Herbert Pictures/iStock Unreleased via Getty Images

In the first two months of the year Airbus (OTCPK:EADSY) (OTCPK:EADSF) collected almost 150 orders and in March we saw orders increase further. In this report, I will be covering the orders and deliveries for Airbus in March in this report. For this analysis, data and images from the TAF Airbus Orders and Deliveries Interactive Infographic and associated monitors have been used.

Airbus single aisle leads, wide body sinks

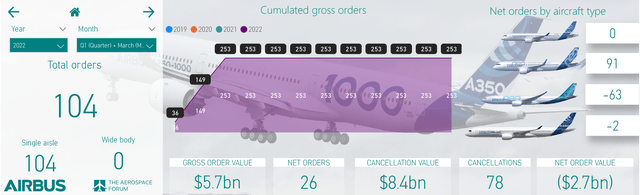

Airbus March 2022 aircraft orders (The Aerospace Forum)

During the month, Airbus received a total of 104 orders, all of which were for single aisle aircraft:

- An undisclosed customer ordered 13 Airbus A320neos and 41 Airbus A321neos.

- A second undisclosed customer ordered 46 Airbus A320neos.

- A private customer ordered one Airbus A320neo corporate jet.

- Iberia ordered three Airbus A321neos.

In March, we saw a strong gross order inflow continue. Contrary to last month, there were no wide body orders or orders for the Airbus A220 but we saw strong performance on the Airbus A320neo family program.

During the month, the following changes were made to the order book:

- China Express Airlines was identified as the customer for one Airbus A32neo.

- Qingdao Airlines converted an order for one Airbus A320neo to an order for one Airbus A321neo.

- SMBC Aviation Capital converted orders for two Airbus A320neos to orders for two Airbus A321neos.

- AirAsia X cancelled orders for 10 Airbus A321XLRs and 63 Airbus A330-900s.

- Air Canada was identified as the customer for one Airbus A321XLRs.

- Air China was identified as the customer for one Airbus A321neo.

- Vueling cancelled orders for three Airbus A321neos.

- Starlux Airlines converted orders for eight Airbus A350-1000s to eight Airbus A350-900s.

- Orders for two Airbus A350-900s for Aeroflot were cancelled.

There were quite some mutations in the order book. We saw a handful conversions between the Airbus A320neo and Airbus A321neo, but also between the Airbus A350-900 and Airbus A350-1000. It also should be noted that the order from Iberia was offset by a cancellation from Vueling, which belongs to the same airline group. However, more interesting was the cancellation of two Airbus A350s for Aeroflot which undoubtedly was a result of the sanctions imposed on Russia and the major adjustment on the Airbus A330neo program as AirAsia X cancelled the lion share of its orders though not completely unexpected. Maybe it was more a surprise that it took Airbus this long to process the adjustments as they were already known in November 2021.

During the month, Airbus logged 104 gross orders valued at $5.7 billion, but the European jet maker had to remove 78 orders valued $8.4 billion, bringing the net order count to 26 and the net order value to -$2.7 billion. While gross orders were strong during the month, there was significant cancellation activity heavily tilted towards high value wide body orders resulting in a negative order value for the month. That, once again, shows that it’s important to keep in mind orders as well and cancellations and not heavily focus on just the gross order inflow.

A year ago, Airbus booked 28 orders and eight cancellations, bringing its net orders to 20 units. So, we see that net orders slightly improved from 20 to 26 units, but the net order value went from $0.8 billion to -$2.7 billion. So, March was actually a net negative as well as a year-over-year deterioration. Year-to-date, the European jet maker booked 253 gross orders and 81, but the net order value was -$1.8 billion. In the first three months of 2021, Airbus booked 39 gross orders and -61 net orders with a net value of negative $3.7 billion. So, we’re seeing that Airbus is having a better year so far, but net order value has been negative for the year.

Airbus decline year-over-year

Airbus March 2022 aircraft deliveries (The Aerospace Forum)

After pushing out 49 aircraft to customers in February, Airbus saw delivery numbers tick up further in February with 63 deliveries valued at $4.3 billion consisting of 54 single aisle jets and nine wide body aircraft:

- Airbus delivered five Airbus A220s.

- A total of 49 Airbus A320neo family were delivered consisting of 22 Airbus A320neos and 27 Airbus A321neos.

- Three Airbus A330 deliveries occurred including one multi-role transport tanker and one Airbus A330-900.

- Six Airbus A350s, four for the -900 variant and two for the -1000 variant, were delivered.

We saw an appreciable uptick in deliveries in March with a significant uptick in single aisle deliveries better aligned with the production rate although some of the increase in deliveries likely is also driven by pushing out aircraft to customers before the end of the quarter. Compared to last year deliveries decreased by nine units while the delivery value decreased by $0.4 billion. Year-to-date, Airbus delivered 142 aircraft valued at $9.7 billion compared to 125 aircraft valued at $7.7 billion last year.

The book-to-bill ratio for the month was 1.65 and 1.33 in terms of value, which are good numbers. However, the industry uses a practice where gross orders are used to measure book-to-bill, when keeping cancellations in mind this metric would drop to 0.4. For the first three months of the year, the gross book-to-bill is 1.8 in terms of units and 1.4 in terms of value. Those numbers are obviously good, but Airbus obviously needs to maintain momentum to maintain a satisfactory book-to-bill ratio.

Conclusion

During the month Airbus saw its net order inflow end up in negative territory for the month as well as the quarter. Nevertheless, this was an improvement compared to last year. In terms of deliveries, we saw deliveries and delivery value decline in March but the quarterly figures showed a 14% increase in deliveries and a 26% increase in value.

So, I continue to like shares of Airbus and continue to be invested in the company. I do keep an eye supply chain issues as those issues might dampen the recovery in the delivery volumes and we are cautious about any weakening in air travel demand due to virtual elimination of one air travel market from the international stage and continued challenges in China.

Be the first to comment