maybefalse

Sentiment on Chinese stocks remain fragile, with elevated sensitivity to both U.S. and China policy changes amid a simultaneous deterioration in global macroeconomic conditions. As mentioned in our previous coverage on Alibaba Group Holding Limited (NYSE:BABA)(OTCPK:BABAF) stock, China’s “unswerving” adherence to the COVID-Zero policy as well as growing economic pains in the region remain the two biggest drags on the Alibaba stock’s performance, as said factors impact both the company’s fundamental and valuation outlook.

The following analysis will assess the anticipated near-term implications of ongoing macro and policy uncertainties in China on Alibaba’s fundamental performance across its core operations – namely, domestic and international commerce, and cloud-computing services – for the second half of the current calendar year. This is inclusive of the anticipated outcome of the just-finished September-quarter in which Alibaba will be reporting this coming Thursday, as well as what to expect in the current fiscal third quarter for the company.

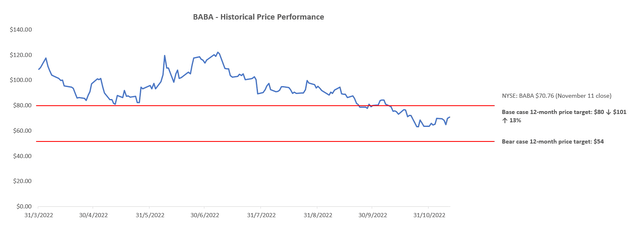

We have also revised the near-term price target (“PT”) for the Alibaba stock to $80 as a result of adjustments made to the company’s near-term growth assumptions in line with current macroeconomic conditions across its core operating regions and segments. While it is likely that most of the downside risks facing Alibaba have already been priced into the stock’s depressed valuation this year, the fragility of investors’ sentiment remains elevated given continued opaqueness of China’s policy agenda regarding COVID controls, private sector regulations, the property sector slump, and intensifying geopolitical tension, among other things. On these considerations, we believe the stock has potential to contest the $50-range again in the bear case scenario.

Core Domestic Commerce

Alibaba’s September-quarter core commerce sales in China like remains muted due to ongoing COVID restrictions that have continued to weigh on the recovery of logistics and supply chain constraints. The added pressure of China’s worsening property crisis has likely deterred consumer end-markets from discretionary spending as well, while intensifying competition in the region’s e-commerce sector has further diluted the pool of retail dollars.

In response to mounting macroeconomic uncertainties, Chinese household savings have climbed to over 30%. This is consistent with the continued deceleration in retail sales observed as of September, which climbed a mere 2.5% compared with 5.4% in August and consensus estimates for 3.3%. While this points to another declining quarter for Alibaba’s core Chinese commerce / customer management results in the September-quarter, we do see a few positive offsetting factors. These include a “successful June 18 Shopping Festival” helped by the brief normalization of logistics capacity in late May, as well as continued resilience of Alibaba’s online grocery and on-demand food delivery (“Ele.me”) sales in the region to support the shift in consumer preference coming out of on-and-off COVID-induced mobility restrictions across the country. Alibaba’s recently completed September-quarter also faces a weaker PY compare versus the June-quarter, which will likely help cushion some of the y/y consumer weakness experienced in China.

Looking ahead, we view the current December quarter as a greater headwind for the stock’s near-term performance. Investors remain fixed on management’s forward guidance in the latest CY/3Q22 earnings season. And Alibaba’s is expected to weaken further. Being already halfway through the fiscal third quarter, Alibaba has faced multiple headwinds on its fundamental performance, including widespread COVID lockdowns across major cities in China that have hampered economic activity, as well as an ongoing property slump that has weighed on consumer sentiment.

Specifically, the annual weeklong National Day holiday that has typically been a strong buying season turned out to be a slump this year. Hopes of a brief reprieve for the retail sector was hampered by government orders to reduce non-essential travel during the weeklong break, as well as COVID-induced lockdown mandates imposed in certain regions given the holiday’s timing-collision with the twice-a-decade Communist Party congress in early October.

