Andrew Burton

Shortly after my article about the challenges that Alibaba’s (NYSE:BABA) core commerce business faces was published last week, news broke out that the Chinese regulators are about to fine its subsidiary Ant Group, in which it has a 33% ownership stake, for over $1 billion. If that’s going to be the case then there’s a high chance that this would lead to the end of the regulatory overhaul that started in late 2020 and resulted in Alibaba losing billions in value. Even though this would also mean that Ant Group could finally apply for a financial holding company license and file for an IPO later, there’s still a risk that Beijing’s interference in its affairs is not going to stop anytime soon.

Ant Group’s valuation has already been significantly trimmed in recent months due to the regulatory risks, and its latest profit plunge, which has negatively affected Alibaba’s bottom-line performance in Q2, shows that the subsidiary’s competitive advantages have waned amid the rising competition not just from the other private actors but from the Chinese state itself. Add to this the fact that the latest movement curbs caused by the resurgence of Covid-19 in various regions within the mainland along with the weak state of the Chinese economy and a devalued yuan would continue to harm Ant Group’s business, and it becomes obvious that the improvement of the subsidiary’s fundamentals is nowhere near in sight.

As a result, Ant Group is unlikely to help Alibaba improve its overall performance and boost the prices of its shares anytime soon, while the news about the potential fine along with the end of the regulatory overhaul shouldn’t be considered as an extremely positive development for both businesses.

Don’t Get Too Excited Too Soon

One of the main arguments of Alibaba bulls about the news of a potential end of the regulatory overhaul of Ant Group is based on the idea that this would help the subsidiary avoid the wrath of the regulators and return to business as usual. However, we shouldn’t forget that Alibaba itself was fined a record $2.75 billion back at the beginning of 2021, and yet it didn’t stop Beijing from continuing to interfere in its affairs directly and indirectly, while its stock depreciates to this day.

Therefore, it’s safe to assume that the same thing would happen to Ant Group as well. On top of that, the same sources that leaked the news about an over $1 billion fine say that the verdict will come out as soon as Q2’23, which indicates that Ant Group would continue to be under regulatory oversight for the next half a year at the very least.

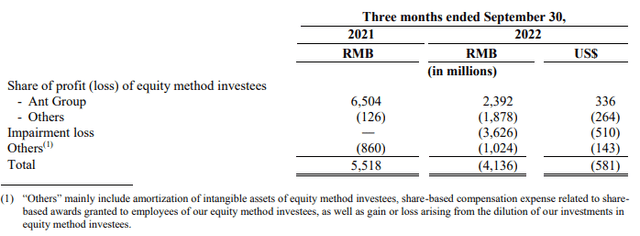

What’s also important to mention is that Ant Group itself doesn’t have as much profit generation capabilities as it did two years ago, which makes the subsidiary less valuable to Alibaba than before. Alibaba’s own Q2 earnings report, which was released earlier this month, showed that its stake in Ant Group generated only RMB2.39 billion in profits during the quarter against RMB6.5 billion in profits a year ago.

Alibaba’s Share of Results of Equity Method Investees (Alibaba)

At the same time, just like Alibaba, And Group also suffers from the recent decision of Beijing to devalue the yuan in order to revive its export-oriented economy. Alibaba’s Y/Y decline in profits from its share in Ant Group in the latest quarter was greater in USD than in RMB due to the fluctuating exchange rate that favors the exporters rather than the domestic-oriented businesses. Considering that Beijing recently imposed additional movement curbs to stop the spread of Covid-19 in the capital city along with other regions, it becomes obvious that the further devaluation of the yuan is a matter of time since it’s one of a few major things that ease the decline of the Chinese economy, which is caused by the zero-Covid policy.

As Ant Group along with Alibaba continue to lose their competitive advantages due to the direct and indirect interferences of the state to this day, it’s hard to see how a potential $1 billion fine is going to improve things in the foreseeable future.

An Existential Threat Is On A Horizon

Another thing that we need to understand is that even if Beijing fully backs off and stops directly interfering in Ant Group affairs, the company would still face an existential risk that’s coming from the state itself. For years, Beijing has been eager on scaling the use of its own central bank digital currency called digital yuan, which is a direct competitor of Ant Group’s cash cow Alipay app. A month ago, I’ve already explained how Ant Group along with Tencent (OTCPK:TCEHY) are more than likely to lose their duopoly in the digital payments space in China, as the rise of the digital yuan along with the digital yuan app are eroding their advantages and making Chinese citizens use the state-backed digital currency directly without the need for third parties.

The latest data shows that transactions using China’s digital yuan already surpassed 100 billion yuan, while at the end of last year around one-fifth of the Chinese population already had digital yuan wallets. In addition to that, the deputy governor of the People’s Bank of China recently has been talking about the need to standardize payment QR codes, which have been pioneered by Ant Group a decade ago and are used in the peer-to-peer and merchant-to-peer transactions to facilitate payments.

At this stage, it’s safe to assume that the unification of those QR codes is a matter of time, as it’ll help Beijing to drastically scale the use of digital yuan and take away any incentive for users to use Alipay in the future. That’s why it’s safe to assume that Alipay is running on borrowed time and could become irrelevant in the next few years when the digital yuan exits a trial period and becomes fully integrated within all areas of Chinese society.

Those developments would undoubtedly negatively affect the ability of Ant Group to create additional shareholder value in the future and make Alibaba’s stake in it even less attractive than it’s today. Ant Group’s valuation has already been cut more in half after the Chinese authorities blocked the IPO, and as regulatory overhaul is not over yet while the digital yuan continues to gain traction thanks to the help from the state, it’s hard to see how Ant Group would be able to recover from all of this anytime soon.

The Bottom Line

In the past, Alibaba’s stake in Ant Group has been able to constantly generate profits on a quarterly basis and help the former to improve its overall bottom-line performance. However, Ant Group’s latest decrease in profits along with weak growth prospects signal that that era is coming to an end.

On top of that, the regulatory overhaul of Ant Group is not over yet, and even in the case of a potential settlement, nothing is going to stop Beijing from continuing to interfere in the business’s affairs directly or indirectly, as it’s currently the case with Alibaba. Therefore, I wouldn’t consider the latest developments surrounding Ant Group as something positive, as the business is likely to pay over $1 billion as a fine, and would still continue to face an existential threat from the state-backed digital yuan.

That’s why I stick with my opinion that Alibaba along with other Chinese stocks continue to be uninvestable in the current environment where all the shots are called not at the meetings of the board of directors, but in Beijing by the CCP.

Be the first to comment