simonkr/E+ via Getty Images

Charlotte-based Albemarle (NYSE:NYSE:ALB) is the world’s largest lithium producer, mainly supplying the growing demand for electric vehicles. The company, founded in 1887, also produces Bromine and Catalyst solutions. The former serves a number of use cases from agricultural chemicals, pharmaceuticals, and flame retardants.

Lithium by far forms the most pertinent bull case for Albemarle and the key driver of investor interest in the company. The chemical element is used as the key ingredient for lithium-ion batteries, the principal battery chemistry for electric vehicles. This places Albemarle at the front of the decarbonization of transport, once a fringe request by environmentalists at the turn of the new millennia but now core policy objectives for some of the world’s largest economies.

On the back of 2021’s United Nations Climate Change Conference was the Glasgow Declaration. It commits signatories to ensure sales of all new cars and vans to be zero emission by 2035. Hence, the list of states and countries on a planned phase-out of combustion engine vehicles has grown significantly. This is not a list of minnows. California, the European Union, the United Kingdom, Japan, and South Korea all feature on the now rapidly growing list that is expanding Albemarle’s total addressable market. The long-term outlook for EVs is strong. Global sales of EVs reached 6.6 million in 2021, more than double its year-ago figure.

Highlighting just how staggering growth has been, just 120,000 EVs were sold globally in 2012. Last year saw that figure being sold in a week with 10% of cars sold in 2021 being electric, 4x the market share in 2019. Growth is fast becoming exponential, albeit partially slowed down as a result of the current weakening macroeconomic environment.

Revenue Goes Parabolic As Demand For Lithium Carbonate Goes Beyond Point Of No Return

