Ethan Miller/Getty Images News

This is an interesting set-up with seemingly strong institutional shareholder incentives. On February 28, US grocery retailer Albertsons Companies (NYSE:ACI) announced a strategic review, hiring Goldman Sachs (GS) and Credit Suisse (CS). The underlying trigger was that despite solid performance compared to peers, ACI has remained undervalued ever since going public through an IPO in June’20.

The key here is that since 2006 ACI is majority-owned by a group of institutional shareholders (69% stake), headed by Cerberus Capital Management (29%). These sponsors have reportedly had already pushed for an IPO in 2015, but unsuccessfully. The IPO finally took place in 2020, with up to 2-year lock-ups. Currently, ~72% of outstanding shares are subject to these lock-ups. Once they expire, these firms will have their first chance to liquidate their positions. By the way, lock-ups should have expired this June but sponsors agreed to extend them to September just a few days ago. Apparently, sponsors are confident that the strategic review will bear fruit. Overall, it seems that the review was initiated to help institutional shareholders increase share price before exiting.

On top of that, on May 24 rumors appeared that Jana Partners, a hedge fund with extensive activism experience in retailers, may be accumulating a stake in the company. Jana also has a shared history with ACI. For these reasons, the stake (if true) points to shareholder value realization brewing behind the scenes in some form or another.

The announced review will focus on “balance sheet optimization”, “capital return strategies” and “potential strategic or financial transactions”. My thoughts on the possibilities here:

-

Share buybacks. The company has been generating $2bn and $2.3bn in FCF in the last two years. This year’s guidance points to flat/increasing profitability and sales. Meanwhile, net debt has been decreasing (see below). For these reasons, ACI could choose this path and repurchase generous amounts of shares. Importantly, the company has already pursued share buybacks – in FY2021, the company bought back ~$1.9b in stock. This amounted to 20% of outstanding shares at the average price of ~$16 per share. However, no other buybacks were initiated other than $26m in FY2019.

-

Individual brand, store or non-store asset sales. ACI owns multiple brands, store and non-store assets, such as fuel stations, that it could sell. Own Brands, for example, could be monetized for cash – Spears is an example of this.

-

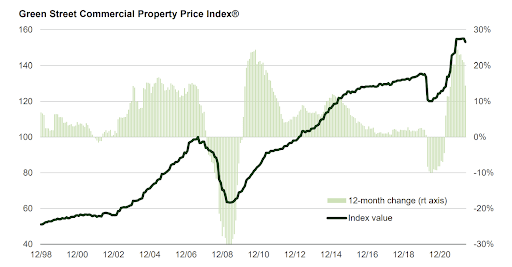

Sale-leaseback of the real-estate portfolio. This option is risky, particularly in the current market environment. Nevertheless, experienced players are involved. For this reason, the sale-leaseback could potentially be a lucrative source of shareholder value. Such an option has been emphasized by the CEO in the latest investor event. Based on the most recent independent fair market valuation done in FY2019, ACI’s real estate portfolio is worth 75% of the current market cap. However, since that valuation, commercial property prices in the US have increased significantly. Potentially, the RE portfolio now makes up north of 85% of the market cap.

-

Acquisitions. Institutional shareholders would likely oppose this option. Further acquisitions would go against their apparent intentions to liquidate their positions.

-

Outright company sale. Unlikely as this would require a very large buyer. Also, a report appeared on April 22 that a 15m block of shares was offered for sale (at $32.50 per share) for what was a small discount to the trading price at the time. This indicates that some shareholders believe that ACI does not warrant any takeover premium – this makes an outright sale unlikely.

With three realistic paths to bring value, I consider ACI an attractive strategic review play.

