maybefalse/iStock Unreleased via Getty Images

Alibaba Group Holding Limited (NYSE:BABA) is an ADR for a variable interest entity (VIE) which receives a portion of Alibaba’s profits. The VIE is a shell company created to allow the company, Alibaba, to access foreign capital while circumventing regulations regarding foreign ownership. Alibaba and many other Chinese companies use this method to circumvent Chinese Communist Party (CCP) regulations. This relationship means BABA investors do not actually own portions of Alibaba. This applies to most other Chinese “stocks” listed on US exchanges. The legality of VIEs are a risk to investors – if the CCP decides to crack down on VIEs tomorrow the ADR selloff will end when the “shares” are worthless.

BABA suffered an enormous drawdown over the last year due to concerns of the CCP’s stance on VIEs and foreign investment. Then, on March 16, the CCP promised to support the market and BABA jumped 36%, one of many Chinese “stocks” which surged that day. There are many arguments for going either long or short BABA. I will not discuss BABA’s fundamentals as a business because there is no shortage of such discussion elsewhere. The most important takeaway for investors should be that Chinese companies will never be separated from the Party. As such, I believe the best way to approach BABA (and most Chinese ADRs) is through holding long dated calls and puts – a long volatility position with little initial directional bias.

The Risks of the CCP

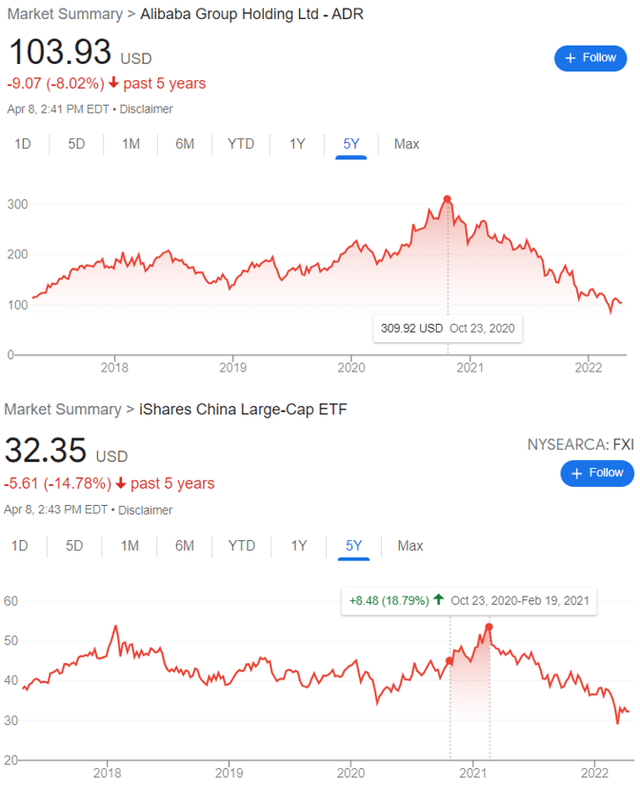

BABA’s risks (both upside and downside) are numerous because of the unpredictability of the CCP. They are often characterized as not playing by the rules or only upholding agreements when it suits CCP interests. The CCP also demonstrates a ruthlessness in squashing serious dissent which threatens their authority. For example, the high-profile disappearance of Jack Ma last year shocked the world. Jack Ma made his critical remarks of the CCP on October 24, 2020. BABA’s massive decline began that day while the iShares China Large-Cap ETF (FXI) rose 18.8% for another four months.

(Source: Google Finance)

China’s growing state of antagonism with the US and the West should also be concerning. The Russian invasion of Ukraine and subsequent Western sanctions have already accelerated the world’s divide along authoritarian and liberal-democratic lines. Investors should acknowledge the possibility that China’s response to serious future conflict could be very costly to ADR owners.

On the other hand, talks of a “China put” has emerged since the CCP promised to support its markets. Of course, this news was immensely positive for Chinese stocks. But even if the put is real for the Chinese economy, it would still be worthless to ADR owners if the CCP decides VIEs are illegal. On the other hand, suppose they declared VIEs legal and made promises that Chinese companies could access foreign capital. That would surely cause a surge in Chinese “stocks.” It seems to many Western investors this would eventually be the natural response, so they hold BABA and other Chinese ADRs with this “long-term investment horizon” in mind. Others view Chinese investment as unfavorable because of a myriad of personal issues with CCP actions, so they are either short or choose not to touch it altogether.

What investors should take away regarding China is not what would happen to Chinese “stocks” if the CCP does something, but rather that an extreme amount of unpredictability which is enormously consequential to both upward and downward movements always exists.