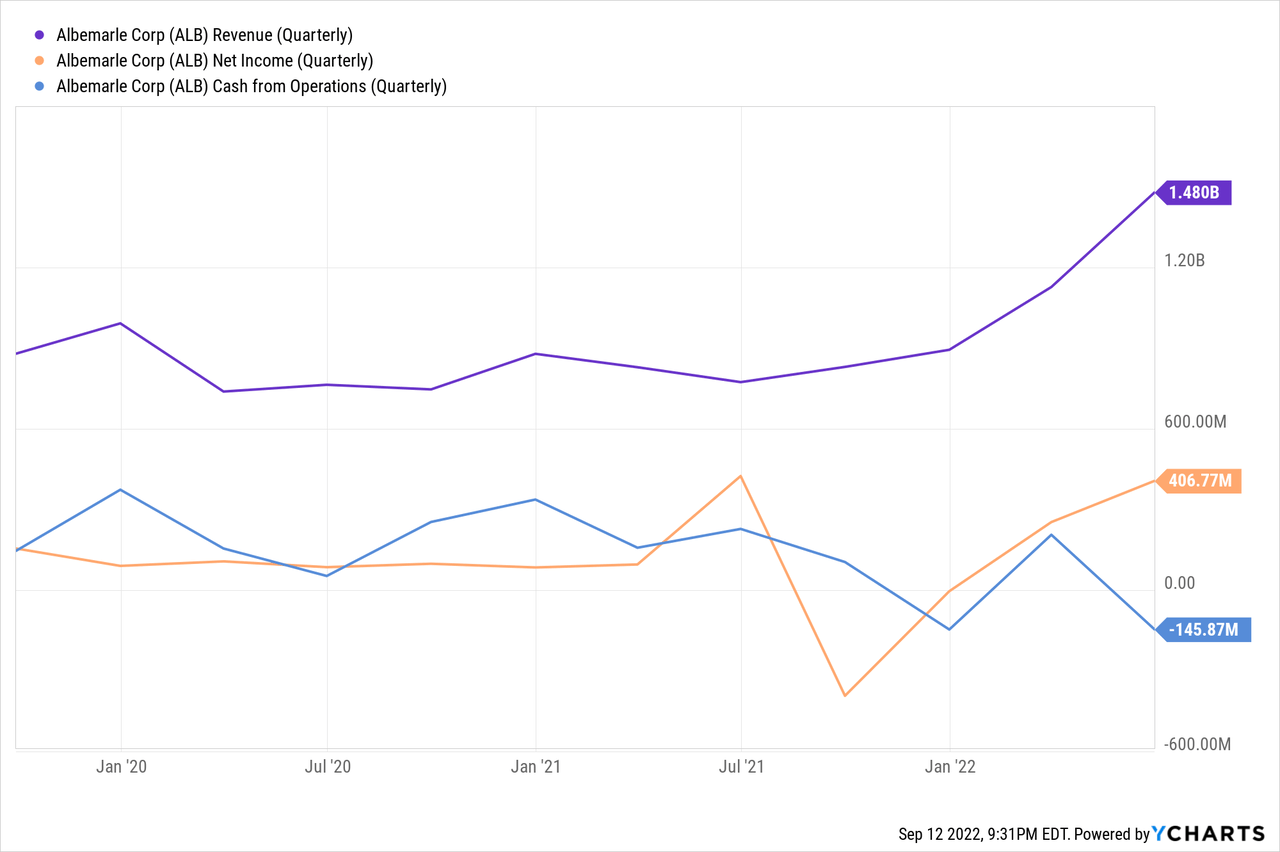

The company last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $1.48 billion, a 91.2% increase over its year-ago period and a marginal beat of $622,520 on consensus estimates. Whilst there was healthy growth across all its divisions with Bromine and Catalysts sales jumping by 35% and 42%, respectively, net lithium sales surged by 178% to reach $891.5 million during the quarter. This constituted 60% of total revenue and was driven by higher pricing as well as an increase in sales volumes.

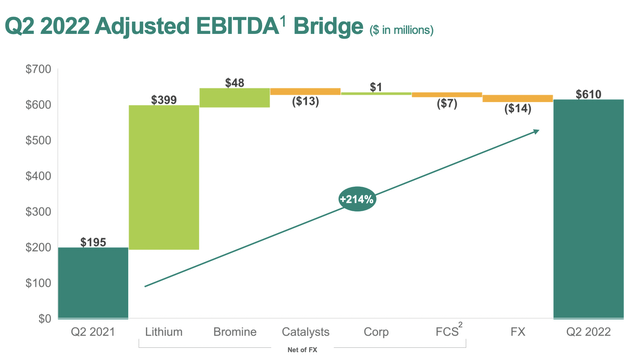

Whilst net income fell to $406.8 million from $424.6 million in the year-ago quarter, adjusted EBITDA grew by 214% year-over-year to reach $610 million with margins at 41%.

Albemarle

Further, whilst cash flow from operations was negative at $145.87 million, the company now expects to be cash flow positive this year with approximately $150 million in positive free cash flow expected at the midpoint of their guidance.

For the year, Albemarle expects adjusted EBITDA will rise by at least 500% as average realized pricing is expected to increase by at least 225%. Full-year volume sold is expected to rise by at least 25% at its midpoint as the company continues to invest in new capacity to meet demand. Several projects are underway in China and a number are in the early stages of planning for the US.

The recently signed Inflation Reduction Act which allocates $370 billion over 10 years for decarbonization is set to drive even greater demand for lithium over current baseline projections. Critically, the Act will see greater demand pull for lithium for utility-scale lithium-ion battery storage as renewable energy is set to undergo a generational boom. Solar and wind are expected to rise to a forecasted 80% of electricity production by the end of the decade, up from around 20% of production currently.

This is set to exacerbate the already dramatic supply and demand imbalance and will likely lead to continued pricing power for lithium producers even as near-term demand moderates against a recession. Current lithium prices are extraordinarily high and some bearish commentary has stated this as unsustainable over the long term. Tesla (TSLA) is already considering setting up its own lithium refinery factory in Texas after comments from Elon Musk that margins in the sector were like software. This move might spur other EV automakers to do the same, reducing overall long-term pricing power if done on a sustained and large enough scale.

