, but it may get the green light any time. The CCP halted the Ant IPO to demonstrate that it had the power and illustrate that speaking against the government ends badly. The CCP proved its point. Moreover, it fined Alibaba a record sum and launched probes into the country’s biggest and most powerful tech giants. However, the CCP has no interest in wrecking its country’s largest companies, and it has no interest in hurting Ant group or Alipay. After all, almost everyone in China (about 90% of the population) uses Alipay. The last thing that the CCP wants is to upset its massive populous. Therefore, the current hostile environment toward Alibaba and Ant group is likely a transitory phenomenon, and the issues should get resolved in time, possibly soon.

What’s Alibaba Worth?

If Alibaba’s 33% stake in Ant Group is valued at around $100 billion, then the rest of Alibaba is only worth around $173 billion. Yes, that’s right, Alibaba’s depressed market cap is only about $273 billion now. Last year Alibaba had around $135 billion in sales. Therefore, if we subtract the estimated $100 billion Ant Group stake, Alibaba is trading at about 1.3 times sales. So, if the Ant Group IPO comes back on the table, Alibaba’s share could be valued at or near the proposed $100 billion. Thus, the stock is probably very undervalued right now. However, let’s now move away from the Ant IPO and look at Alibaba.

First, I want to remind everyone that last quarter, Alibaba reported $1.18 per share, about a 10% beat over the consensus estimates. Moreover, the company delivered $30.28 billion in revenues, well above consensus figures. So, we see the tide turning in Alibaba’s favor on the earnings side now. There’s a relatively high probability that analysts’ estimates came down too fast, and the company could continue beating moving forward.

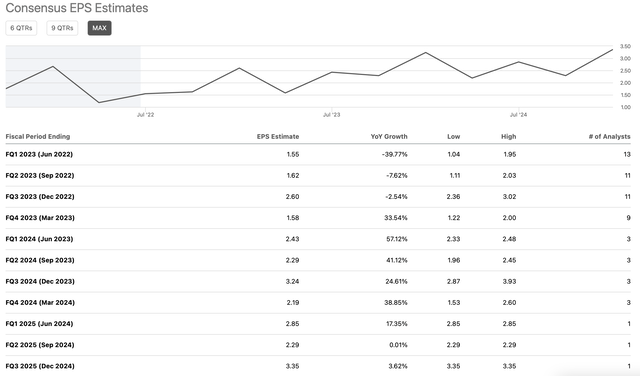

Consensus Estimates EPS

EPS estimates (SeekingAlpha.com)

This year’s (fiscal 2023) EPS estimates are only about $7.35. However, this ultra-low EPS estimate is partly due to the government crackdown, increased regulation, the Ant Group fiasco, and other elements. We can probably say that EPS estimates are at rock bottom now. Last year, in fiscal 2022, Alibaba earned $8.17, and if the company only hits its consensus estimates, we will see around a 10% YoY EPS decline. While this dynamic seems terrible, it’s a temporary phenomenon, and we must consider that the stock is at a low point now.

Furthermore, in fiscal 2020 Alibaba earned $9.56. In fiscal 2021, the company delivered $8.59 in EPS. Alibaba is going through a prolonged phase of EPS declines, which is why the stock crashed recently. Nevertheless, the company’s challenging earnings phase will likely conclude this year, and we can see robust EPS growth as the company advances.

While consensus EPS estimates are $7.35 this year, we saw a 10% beat last quarter. This outperformance implies that EPS estimates may have come down too much, and the company will likely continue to outperform in the coming quarters. Therefore, the company could deliver roughly 10% above consensus figures this year (approximately $8.00-8.10 in EPS). While this outcome would still result in a slight YoY decline, it would only be around one or two percent.

However, the company will likely perform much better as Alibaba comes out of its multi-year route. Next year’s fiscal 2024 consensus EPS estimates are for $10.15, illustrating a high probability of a 20-30% YoY jump in EPS. Moreover, the $10.15 EPS estimate may be lowballed, and we should continue seeing solid double-digit EPS growth in the years beyond 2024. Therefore, with Alibaba’s stock trading around par, its forward (fiscal 2024) P/E multiple is below ten. This valuation is remarkably low for a dominant market-leading growth company that could benefit significantly from the Ant Group IPO when it occurs.

The tide has turned for Alibaba. The company’s period of earnings decline is coming to an abrupt end, and Alibaba should begin growing earnings substantially from here. In addition, China’s government is easing up on regulations, and the Ant Group IPO may get the green light shortly. Alibaba has a significant stake in the fintech giant, which may be worth up to $100 billion. Therefore, the Ant IPO will unlock substantial shareholder value when it occurs. However, regardless of Ant Group, Alibaba is dirt cheap right now. The company’s stock is trading at only about ten times next year’s EPS estimates and is likely to continue growing at a significant pace well into the future. Thus, the company’s stock likely bottomed and should continue heading significantly higher as we advance.

What Alibaba’s financials could look like in the coming years:

| Year (fiscal) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $138 | $156 | $177 | $198 | $222 | $246 | $274 |

| Revenue growth | 13% | 13% | 12% | 12% | 11% | 11% | 10% |

| EPS | $8.10 | $10.10 | $12.63 | $15.16 | $17.88 | $21 | $25 |

| Forward P/E ratio | 10 | 12 | 15 | 18 | 18 | 18 | 17 |

| Price | $101 | $151 | $227 | $322 | $378 | $450 | $500 |

Source: The Author

My revenue growth estimates are pretty conservative. Furthermore, the company’s EPS growth is based on modestly stronger profitability, which is expected considering the company’s focus on increasing earnings. The forward P/E multiple also is relatively conservative, as many companies with far less growth and less earning potential trade at a 20 forward P/E multiple or higher. It’s also plausible that we will see the company’s P/E multiple expand sooner and further than I envision. Ultimately, we should see Alibaba trading much higher, and the stock can probably reach $500 by 2030 or sooner.

Risks to Alibaba

While I’m bullish on Alibaba, various factors could occur that may derail my bullish thesis for the company. For instance, the CCP could resume its tough stance and clamp down further on Alibaba and other Chinese tech giants. Moreover, despite the optimistic tone from Chinese authorities, U.S. regulators could still decide to delist the company’s ADRs. Increased competition could impact Alibaba’s growth and profits. The company’s growth could be worse than my current anticipation. Also, Alibaba’s profitability could continue to struggle for various reasons. This investment has multiple risks, so shares are very cheap right now. I believe Alibaba remains an elevated risk/high reward investment, and investors should carefully examine the risks before opening a position in Alibaba stock.

Be the first to comment