JamesBrey/iStock via Getty Images

Co-Produced With Treading Softly

When I was a child or even a young man, I had a bad habit of leaving the lights on. I’d turn them on when entering a room and forget to turn them off.

My father used to ask the timeless question of fathers to their children:

Do you own the power company or something? Turn off the lights!

Fast forward many years, and one of my earliest stock purchases was my parents’ local utility. Why yes, Dad, I do own the power company.

Now I’m the father turning off lights that I didn’t turn on. I recently saw a meme going around social media that was a son asking his father questions. One was:

Son: Dad, how will I know that I’ve become a dad? Dad: You know when you spend all your time turning off lights you didn’t turn on.

Today, I want to talk about a utility company. It’s not something we frequently discuss. Why? Mainly because utilities often fall outside of the target yield for our HDO Model Portfolio. Most utilities appeal to dividend growth investors. Low yields, steady growth vs. our high yield today focus

We want to look more closely at one utility in particular: Algonquin Power & Utilities Corp. (NYSE:AQN) and a unique investment that offers high yield immediately and exposure to future capital gains.

A Brief Background

AQN has its humble beginnings in 1988 as four smaller companies came together to form AQN. They focused on hydroelectric power projects within Ontario, Canada. They stayed small and Canadian for 13 years until they decided to move into the United States.

In 2001 they bought a water and wastewater regulated utility in Arizona, this soon saw them buy other small and similar regulated water utilities throughout Texas, Missouri, and Illinois.

By 2017, multiple acquisitions later, AQN was now involved in both regulated and non-regulated utilities. AQN operates with Liberty Utilities – its regulated business arm, Liberty Power – its renewable energy division, and Algonquin power. AQN had diversified from hydroelectric and water utilities into natural gas power generation, building solar energy farms and wind power facilities, and operating multiple transmission utilities with a footprint across the U.S. and Canada.

AQN bought a 41% ownership stake in Atlantica Sustainable Infrastructure (AY). AY operates large regulated renewable energy assets in Europe as well as multiple “sustainable” infrastructure assets in the U.S. and Canada.

AQN also expanded internationally with an electric utility in Bermuda and a water/wastewater utility in Chile.

Growing Earnings and Dividend

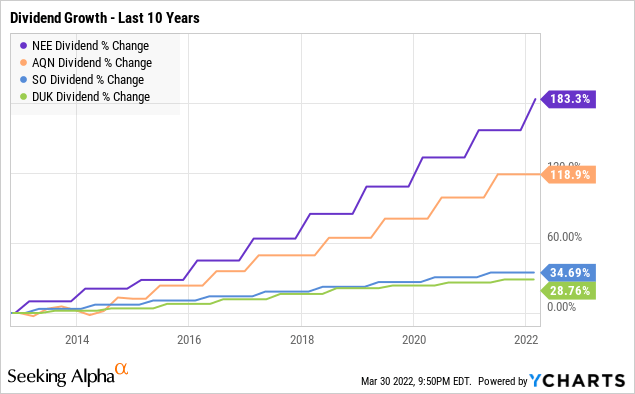

AQN stands above its peers in its ability to rapidly grow its dividend

When compared to a bundle of well-known utilities, such as Duke (DUK), Southern Co (SO), and NextEra Energy (NEE), only NEE has grown its dividend more over the last ten years. To put this into perspective, NEE yields only 2% vs. AQN’s 4.5%. So while impressive, NEE’s growth leaves much to be desired with such low current yields.

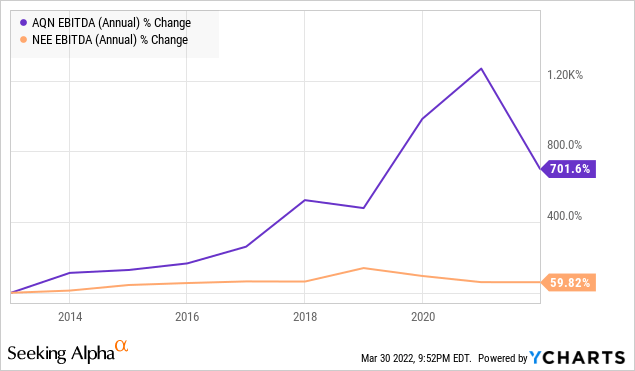

Using the best two utilities in the group, we can see that over the past ten years, AQN has rapidly outgrown NEE in EBITDA.

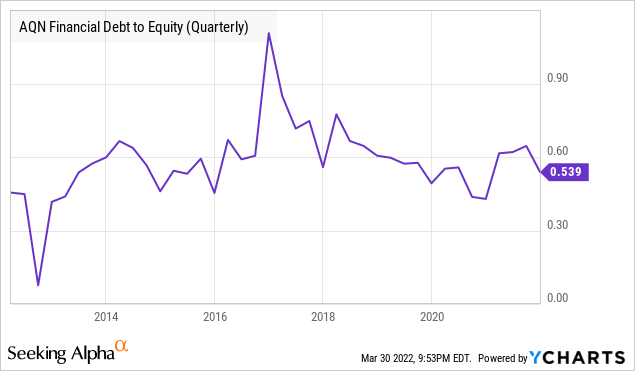

AQN has been exceptionally active in empire-building via share issuance and debt. We can see how their leverage ratio as measured by debt/equity has spiked up as they buy and the trend back down.

With the completion of their latest 4 purchases – Bermuda power, New York American Water, the water/wastewater assets in Chile, and Kentucky Power (set to close 2H of 2022) – AQN will need to take time to absorb these assets and reduce their expenses tied to them. We can expect them to take some time and reduce leverage before expanding more in a year or two.

