Sundry Photography/iStock Editorial via Getty Images

When in doubt over the course of the markets throughout the rest of the year, it’s never a bad idea to lean in on value stocks. Now, there are certainly plenty of legacy value stocks that are businesses in decline, but NetApp (NASDAQ:NTAP), an IT storage provider, is certainly not one of them. Though it was a laggard in adopting flash storage and anticipating enterprise’s shift toward public cloud consumption, NetApp has reclaimed its position as a leading storage vendor.

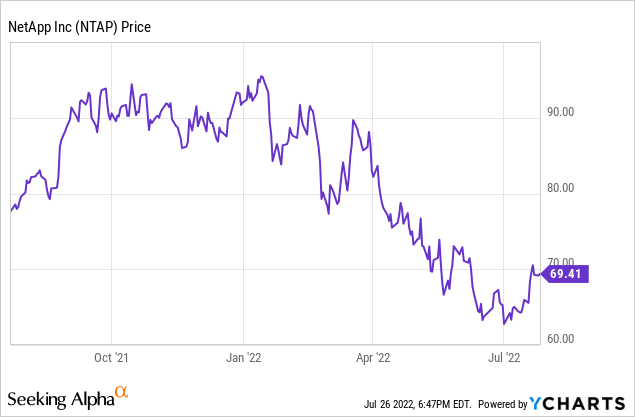

Year to date, the stock has lost 25% of its value, in sympathy with the S&P 500 (underperforming by about seven points) and other tech names. In my view, that decline has taken NetApp to quite attractive levels versus its actual fundamentals, and it’s a great time for investors to be reviewing the bull case on this name.

I am affirming a buy rating here for NetApp. In my view, here are the top reasons to be bullish on the stock:

- Data volumes will only drive robust storage needs. It can’t be emphasized enough how much businesses are adopting a data-driven decision making mindset. As data volumes explode and files become more complex, storage needs will continue to expand.

- Growth businesses are finally on track. NetApp is putting its development and sales focus on its public cloud products as well as flash arrays, allowing it to better compete against its more modern competitors like Pure Storage (PSTG). As these businesses scale, NetApp is also generating much better gross margins on its public cloud products.

- Software mix is increasing. Storage is often thought of as a commodity hardware business, but now, NetApp’s software mix of its product revenue has grown to nearly two-thirds. Over time this will help raise gross margins.

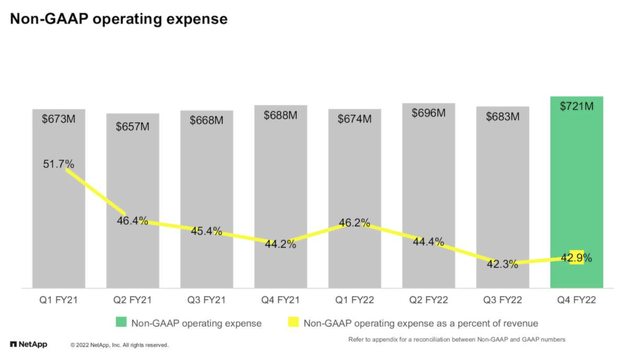

- Profitability is core to its DNA. NetApp has been successful at bringing down its opex as a percentage of revenue over time, helping the company to expand its bottom line at a faster rate than revenue.

- Capital returns. Generous profitability and free cash flow has also given NetApp the liberty to spend generously on dividends and share buybacks. At the moment, NetApp is yielding just shy of 3% – which is a reasonable incentive to stay patient until the stock can get back to “normalized” P/E levels.

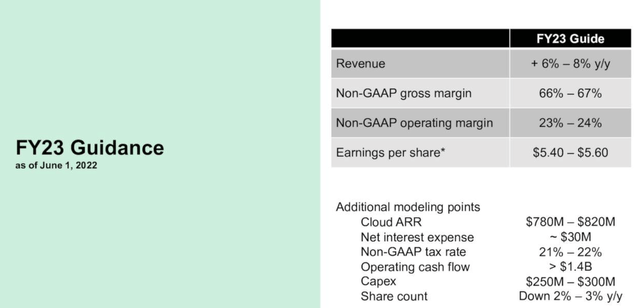

And more to the last point above: at the moment, NetApp is trading at a sizable discount to the S&P 500, despite having rediscovered its growth engine. For the current fiscal year, NetApp has guided to pro forma EPS of $5.40-$5.60, representing 4% y/y growth at the midpoint:

NetApp guidance (NetApp Q1 earnings deck)

For FY24 (the year for NetApp ending in January 2024), meanwhile, Wall Street analysts have a consensus EPS target of $6.06, representing 10% y/y growth over this year’s midpoint EPS guidance. At current share prices near $69, this puts NetApp’s valuation at:

- 12.6x FY23 P/E

- 11.4x FY24 P/E

For me, I think this is a great opportunity to buy NetApp at cheap valuations and get paid a 3% dividend to wait. Note as well that there has been insider buying over recent months. In my view, NetApp is a great value stock to diversify into while we wait for the choppiness in the markets to subside.

