adogslifephoto/iStock via Getty Images

Investment Thesis

Alibaba Group’s (NYSE:BABA) recovery remains a big question for many investors’ and traders’ minds. As characterized by Daniel Schönberger, BABA is indeed A Candidate For The Record Book Of Mispriced Stocks, especially due to Jack Ma’s previous misstep and Beijing Crackdown. The stock has undoubtedly suffered a -72.14% plunge since the peak level of $317.14 in November 2020. Naturally, the risks went beyond skin deep, due to the country’s ongoing Zero Covid Policy, the slowing Chinese GDP growth, the property market crisis, the Marxist government policy, and the ongoing US-China trade war in multiple sectors.

BABA stock remains highly sensitive to market and geopolitical news, which makes our rating of a speculative buy – the understatement of the year indeed. Naturally, the stock is only suitable for investors with lead-lined stomachs and unduly patient investing trajectories.

However, we are already starting to see some light at the end of the tunnel, or as BBC puts it, “The government appears to have quietly dumped Zero Covid as a goal.” With the rhetorics gradually shifting towards some semblance of pre-pandemic life, we may witness a slow, but steady reopening cadence as Beijing carefully calibrates between COVID infection levels and public sentiment over the next few months. Combined with the 300B Yuan stimulus package, China’s economic recovery may surprise the worst of bears, with some analysts projecting an optimistic 5% GDP growth in 2023. Only time will tell, though we choose to be quietly confident that the worst may be over.

BABA’s Declining Margins Warrants A Discount Indeed

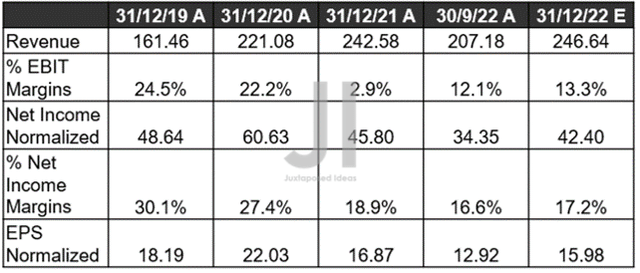

BABA Revenue, Net Income (in billion Yuan) %, EBIT %, and EPS

It is evident that market analysts are quietly optimistic about BABA’s upcoming FQ3’23 earnings call. This is due to the notable inline performance of 1.7% YoY revenue growth and a minimal -5.3% decline in EPS, despite the tougher YoY comparison and persistent lockdowns. Furthermore, with the aggressive cost-cutting strategies and layoffs thus far, the company has been recording improved operating efficiencies by -9.13% YoY in the latest quarter. Therefore, it is not surprising to see improved EBIT margins of 13.3% and net income margins of 17.2% by the next quarter, though still significantly below pre-pandemic levels of 24.5% and 30.1%.

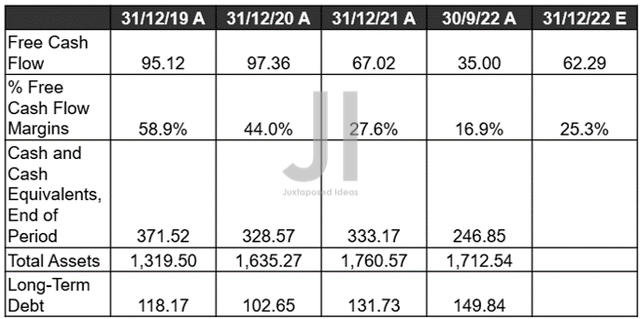

BABA Cash/ Equivalents, FCF (in billion Yuan) %, Debt, and Assets

Even though there is a $1B fine ANT Group overhang from the government, we are not worried at all, since BABA continues to boast excellent cash and equivalents of 246.85B Yuan or the equivalent of $34.7B in FQ2’23. Furthermore, market analysts expect the company to record a more than decent Free Cash Flow [FCF] generation of 62.29B Yuan and margins of 25.3% by the next quarter, indicating its sustained profitability indeed.

One will quickly realize that the Chinese markets are clearly not uninvestable, in comparison to their peers in the US stock market. Naturally, after removing the lens of geopolitical bias. Amazon (AMZN) similarly faces an $865M fine from the EU, Alphabet (GOOG) with an $8.68B fine from the EU, Meta (META) with a $277M fine from the EU, and Microsoft (MSFT) with a total of $1.6B of fine from the EU through the past decade. In spite so, AMZN still enjoys an excellent NTM P/E valuation of 63.07x, GOOG 20.24X, META 16.96x, and MSFT 25.34x, while BABA remains depressed at 11.24x. Thereby, pointing to the latter’s geopolitical misfortune.

