Wang He/Getty Images News

Investment Thesis

Alibaba Group Holding Limited’s (BABA) stock has been down about 18.3% since my last publication on the company and is trading around $100. BABA’s Q3 2022 earnings release has been underwhelming for investors, but the company’s foundations still stand strong, and the floored price tag has turned BABA into a value stock, ripe for the taking.

In the previous article, I have analyzed how BABA has become over-politicized, with the stock no longer weighing on fundamentals but driven by fear and uncertainty. I own Alibaba shares on Hong Kong Exchange (9988), and it is the largest position in my highly concentrated portfolio. Alibaba’s long-term investment thesis remains intact, and I plan to own 9988 shares for the next decade.

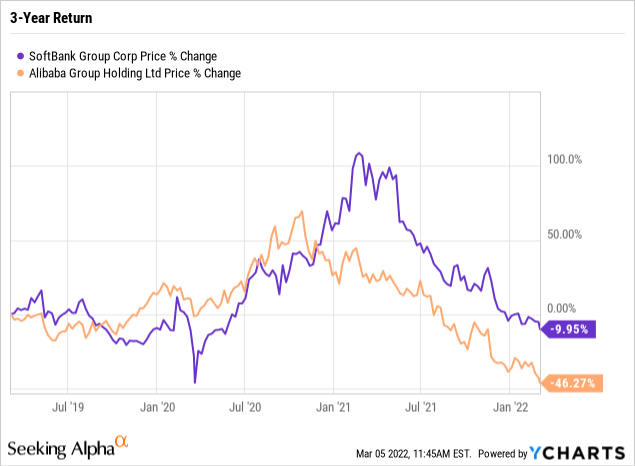

SoftBank, NVIDIA – ARM Deal, and BABA

A quick throwback, in my earlier analysis, I elaborated how a series of events such as the false disclosures by Mr. Ma for ANT Group, Mr. Son’s NVIDIA-ARM deal, and other affairs have contributed to a regulatory crackdown, with both billionaires being at the center of CCP’s attention. However, through all the turmoil, Mr. Son has stuck with BABA while being aggressively involved in his conviction towards selling ARM Holdings Plc. (ARMHF) to the American firm NVIDIA Corporation (NVDA).

True to my previous forecast, the NVIDIA – ARM deal was finally terminated in the previous month pertaining to regulatory pressures. The deal would have given NVIDIA exclusive access to proprietary technology, which is relied upon by technology behemoths like Google (NASDAQ:GOOG), Microsoft (NASDAQ:MSFT), and QUALCOMM (NASDAQ:QCOM), who were major catalysts in objections to the deal. However, the companies have expressed their commitment to working together in the press release. As such, NVIDIA will retain its 20-year license in exchange for $1.25 billion paid to the target company. As a result, such a deal that would lead to a US Hegemony over the semiconductor industry would never be welcomed by the CCP.

Alternatively, the crash of the $40 billion deal has led to the company expressing its intent of reverting to its original plan of pursuing an IPO. It remains to be seen whether the company will be listed on NYSE, NASDAQ, or LSE. However, SoftBank Group Corp. (OTCPK:SFTBY) is adamant about listing in the United States, pursuing its agenda. SoftBank’s primary objective in listing the company would be to raise maximum funds possible, but it seems unlikely to touch the $40 billion mark, a valuation previously expected from the NVIDIA deal.

SoftBank’s ARM public listing is a softer approach than selling it directly to NVIDIA

This hit to the deal is also reflected in SoftBank’s most prized possession, BABA, as the stock fell over 5% from date until its quarterly earnings report on 24th February. SoftBank’s initial $20 million investment in BABA just a year after its incorporation has folded almost 35 times, touching nearly $70 billion with a 25% stake in a little over two decades. So, it’s reasonable to assume that the better ARM’s expected IPO performs, the better it will reflect in SoftBank’s portfolio and the better it will resonate with BABA. However, it is still uncertain how CCP views the potential listing of ARM in a US Exchange, but it is definitely a softer approach by SoftBank exiting its position.

