Dilok Klaisataporn

Thesis

For readers not familiar with Li Lu, this Wikipedia page provides a bit biographical sketch. He is a close friend of Charlie Munger, who calls him the “Chinese Warren Buffett.” And in this article, I will draw from the insights of Li Lu to provide a broader thesis on Alibaba (NYSE:BABA). Many of my past articles are focused on the operation details of BABA. In this article, I will switch the perspective to a more macroscopic level.

And the reason that motivated this switch involves the observation that the ongoing argument between many BABA bulls and bears is not really about its business fundamentals. The argument is more about the so-called “China risk” – a risk that renders all Chinese stock uninvestable in the bears’ view. In contrast, the bulls either do not agree with the risk (it is a broad and vague concept anyway) or see the “China risk” to be fundamentally different from any other risks that other stocks face. After all, the stock market is NOT a place where investors look for risk-free opportunities. It is a place where investors PRICE risks.

I am subscriber to the latter school of thoughts. And Li Lu’s following Civilization 2.5 theory offers an insightful view on what the “China risk” is in his mind. The following quote was taken from one of his lectures (the emphases were added by me). I recommend you read the transcript in its entirety.

I believe China is at interim stage between Civilization 2.0 and Civilization 3.0. Let’s call it Civilization 2.5. China has come a long way but still has a long road ahead. Therefore, I think there is a high probability that China will continue on the main track of Civilization 3.0, as the cost of deviation is very high. If you have a good understanding of China’s culture, people and history, you will agree that China will forge forward. This is particularly the case now that you have a better understanding of the essence of modern civilization. There is almost no chance of China leaving the common market, and the probability of China changing its market rules is also very small. Thus, it is highly probable that, in the next 2 to 3 decades, China will remain in the global market system, and adhere to free market principles, in addition to promoting science & technology development.

Based on this theory, in the remainder of this article, I will argue that BABA is not only investable, but also a good value investment opportunity because of the enormous gap between its valuation and profitability.

Value investing in China – A historical perspective

Let’s start with a historical perspective. One piece of evidence bears use to support the “China is not investable” argument involves the following data (or some variation of it). In the past decade, the Shanghai Stock Exchange Composite Index (SSE, 000001.SS) went up 50%, in pale contrast to the S&P 500’s spectacular 182%.

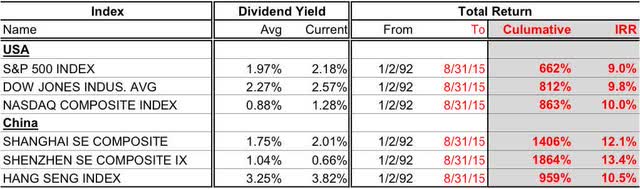

As with another comparison, the picture usually changes when you change the time frame. And the table below compares the same SSE indexes vs. the major U.S. indices from 1992 to 2015 (the chart again is taken from Li Lu’s lecture notes mentioned above). As seen, the SSE delivered a total return of 1406% during this period, translating into an annual IRR of 12.1%, leading all U.S. indices by a large margin. The Shenzhen Composite Index (which focuses less on state-owned stocks) performed even better. So, I agree with the “China risk” in the sense that Chinese stocks have their unique risks (e.g., the civilization 2.5 risks). But I fundamentally disagree that the risk makes all China stocks (or BABA in particular) uninvestable.

Where is China and its stocks going next?

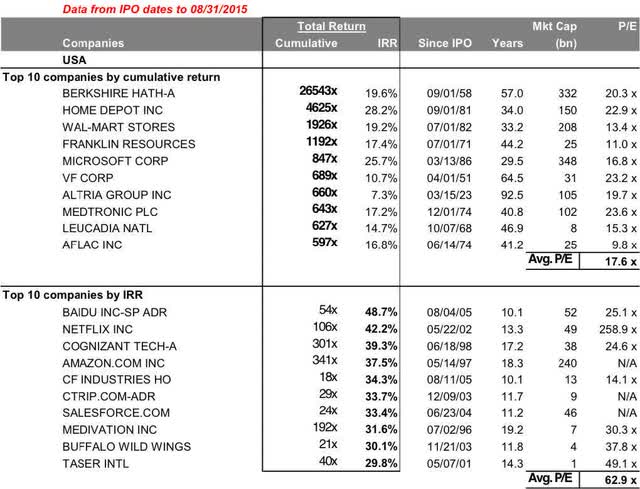

With the above 30,000-feet view of the forests, let’s descend and explore some specific trees. The chart below (again from Li Lu’s lecture) displays the best-performing U.S. stocks since their IPO by total accumulated returns (the top panel) and by IRR (the bottom panel).

And obviously, total accumulated returns favor the “old money”: the stocks that have been doing a solid job (of course) AND also on the market longer. This list is populated by household names like Berkshire Hathaway (BRK.A) (BRK.B), Altria (MO), Aflac (AFL), Home Depot (HD), et al. The youngest one on this list is Microsoft (MSFT), with IPO in 1986. And oldest one is Altria, with IPO in 1923!

