metamorworks

This article is part of a series that provides an ongoing analysis of the changes made to Alex Roepers’ 13F portfolio on a quarterly basis. It is based on Roepers’ regulatory 13F Form filed on 8/15/2022. Please visit our Tracking Alex Roepers’ Atlantic Investment Management Portfolio article for an idea on his investment philosophy and our last update for the fund’s moves during Q1 2022.

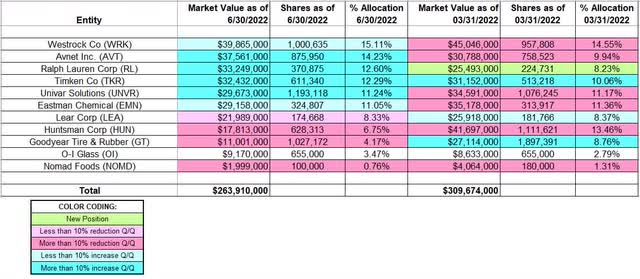

This quarter, Roepers’ 13F portfolio value decreased ~15% from ~$310M to ~$264M. The number of holdings remained steady at 11. The top three holdings are at ~42% while the top five are at two-thirds of the 13F assets: Westrock Company, Avnet, Ralph Lauren, Timken, and Univar Solutions.

Atlantic Investment Management’s annualized returns since the flagship fund’s inception in 1992 thru 2017 was impressive at ~16%. Last four years, the fund has underperformed the S&P 500 Index. To know more about activist investing, check out Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations.

New Stakes:

None.

Stake Disposals:

None.

Stake Increases:

WestRock Co. (WRK): WRK is currently the largest 13F position at ~15% of the portfolio. It was built in Q4 2019 at prices between $33.50 and $43.25. Q1 2020 saw a ~17% selling while next quarter there was a two-thirds increase at prices between $24 and $34. Q4 2020 saw a ~10% trimming while next quarter there was a ~20% stake increase at prices between ~$41 and ~$54. The two quarters through Q3 2021 had seen a ~22% selling at prices between ~$48 and ~$62. The stock is currently at $40.49. There was a ~5% stake increase this quarter.

Avnet, Inc. (AVT): The large (top three) ~14% AVT stake was purchased in Q4 2020 at prices between ~$24.50 and ~$35.25. There was a ~30% stake increase next quarter at prices between ~$35 and ~$41.50. Q4 2021 saw a ~11% stake increase while last quarter there was a ~17% trimming. The zig-zag trading pattern continued this quarter with a ~15% increase. The stock is now at $42.54.

Ralph Lauren (RL): RL is a large (top three) 12.60% of the portfolio stake established over the last two quarters at prices between ~$87 and ~$134 and the stock currently trades at $94.22.

Timken Company (TKR): TKR is a ~12% of the portfolio position established in Q4 2021 at prices between ~$64 and ~$77. Last two quarters saw a ~57% stake increase at prices between ~$52 and ~$75. The stock currently trades at $66.53.

Univar Solutions (UNVR): The large (top five) ~11% of the portfolio stake in UNVR was established in Q2 2020 at prices between $9.60 and $18.15. The two quarters through Q1 2021 had seen a one-third stake increase at prices between ~$16.50 and ~$22. Last quarter saw a ~45% selling at prices between ~$26.50 and ~$34. The stock currently trades at $25.77. There was a ~11% increase this quarter.

Eastman Chemical (EMN): EMN was a large stake established in Q4 2015 at prices between $65 and $74. The position has wavered. Recent activity follows: H2 2019 and Q1 2020 had seen the position sold down at prices between $38 and $83.90. It was re-built in Q4 2021 at prices between ~$101 and ~$121. There was a ~25% selling last quarter at prices between ~$105 and ~$128. The stock is now at $91.85 and the stake is at ~11% of the portfolio. There was a ~3% increase this quarter.

Stake Decreases:

Lear Corp. (LEA): LEA is a large 8.33% of the portfolio position established in Q4 2020 at prices between ~$113 and ~$165 and the stock currently trades at ~$138. There was a ~12% trimming in Q4 2021 at prices between ~$146 and ~$188 while last quarter there was minor ~5% increase. This quarter saw a similar trimming.

Huntsman Corp. (HUN): HUN is a 6.75% of the portfolio stake. It was established in Q1 2021 at prices between ~$25 and ~$29.50. The stake was more than doubled next quarter at prices between ~$25 and ~$31.60. Last two quarters saw a ~64% reduction at prices between $27.40 and $41.20. The stock currently trades at $26.55.

Note: Huntsman is a frequently traded pick in the portfolio. Details of the latest roundtrip follow: It was a ~5% of the portfolio stake established in Q2 2017 at prices between $23 and $27. The five quarters thru Q2 2019 had seen a combined ~50% selling at prices between $17.35 and $35.30. That was followed with another two-thirds selling next quarter at prices between $18.25 and $23.50. Q4 2019 saw the position almost eliminated at prices between $21.50 and $25. The remainder stake was disposed in H1 2020.

Goodyear Tire & Rubber (GT): GT is a ~4% of the portfolio position purchased in Q3 2021 at prices between ~$14.50 and ~$18.75. Q4 2021 saw a ~5% trimming while last quarter there was a ~13% increase. There was a ~45% selling this quarter at prices between ~$10.75 and ~$14.85. The stock currently trades at $13.63.

Nomad Foods (NOMD): NOMD is a 0.76% position established over the last two quarters at prices between ~$24 and ~$29 and the stock currently trades at $17.12. There was a ~60% reduction over the last two quarters at prices between ~$17.65 and ~$26.75.

Note: Nomad Foods is back in the portfolio after a quarter’s gap. A similar stake was established in Q4 2020 at prices between ~$22.60 and ~$26.15. It was eliminated next quarter at prices between ~$27.50 and ~$31.50.

Kept Steady:

O-I Glass (OI), previously Owens Illinois: OI is a very long-term stake. In 2008, the position was minutely small and was built to 11.2M shares by 2012 through consistent buying. Recent activity follows: Q4 2020 saw a ~45% selling at prices between ~$9.40 and ~$13. The two quarters through Q2 2021 had seen another ~75% selling at prices between $11.50 and $19.30. The stock currently trades at $13.76, and the stake is now small at 3.47% of the portfolio.

The spreadsheet below highlights changes to Roepers’ 13F stock holdings in Q2 2022:

Alex Roepers – Atlantic Investment Management’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment