Jonathan Ross/iStock via Getty Images

Alexander & Baldwin, Inc (“A&B”) (NYSE:ALEX) is a premier commercial real estate (“CRE”) company headquartered in Honolulu, Hawaii with the largest portfolio of grocery-anchored, neighborhood shopping centers in the state.

Their regional market dominance is cemented by the state’s high barriers to entry and geographic isolation from the mainland. Rigorous regulatory requirements for new development on the chain of islands also inhibits supply growth, enabling A&B to remain a preferred landlord to their top tenants, which include Albertsons (ACI) and Sam’s Club, who together account for over 10% of their annualized base rents (“ABR”)

YTD, the company is having a solid year. Domestic visitation to the island chains has surpassed pre-pandemic levels and are likely to obtain an additional boost resulting from the recent eruption of Mauna Loa. In addition, guidance was recently increased for the third time this year following their Q3 earnings release. And that followed the announcement of their third straight quarterly dividend hike earlier this year.

Shares have since run up about 20% from September 30. While the business is good, the runway from here appears limited, at least in the near-medium term. For prospective investors, A&B is best viewed from the sidelines.

Hawaii’s Local Economy

A&B continues to produce strong results through three quarters of 2022. This is supported in part by growth in Hawaii’s local economy. Unemployment in the state, for example, was down to levels comparable to the national rate, at 3.5% in September, representing a 310 basis point (“bps”) YOY improvement.

In addition, the state continues to experience improvements in international visitors, which is a significant contributor to overall tourism in the state. Visitors from Japan, however, continues to remain depressed, with figures still down 90% from 2019 levels.

But this is offset by strength in domestic visitation. These levels have exceeded pre-pandemic levels for each of the ten full months of 2022 through the date of their Q3 earnings release and were up 11% over 2019 through October on a YTD basis.

Furthermore, visitor spending is also up nearly 8% compared to 2019 levels. And though total bookings were not at the pre-pandemic level as of the date of their earnings release, it was still expected to rebound and surpass last year’s amount even before the eruption of Mauna Loa, which is an event that will likely create a short-term tourism boom.

Granted, their portfolio is not directly dependent on tourist activity, and their operating presence is more limited on the Big Island, where the eruptions are occurring. But increased tourism to the state, regardless, provides broad benefits to the state’s economy.

Recent Performance

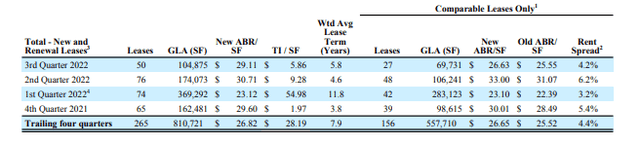

In the third quarter, A&B signed 50 leases at blended spreads of 4.2% for comparable leases. This is down from the 6.2% reported last quarter and lower than their trailing four quarter average of 4.4%. the overall quantity of leases signed is also lower than levels achieved in prior quarters.

Q3FY22 Investor Supplement – Summary Of Leasing Spreads

Lower spreads are offset by the favorable overall rate dynamic in their operating markets. Average retail annualized base rents (“ABR”) per square foot (“psf”), for example, were $34.37/psf as of Q3FY22. This compares to an industry average of $21.46/psf. Similarly, industrial ABR commands $15.53/psf versus an average of $7.68/PSF

Despite the higher rental rates, occupancy continues to hold at healthy levels. Both overall and same-store leased occupancy at quarter end was 94.6%, while economic occupancy was 93.1%, which is up 110bps from last year.

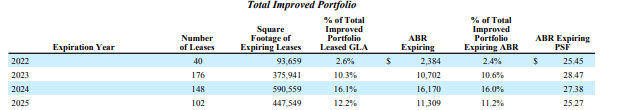

There are, however, an elevated number of expirations over the next several years. Through 2025, 40% of their portfolio ABR is up for rollover. And in 2023, the expiring rates are higher than the portfolio’s current overall rate, which is $28.03/psf, though not significantly so.

Q3FY22 Investor Supplement – Partial Summary Of Lease Expiration Schedule

While it is unlikely A&B will have any issues addressing these expirations, given their market dominance and the lack of alternative options for their tenants, nonrenewal risk is still worth consideration.

Looking ahead, opportunities for further growth exist via further occupancy gains and through the stabilization of their redevelopment project at Manoa Marketplace, which is expected to stabilize in the third quarter of 2024 at a yield of 8-8.5%.

External transactional markets, on the other hand, appears to be softening and is unlikely to figure significantly in the company’s near-medium term growth outlook. At any rate, the company continues to pursue accretive opportunities complementary to their current portfolio. And their strong liquidity position provides them with the flexibility to readily capitalize on current market dislocations.