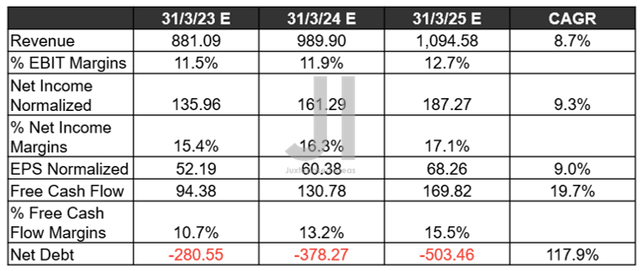

BABA Projected Revenue, Net Income (in billion Yuan) %, EBIT %, EPS, FCF %, and Debt

On the one hand, investors will be disappointed if they are looking for pre-pandemic top and bottom CAGRs of 47.6%/ 31.2%, since BABA’s growth will decelerate further due to the uncertain reopening cadence and slower economic growth. On the other hand, while its margins are not expected to recover to pre-pandemic levels, market analysts are projecting optimistic EBIT/ net income/ FCF margins of 12.7%/ 17.1%/ 15.5% by FY2025. These numbers are notably expanded from 8.2%/16.8%/11.6% in FY2022. We are also looking at an excellent forward EPS of 68.26 Yuan by FY2025, against 52.98 Yuan in FY2020 and 52.69 Yuan in FY2022.

In addition, keen investors must be informed about BABA’s fortress-like balance sheet, due to the stellar projected -503.46B Yuan or the equivalent of -$72.32B in net debts by FY2025 against -$30.48B in FY2020 and -$43.92B in FY2022. Impressive indeed, since its book value per share may also grow tremendously to $71.50 by FY2025, compared to $40.33 in FY2020 and $51.69 in FY2022.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Alibaba: The Black Sheep In A Bear Market

- Alibaba: The Purge Is Finally Here – Jack Ma Says Goodbye To ANT

So, Is BABA Stock A Buy, Sell, Or Hold?

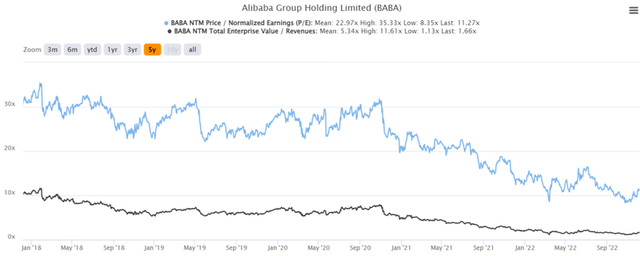

BABA 5Y EV/Revenue and P/E Valuations

BABA is currently trading at an EV/NTM Revenue of 1.66x and NTM P/E of 11.27x, lower than its 5Y mean of 5.34x and 22.97x, respectively. Otherwise, still relatively under-valued based on its YTD mean of 1.69x and 12.22x, respectively. Then again, we expect a certain discount on the previously rich 5Y mean P/E valuations, due to the notable contraction in its margins and growth moving forward. However, these current levels are also admittedly over-pessimistic, due to the worsening world events and China’s chaotic Zero Covid Policy.

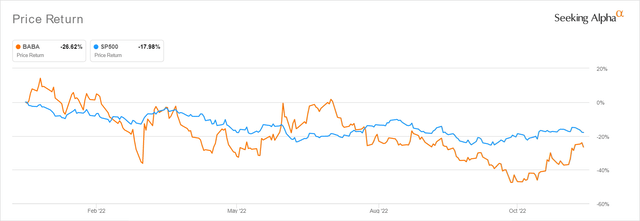

BABA YTD Stock Price

The BABA stock is trading at $88.33, down -36.31% from its 52 weeks high of $138.70. Despite the 52.26% rally from its 52 weeks low of $58.01 in October 2022, consensus estimates remain bullish about its prospects, given their price target of $140.50 and a 55.21% upside from current prices.

Combined with its relatively stellar EPS expansion and potential reopening cadence in China, there is no reason why BABA will not return to its previous glory indeed. Based on the forward EPS of $9.80 in FY2025 and moderate P/E valuations of 17x, we could be looking at an ambitious price target of $166.60.

Therefore, we continue to rate BABA stock as a speculative Buy. The road to China’s pre-pandemic economic levels remains fraught with uphill challenges, further complicated by its supposed “Russian partnership with no limits.” However, no pain lasts forever, and we reckon the same logic applies to China’s geopolitical risk and the Russian-Ukraine war.

Be the first to comment