maybefalse/iStock Unreleased via Getty Images

A lot has happened since my last article about Alibaba (NYSE:BABA) published on Seeking Alpha. The Chinese government decided to exercise extra control over the high-tech sector and there were antitrust probes that also affected Alibaba. Moreover, China applied the zero-Covid policy, which implied very strict lockdowns in cities where Covid-19 was diagnosed. This, in combination with the situation around Ukraine, contributed to the online retailer’s stock price plunging substantially. Right now, given the company’s brand name and operational scale, Alibaba’s stock looks sufficiently undervalued. However, I would probably not buy BABA’s shares right now since the recession risk is very high and therefore the stock price may fall further. Alibaba’s shares are also quite volatile right now. This is an additional risk factor for a conservative investor. But let me explain this in some more detail.

Alibaba’s fall from grace

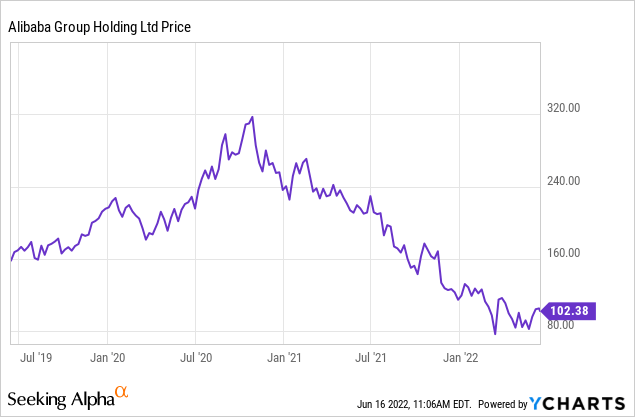

Towards the end of 2020 when I wrote about selling my stake in Alibaba the stock was trading at record highs. In fact, in the autumn of 2020, the online retailer’s stock price even totaled $320 per share.

Right now, however, the stock price is 3 times lower than it used to be. Even at the time when Alibaba was selling for $320 per share, its stock still did not look overvalued as far as the classical multiples were concerned. For example, Amazon’s (AMZN) shares were trading at much higher valuations compared to these of Alibaba. BABA’s revenue was growing and so was the profit. The competitors’ shares were also facing a wonderful rally. However, it was that abundant optimism rattling the stock market that scared me. The stock was rising too fast and the investors were far too bullish despite the coronavirus pandemic still affecting both the Chinese and the global economies. There were also big hopes that BABA would organize Ant’s IPO. Soon after the autumn of 2020, these hopes faded.

Recent results

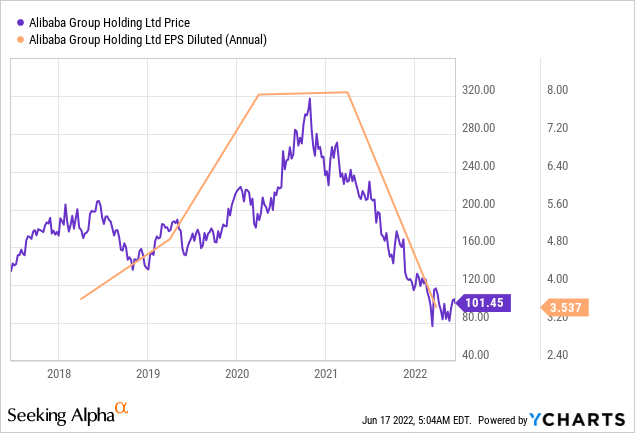

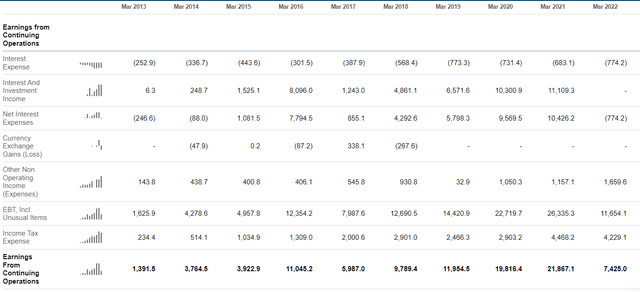

The most important points in the earnings results for 2022, in my view, are the EBT including unusual items, and the interest & investment income. These were the biggest reasons for the fall in Alibaba’s earnings last year.

