cloudytronics/iStock via Getty Images

The bad news for Digital World Acquisition Corp. (NASDAQ:DWAC) just continues to add up. The SPAC taking former President Donald Trump’s Truth Social public is struggling to close the deal due to SEC issues and the lack of retail investor votes. My investment thesis remains very Bearish on the stock, warning investors to stay on the sidelines until better information exists.

Nothing Going Right

At one point, Digital World was one of the most promising SPACs with the stock surging to $100 on news of a deal with Trump Media & Technology Group (“TMTG”). As a social media power looking for a free speech platform, TMTG appeared a great concept for former President Donald Trump and investors.

Nearly 20 months after Trump left the White House and his exclusion from most media platforms, the former President just doesn’t appear to have the same reach. Truth Social hasn’t gotten off to a great start, and the lack of updated financial data isn’t helping the excitement around the social platform.

Regardless, though, the biggest issue facing Digital World is the inability to close the SPAC deal. The SEC continues to investigate the timing of the original deal, and investors recently failed to vote on an extension of the timeline to close the deal.

Now, investors in the original $1 billion PIPE aren’t happy with the stock price dipping. They wanted to work on better terms. The apparent lack of a new deal led to $138.5 million worth of investments terminating the PIPE investment out of the $1 billion original plan.

The PIPE still has $861.5 million in investments, but the delay in closing the deal will definitely lead to lower conversion prices leading to additional shares issued. The initial conversion rate was only 18 million shares at a price of $56, but the conversion price shall be adjusted to the greater of a 40% discount to the closing VWAP and the floor price of $10.00.

The FBI raid of Mar-Lago led to an initial surge of Truth Social app downloads. Though, data from data.ai suggested the app only had 107,500 global downloads for the week ending August 15. The number was 5x the prior week, highlighting how weak app downloads have been for Truth Social.

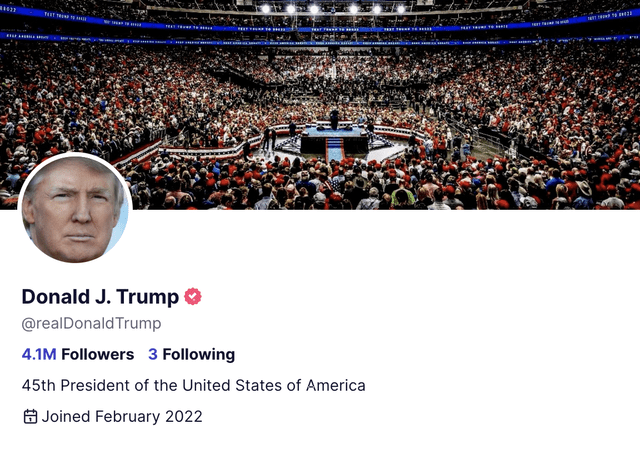

As of now, Trump only has 4.1 million followers on Truth Social after having 89 million on Twitter. The user @realDonaldTrump hasn’t seen much growth in the last few months.

While Trump regularly posts on the platform now, the engagement is far lower than back on Twitter when hundreds of thousands of users would like or retweet his posts. At the same time, the social media platform was probably throttling Trump, while Truth Social is likely promoting the 45th President of the U.S. on a regular basis.

Voting Pains

Digital World isn’t the first SPAC to run into problems getting retail investors to vote on the deal. Though, the SPAC might be the first one with the stock trading above $20 at the time to have investors fail to vote for an extension of the timeline for closing a business combination, which would force the redemption of shares at just $10.30 per share now.

Investors failing to vote for the deal will indeed end up for a 50% haircut from the price those shares could’ve been sold for on the Nasdaq. Digital World adjourned the special meeting vote until October 10, and the SPAC needs 65% of shareholders to vote for the deal per the charter.

Without an extension approval, Digital World only has until December 8 to close the deal. The extension approval will give the SPAC until September 8, 2023 to close the deal. In theory, most SPAC deals close within a year from the original business combination agreement, but this deal involves a former President hated by the legal system with the SEC already having taken 115 days back on September 8 to provide feedback.

The stock has now fallen over 40% since my original warning on Digital World back in June. The Truth Social platform was very basic, and the site had limited users questioning why the stock would be worth nearly $30 on a deal.

Elon Musk, on the verge of being forced to close the acquisition of Twitter (TWTR), remains a very bad outcome for Truth Social and Trump Media. A more neutral social media platform eliminates the main reason for the development of the platform in the first place.

The recent Rumble (RUM) deal closed in just over 9 months after announcing the deal last December and should highlight the other major problems with investing in TMTG. Rumble trades at $12 the week after the SPAC deal closed, yet the online video platform utilized by Truth Social for hosting has gotten limited traction despite reporting nearly 80 million MAUs.

The major problem with Rumble is the lack of Q2 financials nearly at the end of Q3 while analysts only forecast Q2’22 revenues of $5 million. The video platform is far ahead of Truth Social in building out a monetization machine via an internal ad network and a subscription service, questioning how TMTG would maintain even a $16 stock price for a $3 billion valuation.

One still has to wonder whether the SPAC will even close, needing shareholder approval for an extension and ultimately SEC approval. All while, every day Trump becomes more distant without a successful run for President again. After all, Donald Trump turned 76 this summer, questioning the value of a free speech platform relying on someone that should long be retired as the driver of traffic to the platform.

Takeaway

The key investor takeaway is that Digital World isn’t worth the risk with all of the signs questioning whether the deal even closes and how the price could stay above $10 after the de-SPAC transaction. Investors should continue to avoid the stock due to all of the red flags.

Be the first to comment