Olemedia

Albemarle Corporation (NYSE:ALB) has reported impressive growth recently, but this is not reflected in its share price, creating a great buying opportunity for long-term investors.

Background

As I’ve analyzed several times in previous articles, I’m bullish on Albemarle over the long term due to its leadership position in the lithium industry and its geographic exposure to less risky areas than its closest competitors. Indeed, Albemarle is currently the largest position in my portfolio due to share price outperformance over other holdings during the past year, largely justified by its strong revenue and earnings growth reported in the past couple of quarters.

Its recent earnings maintained a very good operating momentum as expected, reinforcing my long-term bullish stance on this company, being in my opinion, one of the best ways to play the lithium growth story that still has many years to run, as the world’s largest auto markets turn to Electric Vehicles (EVs) instead of internal combustion engines (‘ICE’).

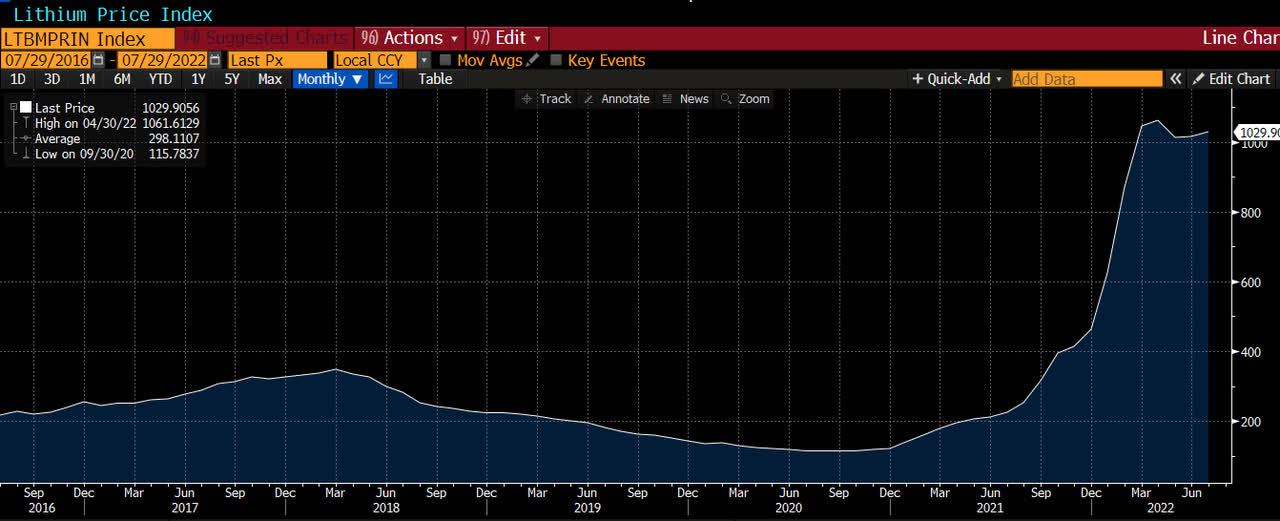

In the first quarter of 2022 the company easily beat expectations due to a steep rise in lithium prices, a situation that has benefited its results in the second quarter once again. As shown in the next graph, lithium prices have skyrocketed during the first few months of 2022 to new all-time highs and remained at very record levels since then, a sign that the lithium market remains tight due to strong EV sales in Europe and China. Note that since the end of 2021, lithium prices have increased by more than 100% from an already high base, boding quite well for Albemarle’s year-on-year (YoY) growth comparisons in the coming quarters.

Lithium prices (Bloomberg)

Q2 2022 Earnings Analysis

Albemarle announced yesterday its earnings related to Q2 2022, beating estimates both on the top and bottom-lines, which bodes well for growth ahead.

Its revenues amounted to $1.48 billion in the second quarter, 3% ahead of expectations, representing an increase of 91% YoY, while its adjusted EPS of $3.45 was 14% above expectations and 89% higher than in Q2 2021. This was again a very good quarter for Albemarle historically, the second in a row, and its shares have reacted positively as expected.

Albemarle’s strong revenue and earnings growth is mainly justified by impressive results from its lithium segment, which is not totally unexpected due to much higher lithium prices in recent months and some lag between the company’s contracted and market prices. While Lithium represented some 42% of Albemarle’s net sales in 2021, in Q2 2022 this segment represented 60% of the company’s total sales, a level that I was expecting Albemarle to achieve only by 2026.

This clearly shows that the explosion in lithium prices had a significant impact on Albemarle’s business profile, making it much more exposed to lithium than it was one of two years ago. Given that most of its investments are expected in this segment over the next few years, this means that lithium weight on revenues should continue to increase in the near future as more production capacity becomes available.

