Sean Anthony Eddy

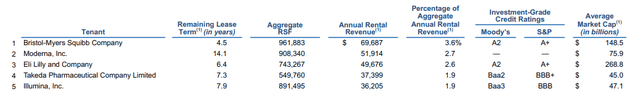

Alexandria Real Estate Equities, Inc. (NYSE:ARE) is a top landlord to the life science industry, with a leading roster of over 1,000 tenants. Among their top tenants are well-known publicly traded companies, such as Bristol-Myers Squibb Company (BMY), Moderna (MRNA), and Eli Lilly and Company (LLY), to name a few.

Q3FY22 Investor Supplement – Summary Of Top Five Tenants

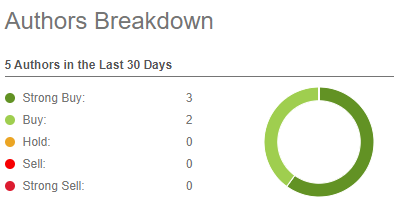

While the company is currently rated as a hold by Seeking Alpha’s (“SA”) quant system, with negative marks on valuation, SA authors and analysts on Wall Street, alike, are equally bullish on the stock, with five SA authors over the past 30 days rating the stock as either a “buy” or a “strong buy.”

Seeking Alpha – Summary Of Author Sentiment On ARE Over Last 30 Days

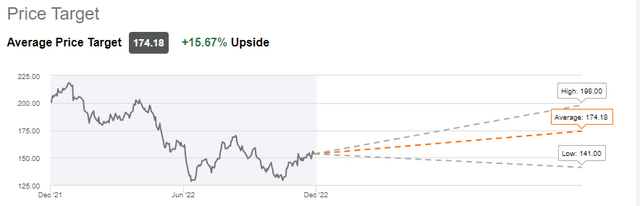

This sentiment is echoed on Wall Street, with an average price target of about $175/share, representing over 15% upside from current trading levels.

Seeking Alpha – Average Wall Street Price Target Of ARE

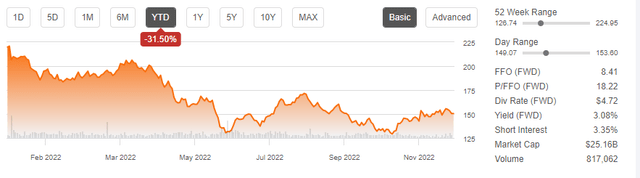

Despite the positive sentiment in the market, shares are down over 30% YTD. This is significantly worse than both the broader S&P 500 and the FTSE NAREIT Equity REIT Index, which is down about 13% and 20% over the same period through November 30.

Seeking Alpha – Current Trading Metrics Of ARE

Despite its underperformance, the company benefits from favorable demand drivers, including a positive industry outlook that is marked by continuing healthcare needs for thousands of diseases with no known cures.

According to management, 90% of known diseases have no available treatment. While significant strides have been made in recent years, the pipeline for further innovation remains robust. And with an average time-to-develop of over 10 years, the growth trajectory for medicinal advancements should remain in-tact regardless of economic conditions.

Sure, a lack of funding could negatively affect the industry, but there have been no signs of stress in this regard. In fact, through Q3, venture funds have raised an all-time high of +$149B, according to management commentary. Even with one quarter left to report on, this is already above 2021 levels, which were itself historic. With adequate funds in hand, this should translate to well-funded private biotech companies for numerous years ahead.

At 18x forward funds from operations (“FFO”), some would cite the elevated multiple as one reason for holding back on investment. But this in it of itself would not encapsulate the true value of the stock. Recent dispositions at exit-rates lower than where shares currently trade provide a more real-time predictive value of the shares. With all this in mind, shares present upside potential of over 20%, in addition to a rock-solid dividend payout that continues to increase at healthy compound growth rates.

ARE’s Key Portfolio Metrics

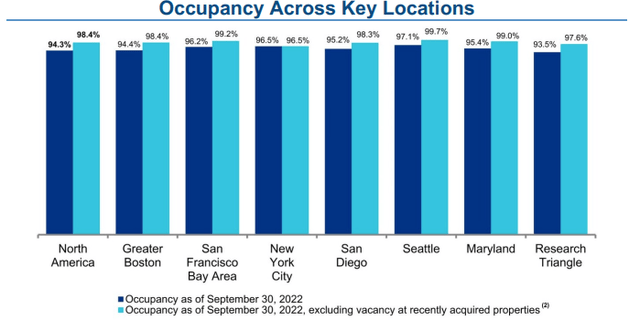

ARE’s portfolio in North America has maintained average occupancy of 96% as of each December 31 for the last ten years and as of September 30, 2022.

And presently, when excluding vacancy at recently acquired properties, overall portfolio occupancy in North America stands at 98.4%, which is 410 basis points (“bps”) above current leased rates, signifying attractive lease-up opportunities on their recently acquired properties.

Q3FY22 Investor Supplement – Summary Of Occupancy Across Key Locations

In addition to strong occupancy levels, the company also benefits from full collection rates on rent, which is a testament to the health of their tenant-base, which numbers over 1,000 tenants.