Source: Alibaba’s financial results, Seeking Alpha

The net income grew between March 2020 and March 2021. But the profit reported in March 2022 was substantially lower due to these two indicators.

According to the company’s management, the biggest damage to BABA’s profit was due to the net losses resulting from decreases in the market prices of the company’s equity investments in publicly-traded companies.

Indeed, many publicly listed companies’ stocks are volatile. Here are the company’s top holdings:

- Youku Tudou Inc., a multi-screen entertainment and media company

- Alibaba Pictures Group, formerly ChinaVision Media, is a film company

- South China Morning Post (‘SCMP’), a famous Chinese newspaper

- Lazada Group, an e-commerce platform

- Intime Department Store, a department store operator

- Sun Art Retail Group Ltd., a hypermarket operator

- Alibaba Diversity and Inclusiveness Transparency

Most of these companies are listed on the stock exchange and are Chinese. In the recent two years, high-tech companies faced tough regulatory scrutiny. Moreover, the Chinese economy started to slow down, which made many investors sell the shares issued by the companies mentioned above.

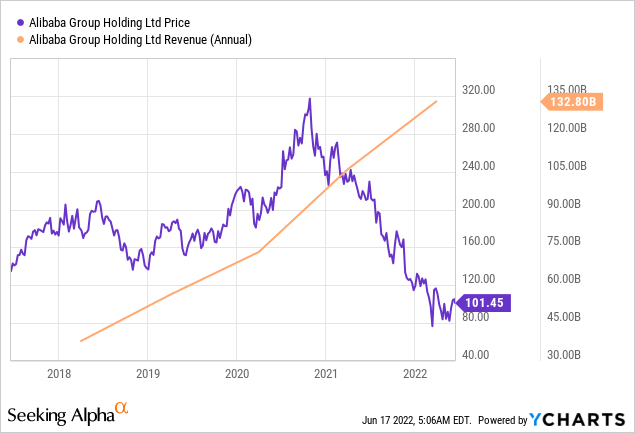

Interestingly, despite the growing regulatory pressures and the slowdown of the Chinese economy, BABA’s sales revenues were very resilient. The growth rates between 2020 & 2021 and 2021 & 2022 totaled almost 52% and 23%, respectively. In 2022, we could say, there was a slowdown in the revenue growth rate. But it was still very sound for a large and mature company like Alibaba.

Alibaba’s earnings and revenues history

|

Year |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Total revenues |

39,893.8 |

56,148.2 |

71,967.7 |

109,468.0 |

134,539.6 |

|

Cost of revenues |

16,935.7 |

30,408 |

39,493.5 |

64,024 |

85,078.7 |

|

Gross profit |

22,958.1 |

25,740.2 |

32,474.1 |

45,444 |

49,460.9 |

|

Selling, General & Admin Expenses |

6,940.5 |

9,385.2 |

11,135.9 |

18,087 |

23,928.5 |

|

R&D Expenses |

3,627.1 |

5,577.7 |

6,082.6 |

8,735 |

8,747.6 |

|

Total Operating Expenses |

11,702.6 |

16,561.2 |

18,985.4 |

28,718.5 |

34,513 |

|

Operating Income |

11,255.5 |

9,179 |

13,488.7 |

16,725.5 |

14,948 |

|

Earnings from continuing operations |

9,789.4 |

11,954.5 |

19,816.4 |

21,867.1 |

7,425 |

|

Net Income |

10,216.8 |

13,094.6 |

21,098.9 |

22,980.2 |

9,817.5 |

Source: Prepared by the author based on the income statement

Interesting is also the fact Alibaba announced it would raise its buyback program to $25 billion from $15 billion.

Despite the quite sound results, the company’s stock price showed extremely poor performance. In other words, there is a total mismatch between BABA’s share price and its sales revenue.

But interestingly enough Alibaba’s equity performance completely reflected its diluted annual EPS trend.