Mr. Son and Mr. Ma Obedience will ease scrutiny

Eventually, SoftBank trimmed its Alibaba stake by 20 million shares in the last quarter. Atul Goyal at Jefferies & Company noted that SoftBank might sell more BABA shares in 2022 to fund its new investments in startups. As a result, BABA stock is expected to trade sideways in the medium term, and Mr. Son could unload more shares gradually, setting downward pressure. As a result, the meaningful reduction of SoftBank’s shareholding in BABA is expected to please the CCP, as it is quite evident that Mr. Son’s actions are against CCP’s plans, and they prefer to see him exit his positions in Chinese equities.

Similarly, Mr. Ma has shown meaningful progress in restructuring the ANT Group and agreed to be regulated as a bank. However, the regulatory scrutiny is not over yet, with the Chinese regulator requiring other state-owned banks to disclose all their exposure with the ANT Group and related parties. BABA owns a third of ANT Group, and the $35 billion IPO cancellation 16 months ago has cost Alibaba Group billions. Loosen regulation over ANT Group and resumption of IPO plans will be another catalyst for BABA’s stock price increase.

Nevertheless, the longer the share price remains at such undervalued levels, the more time long-term investors get to accumulate shares, maximizing the potential of their returns.

Growth and Sales: Trend & Forecasts

Alibaba’s recent reports have highlighted a 10% YoY growth, which many consider a failure of sorts. However, a company the size of BABA, pushing forward through the turbulence of numerous events in the previous two years while showing consistent growth, is a powerful show of the company’s resilience to idiosyncratic and systemic risks. The company has suffered from Ant Group’s IPO cancellation, China’s regulatory crackdown, the $2.8 billion fine, delisting concerns, and even from DIDI’s delisting.

These factors have significantly contributed to the stock falling from over $300 to around $100. Even though these are major factors, none of these events are directly part of the company’s core business and fundamental strength. Still, event-after-event hasn’t let the stock breathe and revert after each risk had been mitigated, resulting in the share price taking a continuous beating. Similarly, the ongoing Russia-Ukraine situation has nothing to do with BABA but will indeed bear down upon the stock as a macroeconomic factor.

The Core business remains robust

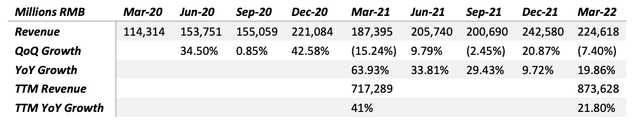

The current 10% YoY growth, in addition to a 19% or 43 million net quarterly increase in active users despite all these ramifications, is far from being considered poor performance. Applying a linear growth forecast based on the previous two years of performance (the tough years) and leaving a 10% error margin (as the last quarter benefited from Holidays and Single’s Day sales) extrapolates a 7.40% QoQ decline and a 19.86% YoY growth, resulting in annual YoY revenue growth of 21.80%, in tune with the company’s revenue guidance of 20% to 23% annual YoY growth, demonstrating the resilience of the company even under challenging times. I used RMB instead of USD to simplify the model and avoid exchange rate differences causing inconsistencies.

Table created by Author using data from the Company’s SEC Filings

At the bottom line, BABA’s EPS of RMB 0.94 ($0.15) in the last quarter exemplified a YoY decrease of 74% but was primarily beaten up by the impairment of the company’s Goodwill concerning the Digital media and entertainment segment to RMB 25,141 million ($3,945 million). Accordingly, the Non-GAAP EPS of RMB 2.11 ($0.33), YoY decline of 23%, is a better metric to take forward as the impairment was a one-time charge.

