John Moore/Getty Images News

When I last wrote about Albemarle Corporation (NYSE:ALB), the company had just reported stellar Q1 results on the back of soaring lithium prices. Management was so confident that lithium markets would maintain their momentum and that Albemarle would be able to continue supplying those markets at ever higher weighted average realized prices, that they went ahead and increased guidance a second time after initially raising performance targets only three weeks earlier. And now several months later we find ourselves in a similar situation, whereby Albemarle has just released stellar Q2 results on the back of soaring lithium prices and management is again confident enough to increase FY22 guidance.

But none of this should come as a surprise to anybody, the fact that the world’s largest lithium producer is doing great when lithium prices are at all-time highs should be expected. What interests me, however, are the steps management is taking to leverage Albemarle’s market leading position and expanding the company’s presence further down the value chain. By putting greater emphasis on expanding its midstream, the company is soon going to start picking up money that it would have otherwise left on the table and that will definitely benefit shareholders.

Second Quarter Results and Revised Guidance

Operationally, Albemarle is split into three silos with the smallest of these being the Catalysts division. Here the company produces a wide variety of FCC catalysts and additives that are marketed to the refining and petrochemical industries. Catalysts had net sales of $210 million in Q2 but EBITDA came in at only $10 million and has been declining for some time. The company had considered selling off the division but recently announced that they had decided to keep it.

Next up is the Bromine division which, as its name suggests, focuses on products derived from the halogen. Here, unsurprisingly, the bulk of the segment’s revenue comes from the sale of brominated flame retardants. Bromine, with net sales of $378 million in Q2, is not only a much larger business than Catalysts, but it’s also much more profitable. Bromine’s second quarter adjusted EBITDA came in at $136 million, which is 46% higher than Q2 of last year. Sales have also been up-trending in recent quarters as the price of bromine climbed.

But in spite of being a growing business, a solid revenue generator, and providing some valuable product diversification, everyone knows that bromine isn’t the star of the show. For Albemarle, lithium is where it’s at. And that’s because, as I mentioned in the intro, over recent quarters lithium has been bringing in the big bucks. Net sales for lithium in the second quarter came in at $892 million, which is 178% higher than Q2 of last year and over $340 million more than Q1’s net sales. At $495 million, adjusted EBITDA was 353% higher than last year’s which is not that surprising given the change in lithium prices, but it was also $186 million more than the Q1 amount.

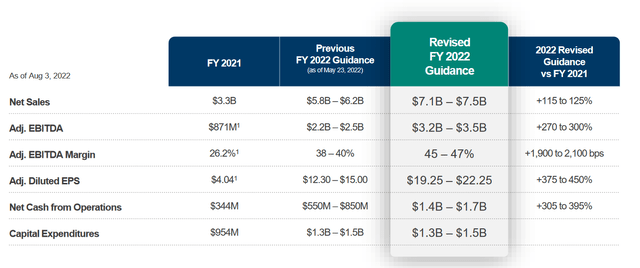

So, given the quarter-over-quarter growth it wasn’t surprising that management revised company-wide guidance higher yet again. Going from the previously announced revenue range of $5.8B-$6.2B and setting the new target in the $7.1B-$7.5B range. At the same time, they took adj. EBITDA from $2.2B-$2.5B to $3.2B-$3.5B.

Rapid Expansion

Given that there are only 3½ months left in the year and assuming lithium prices don’t collapse, which seems rather unlikely, I doubt Albemarle has too much trouble hitting its revised target. But what interests me more are the steps management is taking to make sure that those net sales and adj. EBITDA numbers continue climbing in the coming years.

