RichLegg/E+ via Getty Images

Investment Thesis

Airbnb (NASDAQ:ABNB) is significantly overvalued relative to its near-term potential.

I’ve been making the case for a while that Airbnb’s stock is expensive. And even though its valuation has come down 30% since I wrote that bearish article, I argue that its stock is still too expensive relative to the upcoming struggles that its European business is about to face.

Simply put, even though the stock is already down 30% since the start of the year, that will not stop a sell-off from further manifesting itself further.

Hence, I rate the stock a sell.

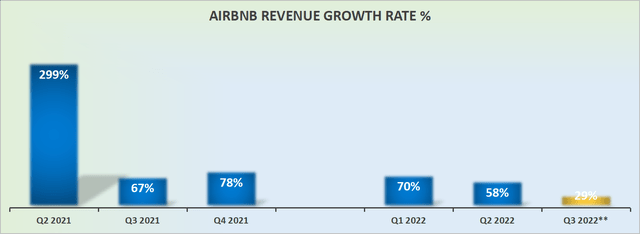

Airbnb’s Revenue Growth Rates Will Decelerate Further

As we look ahead, the high-end of Airbnb’s Q3 guidance points to 29% y/y revenue growth. For a company that earlier this year was clocking up more than 60% revenue growth, this points to a marked deceleration.

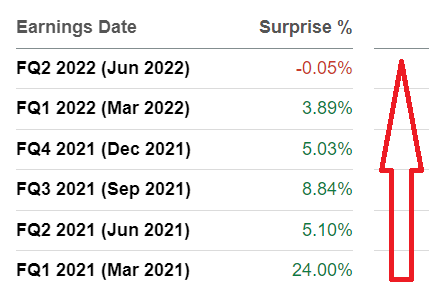

And before readers start to declare that Airbnb is lowballing estimates to allow for easy beats later on, consider the following revenue surprises.

ABNB revenue surprises

As you can see from the trend above, over time, the amount that Airbnb has beaten the Street estimates has consistently reduced and even turned negative last quarter.

This is not a company that is well-positioned to positively surprise the investment community. But there’s more.

Why Airbnb is Primed to Struggle?

Airbnb is the leading vacation rental marketplace. However, despite its leading position, it’s not immune to the underlying reality that the amount of discretionary income available in Europe over the coming twelve months will be severely restricted.

Presently, there’s a significant cost of living crisis manifesting itself in Europe, brought on by sky-high energy prices.

Even though Airbnb doesn’t disaggregate what proportion of its revenues comes from Europe, we can still work back and see that for 2021 approximately 30% of its total revenues came from Europe, Middle East, and Africa (”EMEA”).

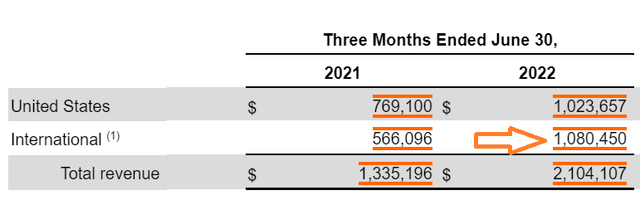

That being said, as you can see above, Airbnb’s strongest growth of late has come from its International business. Hence, we must assume that EMEA now accounts for approximately 35% of its total revenues.

Of that 35% of total revenue from EMEA, a significant proportion will come from Europe. And Europe is going to be very soft over the coming twelve months, as Europeans become forced to embrace a serious cost of living crisis.

Next, further complicating matters for Airbnb, consider that there was a significant amount of pent-up demand for traveling around this summer.

And in the same way that there was a wave of unprecedented travel demand during Q2 and Q3, I believe that there will be a wave of households going nowhere this upcoming Q4.

With higher interest rates in Europe impacting household mortgage payments, together with higher energy costs, plus exorbitant food prices, there simply will not be any appetite for travel. Particularly after a significant amount of the population already got out and about during the Summer.

Explaining Why ABNB’s Free Cash Flows Will Become a Headache

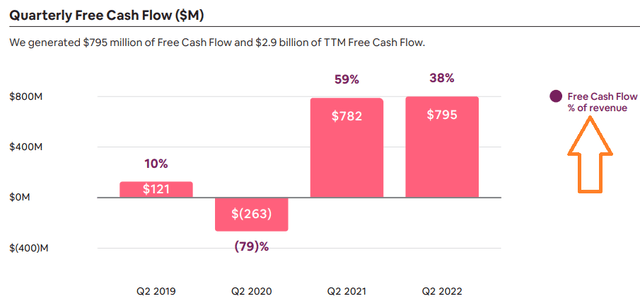

Airbnb shareholder letter, Q2 2022

Presently, Airbnb’s high free cash flow margin goes a long way to support the multiple that investors are willing to pay for the stock.

The problem here is that the bulk of its alluring free cash flow is driven by its robust deferred revenue line. This is cash upfront that Airbnb gets paid for vacations that will only get recognized in the future.

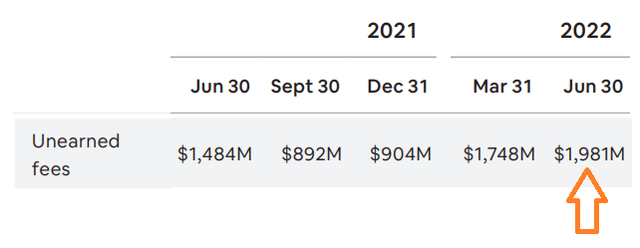

For example, if a guest makes a booking many months ahead, as they plan their itinerary and secure their location, Airbnb gets that cash upfront. But it only pays out that cash once the guest checks in. This is what Airbnb states in its 10-K filing:

We record the service fees that we collect from customers prior to check-in on our balance sheet as unearned fees.

ABNB Q2 2022 shareholder letter

For Q2 2022, unearned fees reached $2 billion. This went a long way to bolster Airbnb’s free cash flow so that in Q2 Airbnb ultimately reported $785 million of free cash flow.

However, looking ahead to Q3, I make the case that Airbnb’s free cash flow will substantially reduce, as demand for rentals will be substantially impaired.

Hence, rather than seeing $2 billion of cash infusion via unearned fees, it wouldn’t be surprising to see this figure fall to less than half in Q3 and not return to above $1 billion at any point over the next twelve months.

ABNB Stock Valuation – 8x Sales is Too Rich

During 2020 and early 2021, we got too accustomed to valuing companies at 10x sales and higher. And while that may have made sense at that time, I do not believe that makes sense right now.

Particularly, when the company is materially exposed to the cyclicality of the economy.

Meanwhile, if we consider Airbnb on an EBITDA multiple, a reasonable EBITDA estimate for 2022, would see around $2.2 billion compared with approximately $1.6 billion for 2021.

That would put the stock priced at approximately 33x this year’s EBITDA. A figure that I believe is simply too high as a starting point, for a company that is going to experience a material weakening in the coming months.

Of course, that doesn’t even factor in the fact that more than 30% of its EBITDA is made up of stock-based compensation.

The Bottom Line

Airbnb is too richly valued relative to the underlying reality.

I recognize that Airbnb is the leading marketplace for rentals and that will go a long way to support its stock carrying a high valuation. Let’s call this its ”brand” multiple. That brand multiple will only go so far.

There’s still a limit to what shareholders will be willing to pay for what is soon to be a ”high growth” company that is losing its alluring revenue growth and is on a near-term path to becoming a middle-of-the-road growth company.

Be the first to comment