Why the Options Play Makes the Most Sense

Options protect the owner from movement in one direction. Owning both calls and puts is a bet that some large movement will occur. This is exactly the case with BABA: we expect some big move, but we are unsure about its direction. The price one would pay to make this bet is determined by one’s expectation for the volatility of BABA.

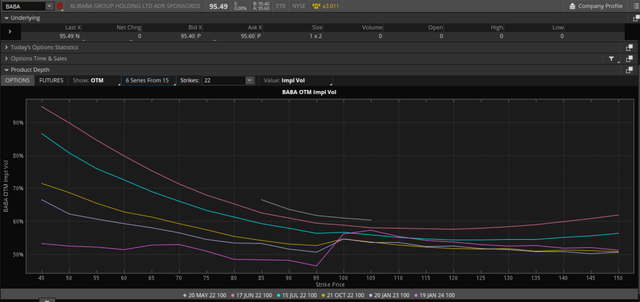

The option market’s implied volatility (IV) indicates the market’s collective expectation of volatility. Today, BABA’s IV skews indicate that longer dated options have far lower expectations of volatility than shorter dated options. With a share price of $95.49, the $95 strike put expiring January 2024 (643 days) has an IV of 46.4% while the $95 strike put expiring in a month has an IV of 61.7%.

BABA IV skews by expiration (TD Ameritrade)

(Source: TD Ameritrade Options Product Depth feature)

At the height of BABA’s price (October 23, 2020), the options which expired in 602 days had much lower IV. The entire curve has shifted up by about 40%. A 10% OTM call option used to have an IV of 41% and now has an IV of 57%. A 10% OTM put option used to have an IV of 34% and now has an IV of 48%. (Note: A 10% move in BABA on October 2020 was about $31, a 10% move in BABA now is about $10).

BABA option chain October 2020 (TD Ameritrade)

(Source: TD Ameritrade ThinkBack)

Broadly summarized, option traders now see BABA as 40% more risky than they had back in October 2020. Given all the CCP-related issues which have materialized since then, an increased risk expectation makes sense. However, 40% more risky is likely understating things.

China’s issues are beginning to appear because intervention like that of the CCP’s will always lead to suboptimal allocations of resources. Economics very clearly demonstrates the superiority free markets have in efficient allocation. For years, Western investors have assumed that China’s state-run economy use capitalist principles while remaining communist in name only. The reality is very different.

The Party’s main goal is to stay in power, like any other autocratic regime. Usually, the welfare of the Chinese people and the health of Chinese markets are consistent with this goal. Therefore, China’s GDP has increased substantially since Deng Xiaoping. However, when leaders of large corporations appear to defy the Party, this is considered unacceptable. This was BABA’s situation in October 2020 when Jack Ma first spoke out against the CCP.

Domestically, the potential for volatility has only increased. China has a prominent wealth gap and widespread corruption. The state-backed economy finances projects which destroy value. Useless real estate development have resulted in ghost cities which do nothing but inflate GDP figures. The impact of the birth rate regulations like the one-child and two-child policies will also be felt as the Chinese population becomes predominantly unproductive elderly. In a bid to maintain the appearance of strength, the CCP threatens Taiwan while accusing the US of problems like COVID-19. This leads to foreign-based catalysts for volatility.

As such, I think the 40% increase from October 2020 is too small considering what lies ahead. Alibaba is a great company considering its fundamentals from a Western perspective. But Alibaba the company is not nearly the most important entity when considering a BABA investment – that role belongs exclusively to the CCP.

If we remember that the CCP’s goal is to stay in power, BABA investing becomes straightforward. It is hard to stay in power with lies when the truth will always materialize. It is hard to create value when people cannot express themselves. In the meantime, Party actions drive price movements and options win from volatility.

The Trade

Owning the longest dated options with lower IVs on the curve is the best way to trade BABA. Right now, this looks like $95 strike puts and $150 strike calls. A true bet on volatility requires the continuous dynamic hedging of options. A trader would be long or short shares such that the delta of the shares plus the total delta from the options would be equal to 0. The number of shares is constantly readjusted to ensure this is true. Under this process, long options will cause shares to be bought when price falls and shares to be sold when price rises – ensuring the trader buys low and sells high. Thus, the volatility of the price is profitable to a trader who is hedging a long option position. The opposite is true for short options. One could do this for BABA – long calls and puts while ensuring at the end of each day the total delta equals 0. This would be a more textbook-accurate way to bet on the understatement of IV. Simply owning the options would be a riskier bet, but it would still be valid if one believes that the CCP’s unpredictability will persist.

Be the first to comment