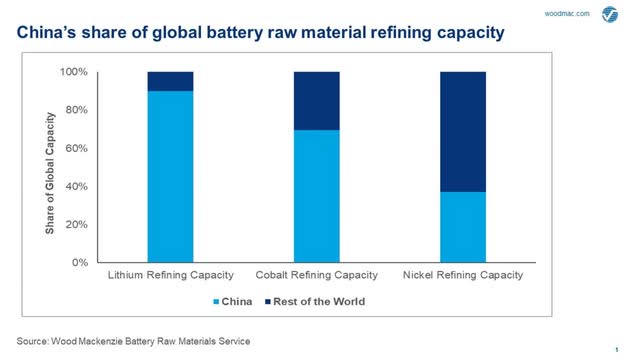

Like most senior lithium producers, Albemarle’s management decided to build up the company’s midstream capacity. It’s a sensible decision given the numerous hard rock and brine projects being developed by junior miners all over the world that are due to come online over the course of the next decade, many of which I have covered in previous articles. The industry is also well aware that over 90% of lithium refining capacity is currently located in China, this level of concentration could be a future problem when one considers the geopolitical tensions between the US and China.

China’s Share of Lithium Refining Capacity (woodmac.com)

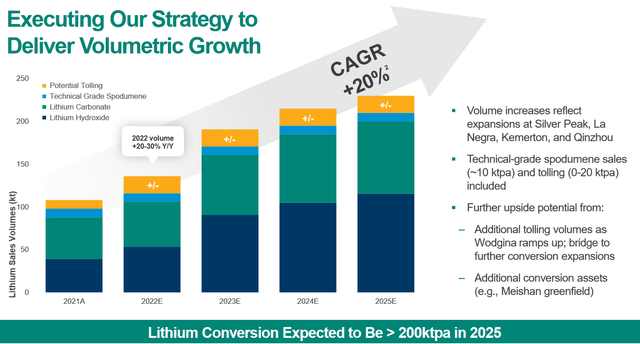

These factors have led many of the senior lithium producers to focus on refining. In fact, Albemarle currently anticipates over 20% annual production growth to come from increases in both carbonate and hydroxide production.

However, the problem is that building new conversion capacity takes time. It can take years for a project to go from the drawing board to first production and the process is prone to all types of regulatory and construction delays. So, to put Albemarle in a position where it can more quickly take advantage of the current elevated carbonate and hydroxide prices, management has decided to expand the company’s use of tolling.

For readers who are unfamiliar with tolling, it’s essentially the outsourcing of the refining process. In this case, Albemarle would send its spodumene concentrate (“SC6”) to a refiner who would convert it to either carbonate or hydroxide for a fee while Albemarle retained ownership over the resource. This will give the company access to refining capacity while it builds out its own conversion plants, and the money generated through the sale of higher priced carbonate and hydroxide produced by the tollers will defray at least a portion of those construction costs. Management has referred to it as a “bridging strategy”.

And although the company had used tollers in the past, Albemarle has clearly stepped it up this year as it anticipates producing between 10k and 20k tonnes of tolled hydroxide and carbonate in FY22 (An exact breakdown hasn’t been provided by the company).

Management has told analysts that they anticipate doing about the same amount next year, but during the company’s Q2 call Scott Tozier, Albemarle’s CFO, said that, “there’s potential upside to our outlook if market prices remain near current levels, or with additional contract renegotiations or additional tolling volumes.” Those comments appear to indicate that the company is open to processing more than 20K tonnes through tollers if favorable market conditions persist.

Albemarle also intends to start sending some of the volume from its recently reopened Wodgina property in Australia to a toller in China in early 2023.

Risks

The main risk that Albemarle faces is a sharp and prolonged decline in lithium prices. Management, like most lithium investors, is betting that lithium prices will remain elevated for years to come, and any type of scenario involving very depressed lithium prices would have strong negative repercussions on the company’s plans and its share price.

Takeaway

Albemarle’s increased use of tolling arrangements is providing it with a strategic advantage relative to many other senior lithium producers. While many other producers sell SC6 into the market as they plan and build conversion facilities, Albemarle’s use of tollers is allowing it to take advantage of booming carbonate and hydroxide prices. As the company continues applying this strategy, its share price should benefit.

Be the first to comment