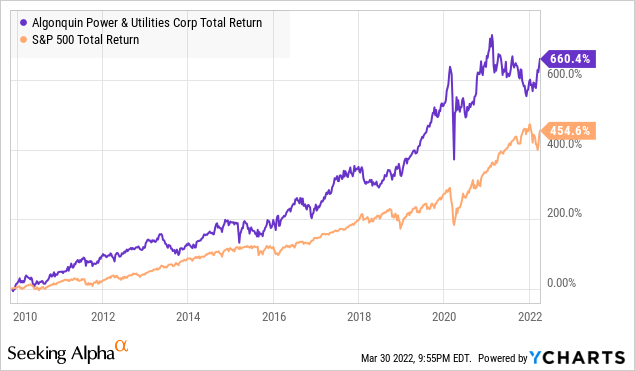

This expansion is a major reason why AQN’s common equity has performed extremely well:

AQN is a growing utility company, taking advantage of its growing economies of scale to consolidate smaller peers. This strategy has richly rewarded shareholders over the past 10 years and will continue to reward them. However, there is one problem with AQN – the yield is only 4%. If that yield were doubled, we would love to buy it.

Turning 4% Yield into 8%

While 4% is outside of our target Model Portfolio yield, 8% fits in nicely. How can we turn AQN’s yield into something nearly double it?

It doesn’t involve using a ton of margin and levering up our portfolio, in case you were worried! It involves looking to the other routes of investing into AQN.

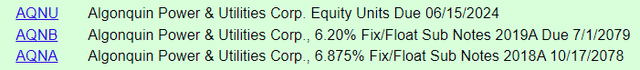

As AQN has grown they have issued a number of securities to finance their growth. This involves bonds, green bonds, baby bonds, preferreds, and even equity units. (Source: Quantumonline)

AQNA and AQNB are both baby bonds trading with a yield in the 6% range. While definitely more attractive than 4%, we want something a little better for our portfolio.

This leaves us with Algonquin Power & Utilities Corp. Equity Units Due 06/15/2024 (NYSE:AQNU). These equity units are PAR $50 and pay distributions quarterly.

When you purchase equity units, you are getting 2 parts:

- 1/20 ownership of a bond issued by AQN – yielding 1.18%

- A contract to buy common shares of AQN on 6/15/2024

As of this writing, AQNU yields just under 8.0%. This yield is comprised of a bond paying interest at 1.18% and a “contract adjustment” rate of 6.57% (for a 7.75% total). Our yield is higher because AQNU is trading hands below its $50 par.

When the contract date approaches, AQN will resell your bond holdings to pay for your purchase of the common shares. Your AQNU shares will be swapped to AQN shares. The conversion ratio is laid out in AQNU’s prospectus:

The stock purchase settlement rate will be 2.7778 shares per unit if the then current market price is equal to or greater than $18.00 and 3.3333 shares per unit if the market price is equal to or less than $15.00. For market prices between those values the settlement rate will be $50 divided by the market value

Currently, AQN trades hands for $15.50, so one share of AQNU will convert to 3.23 shares of AQN. AQNU is trading at a small discount to par while yielding almost 8%!

Furthermore, as AQN raises its common dividend, we will get that dividend once converted from AQNU into AQN shares.

Equity Units allow utilities to fund growth and not massively dilute their common shareholders until that growth has been fully integrated into their earnings. AQNU is a $1 billion offering, meaning its conversion will increase AQN’s share count by approximately 10%.

AQN pays $209 million in interest annually and their 2021 Adjusted EBITDA was a hair over $1 billion, leaving them plenty of coverage to pay AQNU without risks. AQNU investors can have confidence that the company can comfortably make the interest payments, ensuring they are getting paid while waiting for the conversion.

Note that since the “dividends” for AQNU are derived from the interest on the bond and the purchase contract, it will be treated as interest income for tax purposes. Additionally, the bond ranks equal in seniority with AQN’s other senior unsecured debt, providing additional protection for investors. AQNU is rated BB+ by S&P.

On many websites, we have observed that the dividend is not reported accurately. AQNU pays $0.96875 quarterly in U.S. dollars, which is $3.875/year. The misreporting has led to some significantly lower yields being reported which might be why it is such a good price!

Shutterstock

Conclusion

Buying AQNU from Algonquin provides us with strong immediate income from a rapidly growing utility company. The great thing about owning utilities is that they have monopolies in their areas and are allowed to see profits from their investments and upgrades by regulators. They have relatively stable cash-flows in any economic environment, making them great defensive investments for income investors. AQN has a long history of buying smaller utilities, creating long-term value, and passing that value onto shareholders. This empire-building creates an opportunity for share price and dividend growth in the future.

With AQNU, we receive a much higher yield until June 2024, knowing we will be converted into common shares of AQN and receive a smaller but growing dividend in that time. We have some risk exposure to the price swings of AQN’s common shares as AQNU does have a sliding conversion ratio, but if AQN’s shares rise sharply over the next two years, we will see capital gains. We get the benefits of a fixed-income investment today and the benefits of a common equity investment in the future.

These are the kind of investments retirees dream of:

- High current yield

- Low-risk asset base in a regulated monopoly

- Long history of growth and exceptional management

Finding high-yield fixed-income opportunities doesn’t take crazy risk-taking or voodoo magic. It takes patience and the willingness to jump when opportunities arrive. Now it’s your turn to dive in.

Be the first to comment