A Demand Boom Like Never Before

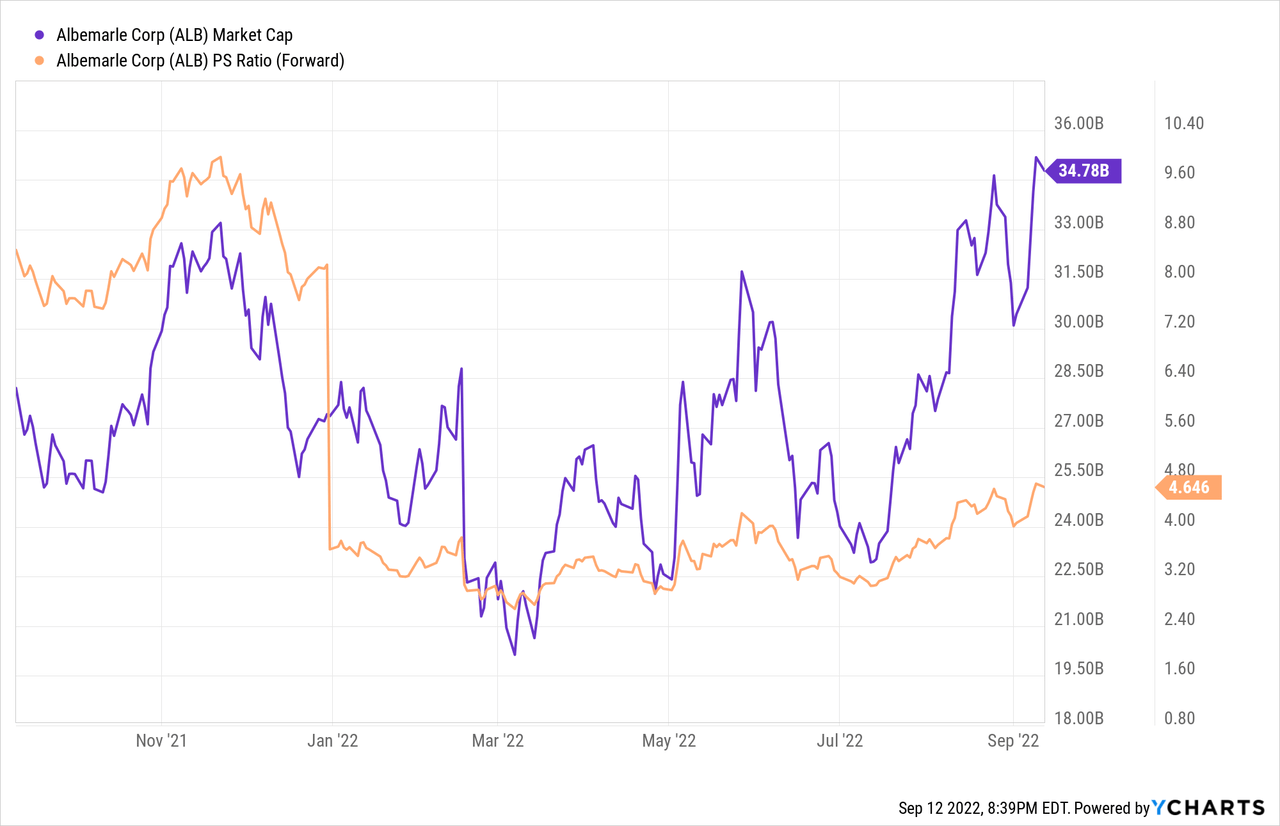

Albemarle’s market cap currently stands at $35 billion with shares trading near 52-week highs. This places its forward price-to-sales ratio at 4.6x, down more than half from the previous multiple high as revenue growth expectations have surged ahead.

The broader demand context for Albemarle remains extremely strong. Decarbonization has become like a gospel with governments around the world building the foundations for long-term decarbonization. And whilst there continues to be a growth in startups chasing different non-lithium battery chemistries, most of these are all experimental at best.

The world is about to see demand for lithium rise to levels never before seen and Albemarle has centered itself at the front of this demand growth. I’m not a buyer at these levels but the long-term bull case is clear and strong.

Be the first to comment