Peers

The company looks cheap on both forward and TTM multiples. It trades at 10.5x-11x FY2023E P/E compared to 12x-13x for the peers that provide EPS guidance other than Walmart (WMT) (25x).

|

ACI |

KR |

SFM |

WMT |

|

|

FWD P/E Lower Bound |

10x |

12x |

12x |

25x |

|

FWD P/E Upper Bound |

11x |

13x |

12x |

25x |

Looking at TTM multiples, ACI is undervalued versus all peers except for IMKTA on a P/E and EV/EBITDA basis.

|

ACI |

KR |

WMK |

SFM |

IMKTA |

WMT |

TGT |

|

|

Market Cap ($m) |

15711 |

35284 |

2034 |

2855 |

1687 |

335435 |

67013 |

|

EV ($m) |

20774 |

47541 |

1742 |

2791 |

2085 |

40289 |

13356 |

|

TTM P/E |

10 |

16 |

18 |

11 |

6 |

26 |

11 |

|

TTM EV/EBITDA |

5 |

7 |

7 |

6 |

4 |

10 |

8 |

|

TTM P/FCF |

8 |

14 |

81* |

9 |

12 |

294* |

31 |

Note: WMK purchased an extraordinary amount of marketable securities ($152m) in FY2021, decreasing FCF. Meanwhile, WMT FCF was significantly negative in the last quarter partly because of inventory build-up.

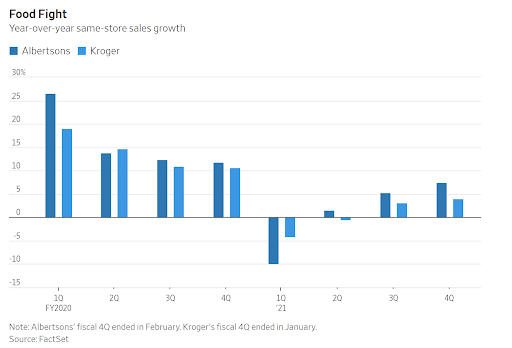

Despite lower multiples, in terms of sales growth, ACI recently outperformed direct peer Kroger (KR). Moreover, TTM EBITDA margins stood at 6.1% versus 5.1% for KR and TTM net profit margins at 2.3% versus 1.5%. Management has argued that this comparison to KR has been one of the main reasons behind the strategic review. Overall, this indeed suggests that there is divergence between ACI’s performance and its valuation.

Wall Street Journal

Business and Financials

ACI has one reportable segment and 12 divisions. However, in terms of assets that the company can possibly sell, my approach is to split it into these parts:

-

Stores. ACI operates 2,276 food and drug stores in the US, 39% of which are ground-leased or owned – the rest are rented. The most prominent banners are Acme, Vons, Jewel Osco and Safeway – 20 in total. Excluding Own Brands, store revenues were ~74% of the total.

-

Non-store assets. Primary assets here are 402 adjacent fuel stations. Apparently, ACI had already sold off its fuel stations before only to reacquire them later. Fuel made up ~5% of revenues in FY2022. Other assets here are distribution centers, manufacturing facilities and digital platforms.

-

Own Brands. Brand portfolio has over 14,000 unique items and includes such product lines as O Organics and Signature Select. In FY2022, Own Brands generated ~21% of total revenues.

Financially, the company seems to be well-positioned for share buybacks. In the last two fiscal years (ending February) ACI has performed very well. It should be noted, however, that recent years were rather one-offs and most retailers were performing exceptionally well. Looking forward, strong performance could continue as ACI has guided for identical sales growth of 2% to 3% in FY2022. Meanwhile, the closest peer KR has already reported Q1 results two weeks ago with identical sales increasing by 4.1% in the quarter. For the full year, Kroger expects 2.5%-3.5% sales growth – generally in line with ACI’s guidance. Recently, however, analysts have predicted that Kroger could face lower gross margins due to ongoing inflationary pressures – there is a fairly strong possibility here that the guidance will have to be revised.

Net debt, on the other hand, has shrunk dramatically over the recent years. It is important to note that ~$7.1bn of it is long-term, reinforcing that the company should be able to return capital by repurchasing shares. Gross cash stands at $2.9bn.

|

FY2018 |

FY2019 |

FY2020 |

FY2021 |

FY2022E |

|

|

Revenue ($bn) |

60.5 |

62.5 |

69.7 |

71.9 |

73.3 – 74.0* |

|

Adj. EBITDA ($bn) |

2.7 |

2.8 |

4.5 |

4.4 |

4.2 – 4.3 |

|

Net Income ($bn) |

0.1 |

0.5 |

0.9 |

1.6 |

1.4 – 1.5 |

|

Net Debt ($bn) |

9.7 |

8.2 |

6.6 |

5.1 |

– |

Source: ACI 10-K Filings. Note: ACI has guided for 2%-3% in identical sales growth. Identical sales do not include increases in fuel sales and increases due to new store openings. For comparison, in FY2021 these two components made up ~3% of total net sales.