While in contrast, IRR removes much of the duration bias and favors stocks with the best performance adjusted for time. Now the list changes dramatically at least in 3 ways. First, the list is more dominated by “new money”: stocks in this list are much younger (most of them IPO’ed around ~2000). Second, most of these stocks are in the “new economy” stocks such as InfoTech and e-commerce. And finally, there are quite a few Chinese stocks that made to this list (with Baidu (BIDU) being the top one) – another strong evidence against the “China is not investable” thesis.

Armed with the above historical perspective, I am going to argue that the same progress that transferred the U.S. from the old economy to the new economy will repeat in China, as reflected in the contrast between the top and bottom panels of this chart. In the end, it is really another way of saying Li Lu’s civilization 2.5 theory.

Next, we will explore a few specifics of BABA and see why I think it is not only investable but also represents a good value investment opportunity.

Profitability comparison

Value investing by definition is to pay less but get more (or get the same). In investing, this means paying a lower valuation and getting the same profitability (or better profitability).

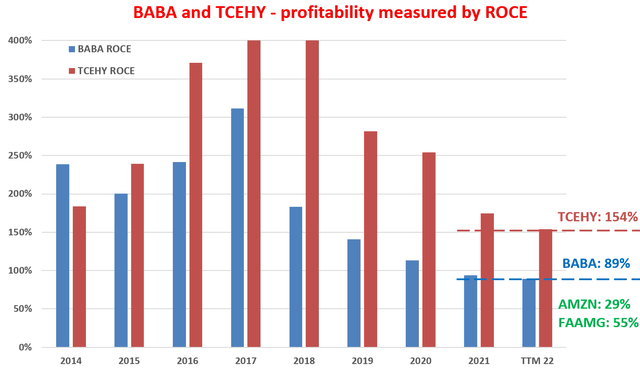

Hence, let’s start with profitability. The next plot shows BABA’s return on capital employed (“ROCE”) compared to Tencent Holdings (OTCPK:TCEHY). I am singling out TCEHY here because it is the most profitable major Chinese company that I can find. And readers following our writing knows that we’ve analyzed and are familiar with the ROCE of a LOT of companies. If you know a Chinese publicly traded stock with the same scale as BABA or TCEHY that has better ROCE than TCEHY, please definitely let me know.

As seen, both BABA and TCEHY’s ROCE were astronomical till ~2019 (with an average ROCE higher than 150% in those years). Due to the Chinese government’s crackdown on its tech firms (probably for good reasons given the astronomical profitability seen here), both BABA and TCEHY’s profitability have declined to 89% and 154%, respectively. But even such a “declined” level of profitability is still very high. To provide a few reference points: the ROCE of JD.com (JD) is about 75% in recent years, AMZN’s ROCE is only about 29%, and the FAAMG stocks’ average ROCE is about 55%.

And next, we will see that the market is now pricing BABA’s profitability at a heavily discounted price.

Source: Author based on SA data

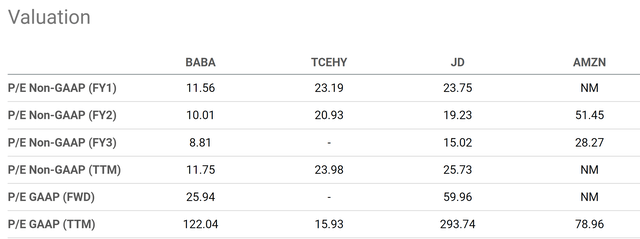

Valuation comparison

Despite BABA’s superior profitability (with the exception of TCEHY) as aforementioned, its valuation is only a fraction of its peers. To wit, its P/E is only about 11x (11.6x on an FY1 basis and 11.7x on a TTM basis). Bear in mind that BABA has $11 of cash per ADR on its ledger. The cash position translates to 12.8% of its share price of $86.8 as of this writing. If we take out the cash position from the stock price, its P/E ratio would be only 10x only on an FY1 basis. In contrast, both JD and AMZN are priced with P/E ratios far higher despite lower ROCE. And in the case of TCEHY, its P/E premium (more than 2x higher than BABA) is a bit overdone for its profitability superiority the way I see it.

Risks and final thoughts

To conclude, I am not denying the “China Risk” in the sense that Chinese stocks face a unique set of risks compared to and in addition to stocks in other countries. Fundamentally, I agree with the risks that Li Lu explained in his civilization 2.5 theory. I do not see China having an alternative but to continue on this path of upgrading to civ 3.0. And the path can be long and torturous. In addition to these macro uncertainties, BABA also faces its own unique risks including its uncertain Ant IPO, government fines and further regulatory changes, and also the development of China’s COVID-19 restrictions.

But I fundamentally disagree that the risk makes all China stocks (or Alibaba in particular) uninvestable. In the end, investing is NOT about finding risk-free opportunities. It is all about PRICING risks. And I see the risks associated with BABA as very attractive priced at its current levels of valuation and profitability.

Be the first to comment