A worsening COVID outbreak across China this month has also dwarf hopes of shoring up consumer sentiment during the annual Singles’ Day shopping festival. The rapid spread of COVID infections in China over recent weeks has sent “two-thirds of the country’s 31 provinces, [which] accounted for 47% of the nation’s GDP” into lockdown at the end of October. Some – including core manufacturing hubs Guangzhou and Zhengzhou – have seen mobility restrictions extended into November with no signs of abating anytime soon as new infection case numbers surge.

Alibaba refrained from disclosing this year’s Singles’ Day actual sales results for the first time since the event launched in 2009, fueling speculation that the related transaction volume handled had “suffered an unprecedented decline”. Instead, the company pointed out that gross merchandise value (“GMV”) – the total dollar value of transaction volume handled through its core Chinese e-commerce sites, Taobao and Tmall – during this year’s Singles’ Day was “in line with last year’s GMV performance despite macro challenges and COVID-related impact”. Last year’s Singles’ Day GMV on Alibaba’s platforms totaled more than RMB 540 billion ($76 billion). Yet, it represented the slowest rate of growth in the history of the shopping festival, which along with the company’s disappointing September-quarter results at the time last year sent the stock on a steep intra-day freefall of as much as 12%.

Admittedly, given China’s macroeconomic situation today has worsened since, investors’ low sentiment has accordingly lowered expectations. This is consistent with the stock’s resilient stability observed Monday (November 14th) since the release of management’s commentary over this year’s Singles’ Day shopping event on Alibaba, which has likely been overshadowed by China’s recent efforts in shoring up the economic slump with new policy support for the property sector as well as relief for stringent COVID controls unveiled over the weekend. The positive market response to China’s recent policy shifts continue to underscore heightened sensitivity to the evolution of ongoing COVID-Zero and macroeconomic uncertainties in the region, on top of other regulatory concerns following President Xi’s precedent-breaking third term as leader of the ruling Communist Party.

While the latest injection of policy support for the property sector, as well as adjustments to the country’s COVID restrictions are a welcome relief, it remains too soon to tell if the expected improvements to China’s stalling economy will materialize. Recall the relief rally in March when the central government vowed to stabilize public markets and alleviate its heavy hand on regulatory overhauls over the private sector, which was short-lived as investors failed to see any structural evidence of said promises being materialized nor any related economic relief delivered. We expect similar risks of fizzling gains this time around, especially with authorities reiterating strict adherence to the country’s COVID Zero policy, while cases also remain on a rapid rise. As such, we would not bank of said sentiment relief, and instead remain cautious on a likely soft December-quarter guidance ahead for Alibaba, which will likely inject further volatility in the near-term.

International Commerce

Alibaba’s international commerce operations is where management’s hopes for renewed growth lies, as the domestic market faces several operational challenges. Yet, fraying macroeconomic conditions in the U.S. and Europe, alongside unfavorable value-added tax change implications on imported Chinese goods in the latter region, are dwarfing Alibaba’s hopes of gaining share beyond Asia. Meanwhile, its Southeast-Asia operations via Lazada, as well as South Korea via AliExpress, remain core growth drivers for the international e-commerce segment.

While China exports have recently fallen for the “first time in more than two years” due to the global macroeconomic slowdown on surging inflation and rising recession risks, Southeast Asian demand remains a bright spot. Specifically, exports to Southeast Asia rose by “double-digits for a sixth month” in October, while net Chinese exports fell 0.3% y/y, underperforming consensus estimates for a 4.5% increase. The resilience is expected to bring relief and contribute positively to Alibaba’s shift in focus to growing its international business this year to compensate for the maturing domestic market:

Alibaba has also turned “increasingly outward” by placing additional focus on its globalization strategy. These include bolstering its growth plans for Singapore-based Lazada, Turkey-based Trendyol, and U.S.- and Europe-centric AliExpress. Specifically, for Lazada, which saw tremendous growth in recent quarters, Alibaba aims to quintuple the unit’s gross merchandise value to $100 billion over the longer-term, while also eyeing a potential IPO.

