vitranc

Boise Cascade (NYSE:BCC) will begin to see normalization in their top and bottom lines at the hands of commodity pricing and the housing industry slowdown. However, recent market pulldowns and an exciting new acquisition of Coastal Plywood position this stock to appreciate in value over the short and medium term while the company still enjoys their market-leader position.

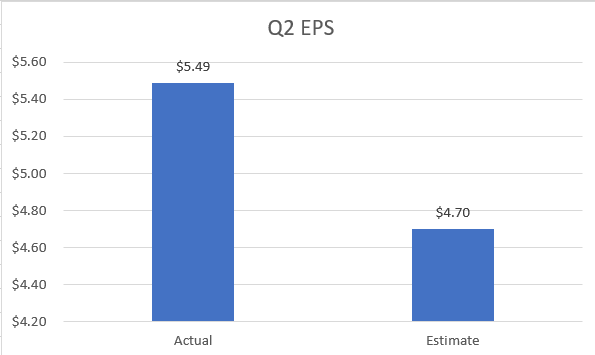

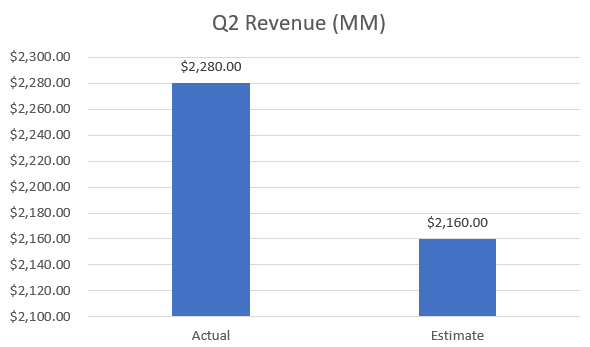

My method of analysis rests in looking at the past two earnings calls of companies and seeing what changed vs. what stayed the same. I’ll then talk about what those similarities and differences mean for the stock going forward as well as how it plays into my valuation of the company through a DCF/3-Statement Model. First, some quick earnings numbers:

Seeking Alpha Financials Seeking Alpha Financials

What Stayed the Same from Q1 to Q2

Pricing Dynamics

Across the last two earnings calls, price developments have been relatively consistent with many areas of Boise Cascade’s business. This is both a positive and negative for the stock due to price trends going in different directions for a few products. Most notably to the downside, plywood prices at the end of each quarter have been much lower than the previous.

In the Q1 call management stated that their current plywood price realization was 12% below their Q1 average. Similarly, leadership in the Q2 call said their plywood price realization so far in Q3 was 17% below the Q2 average. Compounding this together we can get a grasp of how much lower current plywood prices are compared to the peak at the end of Q1. According to the call, Q1 average pricing was at $689 per 1000 and Q2 was at $569 per 1000. As stated above, QTD pricing for this quarter is 17% below that $569 number- leaving current levels at an estimated $472 per 1000. This marks a 31.5% decline from Q1 numbers.

Clearly, such pricing declines will get a hold of precious margins. We can see how such developments can affect the financials of the company further by looking at why the Wood Products division had large sequential EBITDA decline from Q1 to Q2: $227.9 million to $167.8 million. The primary call out for this decline was attributed to plywood pricing declines and is a testament to how swiftly earnings can swing as a result of volatile commodity pricing- especially considering plywood in particular makes up 34% of the Wood Products segment’s sales and a respectable portion of the company’s other, larger segment as well. Unless there are other offsetting levers that can give earnings a nice boost throughout the rest of the quarter, the already lower plywood prices being seen in Q3 will likely follow with sequential earnings declines.

Although the market has had time to digest this, further declines (or increases) will surely be mirrored with respective downswings or upswings in stock valuation. In short, it goes with the territory that a company dealing with volatile commodities likewise has a stock that is subject to equal fluctuations. Many investors have a hard time handling this short-term uncertainty and don’t feel comfortable pulling the trigger to invest in the stock. If you fall into this risk-averse camp I would caution to monitor this pricing closely as we surely still have volatile times ahead of us in the commodity markets.

What Changed from Q1 to Q2

M&A Activity

Mergers and acquisitions are a great way to boost top line growth, expand geographic reach, and lift production capacity. In their Q1 earnings call, Boise Cascade touched on its goal of expanding not just through organic growth, but inorganic as well. Although unwilling to comment on specifics, this call cited a top priority regarding acquisitions/production expansion was through increasing veneer capabilities, closely followed by exploring opportunities surrounding mass timber. Sure enough, by the time the Q2 call came around, the company had announced its acquisition of Coastal Plywood Company. This $517 million all cash purchase brings to Boise Cascade’s portfolio two plywood manufacturing locations, which should increase that product’s capacity 34% by the end of ’23 from ’21 levels.