Investors should note that Albemarle’s pricing structure is mixed, which means that it has some contracts linked to short-term index-references and others have long-term fixed-price settings, while its exposure to spot prices is relatively low. Due to this structure, Albemarle had a significant amount of contracts in the past that had fixed prices for one year, which meant that the company was not able during 2021 to benefit much from higher lithium spot prices.

However, Albemarle has made some efforts to change its pricing structure to have more contracts with variable pricing, enabling it to benefit most from higher spot prices than in the past, explaining why its lithium sales are now increasing so much.

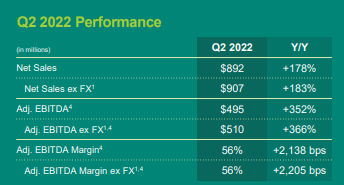

In Q2 2022, Albemarle’s lithium sales increased by 178% YoY to $892 million, with pricing responsible for 160% growth and volume for 18%, as the company increased sales due to renegotiated fixed and index-variable price contracts and increased market pricing. This is an impressive growth rate, but as the segment’s cost structure is largely fixed, its profitability also has improved markedly and its adjusted EBITDA amounted to $495 million, an increase of 352% YoY.

Lithium segment (Albemarle)

Beyond impressive growth in its lithium segment, Albemarle also reported good growth in its bromine and catalysts segments. Bromine reported net sales of $378 million (up by 35% YoY), while catalysts net sales amounted to $210 million, up by 42% YoY. Regarding business margins, bromine improved its EBITDA margin to about 36% (+280 bps compared to Q2 2021), while catalysts’ margins are being pressured by higher costs, namely higher natural gas prices in Europe due to the war in Ukraine. This segment reported a decline of 54% YoY on adjusted EBITDA to only $10 million in the quarter.

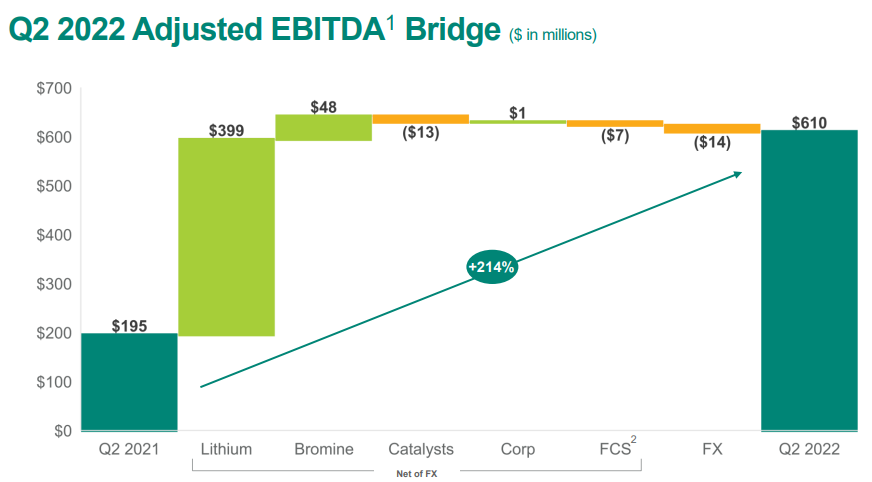

However, as this segment is the smallest one does not have a great impact on Albemarle’s overall profitability, given that its adjusted EBITDA in the quarter was $610 million and increased by 214% YoY driven by lithium and bromine.

EBITDA (Albemarle)

Moreover, Albemarle raised its full-year guidance expecting now adjusted EBITDA to be up by 270-300% YoY, while previously was expecting adjusted EBITDA growth of 200-225% YoY. This is justified by much higher revenue with the revised guidance now projecting full year revenues to be between $7.1-7.5 billion (vs. $5.8-6.2 billion previously), and adjusted EBITDA margin to increase to 45-47% (vs. 38-40% before) compared to 26% in 2021. This is an impressive margin expansion that is justified by the company’s business profile with high fixed costs, leading to a strong margin boost from higher sales, showing that Albemarle has great operating leverage.

Albemarle has revised upwards several times its guidance for 2022 during the past few months, showing that its business is enjoying great operating momentum, even during a tough macroeconomic period and pressure on costs from inflationary pressures. This clearly shows that the lithium boom is a powerful tailwind that should persist for some more years, as the demand of lithium for battery storage is likely to remain strong due to higher EV production and sales in the major auto markets over the next few years.