Source: “Alibaba: A True Value Trap.”

The company is also eyeing on expanding its share of e-commerce opportunities in South Korea. Through its core international e-commerce platform AliExpress, Alibaba now makes one of the top five most popular online marketplaces for South Korean shoppers. The company has already invested $7 million to expand its market share of the region’s rapidly growing e-commerce opportunities. South Korean consumers have spent more than $4.5 billion in online purchases this year, up by almost 30% from the prior year. Yet, much of said sales are currently dominated by American sellers (~40% share), including key international rival Amazon (AMZN). Alibaba’s hefty investments in growing its presence in the region are already seeing early signs of positive payoff, with AliExpress’ user count in South Korea having increased by more than 20% in the first nine months of the year compared to the same period in 2021.

While resilient demand in Southeast Asia and South Korea are expected to offset some of the challenges faced by Alibaba’s international e-commerce operations in other key overseas regions like the U.S., Europe and Turkey via AliExpress and Trendyol, said globalization efforts are expected to remain a near-term pressure on the segment’s profit margins. Specifically, Lazada is not yet a profitable platform, but the continuation of its growth in recent years is expected to drive sufficient scale and narrowing losses beginning as soon as the most recently completed September-quarter. Specifically, Alibaba is expected to report its “first y/y expansion in adjusted EBITDA margin since 2019 thanks to narrower losses expected at its online food delivery platform Ele.me and its Southeast Asia arm Lazada.” As the current market climate shifts investors’ preference from growth to profit, we expect materialization of said expansion expectations for Alibaba’s adjusted EBITDA margin during the September-quarter will represent a potential near-term reprieve for the stock’s staggered performance this year.

Alibaba Cloud

Although Alibaba has recently doubled-down on its cloud division investments, fraying U.S.-China relations could stymie the segment’s forward growth aspirations. The segment’s growth has already decelerated significantly over the past year due to fizzling domestic demand as a result of an unfavorable policy backdrop:

The company’s cloud-computing unit, Alicloud, is slowly losing market share to its state-backed peers due to increasing national security concerns within the public sector. The unit’s market share in China fell from 46% in 2019 to 37% in 2021, while state-backed peer Huawei’s cloud market share doubled over the same period. Despite still being the largest public cloud service provider in China, Alicloud is no longer the preferred choice as the Chinese Communist Party heightens calls for data safeguarding within government agencies. This has accordingly led to the elimination of “foreign PCs” within the Chinese government and hastened the migration away from private clouds like Alicloud to state-backed cloud platforms, threatening Alibaba’s consolidated bottom-line performance. This is further corroborated by the deceleration in Alibaba’s highly profitable cloud business observed in the fiscal first quarter – the segment’s revenues only grew 10% y/y, the slowest pace on record.

Source: “Alibaba is Still Not a Buy, Here’s Why.”

Now, Alibaba Cloud’s prospects are getting further squeezed by the U.S.’ increasing efforts on limiting China’s ability in the development of advanced technologies that can be used to assist expansion of its military capabilities. The segment, which had recently committed to “investing $1 billion to support partners’ technology innovation and their market expansion with Alibaba Cloud in the coming three fiscal years,” will likely face additional challenges to its globalization efforts ahead as it finds itself in the middle of a U.S.-China crossfire. On one hand, the company’s expanding cloud computing business is not favored by the Chinese government on national security considerations. Meanwhile, on the other hand, Alibaba Cloud also suffers from regulatory consequences in the U.S. due to its nature as a Chinese company.