Liquidity And Debt Profile

A&B has current liquidity of just over +$500M, comprised principally of availability on their undrawn revolving credit facility.

On a reoccurring basis, the company also consistently generates positive cash from operations. Current year cash flows, however, have been negatively impacted by cash expenditures relating to the termination of their pension plans, as well as lower inflows relating to their M&C segment.

Existing liquidity, regardless, is more than sufficient to cover their existing debt obligations, which total +$470M, 35% of which matures in 2024.

On a net basis, their debt multiple stood at just 2.5x trailing twelve months consolidated adjusted EBITDA. This is down from 5.5x reported last year. When excluding the EBITDA contribution from their Land Operations and M&C segment, however, the reported multiple is 5x, still within their target range of 5x-6x.

In addition to sufficient liquidity and a reasonable debt stack, the company also benefits from virtually no current exposure to variable-rate debt. Interest rate risk, therefore, is minimal. A drawdown on their revolver would likely change that equation, but that has yet to happen.

Dividend Payout And Safety

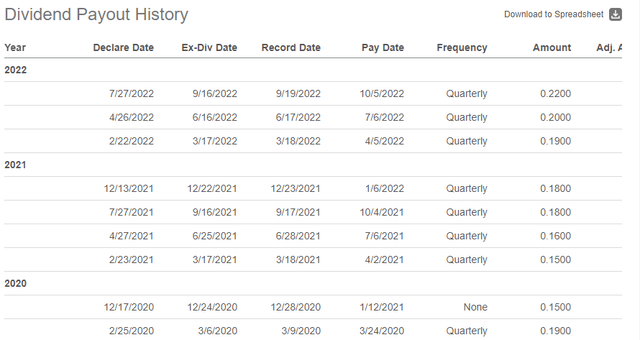

In July, the Board of Directors of A&B approved a 10% increase in their third quarter 2022 dividend from the second quarter dividend of $0.20/share. This was the third consecutive quarterly rate increase.

At a quarterly rate of $0.22/share, the payout represents an annualized yield of about 4.5% at current pricing. This compares to a 2021 year end yield of 2.76%.

Though the dividend yield has increased, it may not be enough to satisfy income investors seeking viable alternatives to risk-free options. Most high yield savings accounts, for example, are presently offering a rate of over 3%.

Nevertheless, the payout is on par with the sector median, which is currently yielding 4.71%. In addition, the continued increases over the past three quarters provides confidence of the strength of the company’s cash flows in recent periods.

The dividend is also adequately covered, with the current payout representing 84% of core funds from operations (“FFO”). While this is up from 80% last year due to the recent increase and higher than sector averages, there is still some cushion for further increases.

The company did suspend the payout in 2020 in anticipation of reduced REIT taxable income, but it was restored later in the fourth quarter, and it recently returned to its pre-pandemic level in the first quarter of this year.

Seeking Alpha – A&B Dividend Payout History

Other than the blip in 2020, A&B has maintained a strong track record on the dividend, and this solid record is likely to continue moving forward.

An Interesting REIT But The Upside Is Limited

A&B is a premier real estate company in Hawaii with a long operating history in the state. Though their operations aren’t directly impacted by tourism into the state, visitation still feeds significantly into the health of the local economy.

And on this regard, the state has benefitted from a rise in domestic travelers to levels that are 11% above 2019 benchmarks. Following the recent volcanic eruption at Mauna Loa, bookings should increase even further during the otherwise quiet holiday season.

Irrespective of the tourism figures, A&B is still producing solid financial results. NOI was up 3.3% YOY, with same-stores up 2.8%. This came on occupancy levels in the mid-90s from a stable roster of tenants, particularly ACI and Sam’s Club, who together account for over 10% of total ABR.

The positive YTD performance thus far has enabled the raising of their full-year guidance for a third time this year. Together with their third consecutive quarterly dividend raise, which was announced earlier in the year, business appears to be going well for A&B.

In a sign of confidence in the stock, the company has been repurchasing shares in recent periods, with 81K shares most recently added in October. While this may imply undervaluation of their shares, it could also suggest that there are limited accretive opportunities in the external markets.

Management did note that land sales were quiet during the quarter following several quarters of significant activity. In addition, they stated that they would pursue more internal growth opportunities, such as development or redevelopment, where better control exists in timing and yields.

If management is more inward looking, it would make sense for investors to remain hesitant as well, especially considering shares have run up nearly 20% since their earnings release. And though they are still off about 15% from consensus price targets, it’s hard to make a compelling case for a further rise higher. Sure, internal growth opportunities exist, but occupancy is already high and re-leasing spreads aren’t particularly attractive.

Though it is a quality REIT operating in a niche location, shares in A&B are better viewed from the watchlist.

Be the first to comment