Q1 download

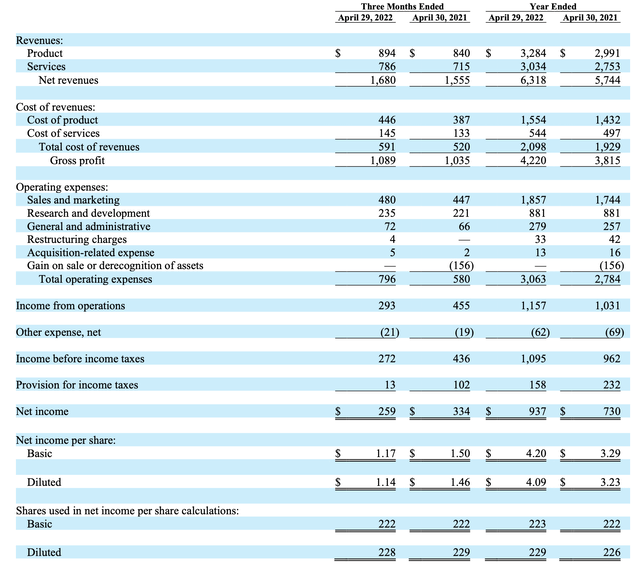

Let’s now go through NetApp’s latest Q1 results in greater detail. Take a look at the Q1 earnings summary below:

NetApp Q1 results (NetApp Q1 earnings deck)

NetApp’s revenue in Q1 grew 8% y/y to $1.68 billion, in-line with expectations. Underneath product revenue, note that software revenue of $530 million grew at 10% y/y, indexing higher than the overall company growth rate.

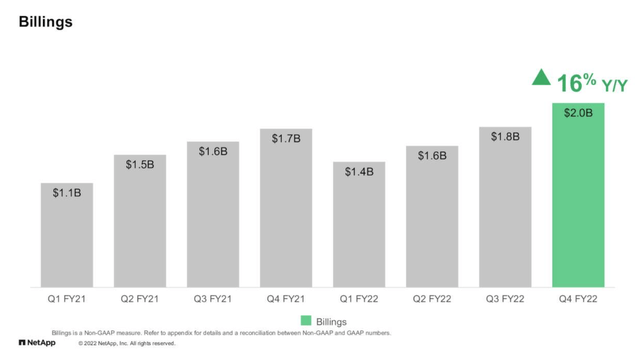

Another positive drive here: NetApp’s billings grew 16% y/y in the first quarter to $2.0 billion, adding ~$320 million to the company’s deferred revenue balances – giving us hope that acceleration in revenue is a possibility.

NetApp billings (NetApp Q1 earnings deck)

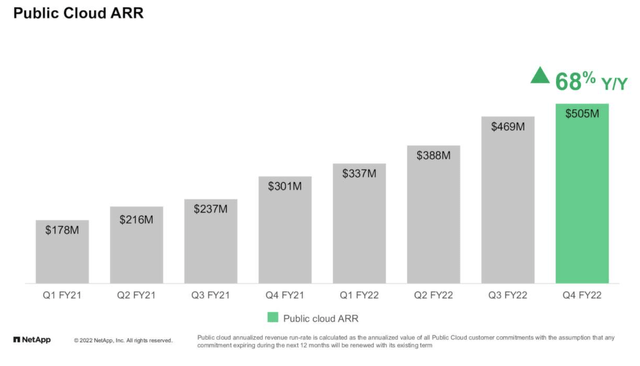

And as previously noted, next-gen products have been a strong fuel for NetApp’s revenue. Annualized recurring revenue for the company’s public cloud products grew at a stunning 68% y/y rate in the quarter to $505 million.

NetApp public cloud growth (NetApp Q1 earnings deck)

Still, this did come in below management’s expectations, due primarily to higher churn in the shaky macro environment. Per CEO George Kurian’s prepared remarks on the Q1 earnings call:

I want to address the fact that our Public Cloud ARR came short of our expectations. Demand for our cloud storage solutions was strong in Q4. We also saw a healthy number of new customer additions across both cloud storage and cloud operations services in the quarter. Unfortunately, these tailwinds were not enough to offset the lower than expected growth created by higher churn, lower expansion rates, and sales force turnover in our cloud operations portfolio. We understand the root causes of these temporary headwinds, and, in FY 2023, our focus will be on returning these services to the growth trajectory we saw in the first three quarters of the year. We have made organizational changes to increase focus on renewal and expansion motions and will continue to refine our go-to-market activities to better address the cloud operations market. Additionally, we have refreshed the sales organization and strengthened the leadership team.”

We note as well that the company continued to face supply chain constraints, and because of that exited Q1 with backlog (signaling that revenue growth in the quarter could have been higher in the absence of delays).

In spite of the headwind on public cloud revenue, however, NetApp did admirably well on profitability. Pro forma operating expenses as a percentage of revenue fell 130bps to 42.9%:

NetApp opex trends (NetApp Q1 earnings deck)

Pro forma net income, meanwhile, jumped 21% y/y to $324 million, while pro forma EPS of $1.42 came in well ahead of Wall Street’s expectations of $1.28 with 11% upside.

Key takeaways

While NetApp is hardly the most exciting company in the tech sector, the company offers a rare combination of reasonable growth rates, a compelling product stack with secular growth drivers, rich profit margins and a rewarding dividend yield. Trading at just a ~12x P/E, I think NetApp is certainly worth a small position in your portfolio.

Be the first to comment