As mentioned in our previous coverage on the stock, the newly implemented restrictions levied by the U.S. government on American exports of advanced chip technologies to China introduces significant risks to Alibaba’s aspirations of growing its cloud-computing market share beyond its home market:

Last year, Alibaba introduced a new in-house-developed server processor based on 5nm processing technology, which marked a “milestone in China’s pursuit of semiconductor self-sufficiency.” The company had planned to integrate the in-house developed silicon into its data centers, and potentially commercializing it in the future. However, the only foundries capable of producing chips with the advanced 5nm process today are Taiwan Semiconductor (TSM) and Samsung Electronics (OTCPK:SSNLF / OTCPK:SSNNF) – both of which have been restricted from providing chip manufacturing expertise that is anything more advanced than 16nm technology to China in order to stay compliant with the U.S.’ new rules. This likely means a big part of Alibaba’s growth goals in cloud-computing have been held back.

Source: “Revisiting Why Alibaba is Uninvestable.”

In the latest development, Netherlands-based ASML Holding (ASML) – leading manufacturer of chipmaker equipment – pointed to compensatory demand from markets beyond China that are looking to “build chip plants to prevent future supply issues”. This suggests that China is losing its luster as a key buyer of semiconductor technologies amid growing “geopolitical disruptions in the Chinese semiconductor market,” which inadvertently means Alibaba’s cloud competitiveness on the global scale will remain muted. Companies operating in the U.S. and across allied countries impacted by the new export curbs are already looking to mitigate risks of conducting business in / with China, and diversify its financial exposure to the Chinese market. This will inevitably thwart Alibaba’s efforts in realizing its full potential on capturing global cloud-computing opportunities ahead of ongoing digital transformation trends. Yet, on a positive note, Alibaba Cloud – which includes Alibaba’s DingTalk cloud-based productivity platform – remains profitable for now, which could potentially help partially divert focus from the myriad of operating challenges faced as the segment continues to ramp up deployment of its services towards scale.

Fundamental and Valuation Considerations

While we remain cautious on investing in Alibaba due to both regulatory and macroeconomic uncertainties, we do believe much of the fundamental downside risks have already been priced into the stock’s current levels. Yet, because of the fragility of investors’ sentiment on the prospects of Chinese entities operating under China’s opaque regulatory playbook, with ever-evolving policy changes spanning COVID Zero, and a crackdown of the tech and property sector, among broader macroeconomic implications, volatility remains the theme for the Alibaba stock.

Drawing on the foregoing analysis of key recent developments on the fundamental performance of Alibaba’s core operating segments, we have revised our base case financial forecast for the company. Key assumptions include a conservative five-year sales CAGR of 6.5%, which takes into consideration expectations for moderating domestic growth opportunities amidst intensifying competition, near-term macroeconomic impacts, as well as the Chinese government’s call for “common prosperity” to crackdown on outsized expansion and influence. The downside risks to Alibaba’s forward fundamental performance is expected to be partially offset by potential international market share gains reaching alignment with broader market growth trends across e-commerce primarily, considering there is likely more prominent regulatory roadblocks on the provision of the company’s cloud-computing services due to national security concerns between China and the U.S. and its allies.

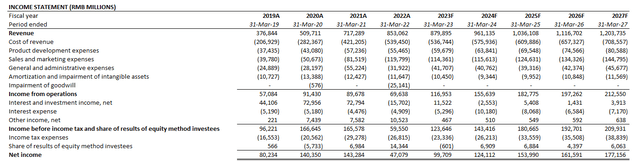

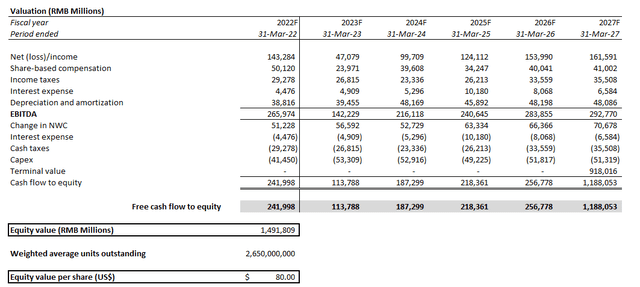

With expectations for profit margins to slightly improve over time, consistent with Alibaba’s historical cost structure, our base case forecast estimates net income of RMB 99.7 billion by the end of fiscal 2023, with growth towards RMB 177.2 billion by fiscal 2027. Paired with the stock’s current valuation multiple adjusted for its forward projections (i.e., about 3x exit EV/EBITDA multiple), which factors into consideration the reasonable near- and longer-term downside risks facing Chinese investments – primarily on the regulatory front – our 12-month PT is at $80.