Alibaba’s Ecosystem will grow stronger

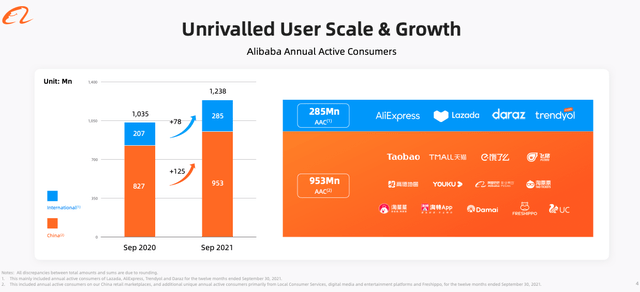

Undoubtedly, the increased compliance cost with antitrust laws eventually increased competition and shrank the company’s market share of Gross Merchandise Volume (GMV). Nevertheless, BABA is expected to reach a major milestone of accumulating over 1 billion aggregate active customers in China alone this quarter. This covers nearly the entire 1.2 billion online population with meaningful spending power in the country. This will move BABA from customer acquisition to a customer retention strategy.

Alibaba’s User Growth

Remarkably, the company achieves a population penetration rate of 90% among young consumers, and the 25-44 years old segment contributes about 70% to the total GMV. Apart from the strong brand loyalty, the average revenue per user (ARPU) has tripled in the last five years, proving Alibaba’s ecosystem resilience and ability to effectively monetize its users. Consequently, the company will effectively progress in its pursuit of increasing and reducing operational costs.

It is also a point of emphasis that Alibaba’s ‘Taobao Deals’ and ‘Taocaicai’ are becoming a major source of attracting new customers in the low-income demographic of China, which might result in a lower ARPU. Taobao Deals had 280 million Annual Active Customers (AAC) in 2021, up 39 million from the prior quarter with 100% growth in paid orders. In contrast, International Commerce Retail AACs grew by 16 million QoQ to 301 million. Amid growing competition, it would be an edge for the company to target the accumulation of international customers who can directly increase its ARPU.

Almost all the profit generated by the business is currently coming from its core commerce business, while Ali Cloud and other loss-making segments are quickly catching up with great growth metrics. Even though BABA is trekking treacherous waters, the growing customer base, and the increased investments in the non-core business segments such as cloud computing, which are showing robust growth, are well-positioned for promising future revenue generation.

Valuation is no longer based on Fundamentals

Even though the market sentiment around BABA has moved negatively across the board in the previous year, almost all of it has been politically charged with negligible culpability on Alibaba’s part; this has resulted in the dirt-cheap share valuation, especially considering that the company is a free cash flow (FCF) generation machine. With an FCF of $9.93 per share, the 10-year DCF model suggests an intrinsic value of around $189 using a 10% annual growth rate, 4% terminal rate, and 9% discount rate (my required rate of return). Comparably, based on the company’s current FCF/share, the price to FCF ratio of 10 is the lowest of all its peers like JD.com’s (JD) at 16.45 and Pinduoduo Inc.’s (PDD) at 13.37.

Additionally, the company has amassed $77.9 billion of cash and cash equivalents as of the year-end, representing nearly 29% of its market capitalization, with a net cash per share of $18.49 after debt obligations. As of today, the short interest in BABA stock stands at 1.71% of the float, down 3.65% than last month and nearly halved YoY, showing the market’s overall uncertainty over further stock declines. Likewise, veteran investors such as Charlie Munger have doubled down on their BABA positions, signifying the stock’s dirt-cheap price tag.

Concluding Thoughts

Achieving the 2022 guidance for BABA will be a huge win, and the stock is likely to respond in kind as investors start to reiterate their faith in the company. Right now, the company is riddled with extrinsic factors that are weighing down the stock, and showing resilience and growth through the storm will start moving the stock in the right direction.

Daniel O’Keefe, managing director and portfolio manager at Artisan Partners, goes on to call the company “Cheapest Company in the World’ Outside Russia” because of its ludicrously attractive valuation metrics that make the online retail behemoth a value stock. With such strong fundamentals and financials, BABA will withstand all the noise and create great shareholder wealth in the long run.

The previous two years have been testing the patience of BABA investors. Therefore, this is exactly the point where the risk-averse investor gets an opportunity to own at dirt cheap price one of the upcoming largest companies by revenue in the world by 2030. Accordingly, I maintain my buy position in BABA for the next decade.

Be the first to comment