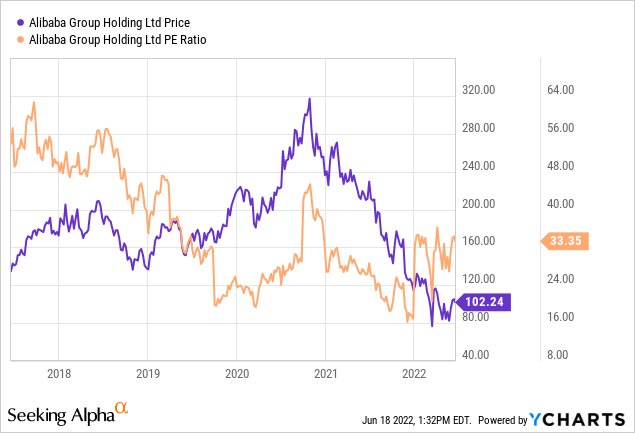

But let us look at the company’s current valuations using the classical valuation ratios or equity multiples.

Valuations

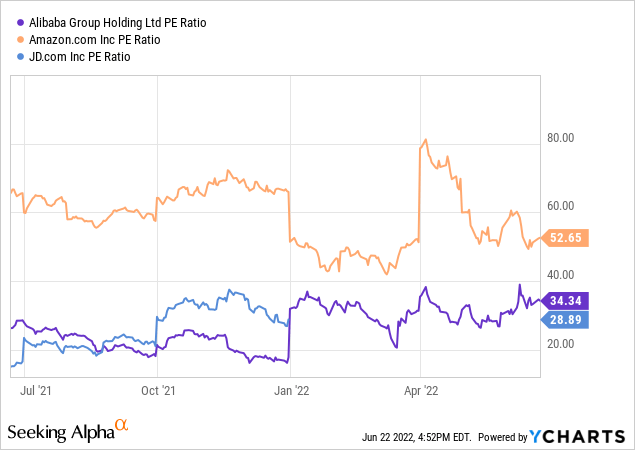

Right now the company’s price-to-earnings (P/E) ratio is 33. If we compare this to the S&P 500’s current average of about 19, that is not very low.

But we should not forget the fact Alibaba is a high-tech company, also known as the “Amazon of China”. So, in my view, it would be reasonable to compare BABA to AMZN. To get a better picture of Alibaba’s valuation, I would also like to compare BABA to its Chinese rival JD.com (JD).

BABA’s P/E of 34 is sufficiently lower than Amazon’s 53, which means BABA is quite undervalued compared to AMZN. As concerns JD.com, it does not have any P/E ratio right now because the company recently reported negative earnings. So, it looks like BABA is the best value for money based on this indicator alone.

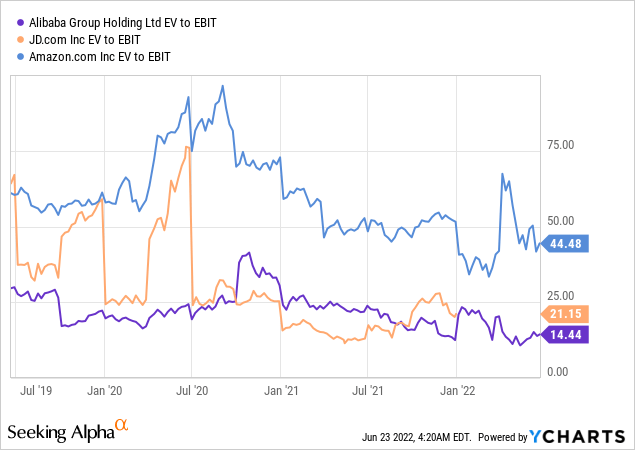

Let us also look at BABA’s EV/EBIT ratio history. Alibaba’s EV/EBIT is at multi-year lows and totals just over 14. A healthy EV/EBIT should ideally be below 10 but this is not often the case. However, if we compare BABA’s EV/EBIT to these of its rivals, we will see that Amazon’s ratio of 44 is more than 3 times bigger. As concerns JD, its recently reported earnings before interest and taxes were negative. So, I was unable to generate any chart for JD.com. We can see that by this indicator BABA is also the best among the three companies.

