AVZimovskoy/iStock Editorial via Getty Images

Aircraft manufacturers are facing an interesting combination of dynamics. Currently, demand for air travel is high but many airlines simply don’t have enough pilots to fly the jets, while aircraft manufacturers are facing significant supply chain disruptions that cloud the prospect of envisioned aircraft production rate increases. Airbus, for example, is looking to push the production levels of its most successful jet to 75 aircraft per month, but barely is able to consistently produce and deliver aircraft at the current production rates.

With that in mind, it is interesting to keep track of the earnings releases and calls, as they provide some information on supply chain disruptions and their impacts. In this report, I will have a look at the first quarter results and comments from Airbus SE (OTCPK:EADSY).

Airbus Commercial Airplanes: Strong Year-Over-Year Improvement

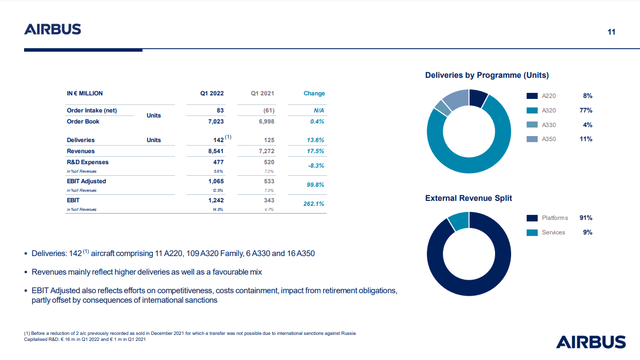

Airbus Q1 2022 results (Airbus )

The commercial environment has significantly improved this year, and that also shows in the Q1 2022 orders, deliveries, revenues, and earnings. The net order intake was +83 compared to -61 in the same quarter last year while deliveries increased 13.6%. The backlog is now 0.4% higher than a year before, partially driven by difficulties to meet production rates on the Airbus A320neo family program.

Each quarter, we provide a check on the revenue to see whether the revenues were satisfying when considering the delivery mix. The first transformation we apply to the €8.5 billion is using the external revenue split to calculate the platform revenues followed by converting this Euro-amount to a dollar-amount. Subsequently, this number is being compared to the valuation output of our data analytics tools for Airbus and Boeing aircraft.

In the first step, the platform revenues are estimated at €7.72 billion to €7.82 billion. Using the 1.21 € vs. $ hedge rate for Q1 2022, the platform revenues are around $9.3 billion to $9.5 billion. Our estimator for the Airbus commercial airplane deliveries returned an estimated Q1 2022 value of $9.4 billion, showing Airbus posted revenues in line with what we would have expected based on our model. In earnings and adjusted earnings we also saw a strong uptick, and we are really seeing the strong margins in the segment now.

Airbus Helicopters: Profits Lifted

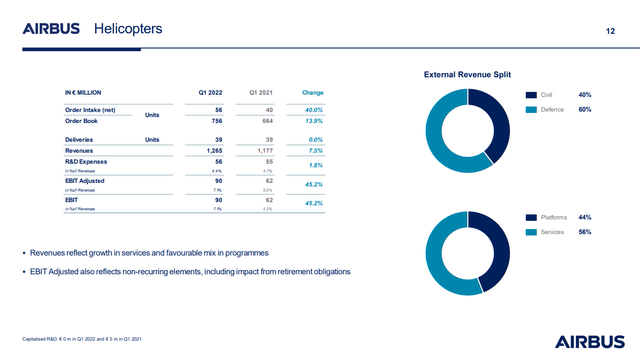

Airbus Helicopters Q1 2022 results (Airbus )

Airbus Helicopters saw order inflow improve while deliveries remained stable. On stable deliveries, Airbus increased revenues by 7.5% driven by attractive civil/defense mixes and platform/services mixes. EBIT adjusted grew 45% to €90 million, providing a 7.1% EBIT margin compared to 1.5% in the same period in 2019. Compared to 2019, we are seeing that revenues as well as profits are up. So, the helicopter business seems to be doing quite well, exceeding pre-pandemic performance.