Real Estate

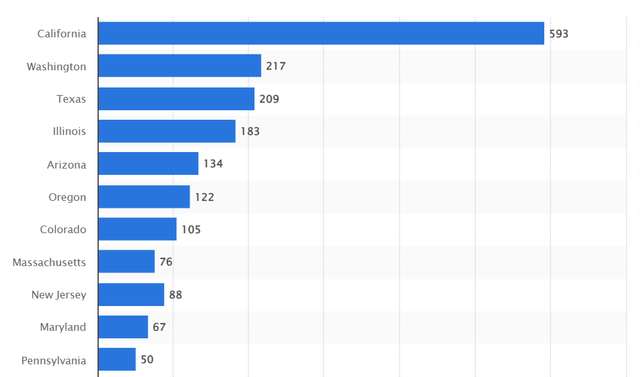

During the IPO in June 2020, ACI’s real estate portfolio was valued at fair value at $11.2bn. More recent appraisal value is not available but Green Street’s US Commercial Property Price Index (below) has grown 27% since July 2020. Most of ACI’s properties are on the West Coast (most stores are in California – 593). This suggests that a 15% growth assumption is conservative. With this rough estimate, real estate makes north of 60% of the EV.

Number of ACI stores by state (Statista) Green Street

Activist

Jana Partners is a highly-respected hedge fund with a lot of industry competence. The company’s history with ACI goes back to the ACI-Safeway merger in 2013. At the time, Jana had accumulated a 6.2% stake in Safeway (SWY) and successfully pushed it to exit the lower margin Chicago market and to authorize additional share repurchases of $2bn. Eventually, ACI reached out to SWY to negotiate a merger which closed around six months later.

The point here is that the turnaround was quick and Jana had started activism at just the right time – Jana disclosed its stake just two weeks after discussions between ACI-SWY began. This could be a coincidence. However, Jana’s other campaigns with groceries and, more generally, retailers, indicate that the hedge fund has been able to successfully pursue activism in these companies:

-

In April’17, Jana acquired an 8.2% stake in Whole Foods and pushed the company for sale. Just two months later, Amazon (AMZN) acquired the company for $13.7bn – 10x 2016 adjusted EBITDA. Once again, Jana’s play was very swift – the hedge fund disclosed its position in April and exited it in July on a reported $1.1bn compared to $0.8bn initial position. Interestingly, ACI was also bidding for Whole Foods but not successfully.

-

In April’18, Jana bought 9.5% of Pinnacle Foods shares. A merger deal with Conagra (CAG) was then announced in June’18 and closed in October’18. Total consideration stood at $10.9bn or 16x 2017 adjusted EBITDA. Jana pocketed $144m in profit. The activist still to this day has a stake in Conagra.

-

In February’21, the hedge fund opened a 7.3% position in TreeHouse Foods (THS). In November’21, a strategic review was announced. In March’22, an agreement with Jana was reached for it to appoint two Board members.

-

More recently, in October’21, Jana pushed for e-commerce unit separation in Macy’s (M). Share price climbed gradually from $23.11 per share to a high of $37.37 in November. Reportedly, Jana largely exited its position in Q4’21 in what was likely a substantial profit. Macy’s ultimately refused to spin off the e-commerce business but the strategic review is still ongoing.

Risks

The main risks are as follows:

-

The strategic review may simply result in a restructuring of the institutional ownership, i.e. other institutional investors will replace the current ownership group. However, if the company remains undervalued, Cerberus and others might not be willing to simply sell their shares on the open market.

-

Given the large company size, the market might be pricing the odds here efficiently and the edge to retail investors is likely limited.

-

Timeline of the strategic review may get prolonged. President/CFO has recently stated:

“My guess is that we’re still a period away, and we’re not in a hurry”

Conclusion

ACI presents an interesting strategic review opportunity with multiple paths to win. The underlying business has been undervalued but profitable and generated significant FCF in recent years. Most importantly, institutional holders here likely have a strong incentive to raise the company’s value before exiting their positions in September. On top of that, there are rumors of an experienced activist hedge fund acquiring a stake. For this reason, I am very interested in putting this stock on my watchlist. For now, however, given the risks outlined, I will not open a position.

Be the first to comment