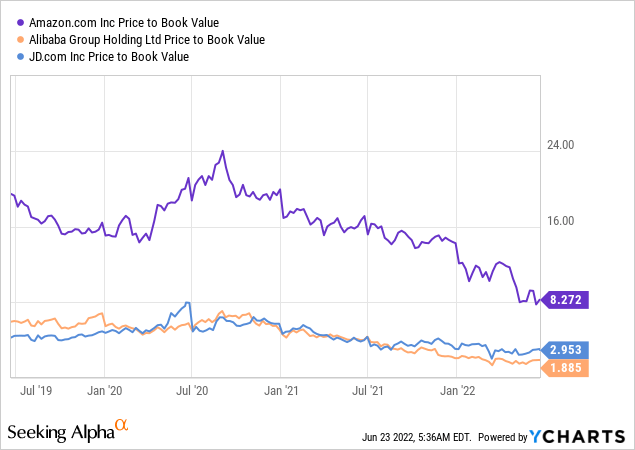

Even the company’s price-to-book (P/B) ratio is very low. Having a P/B close to 3 is considered to be good. However, a P/B of 1.9 for a high-tech company is excellent. Such a P/B is impressive also because JD’s 2.95 and AMZN’s 8.3 are much higher.

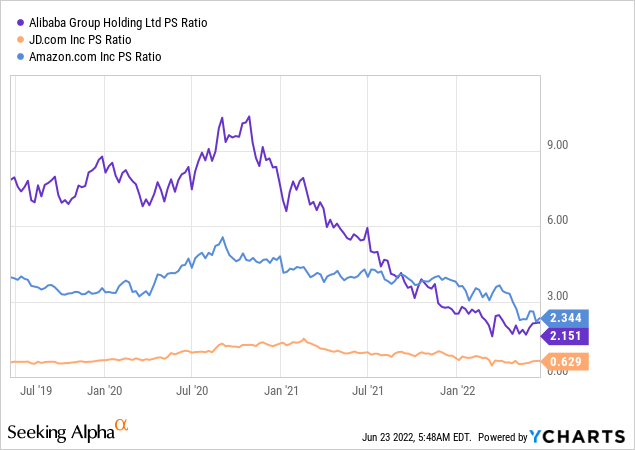

The same can be said about BABA’s P/S ratio. It is about 2, which is again very low for a high-tech company since an acceptable P/S ratio is normally around 3. However, BABA’s close rivals JD.com and AMZN also enjoy low P/S ratios. AMZN’s 2.3 is somewhat higher than BABA’s but JD’s is sufficiently lower and currently stands at about 0.63.

But P/S is the only indicator where BABA does not beat its competitors.

Key developments

The most important news dominating the headlines devoted to Alibaba, in my view, was the regulatory pressures from the side of the Chinese government.

In April 2021, Alibaba was fined $2.8 billion by Chinese regulators after an antimonopoly probe. At the time, it seemed like BABA stock was ready to break out of a downtrend, but sellers made the stock crash again.

BABA stock fell further in November after the Chinese government announced new antimonopoly regulations for Chinese high-tech companies like Alibaba and JD.com.

Alibaba also decided to restructure its e-commerce department by creating two new digital commerce divisions. They will deal both with international and domestic markets.

Soon afterward, BABA plunged somewhat in December after the government of China punished the company for not reporting an open-source security vulnerability to the regulator.

However, quite recently anti-monopoly pressures were somewhat weakened. Many investors thought there would be no Ant IPO any time soon. At the same time, earlier this month there appeared reports China took steps to ease the tech crackdown. In regards to Alibaba, it involved allowing the company to revive its IPO ambitions in Shanghai and Hong Kong. In my view, this decision was due to the slowdown of the Chinese economy. But I do not think investors should completely disregard the regulatory threats.

Main risks

The main risk, in my view, is the risk of a global, full-scale recession. In many countries, including the US and the EU, central banks are now tightening the monetary conditions, which, as many analysts say, is highly likely to provoke an economic downturn. The demand for Alibaba’s goods certainly depends on consumers’ incomes since the company does not just sell necessities. Although most of BABA’s customers are based in China, the country’s well-being largely depends on other countries because China is an export-oriented economy.

There is also a chance the Chinese government may further tighten its anti-monopoly regulations. Since the Chinese government also wants competition, it might try to make the economic conditions more favorable for smaller companies. These could, in turn, become rivals to Alibaba. Large-scale companies become very powerful since they get control over their users’ data. Many governments, including China’s, try to limit this power by passing tougher regulations and disciplining companies that fail to comply.

Conclusion

Surely, Alibaba’s stock is undervalued and is issued by a leading company. But in my view, there are too many external risks surrounding the stock. The most important one, in my view, is the risk of a global recession, which would also substantially affect China. Although I consider BABA a steal at the price, I would not personally jump in. In other words, buying Alibaba stock would make sense during a full-scale recession when the stock market overall crashes further.

Be the first to comment