Ryan Fletcher

In my analysis of the Q1 2022 results from Airbus, I pointed out that earnings were strong but I had concerns about the delivery guidance of the European plane maker. What I did observe was that through May commercial aircraft orders lost momentum. However, Airbus did recently announce a big order from China which we expect to be processed in the July order numbers and the same holds for orders announced during the Farnborough International Airshow, which I estimated to be worth $4.5 billion.

In this report, I will have a look at the orders, deliveries and cancellations for Airbus booked in the month of June. In order to get a comprehensive overview with capabilities to get to the fine details, The Aerospace Forum has developed data analytics solutions for the big aircraft manufacturers that will be used in this report. Using these tools, we are able to analyze orders and deliveries and see where manufacturers are falling short, meeting or exceeding expectations.

Qantas Gives Order Book Wings

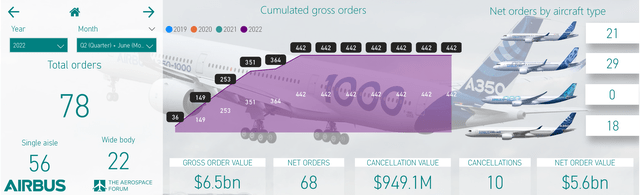

Airbus commercial aircraft orders June 2022 (The Aerospace Forum)

During the month, Airbus gathered 78 orders, which is a sequential increase of 65 units. In total, 56 single-aisle aircraft were ordered along with 22 wide-body aircraft:

- An unidentified customer, likely Etihad Airways, ordered seven Airbus A350Fs.

- A private customer ordered one Airbus A220-100 and one Airbus A319neo.

- Delta Air Lines ordered one Airbus A330-900.

- International Airlines Group ordered five Airbus A320neos and one Airbus A321neo.

- Pegasus Airlines ordered eight Airbus A321neos.

- Qantas Airways finalized an order for 20 Airbus A220-300s, 20 Airbus A321XLRs and 12 Airbus A350-1000s.

- Silk Way Airways ordered two Airbus A350Fs.

Qantas ordered aircraft (Airbus)

In June, we observed a significant restoration in sales momentum for commercial aircraft, which I expect to continue in July. Without doubt, the order from Qantas was the highlight of the month. I previously discussed how this order showed almost all weaknesses in Boeing’s product line up.

During the month, the following changes were made to the order book:

- China Southern Airlines was identified as the customer for one Airbus A319neo.

- BOCOMM Leasing was identified as the customer for two Airbus A320neo aircraft.

- Juneyao Airlines was identified as the customer for one Airbus A320neo.

- BOCOMM Leasing was identified as the customer for one Airbus A321neo.

- AerCap (AER) converted one Airbus A320neo order to an order for one Airbus A321neo.

- CALC converted orders for two Airbus A320neo aircraft to orders for two Airbus A321neo aircraft.

- SMBC Aviation Capital converted orders for four Airbus A320neos to orders for four Airbus A321neos.

- Etihad Airways cancelled orders for six Airbus A321neo aircraft.

- Virgin Atlantic cancelled an order for one Airbus A330-900.

- An undisclosed customer cancelled orders for two Airbus A350-900s.

- Airbus unilaterally cancelled an order for one Airbus A350-1000.

During the month we saw some usual conversions taking place as lessors and airlines align their orders with their fleet requirements leveraging the contract flexibility that Airbus provides. At the same time, we did see some shifts in the wide body order books and Etihad Airways cancelled orders, as expected, for some of its A321neo jets on order and likely made these part of an agreement for the new Airbus wide body freighter.

In June, Airbus logged 78 gross orders valued at $6.5 billion while it scrapped 10 orders valued $950 million from the books bringing the net orders to 68 orders valued $5.6 billion. A year ago, Airbus booked 71 orders and 2 cancellations, bringing its net orders to 69 units valued $4.2 billion. So, we see that net orders declined year-over-year but a more favorable mix drove the value of the net orders higher.

