simonkr/E+ via Getty Images

The lithium stocks have dipped with the market recently providing an opportunity to buy one of the most advanced plays in Albemarle (NYSE:ALB) on a major dip. With or without a full Chinese reopening, lithium demand is set to soar due to surging EV demand. My investment thesis is Bullish on the stock after falling $100 from the highs.

Lithium Rules

Albemarle isn’t a completely 100% lithium play turning off some investors. The surging lithium spot prices and expansion plans make lithium the driver of the business heading into 2023.

In the last quarter alone, Albemarle produced $1.1 billion in adjusted EBITDA from the lithium unit alone on sales of $1.5 billion. The big question for this unit is the future prices of lithium after a big rally in the spot price this year.

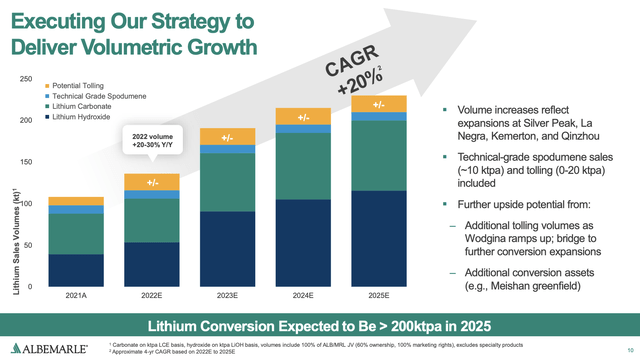

In Q3’22, the company expects produce somewhere below 150K tons of lithium on a mid-20% supply growth without providing any details on expected pricing. Albemarle expects to increase capacity another 30% next year to close in on 200K tpa.

Source: Albemarle Q3’22 presentation

If anything, Albemarle sells lithium below market spot prices due to existing fixed contracts. The lithium miner is quickly moving towards variable contracts.

At the recent Lithium Battery Supply Chain conference, Lithium President Eric Norris discussed a couple of dynamics where lithium prices will remain high and might not revisit prior levels, especially with escalating costs for new supply:

So just to put some numbers on it and these are round numbers but maybe 100,000 tons of supply came on year-on-year to this year by the time the year is done. It might be twice at that level as you go into next year. But demand is going to be closer to 300,000 tons. So we still see — in growth — so we still see that deficit there that perhaps by the middle of the decade there’s some more balance restored. But as you then go out to the end of the decade, we see a deficit potentially emerging again.

The challenge when you look at any lithium cost curve is that, a), it’s an upward sloping cost curve because the best resources have already been tapped and those being the high — rich or high in quality lithium, low on the cost curve. But as you go out, you don’t see any — if you think of cost curve as being the high and with being how much you can contribute to the market, the width of this is very narrow. You’re talking about small bites and many, many, many projects being required to get there. So that magnifies the complexity of growing in this industry.

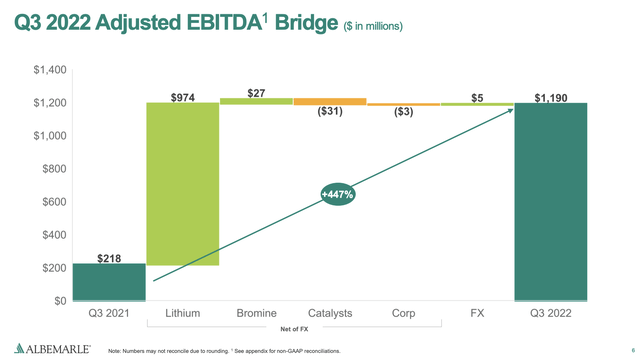

No other chart highlights the lithium impact on the overall business better than the Q3’22 adjusted EBITDA chart. Albemarle has a bromine and catalysts business, but lithium accounted for 71% of sales in Q3 and contributed to $974 million growth in the adjusted EBITDA from the Q3’21 level of only $218 million.

Source: Albemarle Q3’22 presentation

Difficult To Value

Albemarle is difficult to value due to questions on the sustainability of the lithium sales and profits growth. The company makes a compelling case for why lithium prices are likely to only rise from here even with additional capacity coming online in 2023 to the tune of 200K tpa with demand likely to grow by 300K tpa.

Goldman Sachs disagrees with this undersupply scenario and recently slashed the target prices for lithium. The investment firm forecast a lithium carbonate price of $53,300 a tonne in 2023 cratering to only $11,000 in 2024.

Other research firms don’t agree with Macquarie Research calling for a more steady average price in the $72,500 a tonne range until 2026 due to the supply deficit. The Goldman Sachs negative call appears to suggest a slowdown in EV demand will occur while this doesn’t appear anywhere close to the case with global auto manufacturers ramping up EV production and surging growth for battery storage.

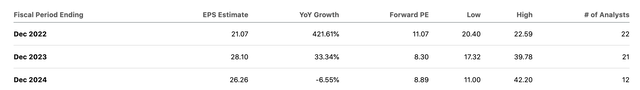

The consensus analysts’ targets have Albemarle earning $26 to $28 per share in the next couple of years. These numbers aren’t based on the current China spot prices above $80,000 a tonne and the capacity growth of the company unlikely to meet surging demand for the next decade.

Naturally, huge risks exist considering the Goldman Sachs predictions would crater the profits of Albemarle and all other lithium miners. The stock is cheap based on hitting analyst targets and these estimates have plenty of upside potential considering the company expected to triple production by 2030 and isn’t even paid market prices yet.

Takeaway

The key investor takeaway is that Albemarle is an appealing stock after falling $100 from the recent highs. The market is concerned about EV demand in 2023, but all signs continue to point to demand exceeding supply requiring lithium prices to remain at elevated levels for years.

Be the first to comment