z1b

Markets can be fickle, but it is worth listening to what it’s trying to tell you. For example, stocks that were thought of as being safe only 12 months ago are simply no longer. That’s been the case for so-called growth stocks that were reminiscent of the Nifty 50 decades ago.

For those who are unfamiliar with this term, the Nifty 50 was a collection of growth stocks from a generation ago, in which the market was willing to overpay for, because of their quality and growth attributes. This thesis was proven wrong over the long-run, as those lofty valuations failed to live up to their high expectations.

That’s why it’s better to pay for quality stocks when they are cheaply valued relative to their past performance and which pay a healthy dividend yield to boot. This brings me to the ultra-high quality REIT, Alexandria Real Estate Equities (NYSE:ARE). In this article, I highlight why bargain hunters may want to seek out this gem, so let’s get started.

Why ARE?

Alexandria Real Estate Equities is an S&P 500 company and a REIT with a long operating history since 1984. ARE is focused on owning urban office real estate leased to leading life science and agtech tenants. At present, its asset base includes nearly 41 million rentable square feet of properties that are located in major metropolitan areas such as SF Bay Area, New York City, Greater Boston Area, San Diego, and Research Triangle in North Carolina.

ARE reminds me of VICI Properties (VICI) in the sense that many of its assets are irreplaceable in densely populated urban innovation centers. This is reflected by the fact that it’s in close proximity to major research institutions in the United States. This was done by design, as this gives ARE’s tenants ready access to a pool of highly educated and motivated talent.

Moreover, 50% of ARE’s annual rental revenue comes from either investment grade-rated or large cap publicly traded companies, and ARE counts some big players in its tenant roster. This includes major pharmaceutical companies such as Eli Lilly (LLY), Pfizer (PFE), Merck (MRK), and Bristol Myers Squibb (BMY). As shown below, ARE has produced a 156% total return over the past 10 years, far surpassing the 82% return of the Vanguard Real Estate ETF (VNQ) over the same timeframe.

ARE Total Return (Seeking Alpha)

Meanwhile, ARE boasts one of the highest occupancy rates in the office sector, with a 98.4% occupancy rate (excluding vacancy at recently acquired properties). It also enjoys a relatively long weighted average remaining lease term of 7.1 years (10.2 years for the Top 20 tenants), and a high operating margin of 70%, due to premium pricing that it’s able to charge for its well-located and high-quality properties.

Rent collection is very strong at 99.9%, and demand remains high for ARE’s properties, with a 45.4% (straight line) and 33.9% (cash basis) rental rate increase, representing the second-highest and highest quarterly increases in ARE’s history. Importantly, ARE has built a sterling reputation with its tenants, as 87% of this leasing volume came from existing tenants.

Potential headwinds to ARE include economic weakness as it relates to emerging biotech companies. This could impact the health of some of ARE’s tenants. However, private funding for emerging companies have remained strong, with near record amounts of capital raised in the first half of the year despite talks of a recession. This was highlighted by management during the recent conference call:

While funding has slowed across all industries compared to 2021 due to macro market conditions, venture funds continue to raise historic levels of capital and deploy it at a sustained pace. $30 billion was deployed into private biotechnology companies in the first half of 2022 compared to a record-breaking $39 billion in the first half of 2021, and still up over 50% compared to the first half of 2019 and 2020. Indeed, companies like incoming New York and Bay Area tenant, Icon Therapeutics, with a stellar management team and highly differentiated platform recently raised over $0.5 billion.

This is not to say that investment thesis haven’t shifted. With downward pressure on valuations and are refocusing towards the most innovative companies with experienced management teams, but market resets are ultimately healthy for a sector in the long run as companies are forced to double down in their core strength and talent is diverted to the most promising applications.

Moreover, ARE sports a strong BBB+ rated balance sheet, and pays a respectable 3.4% dividend yield that’s well-covered by a 56% payout ratio (based on Q2 FFO per share of $2.10). The 5-year dividend CAGR has “only” been 6.7%, but that’s because ARE is plowing money into funding its pipeline, which comes to $2 billion of cash flows invested over a 10-year period by the end of this year. As such, I believe patient investors can expect to see more robust dividend increases down the line.

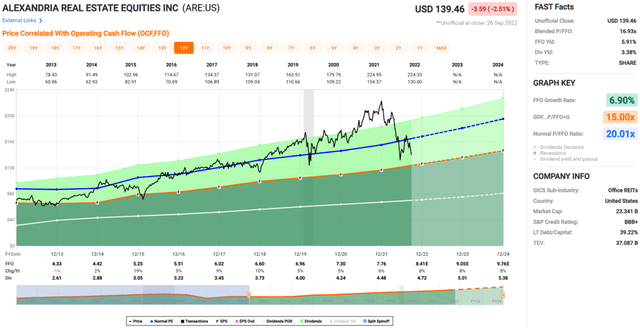

Lastly, ARE appears to be cheap on a relative basis at the current price of $139.46, sitting well below its 52-week high of $225. It also carries a forward P/FFO of 16.6, sitting well below its normal P/FFO of 20 over the past 10 years. Sell side analysts have a consensus Strong Buy rating with an average price target of $197.64. This implies a potential one-year 45% total return including dividends.

ARE Valuation (FAST Graphs)

Investor Takeaway

In summary, I believe ARE is an ultra-quality REIT that’s well positioned to capitalize on the long-term secular tailwinds in the biotechnology space. It boasts a strong portfolio of properties with long-term leases, robust rent collection, and attractive dividend growth potential.

While it’s not immune to macroeconomic headwinds, its strong balance sheet and position in an innovative and high-growth industry gives it a wide margin of safety. For these reasons, I believe ARE is a great long-term investment at the current price.

Be the first to comment