With a business that has really grown over the last couple years on the back of strong pricing and a sound macro-environment, I like seeing the company looking to achieve some balance on the PVM side of things. Price is an extremely effective yet sometimes unreliable component to top and bottom line growth, and as can be seen with plywood pricing, the macro-environment for wood-related products is seeing incredibly volatile times. Volume, especially with the company believing the medium and long-term demand outlook for housing remains strong, can be a more reliable way to grow the business. Certainly the company can benefit in the near term with higher levels of volume capability coupled with still historically-high product pricing. There’s plenty of more benefits to this acquisition than strictly volume, such as increasing geographic footprint in the South (57% of ’21 U.S. single family housing starts) and improved mix, but I’m a big fan of the stock expanding production volume capability after several quarters of seeing a broad price tailwind.

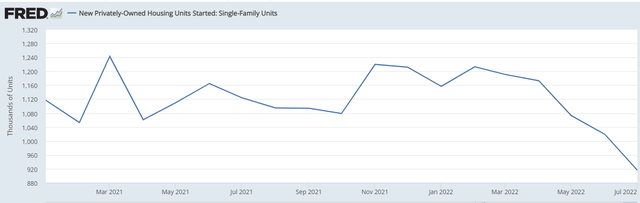

Housing Starts Backdrop

In each call, leadership gives a very brief update on housing starts and how they contribute to the growth of the company. In Q1, their prepared remarks stated that U.S. housing starts improved 10% YoY, with single family starts being the primary contributor to the 4% sales volume increase. Things changed quite a bit heading into Q2, with the company now saying single family housing starts were down 3% with sales volume decreasing along with it. Even as we exit Q2 and look what happened in the most recent month, we see that housing starts dropped 9.6% from June to July. It’s safe to say a trend is forming.

Let’s dig into what trends are driving this reversal and how housing starts look in future months. The lowest hanging fruits are that inflation is still running high and housing prices are just coming off all-time levels. This combination creates an expensive situation for any buyer, who is paying a lot of money for property regardless if it be for raw materials to build a house or for the finished property itself. Rising interest rates, thus affecting mortgage rates, have also contributed to the affordability issue- leading to a decline in existing home sales for six months straight. These levers are leading to a downward trend in housing starts – a metric that a lot of Boise Cascade’s revenue relies on. As we look to future months, there is not a lot of promise of starts returning any time soon. Powell retained a hawkish stance and sent shockwaves throughout financial markets in the most recent meeting, dashing any hopes of a pivot in policy even amid slowing inflation. Future rises in interest rates are likely to be met with further drops in housing starts, and because of this, I think there is a strong chance Boise Cascade’s stock remains volatile in the near term. With that being said, we can’t throw investing in the stock out of the equation if we can still get it at a fair price.

What This All Means for BCC’s Valuation

As mentioned in the intro of my article, I derive my share price targets from a discounted cash flow model that is driven by a full three-statement model for each company I analyze. At a high level, here are some assumptions for 2022 and beyond I gained from each earnings call that is input into my models.

1. The company has yet to provide margin guidance for 2022, so unlike my previous articles where my model could be tied to a concrete profit margin number for the upcoming year, that cannot be the case. Instead, I will be tying to 2022 and 2023 consensus EPS estimates for the year, which most recently stood at $19.76 for 2022 and $8.57 for 2023. The last time I updated my model, these numbers were $15.07 and $8.88, respectively. So overall, these changes led to some upside in the valuation.

2. Prior to this model being updated, my assumptions were that there will be no revenue growth in 2022 and 2023 will see a YoY decrease. My logic here lied in the assumption that commodity markets would normalize and BCC will face headwinds in terms of both revenue and profits as this correction takes place. With several months of actuals underway, Wall Street has revised their revenue estimates for the company over the next couple of years. In each of the next three years, my original revenue percent growth was 0%, -5%, and 3%. With updated figures, these numbers have changed to 6%, -10%, and 5%. The total dollar value of this upward revision is ~$800k across the three years.

3. CapEx guidance for 2022 in both the Q3 and Q4 2021 calls was between $110 and $130 million. I have adjusted the capex as a % of revenue in my three statement model so that 2022 annual capital expenditures fall in between the new range they provided: between $100 and $120 million. This decrease had a slight positive impact in the DCF model.

4. Rates have risen since the last time I published an article about this stock. Back when I wrote earlier this year, the 10-year was hovering around 2.7%. After another recent bump up, the number I’m using for my model is 3.1%, ultimately driving down the price estimate of the stock.

5. The last major change for the model was the acquisition of Coastal Plywood. The company funded the purchase with $517 million of all cash, hurting near term cashflow which lowers the valuation as a consequence. Any synergies or revenue growth as a result of the acquisition would be baked into the revised revenue and EPS estimates derived from consensus estimates.