Year-to-date, the European jet maker booked 442 gross orders and 185 cancellations bringing the net orders to 257 units with a net order value of $10.5 billion. In the first six months of 2021, Airbus booked 165 gross orders and 38 net orders with a net value of $2.4 billion. So, we’re seeing that Airbus is having a better year so far with improving net order quantities and value and we expect there will be more to come to solidify Airbus’s position in the annual order battle.

Airbus Deliveries Show Usual Quarter-End Jump

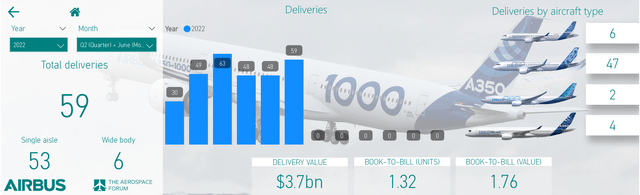

Airbus commercial aircraft deliveries June 2022 (The Aerospace Forum)

In June, Airbus delivered 59 jets compared to 47 in the previous month. The European jet maker delivered 53 single-aisle jets and 6 wide-body aircraft with a combined value of $3.7 billion:

- Airbus delivered six Airbus A220s, all four were the bigger -300 model.

- A total of 47 Airbus A320neo families were delivered consisting of one Airbus A319neo, 21 Airbus A320neos and 25 Airbus A321neos.

- Two Airbus A330s were delivered, all of the previous generation family.

- Four Airbus A350s were delivered, all -900 models.

In June, deliveries increased sharply month-over-month. However, the surge in deliveries is not one that I deem sustainable but merely one that shows the usual quarter-end surge showcasing the strain on the supply chain.

It does seem that Airbus is facing significant challenges aligning its deliveries with the announced production rate. Primarily on the Airbus A320neo program, we are seeing deliveries being below 40 units while the communicated production rate is 45 aircraft per month. Even adjusted for the number of production months per year, on average deliveries are currently falling short by around 15% which I consider a sign of significant stress on the supply chain.

Compared to last year, deliveries decreased by 18 units while the delivery value decreased by $2 billion. Year-to-date, Airbus delivered 297 aircraft valued at $19.8 billion compared to 297 aircraft valued at $19.6 billion last year. Year-to-date numbers show that Airbus lost the 7% lead in deliveries it had compared to last year further supporting my view that the jet maker is suffering significant challenges in realizing sustained growth in delivery figures and I have significant doubts about the company’s ability to realize its delivery target of 720 aircraft this year and expect them to lower this target in the upcoming earnings release.

The book-to-bill ratio for the month was 1.32 and 1.76 in terms of value, which are good numbers. For the first six months of the year, the gross book-to-bill is 1.49 in terms of units and 1.38 in terms of value. Those numbers are good, but Airbus needs to maintain momentum to maintain a satisfactory book-to-bill ratio. While I do believe Airbus will keep the sales momentum up, part of the strong book-to-bill ratio is caused by the fact that the delivery ramp-up is not coming along as planned.

Conclusion

In June, Airbus regained sales momentum booking just 78 orders growing sales sequentially as well as year-over-year. With announcements from the Farnborough International Airshow and orders from the Chinese main carriers I do expect an extremely strong July month for Airbus underlining the strong sales momentum.

While month-over-month my sentiment on either order or deliveries rarely changes, I do believe that the target for commercial aircraft deliveries set by Airbus is not achievable. The jet maker has set a delivery target of 720 units and only delivered 297 aircraft year-to-date. Airbus is known to push out a significant number of aircraft in the final months of the year. However, we are currently seeing that delivery rates are significantly below the communicated production rates sparked by supply chain issues. This also makes one wonder how much space Airbus has to increase deliveries in the upcoming months. Doubting Airbus’s ability to meet its delivery target has proven to be a dangerous thing to do in the past years as the jet maker always seemed to reach its target somehow, but at this point, I have significant doubts about the company’s ability to reach its delivery target.

So, I continue to like shares of Airbus and continue to be invested in the company. Sales are good so far this year and I expect them to become even better, but I don’t believe the current guidance on deliveries reflects the company’s ability to produce and deliver.

Be the first to comment