Furthermore, approximately 50% of total annual revenues is generated from either investment-grade rated or publicly traded large cap companies. This provides an added element of safety to their reoccurring cash flows.

Strong YTD leasing volumes with spreads of over 20%, in addition to a significant development pipeline provide the company with ample runway for continued earnings growth. All considered, the value-creation pipeline is expected to add about +$645M to projected incremental annual rental revenue through the second quarter of 2025.

ARE’s Liquidity And Debt Profile

Supporting their development pipeline is a sizeable liquidity position of +$6.4B and their strong reoccurring operating cash flows, which, after accounting for dividends paid, amounted to +$1.3B retained for reinvestment over the last five years.

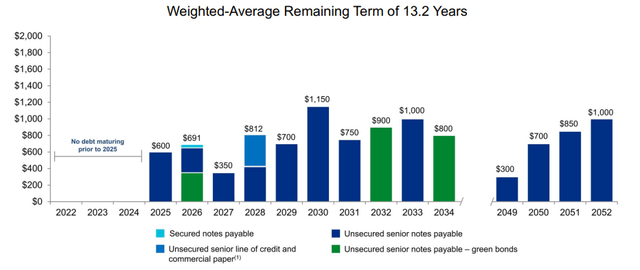

In addition to significant liquidity, the company also has a modest total debt load equating to 5.4x of EBITDA on a net debt basis. Furthermore, their debt ladder is highly accommodative, with no maturities until 2025 at the earliest.

Q3FY22 Investor Supplement – Debt Maturity Schedule

On average, their debt term is over 13 years. And at a 96% weighting to fixed rates, ARE’s exposure to interest rate volatility is limited.

Recent dispositions, despite a challenging transactional market, also lend credence to the company’s ability to generate surplus funds for their capital priorities. In the current quarter, for example, ARE raised over +$1.0B through asset sales, bringing their YTD proceeds to +$2.2B.

Dividend Safety Of ARE

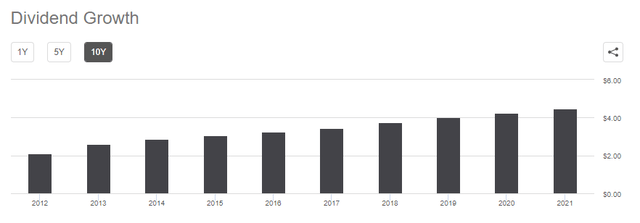

ARE has a strong track record of not only paying dividends but also of growth. Over the last five years, the payout has grown at a compound rate of about 6.5%. And most recently, it was increased 2.5%. Moving forward, the quarterly payout will amount to $1.21/share, which represents an annualized yield of 3.2%.

Seeking Alpha – ARE Dividend Growth History

While the yield likely isn’t high enough for many REIT investors, especially in an environment where risk-free alternatives offer competitive yields, the company makes up for it with their commitment to modest increases.

Furthermore, the continuous increases are a reflection of ARE’s solid financial position and their ability to generate positive operating cash flows. Through nine months of the year, for instance, ARE has generated nearly +$900M in operating cash flows. This is over 1.5x their distributions paid out over the same period.

And as an additional measure of safety, the payout represents a ratio of FFO of just 56%, which is on par with historical averages and better than the sector average of 62%.

Why ARE Is A Buy

ARE continues to maintain strong occupancy levels in both their overall and same-property populations on a roster of over 1,000 tenants. And this is contributing to robust earnings growth that continues to track above 10-year averages. In their same-property population, for example, YTD NOI has grown at 7% and 8.9% on GAAP and cash basis, respectively. This compares favorably to their 10-year average of 3.6% and 6.6%.

In addition, the company’s leasing pipeline remains robust. While management doesn’t expect to see the same level of activity that they did in their record-breaking year in 2021, current figures are still impressive, with overall quarterly volumes still above long-term averages and well above their pre-2021 five-year quarterly average of 1.1M SF.

YTD, volumes stand at 6.4M SF, which is already above their five-year average of 6M SF, despite one more quarter left to be reported on for the year. Furthermore, spreads on these signings are coming in at cash and GAAP spreads of over 20%. And despite these gains, they still have a mark-to-market opportunity of approximately 30%.

For income investors, the company continues to provide a well-covered payout that is backed by a strong track record of growth. Over the last five years, for example, the annual payout has grown at an average rate of 6.5%. Though the yield is likely unappealing to those seeking a high yielding investment, this is offset by the upside potential in the shares.

At present, shares are trading at an implied cap rate of 5.3%, based on an estimated total enterprise value of +$34.919B and total Q3 GAAP annualized NOI of +$1.835B. Yet several recent dispositions were completed at a valuation greater than where shares currently trade. With this in mind, a sub-five cap rate would be more representative of the company’s true value.

At a 4.5% rate, shares would trade lower than the approximately 3.4% cap they fetched at the end of 2021, but they still would have embedded upside of about 24% from current trading levels. That would be enough to recover a sizeable portion of their YTD losses and would bring valuations more in-line with the GAAP exit rates commanded by some of their higher quality assets. For long-term investors, ARE remains worthy of a core position in any REIT-focused portfolio.

Be the first to comment