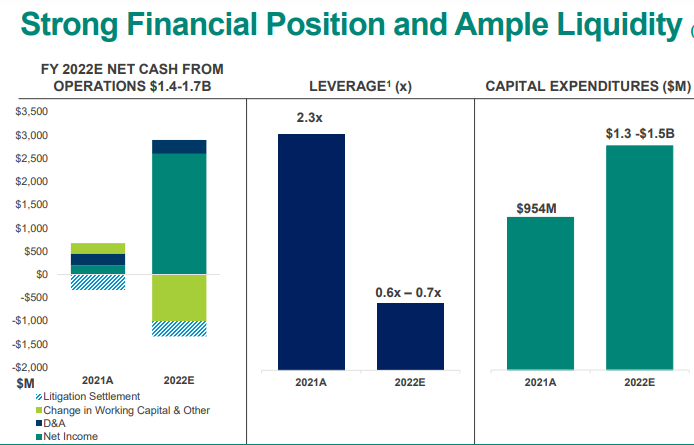

Another positive factor of Albemarle’s higher earnings is also the positive impact on cash flow generation, with the company now forecasting positive free cash flow this year, the first time in six years. This improved profitability and cash flow profile is leading to a much stronger balance sheet, enabling it to invest even more on capacity expansions and provide an attractive shareholder remuneration policy of growing its dividend each year, at the same time. This means that Albemarle’s fundamentals have improved very rapidly, achieving in some just a few months what it was targeting for the next three to four years.

Financial Profile (Albemarle)

Going forward, Albemarle has many growth projects, especially in the lithium segment, that are expected to boost its volumes over the next three to four years. However, the company was somewhat conservative in recent years as lithium prices were relatively low for some time, but now with prices skyrocketing and the supply-demand situation expected to remain tight due to strong demand from EVs, Albemarle is likely to approve new long-term projects that were ‘on hold’.

Valuation

Considering this strong backdrop and strongly revised guidance, it’s not surprising that current sell-side estimates are way below Albemarle’s current guidance for the full year. Current market expectations were for 2022 net sales of about $6.2 billion, much lower than the bottom of its guidance at $7.1 billion. Therefore, revenue revisions are more than likely in the next few days, which are supportive for a higher share price.

Moreover, Albemarle’s current 2022 guidance is higher than street expectations for 2023 and within the value expected for 2024, which are also likely to be considerably revised upwards by the street. For 2025, current expectations are for $8.6 billion in revenue and EPS of $22.21, which seem to be conservative considering the company’s growth prospects.

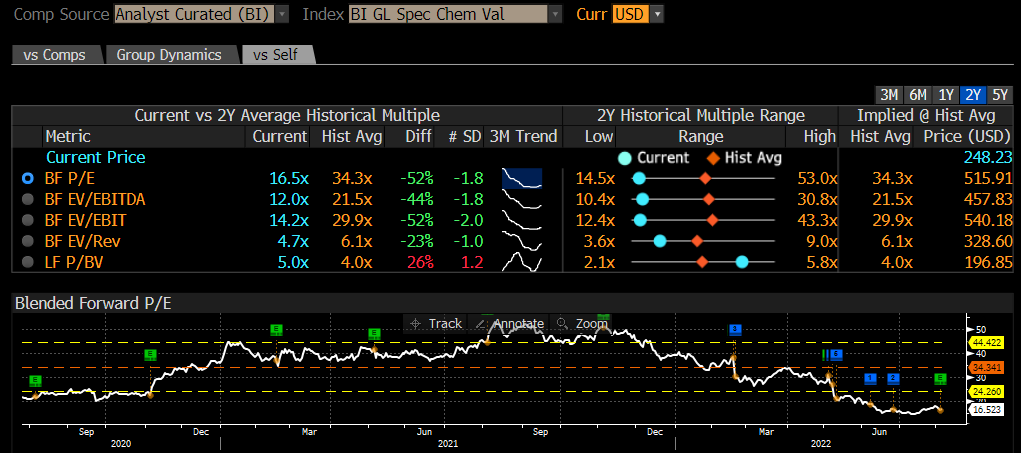

Regarding its valuation, Albemarle is currently trading at only 16x its next twelve months earnings, which is quite low considering its historical valuation and is likely to become even cheaper as analysts revise upwards their estimates for the next few quarters. This means that Albemarle has de-rated considerably since its peak valuation back in December when was trading at more than 50x forward earnings, as the bear market has not been supportive of growth stocks.

Valuation (Bloomberg)

I see this as a very undemanding valuation for a company that is reporting impressive growth, being therefore a compelling buy for long-term investors that want to be exposed to the secular growth theme of EVs. Note that compared to its historical multiple over the past couple of years, Albemarle is trading at half its ‘normal’ valuation, which doesn’t seem to be justified as the company’s fundamentals and growth prospects have improved markedly in the past two quarters.

Conclusion

Albemarle had another fantastic quarter, beating estimates and again raising its guidance for the full year, now trading at a very undemanding valuation. The major risk here is that lithium prices may decline in the near future, a situation that seems unlikely as EVs continue to gain market share in Europe and China, and to a less extent in the U.S., and this trend is not expected to change in the foreseeable future.

Thus, the disconnection between Albemarle’s improved fundamentals and somewhat muted share price over recent months has created a great buying opportunity for long-term investors, and therefore I rate Albemarle as a ‘strong buy’.

Be the first to comment