Airbus Defense & Space: Something For The Future

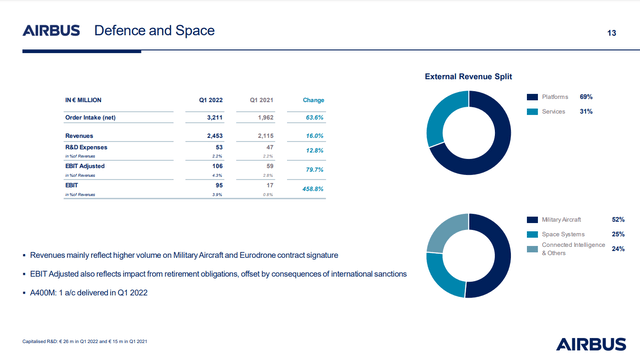

Airbus Defence and Space Q1 2022 results (Airbus )

On Defense, Airbus saw strong order intake. However, this is most certainly not driven by the situation in Ukraine. The first quarter of 2022 is simply too early for increased appetite for defense equipment to translate into order intakes. However, driven by contract signing for Eurodrone and higher volumes the revenues for the Defense and Space arm increased 16%, while adjusted EBIT increased 80%. Revenues increased by 16% compared to pre-pandemic levels while adjusted EBIT increased by 5%. Margins contracted slightly.

So, Defense and Space is not the brightest part of the business, but we already knew that, since performance was so underwhelming that the company looked to reorganize the business three years ago. With a changing defense spending environment and long term changes in geopolitics, Defense and Space could benefit from some order inflow.

Germany recently selected Boeing’s (BA) CH-47F Chinook for which the U.S. company teamed up with Airbus. Airbus will likely end up adding a big order for the Eurofighter Typhoon for electronic warfare capabilities. So, there are some leads and prospects that could help Defense and Space as well as the Helicopter business.

Airbus Posts Bullish Guidance

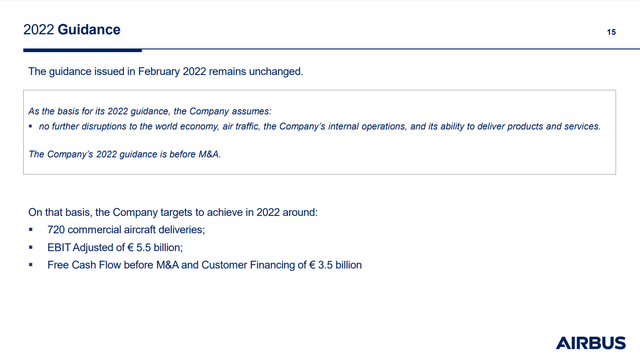

The guidance that Airbus provided is strong, with 720 commercial aircraft deliveries expected. However, the guidance for EBIT adjusted and Free Cash Flow before M&A were rather soft. The company guided for €5.5 billion adjusted EBIT, up from €4.9 billion last year, and Free Cash Flow of €3.5 billion, in line with last year. So, adding billions in revenues is not translating extremely strongly to earnings, let alone free cash flow.

Supply chain challenges were somewhat surprisingly not subject to extremely elaborate comment or discussion. Airbus is working to reach 75 A320 aircraft in production per month and 65 A320s produced in mid-2023. Airbus believes it can reach 65 per month in 2023, and from there it has enough time to get everything in order for a rate of 75 aircraft per month.

However, where Airbus in my view significantly lacked comment is how they get from the current rates to 65 per month especially given that the supply chain is already under significant pressure at the current rates which are far from 65 aircraft per month. Airbus is currently sitting at a rate of 45 aircraft per month and is already suffering engine delays of several weeks, and that is something that was barely addressed while it is pivotal to the 2022 guidance. So, that was extremely disappointing.

In the first five months of the year there have been 237 deliveries of which 183 Airbus A320neo family deliveries. That is indicative of a delivery rate of 36.5 aircraft per month, which is significantly lower than the 45 aircraft per month targeted. Airbus tends to spool up deliveries as the year progresses, but getting a stable 45 aircraft per month is already challenging and there is little comment on these current challenges that were already clear during the first quarter earnings call.

Conclusion

Overall, I am liking the results that Airbus posted. Defense and Space is still somewhat weak as it has been before, but Helicopters and Commercial Aircraft did well. The guidance for 2022 was somewhat disappointing given the significant uptick in expected deliveries. Essentially, Airbus plans to boost output while not seeing any of that translate into free cash flow before M&A.

At the same time, while Airbus has a strong past of boosting deliveries towards year-end, I do have doubts about the company’s ability in stabilizing the current production rates in time to reach this year’s delivery target. Beyond this year, there also is a strong uptick in production planned, which would be extremely good for investors if it can be executed on. However, an extremely steep ramp up is required to get there. The company is aiming for a 18% increase in deliveries but has only been able to increase year-to-date totals by 7%. So, there certainly is a lot of work to be done for Airbus to make things happen.

Be the first to comment