maybefalse/iStock Unreleased via Getty Images

Thesis

I am very bullish on Alibaba (NYSE:BABA) stock. I strongly believe that the market has priced in too much negativity and pessimism as compared to reality and investors are well advised to follow one of Buffett’s key maxims:

Be greedy when others are fearful.

Alibaba has grown at a 5-year CAGR of more than 42%, but the company’s stock is trading at a PE of about x17. This indicates a clear undervaluation.

Of course, I understand that investors are worried about a potential ADR delisting, China’s slowing economy and the CCP’s crackdown on internet/tech companies. However, just like a bull market tops on the most bullish conditions, a bear market bottoms on the most bearish conditions. While investors should study and understand the risks, I personally believe that Alibaba stock will rebound strongly from current price levels of below $100/share.

Personally, I see more than 50% upside for BABA stock, as I calculate the company’s fair value with a residual earnings model anchored on fundamentals and analyst consensus estimates. My target price is $133.92.

A Best-In-Class Company

Alibaba is one of the biggest e-commerce companies in the world. The company operates three main shopping sites Taobao, Tmall and Alibaba.com, which cumulatively serve some 828 million monthly active buyers (fiscal year ending March 31, 2021).

Alibaba also has stakes in multiple innovative internet/technology businesses such as Youku (video entertainment), Pony.Ai (Autonomous Driving) and most notably Ant Group (The world’s biggest financial service company). Alipay serves almost the entire population in China. The platform has 1.3 billion users and 80 million merchants. Notably, the total payment volume of Alipay was more than $19 trillion in 2021.

Moreover, Alibaba is a dominant force in China’s cloud market with about 37% market share. China’s cloud market is expected to grow at a 4-year CAGR of more than 25%, reaching $85 billion in 2026. As the market leader in China, Alibaba is poised to benefit from this super-charged cloud-growth. Cloud is also a business vertical where the company should enjoy government tailwind, as the Chinese Communist Party is actively supporting digitalization efforts of the economy and has made cloud development a key-priority in the party’s 5-year development plan.

Bullish Financials

In the past financial year, the Alibaba Group generated total revenues of about $134.5 billion and recorded an operating income of about $15 billion. Most notably in the past five years, from March 2017 to March 2022, Alibaba has grown at an unbelievable 5-year CAGR of 42%. For reference, this is almost double the growth rate of Amazon, which grew at a 5-year CAGR of 22% CAGR over the same period. Alibaba closed the fiscal year 2021 with 9.8 billion of net-income available to common shareholders.

Alibaba’s balance sheet is very strong: As of March 2022, the company recorded $71.7 billion of cash and cash equivalents and only $27.85 of total financial debt. This makes Alibaba a net-creditor of about $43 billion — which is 17% of the company’s market capitalization. Moreover, Alibaba’s business operations, despite the strong growth, are cash-accretive. In fiscal 2021, the company generated cash from operations of $22.5 billion. Under these circumstances it should come to no surprise that the company announced a $25 billion share-buyback program, more than 10% of the outstanding shares) in March 2022.

Alibaba will announce earnings for the quarter from April to end of June on August 4th before market open. Analyst consensus expects total revenues of $30.21 billion and EPS of $1.56.

The Buying Opportunity

Despite the strong business fundamentals, Alibaba stock suffered a spectacular sell-off. BABA shares are down about 70% from ATH as the company was pressured by multiple headwinds: ADR delisting fears, as slowing economy in China, Covid-19 lockdowns and an aggressive regulatory crackdown that started with the cancellation of the Ant Group IPO in November 2020.

Alibaba is a quality company, and the stock’s undervaluation is no secret to investors. The key-question is: is the worst behind, and can investors safely invest in Alibaba stock?

I strongly believe that a safe investment does not exist. In my opinion, every investment opportunity must be judged as a function of its price. And the lower the price, the less risky an investment becomes. Thus, investing is a question of risk/reward. Given Alibaba’s extremely depressed valuation – now the company’s stock is trading at a PE of about x17 – I argue an investment is justified.

Moreover, there are signs that all of Alibaba’s headwinds are easing and the negativity surrounding the stock has peaked. The CCP has on multiple occasions tried to communicate to investors that the internet/technology crackdown is coming to an end and that the party is actively supporting the healthy expansion of digital platform economies (here, here, here).

In addition, to fight a slowing economy, China has vowed to push more fiscal economic support – with a special focus on digitalization. While western economies are hawkish on fiscal and monetary stimulus – ending a decade long easing cycle, China is one of the few economies that appears to start a new stimulus cycle.

Analysts agree with the bullish thesis. In general, analysts are very bullish on Alibaba stock. Based on ratings of 44 analysts, 33 analysts give a Strong Buy rating, 8 are Buy rated and 3 assign a Hold recommendation. There is no Sell or Strong Sell rating. The average price target is $155.47/share, indicating more than 70% upside.

Residual Earnings Valuation

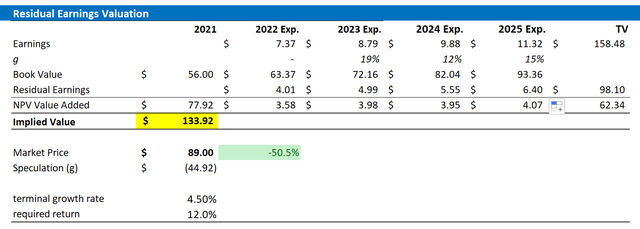

Let us now look at the valuation. What could be a fair per-share value for Alibaba stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the Hang Seng to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 22nd, 2022. My calculation indicates a fair WACC of about 9.8%. I adjust upward to 12% in order to reflect the company’s idiosyncratic market risk.

- To derive Baidu’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth plus one percentage point to reflect a favorable growth outlook for Alibaba’s high-potential initiatives

- I do not model any share buyback further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for Alibaba of $133.92/share, implying material upside of more than 50%.

Analyst Consensus EPS; Author’s Calculation

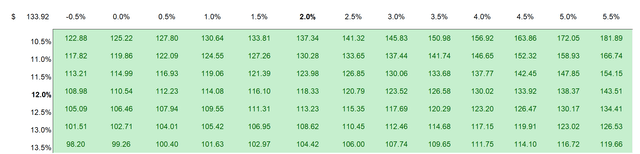

I understand that investors might have different assumptions with regards to Alibaba’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation. Notably, all tested combinations imply an undervaluation!

Analyst Consensus EPS; Author’s Calculation

Investment Risks

Investors should be aware of the following downside risks that might cause Alibaba stock to materially deviate from my base-case target price of $133.92/share:

First, the economy in China is currently pressured by multiple headwinds including inflation, real-estate crisis and COVID-19 lockdowns. If the Chinese economy would slow more than what is expected and priced in, investors should adjust expectations for Alibaba’s short/mid-term business monetization accordingly.

Secondly, China’s internet/tech companies are strongly exposed to regulatory risk. While the worst seems to be behind us, the elevated risk exposure persists — and will arguably never completely fade.

Third, much of BABA’s share price volatility is currently driven by investor sentiment towards Chinese ADRs and risk assets. Thus, BABA stock price might show strong price volatility even though the company’s business fundamentals remain unchanged.

Conclusion

Alibaba stock is down 70% from ATH, but the company remains a global powerhouse with enormous long-term potential. Trading at a PE of below x17, despite growing like a start-up, I argue Alibaba’s sell-off could offer long-term focused investors, that can stomach short term share-price volatility, a generational buying opportunity.

Personally, I see more than 50% upside for BABA stock, despite cautious and conservative valuation assumptions. Strong Buy.

My articles on China ADR stocks:

Be the first to comment