Alibaba Financial Forecast (Author) Alibaba Base Case PT (Author)

Alibaba_-_Forecasted_Financial_Information.pdf.

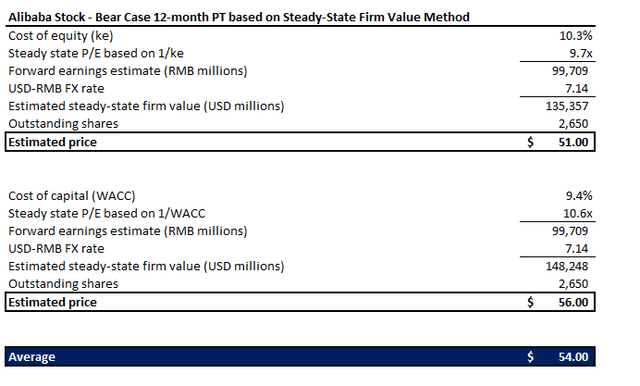

But given continued deterioration in market sentiment over Chinese equities – especially privatized big tech which has been significant victims to China’s common prosperity mandate – it has admittedly become more difficult to gauge the “freefalling bottom” reflective of a compelling risk-reward trade-off. Since Alibaba still runs a viable business with sustained market leadership still in the current operating environment, we have turned to basic valuation theory to gauge the stock’s steady-state firm value when “NOPAT (net operating profit after tax) is sustainable indefinitely and incremental investments will neither add, nor subtract, value.” Specifically, the steady-state firm value denotes a forward P/E ratio equivalent to 1 / firm cost of equity:

A company can continue to grow earnings as it invests at the cost of capital. It will just fail to create value, and hence should trade at its steady-state worth. We can readily translate from the steady-state value to a steady-state price-earnings multiple, which is the reciprocal of the cost of [capital].

Source: Credit Suisse.

In Alibaba’s case, the steady-state P/E ratio should hover around 10.6x based on cost of equity of 10.6x and cost of capital of about 9.4% inclusive of leverage. The multiple yields a steady-state firm value of about $51 to $56 per share, which aligns with support found in the mid- to high-$50 level during late October when the stock last bottomed in response to peak speculation that President Xi’s steadfast commitment to common prosperity with the appointment of a Politburo Standing Committee based on loyalty would point to further regulatory tightening on the private sector.

Alibaba Estimated Steady-State Firm Value (Author)

Yet, the slight rebound since implies positive investors’ interest in the stock still, buoyed by dip-buying activity further fueled by the latest boost in sentiment on an easing policy stance over COVID restrictions and the struggling property sector. However, given China’s policy support – both fiscal and monetary – have time and again failed to bring much structural reversal to the country’s economic downturn, the latest rally may imply a brief stint of cautious optimism only, making the last $50-range sighting a reasonable bear case that could resurface ahead of ongoing turbulence for not just the Alibaba stock but the broader cohort of Chinese equities as investors’ sentiment and global macro conditions deteriorate further.

Is the Alibaba Stock a Buy Before FQ2’23 Earnings?

Trading at forward sales and earnings multiple of 1.5x and 9.3x, respectively, there is a significant discount priced into the Alibaba stock given its additional regulatory and macroeconomic risks compared with U.S. counterparts like Amazon. Considering the base case, which reflects the most conservative expectation on Alibaba’s growth and profitability outlook alongside a muted valuation multiple to account for its risk profile, we agree the stock may be in oversold territory. But given the myriad of moving pieces still on China’s macro and policy outlook, fraying investors’ sentiment could likely expose Alibaba Group Holding Limited stock to further downsides in the near term – even if FQ2’23 earnings stage a better-than-expected showing.

Be the first to comment