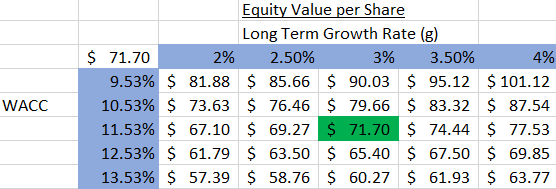

For those familiar with these types of models, there are obviously a lot more assumptions that go into it. In future articles, I plan on digging into my assumptions and what went wrong versus what went right. But to oversimplify everything and provide some numbers, here is a snippet of a valuation sensitivity table with a range of WACC (Weighted Average Cost of Capital) and Long-term growth rate assumptions (both very important for the terminal value of a DCF).

Personal Financial Model

A few notes about the inner workings of my model and DCFs in general. A DCF sums the present value of all future years’ cash flows. There are two periods we project unlevered free cash flow for. The first stage is your forecast period, which for this model is 5 years. The stage one cash flows are ultimately determined by various assumptions such as revenue growth rate and profit margins, among other things. These 5 years of free cash flows are then discounted by some factor to get the present value of each and then summed together. For Boise Cascade, the sum of its present valued cash flows for the next 5 years is $923 million, with the company seeing a gradual decrease in record setting free cash flows from its most recently completed year.

This completes the first half of the enterprise value calculation. The remaining step is to find a way to quantify the present value of all future cash flows after the initial 5-year forecast period. There are a few methods of doing this, but I use the Perpetuity Growth Model. At a high level, this model assumes an infinite long-term growth rate of free cash flows and utilizes this growth rate and Weighted Average Cost of Capital to arrive at the terminal value. This terminal value is then discounted to find the present value, and for BCC, this number is $1.6 billion. Adding this $1.6 billion terminal value of cash flows to the $923 million of stage 1 cash flows brings us to the Enterprise Value of $2.5 billion.

We then need to get to Equity Value, which is obtained by subtracting cash & equivalents from long-term debt to get Net Debt. For BCC, Net Debt is equal to -$303 million (more cash and short term equivalents on the books than long term debt). This number is subtracted from Enterprise Value and leaves us with an Equity Value of $2.8 billion. To get our final share price estimate, take this equity value and divide it by our diluted common shares outstanding (39.375 million) to get an average share price of $71.70.

As mentioned earlier, I will be reviewing particular assumptions and their accuracy (or lack thereof) in future articles when more company actuals are available.

Comps

For reference sake, here are some comparable companies and how Boise Cascade stacks up in regards to some key ratios. Apples to apple comps are impossible to find in any industry, but both Louisiana-Pacific (LPX) and Builders FirstSource (BLDR) are pretty close. BCC seems to be valued on the lower end amongst the group, especially if you put any stake in EV ratios. The stock also trades at a comparatively low earnings multiple while boasting the highest EPS of the peer group. Clearly the sector has been hit pretty hard in the past month, but I view it as a good buying opportunity especially considering the intrinsic value of Boise Cascade.

| BCC | LPX | BLDR | |

| P/E Ratio | 3.15 | 3.25 | 4.05 |

| EPS | $19.80 | $16.40 | $14.48 |

| EV/EBITDA | 1.70 | 2.00 | 3.11 |

| EV/Sales | .24 | 0.80 | 0.57 |

| 1 Month Performance | -10.96% | -16.23% | -18.23% |

Bottom Line

There are certainly shortcomings to primarily analyzing earnings calls, but I believe it can be a very useful tool in a holistic analysis of a stock – especially as wording from executives across these calls can be so strategic and have a deeper meaning than face value. Financial models also rely on forecasts and inputted assumptions, but just like earnings calls, if they are utilized correctly, they can provide valuable insights into the valuation and financial health of a company.

My Discounted Cash Flow valuation model suggests the intrinsic value of Boise Cascade’s stock is $71.70, representing a ~15% upside from the most recent closing price of $62.42.

This new price is sizably lower than my previous target price of $78.46 (it did close as high as $85/share in early June), but the large decline since that peak leaves the stock in a position to be bought at a discount- despite rising rates and profits falling in the near term due to ebbs and flows of the commodity markets. Glancing through my article, I’m sure it becomes clear that short-term trends aren’t heading in the right direction for the company. Housing starts are declining while rising rates are hurting buyer’s affordability along with sequential and YOY pricing drops starting to impact results.

However, I feel comfortable that these negative impacts are conservatively implemented into the model to properly reflect the obstacles the company will face in the future. The acquisition of Coastal Plywood helps the company move into an exciting new chapter in its history and will support the strong cash flow the company has been able to attain. Additionally, the board is very shareholder friendly – providing a healthy supplemental dividend earlier this year on top of its normal dividend payout. Overall Boise Cascade is one of the key players in the Wood Products space, and just because we are seeing and expecting to see further normalization in economic indicators and company profit levels, doesn’t mean we need to turn a blind eye to companies that are undervalued and have healthy medium and long-term economic backdrops.

Be the first to comment